IST,

IST,

Annex 1: Systemic Risk Survey

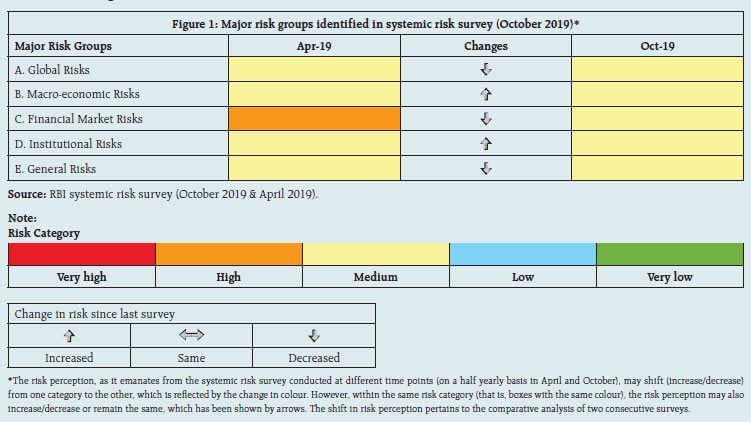

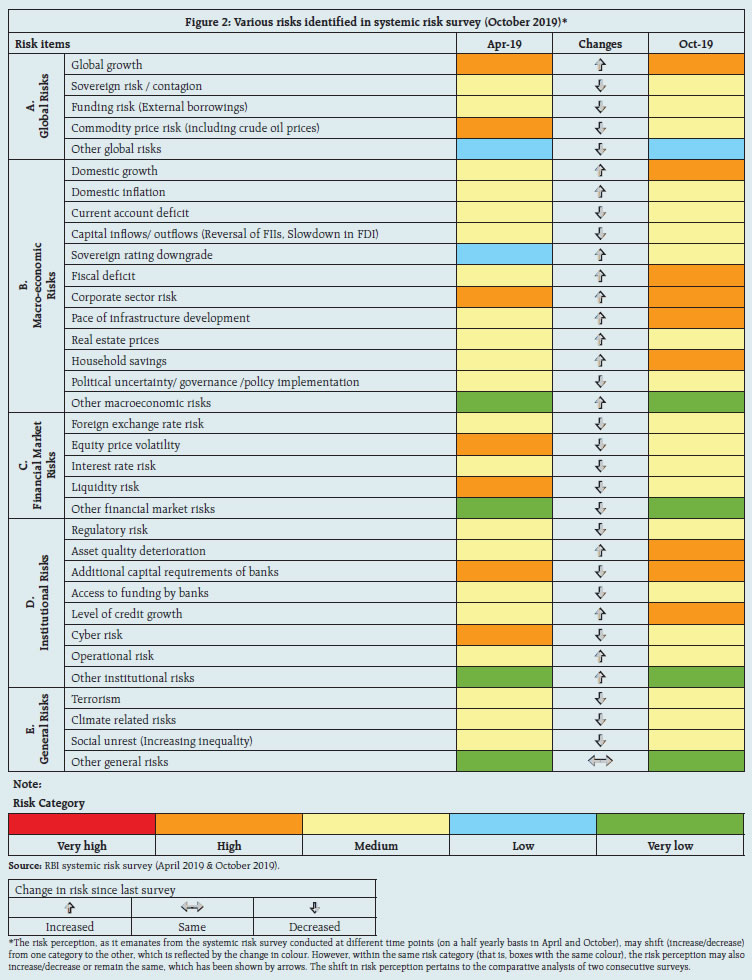

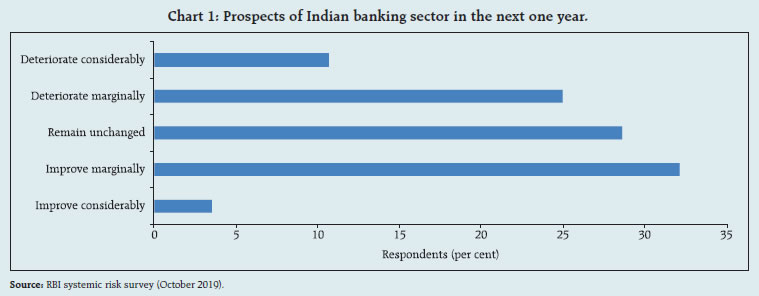

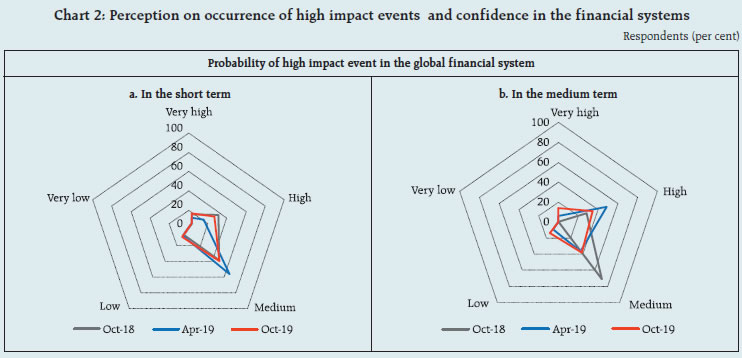

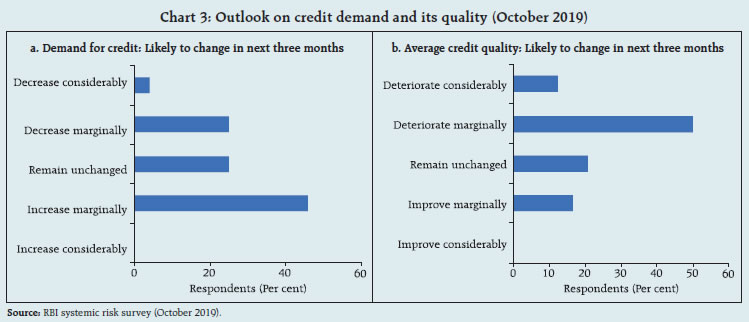

The systemic risk survey (SRS), the seventeenth in the series, was conducted during October-November 2019 to capture the perceptions of experts, including market participants, on the major risks presently faced by the financial system. According to the survey results all major risk groups viz., global risks, risk perception on macroeconomic conditions, financial market risks and institutional positions were perceived as medium risks affecting the financial system (Figure 1). Within global risks, the risk on account of global growth was categorised as high risk. Within the macroeconomic risks group, risks to domestic growth, fiscal deficit, risks on account of corporate sector vulnerabilities and household savings were perceived to be in the high-risk category. Among the institutional risks, the risks on account of asset quality deterioration and level of credit growth were perceived as high risk factors (Figure 2).   Participants opined that banks have become more prudent and have tightened their appraisal over the last couple of years substantially. Despite measures taken by the Reserve Bank, transmission of rate actions is still slow. This coupled with continued risk aversion, has thrown up challenges to the flow of credit to the productive sectors. Demand position for next 3 months may be lower on account of no trigger for fresh increase in demand for goods and services (such as festivals). Notwithstanding the persistent weakness in private investment activity, fiscal spending and better rural economy with a good monsoon should spur some consumption going forward. About 32 per cent of the respondents opine that the prospects of Indian banking sector are going to improve marginally in the next one year while 25 per cent of the respondents feel that the prospects are going to deteriorate marginally (Chart 1). Banking sector participants opine that unless the resolution of the legacy bad assets (especially NCLT1 and 2) are completed, the banking system may find it difficult to support the economic growth aspirations.  Majority of the participants in the current round of survey expect possibility of occurrence of a high impact event in the global financial system in the short term (upto 1 year) as medium. However, in the medium term (1 to 3 years) majority of the participants in the current round of survey assign a high probability to the occurrence of a high impact event in the global financial system. In the Indian financial system possibility of occurrence of a high impact event in the short-term as well as in the medium term has been assigned medium. There was a decrease in the respondents in the current survey who were fairly confident of the stability of the global financial system (Chart 2).   Majority of the respondents were of the view that the demand for credit in the next three months would increase marginally. Average credit quality is however expected to deteriorate marginally in the next three months (Chart 3).  |

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: