IST,

IST,

Nowcasting Global Growth

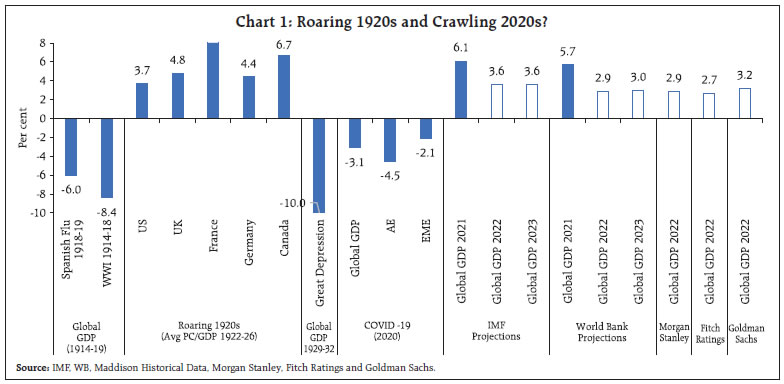

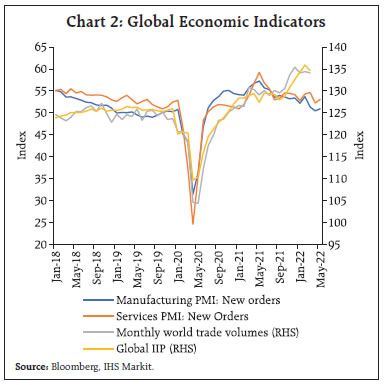

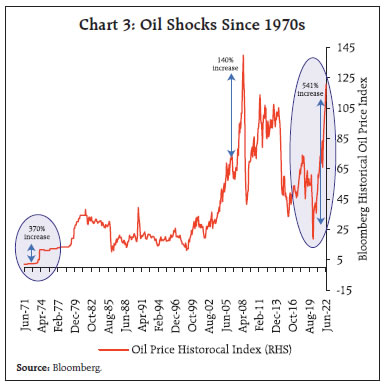

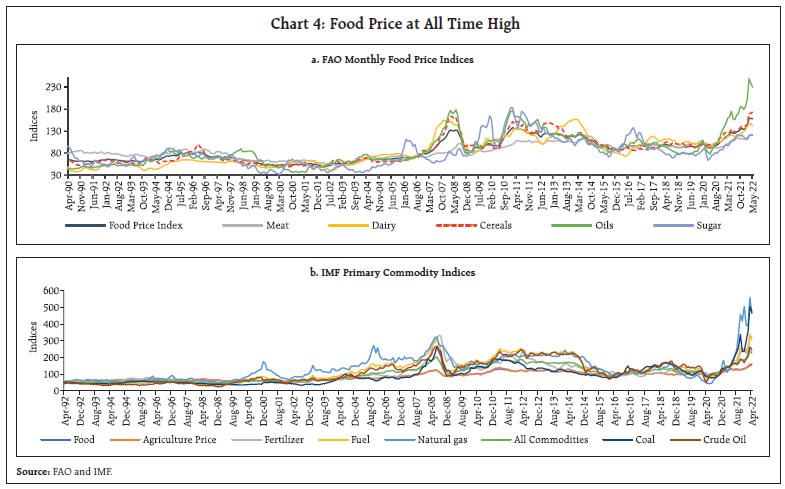

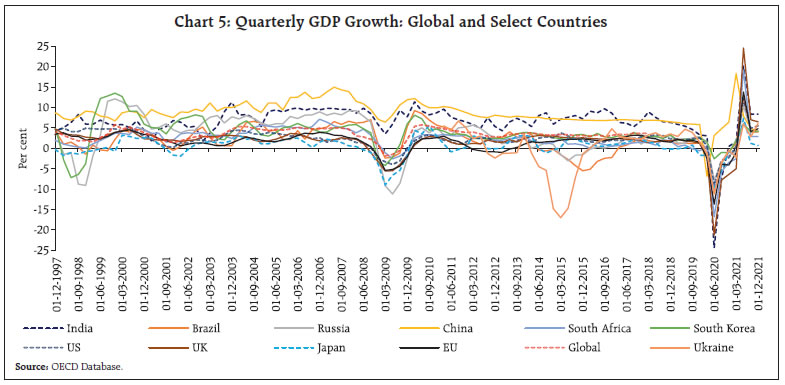

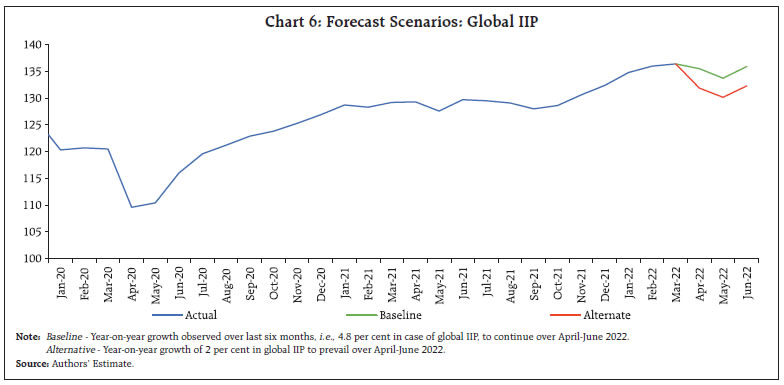

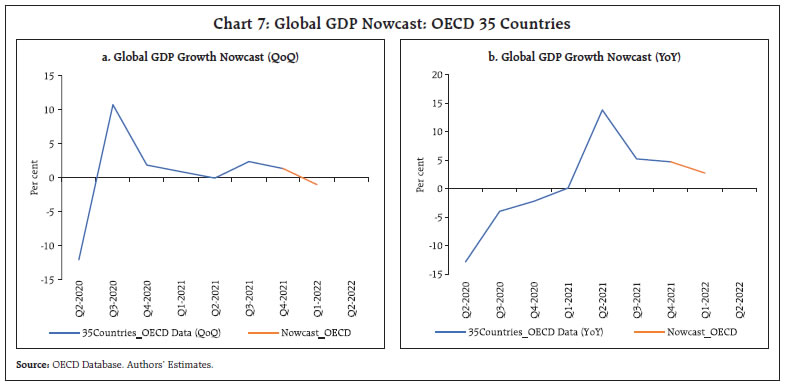

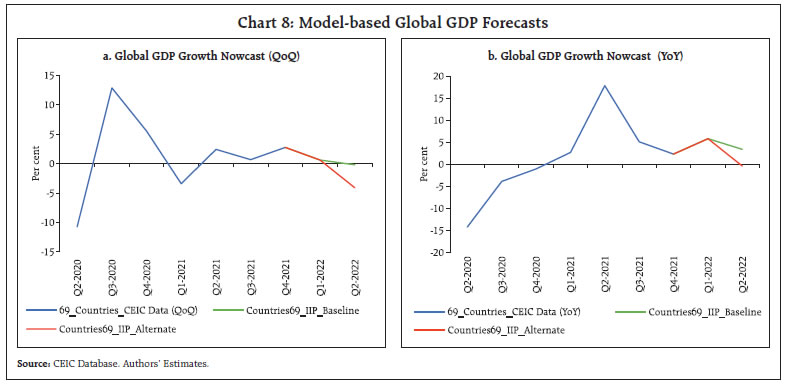

Incoming data suggests that global growth is losing steam in the first and second quarter of 2022. Estimates and forecasts of global GDP growth are on an annual basis. This article attempts to bridge the gap between the availability of and the arrival of global GDP estimates and higher frequency indicators of global economic activity. Introduction The year 2022-23 has begun on a sombre note. The global economy was on the cusp of recovery when it was hit by a mammoth geopolitical shock. The escalation of geopolitical tensions has also led to a broad-based increase in global commodity prices with the potential of keeping elevated inflation persistent and undermining global trade and growth. Available high frequency indicators suggest that global growth is losing steam in the first and second quarters of 2022. It is in this backdrop that this study attempts to gauge global growth outcomes on an ongoing basis based on incoming data. These findings can be considered as indicative and would get firmed up as more experience is gained with these nowcasts that are based on actual releases of official data. They are intended to fill the gaps in the availability of estimates and forecasts of global GDP growth which are currently on an annual basis. The rest of the study is organised into four sections. Section II deals with some stylised facts. Section III discusses the analytical framework of the study and data construction while section IV presents the main findings. Section V concludes the study. The global economy grew by 6.1 per cent in 2021 – the highest in six decades but is now projected to decelerate to 3.6 per cent in 2022 and 2023 (WEO, April 2022), and 2.9 per cent in 2022 and 3.0 per cent in 2023 (GEP, June 2022).1 This has prompted some to expect the current decade to be “crawling 2020s” (Chart 1). After the double shock of Covid-19 and the Russia-Ukraine war, inflation rates have exceeded expectations, surging to their highest levels in decades in many countries, while economic growth forecasts are rapidly deteriorating. Early high frequency data provides a mixed picture: as per available data, global IIP and trade volume slowed-down in March 2022; composite global PMI index accelerated marginally in May 2022 after two consecutive months of deceleration during March- April, driven mainly by expansion in new orders – both manufacturing and services (Chart 2). GDP data released so far for Q1:2022 point to contraction and deceleration. Global food and energy prices have skyrocketed resulting in higher and more broad-based inflation than in several decades. Brent crude oil hit an average of US $120.7 per barrel in June 2022 so far – the highest since the June-August 2008 average of US$ 129.9 per barrel. The current oil price shock has been described to be one of the biggest in decades (Chart 3). There have since been revisions and projections of oil prices - Environmental Investigation Agency (EIA): US $105.22 per barrel for 2022; Goldman Sachs: US $135 per barrel for 2022; Morgan Stanley: US $115 per barrel in Q2 and US $150 per barrel for the rest of 2022.  Meanwhile, global food prices – measured by both the Food and Agriculture Organisation (FAO) and the International Monetary Fund (IMF) were at an all-time high in April 2022 and expected to remain elevated due to supply disruptions (Chart 4: a-b).    In this uncertain environment, high correlation between India’s GDP growth and those of major economies suggests that business cycles across countries have become highly synchronised (Chart 5; Annex Table 1).  As stated earlier, this study aims to nowcast global GDP growth for Q1:2022 and Q2:2022 to test the waters for the possibility of generating these nowcasts on a regular basis. Two approaches have been adopted in the exercise. In the first, the dataset on global GDP, compiled by the Organization for Economic Co-operation and Development (OECD), covering 48 countries (both OECD and non-OECD members) comprising more than 80 per cent of the global GDP in purchasing power parity terms (PPP) at 2015 prices is used. The latest update covers data till Q4:2021. So far, GDP data for Q1:2022 have been released by 35 countries accounting for 61 per cent of global GDP. For the purpose of these nowcasts, 35 countries are considered as representative of global GDP. In the second exercise (Annex Box 1), several candidate indicators such as global index of industrial production (IIP), trade volume and purchasing managers index (PMI) that are known to be highly correlated with global GDP are tested for their ability to predict global GDP growth. In an autoregressive integrated moving average (ARIMA) framework with exogeneous regressors, global IIP emerges as the strongest predictor of global GDP growth. The data on global GDP from Q1:2012 to Q4:2021 is computed by aggregating real GDP for 69 countries currently available in the CEIC database. The data for global IIP is available till March 2022. Two alternate scenarios are considered for the forecasting exercise. Under the baseline scenario, global IIP during April-June 2022 is assumed to grow at the same year-on-year rate as during the previous six months. The alternative scenario assumes a much slower growth rate of 2.0 per cent for April-June 2022 to capture risks to the global economy (Chart 6).   As it emerges, extension of OECD database to Q1:2022 using Q1:2022 GDP growth rates for 35 countries indicates that the momentum of global GDP growth during Q1:2022 has lost steam sequentially and annually, possibly entering contractionary zone (Chart 7: a-b). As regards the model-based forecasts of global GDP for Q1:2022 and Q2:2022, global GDP growth momentum seems to have decelerated in Q1:2022 and is likely to contract in Q2: 2022. The decline is expected to be much sharper under the alternative scenario (Chart 8: a-b; Annex Box 1).  Global growth has lost momentum over the first half of 2022 as evident from incoming data. The outlook is fluid and uncertain. In this highly uncertain environment, our endeavour will be to track global GDP and subsequently inflation on as contemporaneous basis as possible so as to keep all stakeholders forewarned and forearmed. References Global Economic Prospects (GEP, June 2022). World Bank. Monetary Policy Report (RBI April 2022). Reserve Bank of India. Reuters (2022, May 11). Morgan Stanley warns 2022 Global Economic Growth to be less than half of 2021. Available at: https://www.reuters.com/world/morgan-stanley-warns-2022-global-economic-growth-be-less-than-half-2021-2022-05-11/ Romei, V. & Smith, A. (2022, May 02). The Global Stagflation Shock of 2022: How Bad Could it Get? Financial Times, Available at: https://www.ft.com/content/d490ef4e-3187-471e-84ff-9c065871a1a5 World Economic Outlook (WEO, April 2022), “War Set Back Global Recovery”, International Monetary Fund.

* This article has been prepared by Ramesh Kumar Gupta, Bhanu Pratap, Jessica Maria Anthony and Thangzason Sonna of the Department of Economic and Policy Research. The team is grateful to Dr. Michael Debabrata Patra, Deputy Governor, for conceiving this analytical exercise and encouraging us in writing this study. The views expressed in the article are those of the authors and do not represent the views of the Reserve Bank of India. 1 Independent estimates/forecasts place global GDP growth for 2022 in a range of 2.7-3.3 per cent. According to Morgan Stanley, global GDP growth for 2022 could be down to 2.9 per cent (May 11, 2022), and 2.7 per cent, according to Fitch Ratings (March 21, 2022), and 3.2 per cent as per Goldman Sachs (January 31, 2022). The consensus global economic growth is only 3.3 per cent, down from 4.1 that was expected in January (Financial Times, May 02, 2022). |

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: