VII.1 The Reserve Bank continued to take measures to ensure adequate availability of banknotes and coins while improving the quality of banknotes in circulation. Banknotes with new/ additional security features were introduced during the year. Mechanisation of note processing activities at currency chests and disposal of soiled banknotes remained the major thrust areas towards improving the quality of banknotes. Banks were advised to install note sorting machines at all currency chests. The trend of reverse flow of coins continued although there was some abatement towards the end of the year as demand for coins picked up in a few centres.

VII.2 This Chapter reviews the currency management operations during 2005-06 covering the currency chest network, issue of new banknotes and coin and distribution strategies. Various measures taken to ensure the quality of banknotes in circulation and the initiatives undertaken to expand the use of computerisation in currency management as part of the overall drive to upgrade customer service are also covered along with activities of the Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL).

Currency Operations

VII.3 The core central banking function of note issue and currency management vested with the Reserve Bank in terms of Section 22 of the Reserve Bank of India Act, 1934 is performed by the Reserve Bank through its 18 Issue Offices, the sub-office of Issue Department at Lucknow, a currency chest at Kochi and a wide network of 4,408 currency chests and 4,102 small coin depots. The Reserve Bank has agency arrangements mainly with scheduled commercial banks under which the currency chest facility is granted to them. A currency chest branch is an extended arm of the Issue Department and carries out the same functions of issue of fresh banknotes/ coins, retrieval of soiled banknotes, exchange of banknotes and coins including mutilated banknotes. The total number of currency chests declined marginally during 2005-06 reflecting the implementation of the on-going policy to progressively convert and/or close currency chests held with the State Treasuries (Table 7.1). The currency operations at sub-Treasury currency chests are very nominal and

Table 7.1: Currency Chests |

Category |

Number of Currency Chests |

|

June |

June |

June |

|

30, 2004 |

30, 2005 |

30, 2006 |

1 |

2 |

3 |

4 |

Treasuries |

214 |

149 |

116 |

State Bank of India |

2,173 |

2,198 |

2,182 |

SBI Associate Banks |

1,004 |

1,008 |

994 |

Nationalised Banks |

943 |

983 |

1,028 |

Private Sector Banks |

58 |

72 |

83 |

Co-operative Banks |

1 |

1 |

1 |

Foreign Banks |

4 |

4 |

4 |

Reserve Bank |

20 |

20 |

20 |

Total |

4,417 |

4,435 |

4,428 |

they cause difficulties for accounting not only for the Reserve Bank Issue Offices but also the concerned State Governments. In view of these factors, it has been decided to progressively close the currency chests with the Treasuries and sub-Treasuries. The needs of the State Governments at these places are proposed to be met from the currency chests with the public sector banks. The State Bank of India closed or merged a few chests during the year after carrying out cost benefit analysis. It has, however, been ensured that Government business, public services and linkage schemes to the attached banks are not affected adversely by closure of these currency chests. The State Bank of India is also setting up Currency Administration Cells to streamline currency chest functioning. Subsequent to the announcement in the Mid-term Review of the Annual Policy Statement for 2005-06, it has been decided to grant in-principle approval to urban cooperative banks and regional rural banks to set up currency chests.

BANKNOTES IN CIRCULATION

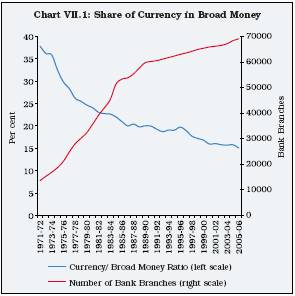

VII.4 During 2005-06, banknotes in circulation registered growth of 16.8 per cent (13.0 per cent a year ago) in value terms in consonance with acceleration in economic activity. The ratio of currency with the public to broad money fell to 15.1 per cent at end-March 2006 from 15.8 per cent at end-March 2005, continuing with its declining trajectory over the past few years (Chart VII.1).

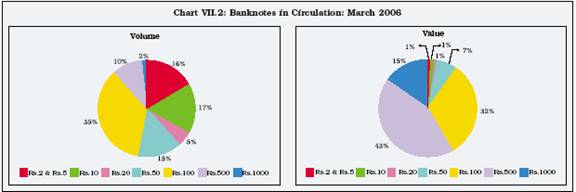

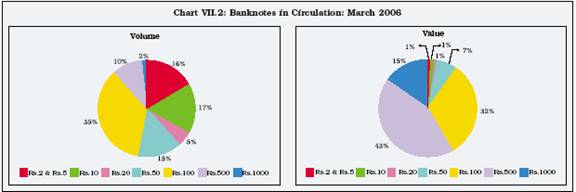

VII.5 The growth in volume of banknotes (2.3 per cent) continued to be substantially lower than that in the value, reflecting the ongoing compositional shift towards higher denomination banknotes, particularly Rs.1000 and Rs.500 denominations. The volume of banknotes in circulation of Rs.2, Rs.5, Rs.10 and Rs.50 denominations declined further during the year. On the other hand, the volume of banknotes in circulation of Rs.100 denomination recorded an increase of 9.2 per cent while those of Rs.500 and Rs.1000 denominations recorded sharp increases of 19.4 per cent and 52.7 per cent, respectively. In terms of volume, Rs.100 denomination notes continue to lead the circulation while in terms of value, Rs.500 denomination notes take the largest share (Table 7.2 and Chart VII.2).

Table 7.2: Banknotes in Circulation |

Denomination |

Volume |

Value |

|

(Million pieces) |

(Rupees crore) |

|

End- |

End- |

End- |

End- |

End- |

End- |

|

March |

March |

March |

March |

March |

March |

|

2004 |

2005 |

2006 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rs.2 & Rs.5 |

6,911 |

6,484 |

6,217 |

2,748 |

2,548 |

2,431 |

Rs.10 |

7,750 |

6,770 |

6,274 |

7,750 |

6,770 |

6,274 |

Rs.20 |

2,192 |

1,938 |

2,038 |

4,383 |

3,876 |

4,076 |

Rs.50 |

6,605 |

5,988 |

5,568 |

33,027 |

29,941 |

27,840 |

Rs.100 |

12,144 |

12,328 |

13,464 |

1,21,442 |

1,23,282 |

1,34,640 |

Rs.500 |

2,459 |

3,055 |

3,647 |

1,22,938 |

1,52,728 |

1,82,350 |

Rs.1000 |

275 |

421 |

643 |

27,473 |

42,082 |

64,300 |

Total |

38,336 |

36,984 |

37,851 |

3,19,761 |

3,61,227 |

4,21,911 |

VII.6 The consistent shift from lower denomination notes to higher denomination notes can be partly attributed to the growing network of Automated Teller Machines (ATMs). Banks do not find it commercially viable to stock the machines with lower denomination notes because they run out sooner and increase both the capital cost and operating costs. The Reserve Bank has accordingly been facing increasing demand of fresh notes in Rs.500 and Rs.100 denominations. In the context of the increased demand for ATM fit notes, banks have been advised to use desktop sorters to salvage good quality notes for use in their ATMs.

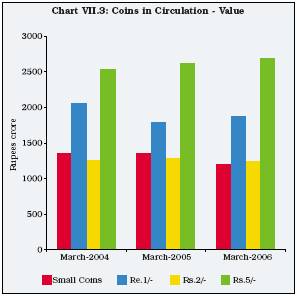

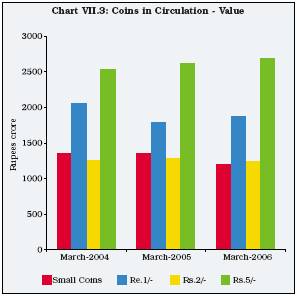

VII.7 The total value of coins (including small coins in circulation) increased by 2.3 per cent during 2005-06 as compared with a decline of 2.0 per cent in 2004-05. In volume terms, the increase was 1.4 per cent in 2005-06 as compared with a decline of 2.8 per cent in 2004-05 (Table 7.3 and Chart VII.3). The increase during 2005-06 could be attributed to the increase in circulation of Re.1 and Rs.2 denomination coins by 4.6 per cent and 3.6 per cent, respectively.

Table 7.3: Coins in Circulation |

Denomination |

Volume |

Value |

|

(Million pieces) |

(Rupees crore) |

|

End- |

End- |

End- |

End- |

End- |

End- |

|

March |

March |

March |

March |

March |

March |

|

2004 |

2005 |

2006 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Small Coins |

54,102 |

54,051 |

54,115 |

1,353 |

1,353 |

1,357 |

Re. 1 coin |

20,565 |

17,896 |

18,730 |

2,057 |

1,790 |

1,873 |

Rs. 2 coin |

6,275 |

6,449 |

6,684 |

1,255 |

1,290 |

1,337 |

Rs. 5 coin |

5,071 |

5,238 |

5,289 |

2,536 |

2,619 |

2,645 |

Total |

86,013 |

83,631 |

84,818 |

7,201 |

7,052 |

7,212 |

Printing of Fresh Banknotes

VII.8 Total supplies by the Presses were 47 per cent of indent in terms of volume and 41 per cent of indent in terms of value (Table 7.4 and Table 7.5). The shortfall in supply was due to the delay in arrival of Cylinder Mould Vat Watermarked Bank Note (CWBN) paper with revised specifications for printing of banknotes with new/additional security features and the decision to commence printing of new design banknotes only on exhausting old design paper to avoid mixing of old and new notes and to salvage maximum number of old design notes from semi-processed sheets. Although supply was less than 50 per cent of the indent, the available supplies were distributed judiciously by arranging supplies from surplus circles to needy circles, especially during festival season. Furthermore, the return of soiled notes recorded a decline from 11,285 million pieces in 2004-05 to 9,304 million pieces in 2005-06. No case of any short supply of banknotes was reported.

VII.9 As noted above, demand for banknotes during 2005-06 could be met even though supply was lower than the indent. Taking into account the experience of 2005-06 as well as improvements in inventory management practice, indent for fresh banknotes for 2006-07 (April-March) has been placed 23.3 per cent lower than that for 2005-06, although it would be substantially higher (64.2 per cent) than the actual supplies during 2005-06 (Table 7.4). The Reserve Bank has taken various steps to assess an optimal inventory of banknote requirements. In order to strengthen these efforts, an internal Working Group was constituted to look into issues relating to currency

Table 7.4: Volume of Banknotes Indented and Supplied |

(Million pieces) |

|

2003-04 |

2004-05 |

2005-06 |

2006-07 |

Denomination |

Indent |

Supply |

% of |

Indent |

Supply |

% of |

Indent |

Supply |

% of |

Indent |

|

|

Supply |

to |

|

|

Supply to |

|

|

Supply to |

|

|

|

|

Indent |

|

|

Indent |

|

|

Indent |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Rs.5 |

1,500 |

1,470 |

98 |

160 |

179 |

112 |

- |

50 |

- |

- |

Rs.10 |

3,500 |

3,070 |

88 |

4,700 |

4,332 |

92 |

3,300 |

1,183 |

36 |

3,500 |

Rs.20 |

1,000 |

959 |

96 |

1,000 |

755 |

76 |

1,200 |

706 |

59 |

500 |

Rs.50 |

3,000 |

2,129 |

71 |

2,040 |

1,862 |

91 |

2,700 |

1,063 |

39 |

1,400 |

Rs.100 |

5,000 |

4,161 |

83 |

5,030 |

3,956 |

79 |

5,550 |

3,208 |

58 |

4,000 |

Rs.500 |

1,500 |

1,168 |

78 |

1,625 |

1,252 |

77 |

1,800 |

661 |

37 |

1,500 |

Rs.1000 |

300 |

209 |

70 |

300 |

257 |

86 |

450 |

130 |

29 |

600 |

Total |

15,800 |

13,166 |

83 |

14,855 |

12,593 |

85 |

15,000 |

7,001 |

47 |

11,500 |

Table 7.5: Value of Banknotes Indented and Supplied |

(Rupees crore) |

|

2003-04 |

2004-05 |

2005-06 |

Denomination |

Indent |

Supply |

% of |

Indent |

Supply |

% of |

Indent |

Supply |

% of |

|

|

|

Supply to |

|

|

Supply to |

|

|

Supply to |

|

|

|

Indent |

|

|

Indent |

|

|

Indent |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Rs.5 |

750 |

735 |

98 |

80 |

90 |

113 |

- |

- |

- |

Rs.10 |

3,500 |

3,070 |

88 |

4,700 |

4,332 |

92 |

3,300 |

1,183 |

36 |

Rs.20 |

2,000 |

1,918 |

96 |

2,000 |

1,510 |

76 |

2,400 |

1,412 |

59 |

Rs.50 |

15,000 |

10,645 |

71 |

10,200 |

9,310 |

91 |

13,500 |

5,316 |

39 |

Rs.100 |

50,000 |

41,610 |

83 |

50,300 |

39,560 |

79 |

55,500 |

32,084 |

58 |

Rs.500 |

75,000 |

58,400 |

78 |

81,250 |

62,600 |

77 |

90,000 |

33,065 |

37 |

Rs.1000 |

30,000 |

20,900 |

70 |

30,000 |

25,700 |

86 |

45,000 |

12,960 |

29 |

Total |

1,76,250 |

1,37,278 |

78 |

1,78,530 |

1,43,102 |

80 |

2,09,700 |

86,020 |

41 |

management and suggest ways for fur ther improvement and rationalisation. It has been decided to design a model for forecasting the demand for banknotes. Furthermore, with a view to streamlining the procedures relating to remittance of fresh banknotes, it has been decided to explore the possibility of rationalisation of logistics of distribution and movement of currency/treasure. The Indian Institute of Technology (IIT), Madras has been requested for developing an optimal distribution model for sending currency notes to the currency chests. As part of its efforts to reduce the expenditure for printing of banknotes, the Reserve Bank continued with its efforts to source the maximum amount of banknotes from the lowest cost producer.

VII.10 For the past three years there has been reverse flow of coins, par ticularly of lower denominations. The Reserve Bank has advised the banks to accept coins of all denominations and also made arrangements with the Government of India mints to accept non-current coins for melting. It has already been decided to phase out from circulation all coins of 5 paise, 10 paise and 20 paise denomination, irrespective of their metal composition, as they are no more in demand. Cupro-nickel coins of 25 paise, 50 paise and Re. 1 denomination are also being phased out. Banks have been directed to accept and remit these coins to the Government mints. The Reserve Bank has not placed any indent for coins for 2006-07 with the Government mints in view of the adequate stock position at the Reserve Bank and the reverse flow of coins (Table 7.6).

VII.11 In order to address various issues pertaining to the availability and distribution of small coins, the Reserve Bank commissioned a study ‘The Need and Use Behaviour for Small Coins’ by Dr. Velayudhan of Birla Institute of Technology and Science (BITS), Pilani. The findings of the study reaffirm the belief that there is no shortage of both rupee coins and small coins. However, in case of small denomination coins, especially of 25 paise, the problem is more of acceptance than that of availability. The regional offices continued to receive coins over the counters from members of the public (Table 7.7).

Table 7.6: Indent and Supply of Coins |

(Million pieces) |

|

2003-04 |

2004-05 |

2005-06 |

Denomination |

Indent |

Supply |

Indent |

Supply |

Indent |

Supply |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

25 paise |

0 |

20 |

0 |

0 |

0 |

0 |

50 paise |

0 |

325 |

0 |

0 |

0 |

0 |

Re. 1 |

2,000 |

1,463 |

1,250 |

463 |

0 |

12.7 |

Rs. 2 |

700 |

546 |

500 |

232 |

0 |

21.5 |

Rs. 5 |

760 |

474 |

750 |

201 |

0 |

7.2 |

Total |

3,460 |

2,828 |

2,500 |

896 |

0 |

41.4 * |

* : Includes commemorative coins. |

Table 7.7: Coins Received from Public |

|

2 0 0 3 - 0 4 |

2004-05 |

2005-06 |

Denomination |

Pieces |

Value |

Pieces |

Value |

Pieces |

Value |

|

(million) |

(Rupees crore) |

(million) |

(Rupees crore) |

(million) |

(Rupees crore) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

5 paise |

0.5 |

0.0 |

0.4 |

0.0 |

0.2 |

0.0 |

10 paise |

8.1 |

0.0 |

8.5 |

0.0 |

5.6 |

0.0 |

20 paise |

36.5 |

0.0 |

21.3 |

0.0 |

12.5 |

0.0 |

25 paise |

32.4 |

0.1 |

129.7 |

0.3 |

101.6 |

0.3 |

50 paise |

49.9 |

0.3 |

131.6 |

0.7 |

117.7 |

0.6 |

Re. 1 |

49.4 |

4.9 |

66.7 |

6.7 |

47.8 |

4.8 |

Rs. 2 |

21.3 |

4.3 |

59.8 |

12.0 |

41.8 |

8.4 |

Rs. 5 |

15.2 |

7.6 |

25.1 |

12.6 |

19.2 |

9.6 |

Total |

213.3 |

17.2 |

443.1 |

32.3 |

346.4 |

23.7 |

CLEAN NOTE POLICY

VII.12 The Reserve Bank persevered with its efforts to improve the quality of banknotes in circulation. In addition to regular supply of fresh notes, speedier disposal of soiled banknotes, mechanisation of cash processing activity, and discontinuance of the practice of stapling banknotes have contributed to improvement in quality of banknotes. Banks have also been issued directives instructing, inter alia, to sort banknotes into issuable and non-issuable, issue only clean notes to public and to remit the soiled notes in unstapled condition to the Reserve Bank through currency chests. Disposal of Soiled Notes

VII.13 During 2005-06, 9,304 million pieces of banknotes (almost one-fourth of total banknotes in circulation) were processed and disposed off. Rs.100 denomination notes constituted the largest share of soiled notes (Table 7.8).

Table 7.8: Disposal of Soiled Notes |

Denomination |

Volume in million pieces |

|

2003-04 |

2004-05 |

2005-06 |

1 |

2 |

3 |

4 |

Rs. 1000 |

13 |

5 |

5 |

Rs. 500 |

247 |

257 |

242 |

Rs. 100 |

3,954 |

4,324 |

3,250 |

Rs. 50 |

2,617 |

2,490 |

2,160 |

Rs. 20 |

306 |

485 |

532 |

Rs. 10 |

5,004 |

3,716 |

2,593 |

Up to Rs. 5 |

304 |

475 |

522 |

Total |

12,445 |

11,752 |

9,304 |

Memo: |

|

|

|

Total Banknotes in Circulation |

38,336 |

36,984 |

37,851 |

Mechanisation

VII.14 Mechanisation of cash processing activity and disposal of soiled banknotes has been one of the major thrust areas of the Reserve Bank in currency management. With a view to augmenting the banknote processing capacity, as also to equip all the offices with mechanised processing capabilities, six Currency Verification and Processing Systems (CVPSs) and one Shredding and Briquetting System (SBS) were installed in the new office building at Lucknow during 2005-06, in addition to the existing 48 CVPSs and 27 SBSs installed in phases, at 18 Issue Offices. During 2005-06, 5,309 million pieces of banknotes were processed on these machines.

Counterfeit Banknotes

VII.15 The number and value of counterfeit banknotes detected at the Reserve Bank offices and bank branches during the year continued the declining trend of the previous two years. There was a reduction of 31.9 per cent in the number and 27.5 per cent in the value of counterfeit banknotes detected at the Reserve Bank offices and bank branches during the year. There was an increase in the detection of the counterfeits of Rs.1000 denomination while there was a large decline in detection of counterfeits of Rs.100 denomination banknotes (Table 7.9). Data on counterfeits detected is reviewed and analysed on a continuing basis to aid in policy decisions relating to upgradation of security features and mechanisation of bank branches to facilitate detection of counterfeit banknotes by banks.

New/Additional Security Features of Banknotes

VII.16 Security features of banknotes are reviewed continuously and updated periodically with the

Table 7.9: Counterfeit Banknotes Detected |

|

Number of pieces |

Value (Rupees) |

Denomination |

2003-04 |

2004-05 |

2005-06 |

2003-04 |

2004-05 |

2005-06 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rs.10 |

77 |

79 |

80 |

770 |

790 |

800 |

Rs. 20 |

56 |

156 |

340 |

1,120 |

3,120 |

6,800 |

Rs. 50 |

4,701 |

4,737 |

5,991 |

2,35,050 |

2,36,850 |

2,99,550 |

Rs. 100 |

1,82,361 |

1,61,797 |

1,04,590 |

1,82,36,100 |

1,61,79,700 |

1,04,59,000 |

Rs. 500 |

17,783 |

14,400 |

12,014 |

88,91,500 |

72,00,000 |

60,07,000 |

Rs. 1000 |

248 |

759 |

902 |

2,48,000 |

7,59,000 |

9,02,000 |

Total |

2,05,226 |

1,81,928 |

1,23,917 |

2,76,12,540 |

2,43,79,460 |

1,76,75,150 |

Note: The above data do not include the counterfeit notes seized by police and other enforcement agencies. |

objective of staying ahead of the counterfeiters and to maintain the confidence of the public in the banknotes as also to take advantage of the latest innovations. In continuation of this process, the Reser ve Bank introduced banknotes with the following new/additional security features in a phased manner in 2005-06: (a) demetallised, magnetic and machine readable windowed security thread with a colour shift from green to blue in Rs.100, Rs.500 and Rs.1000 denominations, (b) improved intaglio printing, (c) improved see-through feature having the denominational numeral instead of the floral design and (d) electrolyte watermark having denominational numeral alongside Mahatma Gandhi portrait in the watermark window. These enhanced features approved for banknotes of Rs.10, Rs.20, Rs.50, Rs.100, Rs.500 and Rs.1000 denominations have already been introduced. Press briefings and posters containing the pictorial details on security features of banknotes with additional/new security features for educating the public were made available to all the banks. Posters in Hindi and English have been put on the website of the Reserve Bank. Regional offices have also been advised to create public awareness at the local level through public organisations like the railways and police authorities. The publicity is being carried out continuously. All banks have been advised to set up a Forged Note Vigilance Cell at their Head Offices to closely monitor detection of counterfeit banknotes at currency chests and initiate control/measures on the dispensation of counterfeit banknotes through ATMs or over the counters. Banks have also been advised to install note sorting machines at their currency chest branches to, inter alia, detect counterfeit banknotes so that they are not issued through ATMs/cash counters or any other delivery channel at the bank branches. Introduction of Star Series Banknotes

VII.17 It has been decided to introduce star series numbering system for replacement of defectively printed banknotes at the printing presses (Box VII.1).

Computerisation of Currency Management

VII.18 The Reserve Bank has taken up the task of putting in place an Integrated Computerised Currency Operations and Management System (ICCOMS) in the Issue Departments in regional offices and in the central office. The project also includes computerisation and networking of the currency chests with the Reserve Bank’s offices to facilitate prompt, efficient and error-free reporting and accounting of the currency chest transactions in a secure manner (Box VII.2). It is expected that the IT initiatives taken by the banks for computerisation of branch operations coupled with the advances in the communication facilities in the country will provide the necessary environment for successful implementation of the system across all banks and all over the country.

VII.19 The progress of the system is being closely monitored. Parallel run has started in Belapur and Mumbai offices. Workshops have already been conducted for all offices to provide a first hand knowledge of the Currency Chest Reporting System (CCRS). The CCRS module is being rolled out parallel in phases in all Issue Offices and is expected to be completed in all offices by August 2006. All modules pertaining to ICCOMS are likely to be completed by September 2006. Thereafter, the MIS module for Department of Currency Management (DCM) shall be implemented. The entire project is expected to be in place and operational by December 2006. Box VII.1

Introduction of Star Series of Banknotes Genuine banknotes bear a distinctive serial number along with a prefix. The prefix consists of a numeral and a letter depending upon the banknote denomination. Banknotes up to Rs.20 denomination have two numerals and one alphabet as prefix while banknotes of Rs.50 and above denominations have one numeral and two alphabets as prefix. Fresh banknotes issued by the Reserve Bank, at present, are serially numbered. The notes are issued in packets containing 100 pieces. In the existing system, the banknotes/packets with defects related to printing, numbering and wrong cuts are replaced at press level with good re-numbered (same number) banknotes to maintain the sequential numbering of banknotes in a packet. This procedure involves additional time/cost and manual intervention.

Adoption of star series concept would imply that a fresh banknote packet which, at present, contains banknotes numbered from 1 to 100 may contain 100 pieces that are not serially numbered from 1 to 100. The packet would still contain 100 pieces but one or more pieces in the packet may have a different number containing the star series notes. This system would help in streamlining procedures and reducing manpower deployed in replacement activity.

Star series banknotes, to begin with, will be issued in Rs.10, Rs.20 and Rs.50 denominations and will look exactly like the existing banknotes in the Mahatma Gandhi series but will have an additional character viz., * (Star) in the number panel between the prefix and the serial number. The bands of the fresh note packets containing the star series numbered note/s will clearly indicate the presence of such banknotes in the packets. The packets with star series notes will, as usual, have 100 pieces but not in serial order. The quantitative correctness of these packets can be verified with the help of note counting machines provided at the counters by banks. It may be mentioned that the serially numbered banknotes are available only in fresh banknote packets. The majority of the public/users of cash receive re-issuable banknotes which are not serially numbered. Star series banknotes will be legal tender. Adequate publicity in Hindi, English and regional languages through print/electronic media is being given to this effect. Customer Service

VII.20 During the year, the Reserve Bank stepped up its measures towards improvement of customer services in matters relating to issue of coins, acceptance of coins from public and exchange of soiled and mutilated banknotes. The Reserve Bank reiterated its directions to all scheduled commercial banks to issue coins and, accept coins and soiled banknotes in transactions or for exchange without any restriction. Adequate availability of coins in circulation was thus ensured.

VII.21 Efforts were continued to provide timely and efficient customer service not only at the Reserve Bank offices but also at the bank branches. The Reserve Bank also revised the Citizens’ Charter and placed the same on its website. The recommendations of the Committee on Procedures and Performance Audit on Public Services (CPPAPS) have been accepted for implementation. Department of Currency Management is one of the departments that have received ISO 9001: 2000 certification (Box VII.3).

The Bharatiya Reserve Bank Note Mudran Pvt. Ltd

VII.22 The Bharatiya Reserve Bank Note Mudran Private Ltd. (BRBNMPL), incorporated as a wholly owned subsidiary of the Reserve Bank, was set up in 1996 to take over the work of the new note press project. It operates the single business of printing Bank Note Forms in its two Note Presses at Mysore (Karnataka) and Salboni (West Bengal). Both the Presses put together have an annual installed capacity of 9,540 million pieces of note forms in single shift depending on the mix of denominations. The total production of banknotes by the two presses at Mysore and Salboni during the year 2005-06 was 4,092 million pieces as compared with 8,625 million pieces during the year 2004-05, showing a decline of 52.6 per cent. The fall in production was due to the switchover to printing of banknotes with new/additional security features and, as noted before, the delay in arrival of CWBN paper with revised specifications. The Company has been re-certified as being fully compliant with the requirement of ISO 9001:2000 for a further period of three years. Box VII.2

Automation in Currency Chests Banks have been advised to provide, in a time-bound manner, note sorting machines of appropriate capacity at currency chest branches for proper sorting of banknotes and identification of suspect banknotes. These note sorting machines will help: (i) mitigate the circulation of counterfeit banknotes through the banking channel; (ii) ensure that only non-issuable banknotes are sent to the Reserve Bank while re-issuable banknotes are sent to the public; and (iii) facilitate smooth processing of banknotes in the Reserve Bank. Out of a total of 4,428 currency chests, 4,292 currency chests are maintained by various banks and rest are with State Treasury Offices (STOs) and the Reserve Bank. Of the 4,292 currency chests maintained by the banks, 2,027 currency chests have so far been equipped with note sorting machines and orders have been placed in respect of 2,087 currency chests. The position is being monitored in the remaining 178 currency chests.

Out of the banks having less than 100 currency chests, 12 public sector banks and 17 private sector banks have mechanised their currency chests fully. The Reserve Bank is closely monitoring the progress made by various banks. Box VII.3

ISO Certification on Currency Management and Banking Services International Organisation for Standardisation’s (ISO) certification ensures that minimum international quality standards are adhered to in the systems and procedures followed in an organisation. Quality means doing the right things, the right way, first time and every time. The Reserve Bank decided to opt for ISO certification of currency management and banking services as they are highly service oriented in nature. Fur thermore, currency management is one of the most important functions of the Reserve Bank. Department of Currency Management (DCM), Department of Government and Bank Accounts (DGBA) and Issue/Banking Departments of Kolkata and Hyderabad offices were identified for the ISO Certification. Accordingly, a Core Group was set up to ensure smooth implementation of the ISO standards. Quality Manual and Procedural Manual were prepared towards implementation of ISO standards. The Quality Policy for Currency Management was formulated as follows: “That the Bank is committed to consistently provide adequate quantity of clean banknotes and coins to the members of the public coupled with timely withdrawal of soiled and mutilated notes from the currency chests as also facilitating processes to check the circulation of counterfeit banknotes and also to continuous improvements in the currency management systems through upgradation of technology for maximisation of the satisfaction of the members of the public.”

Departmental officials were given awareness and internal audit training by Consultants, M/s. Allied Boston Consultancy India Limited. Certification audit of the Departments concerned was conducted in March 2006 by Certifying Agency M/s. International Certification Services Asia (P) Limited. The Certificate stating that the audited Departments are conforming to the international quality norms was received in June 2006. Outlook

VII.23 The Reserve Bank will continue with its key objectives of providing adequate supply of good quality banknotes and coins in the country. The ongoing computerisation of currency chests along with enhanced mechanisation of note processing would help to improve the quality of banknotes. The Reserve Bank will pursue with its efforts to further strengthen security features in banknotes to offset challenges posed by counterfeiting. Efforts will, therefore, continue to ensure availability of coins and banknotes to the consumers in their day-to-day cash transactions, to combat the counterfeiting of banknotes, to examine various options for increasing the circulation life of banknotes of lower denominations, to ensure printing of banknotes to very strict quality rules/standards, to review the banknotes and coins handling practices including recycling of banknotes and coins, to upgrade banknote security features on a continuous basis, and to put in place an integrated computerised system for management of currency.

VII.24 Various alternatives are being explored to ensure availability of adequate quantity and quality of banknotes and coins to the public in all parts of the country while containing the cost of currency management. The measures being taken/explored in this regard are: (i) use of alternate substrates and coating for enhancing life of banknotes, especially lower denomination notes; (ii) optimising the size of inventory in note form of currency chests; and (iii) more efficient practices in movement of treasure without compromising on security aspects. The Reserve Bank is taking up the issue of indigenisation of raw materials for printing of banknotes. An initial feasibility study conducted by the BRBNMPL for indigenisation of the CWBN paper indicates that setting up of paper mill in India is technically feasible. BRBNMPL proposes to undertake a detail project report by constituting an in-house team. BRBNMPL has called for ‘Expression of Interest’ from interested parties for setting up a paper mill in India. In order to promote research and development on currency management, the Reserve Bank would facilitate BRBNMPL’s partnership with external institutions/ experts on a continuous basis with regard to issues such as indigenisation, alternate substrates and coating. |