IST,

IST,

Challenges in Developing the Bond Market in BRICS

Shri R. Gandhi, Deputy Governor, Reserve Bank of India

delivered-on సెప్టెం 27, 2016

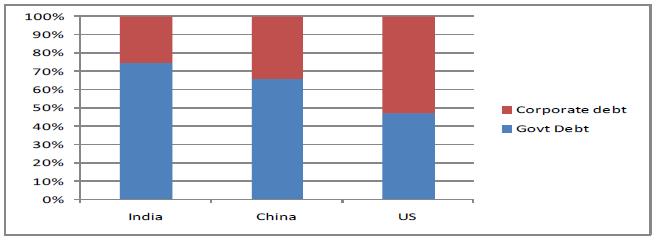

I. Introduction I notice that the Seminar is on developing bond markets in BRICS. Though bond markets include both the government securities market and the corporate bonds market, I would dwell upon only on corporate debt market. The reason is simple. The government securities market in the BRICS countries have attained a definite positions, whereas the corporate bonds market are at nascent stage. 2. For example, India’s Government securities market - by whatever criterion – is as developed as any other emerging market. It compares favourably with many AE markets as well; despite its thin investor base (on which we need to work more), in terms of instruments, transparency, trading and settlement systems and liquidity, the government securities market has grown in a big way. So, I am clear in my mind that at this stage of our development, our focus should be on corporate bond markets. 3. We do not have a well developed corporate bond market, and this fact is widely recognized. Not as well recognized is the fact that even in developed economies, corporate bond markets are not as developed and as liquid as Government bond markets. It is not uncommon in advanced economies that the corporates’ primary source of funds is not corporate bond market, but the credit market. Many European countries including Germany, Japan and China have achieved economic success based largely on a bank financed model. So when we talk of developing corporate bond markets we must be realistic about our goals. More importantly, we must not be blinkered in squeezing bank finance to force-feed the corporate bond market. We would do well and act wisely if we keep our efforts in this perspective. 4. With the caveats out of the way, let us get back to the issue at hand. What is happening in the global space? In an era of negative interest rates and unconventional monetary policies, with a substantial amount of global debt offering sub-zero yields, the focus is back on emerging markets (including BRICS) as investors are in search of yields. 5. Emerging economies produce 39% of global output, yet they account for only 14% of the global corporate bond market value. This suggests that emerging economies may be able to better utilize corporate bonds to finance their private sector and, consequently, their growth. Furthermore, as the landscape for bank-intermediated financing transforms under regulatory reforms and technological advances, the need and opportunities for domestic corporate bond markets development are apparent. 6. An IMF study on increasing corporate leverage indicates that over the period 2004-2014, non-financial corporate debt of emerging markets had grown from $4 tn to over $18 tn. Over this period the share of bonds in corporate debt has grown from 9% to 17%. The shift from bank finance to bond finance is slow but steady. 7. Is this trend likely to sustain? More generally, would this rise in corporate borrowing survive a reversal of the decade-and-a-half long accommodative liquidity in advanced economies? Of the $3 tn of corporate bonds in EMs, about $0.8 tn is foreign currency borrowing. If we take this as an indicator of international capital flows into EM bonds over the last decade, the indicative answer to our question is that EM corporate bond market could still continue to grow, albeit slower. The outflow of international capital from EM bond markets, if AEs tighten policy, would not be trend reversing. 8. Now, to the all important question. What ails the corporate bond market? I will try to answer this in the context of India. Broadly speaking, high Government borrowing crowding out private debt, excessive regulatory restrictions on the investment mandates of financial institutions, corporate preference for bank financing for historically idiosyncratic reasons (e.g. the cash credit system), tepid investor interest for whatever reasons in all but the best rated instruments, the absence of a well-functioning bankruptcy code, etc. are some of the key factors. However, most of these issues are not a deal breaker as far as market development is concerned and are being tackled by the Government and other regulators. 9. Let me now touch upon the current scenario of bond markets in BRICS and India in particular, major challenges and the way forward. II. Overview of the bond market 10. In terms of Govt debt to GDP ratio, an indicator of maturity of debt market, barring Russia, other BRICS nations have a relatively deep Sovereign debt market. It ranges from 66% in Brazil to 18% in Russia. India has a Govt. debt to GDP ratio of 66%. 11. China’s bond market has seen a rapid growth in recent times making it the third largest bond market of the world after US and Japan. China’s bond market size is about $ 6.2 trillion. India’s bond market is estimated to be about $ 1.1 trillion (Dec 2015: source ADB). Unlike US, where the corporate debt market is bigger than the Govt debt market, India and China have bigger sovereign debt segment with Sovereign debt to corporate debt ratio at 2.7 and 2.1 respectively.  12. A snapshot of India’s debt market is given in the Table below:

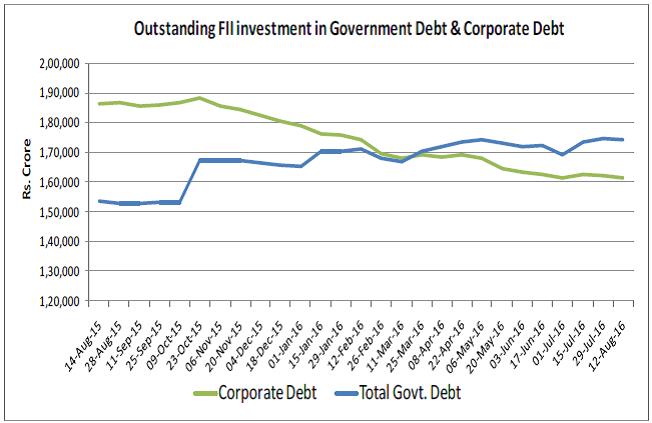

FPI investment in Debt 13. India has taken a calibrated approach to letting in foreign portfolio flows into her debt market. Over time, the FPI debt portfolio has been getting more stable with a steady inflow of long-term investors. Obviously, it would be preferable from the point of view of financial stability that the FPI investor base consists largely of this category of investors rather than speculative capital or arbitrage funds. We would need to work towards that outcome.  III. Corporate Bond Market 14. Indian Corporate Bond market has seen some growth in recent years, both in terms of number of issues and amount. The outstanding issues which were at 12,155 as at end March 2011 increased to 22,374 by end March 2016. During the same period, the amount outstanding increased from ₹ 8,895 billion to ₹ 20,193 billion. While the types issued included fixed rate bonds, floating rate bonds, structured notes and other types, the fixed rate bonds were predominant both in number and value. Another characteristic of the issuances was that almost all issuances were by financial sector entities. Yet another peculiar feature of our Corporate Bond market is that private placements are the norm. The public issuances which were ₹ 94.51 billion in 2010-11 increased to ₹ 338 billion in 2015-16. The private placements which were ₹ 2187.85 billion in 2010-11, were ₹ 4580.73 billion in the year 2015-16. The secondary market trading which was at ₹ 6053 billion in 2010-11, was at ₹ 10224 billion in 2015-16. 15. I will elaborate what I consider the major tendencies of this market, if only to give us an idea of where reform efforts need to be directed. 16. The primary issuance of corporate bonds is dominated by private placements. More than 95% of total issues are privately placed. This is not, per se, a shortcoming as long as there is transparency regarding such issues. As long as information about such issues and their life-cycle performance (particularly default history) is publicly available, investors should be able to take informed decisions. What is required here is a public database that is freely accessible. Effort of authorities has been towards building a trade repository of both primary and secondary activities. 17. Another significant character of India’s corporate debt market is the dominance of financial institutions. Bulk of the issuance is in the so-called BFSI Sector (Banking, Financial Services and Insurance). Banking and financial services account for 74% of all primary issues in FY 2015 (NSE, ISMR 2015). Non-financial corporates account only for 19% of all outstanding issuance. Clearly, access of non-financial corporates is limited and needs to be encouraged. It is in this context that RBI’s recent announcement to push large borrowers to the bond market assumes significance. 18. But this in itself would not be enough. Most of the corporate issuance in India is of top credit quality, with AA- or better accounting for about 80% of all issuance while BBB or worse accounted for only 14% in FY 2016 (CRISIL IDM 2015). What this shows is that the corporate bond market is largely accessible to the top rated borrowers. Efforts in this respect should be focused on facilitating access of low credit (high yield sounds better) borrowers to this market. For this to happen, loosening investment guidelines of insurance and pension funds would not be enough, what is required is to create an investor category to distribute risk widely. Risk taking culture assumes importance if we were to achieve this objective. 19. Thin secondary market activity not only affects transparency of the market, it also makes the process of price discovery suspect. Trading volumes have been increasing, from about ₹ 5 bn (average daily) in FY 2009 to about ₹ 45 bn in FY 2015 (CRISIL IDM 2015). But this is less than a tenth of the volumes in the G-sec market. It is unrealistic to expect that corporate bonds will trade as much as G-secs. Yet we must continue efforts to achieve a reasonable degree of transparency into the market. 20. Several measures have been taken by GoI, RBI and SEBI to aid the growth of corporate debt market in India. The impact of such development measures is evident in the growing primary issuances and also the growth in the secondary market volumes. Measures such as rationalising the listing norms, simplification in issuance procedures and processes, standardisation of market conventions, setting up of reporting platform, implementation of DvP settlement of corporate bond trades, allowing banks to hold corporate bonds from the infrastructure sector on their balance sheet as HTM assets and issuing long term bonds without the requirement for maintaining reserves have had an encouraging impact on the market. 21. Some of the other major bottlenecks can thus be listed as below:

22. To address these issues, recently Khan Committee has made various recommendations which are being examined and implemented by the regulators and the GoI. Some of the recommendations which have been implemented are:

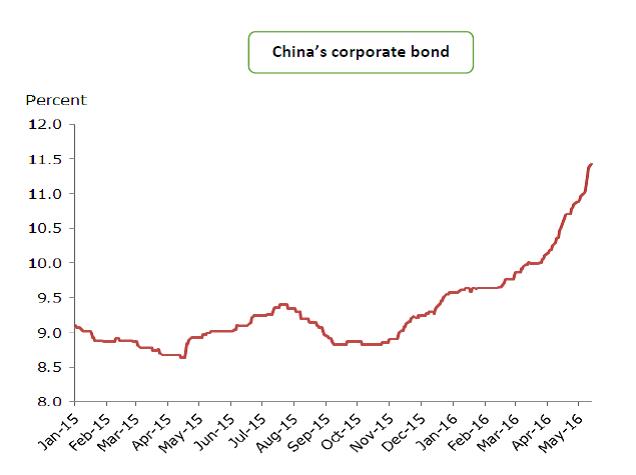

IV. Challenges and way forward for development of bond market 23. I would not be able to tell you anything new about the way we need to proceed that has not been told by many of the learned committees that have studied this market in depth, most recently the Khan Committee under the aegis of the FSDC. What I would try to do is just highlight what I feel are a few of the more important actions we need to take. a. Tackling the problem of ‘Original Sin’ hypothesis 24. One of the challenges for improving the depth of the debt market will be the ability to tackle the ‘original sin’ hypothesis - which in its strongest form alludes to inconsequential bond markets in EME due to their inability to raise money in its own currency outside its border. India has started the ‘masala bonds’ which is picking up but the process still has some way to go. b. Managing and transferring risk - Credit Default Swaps 25. Another important challenge that all emerging economies face in the development of a vibrant and robust bond market is the issue of managing risk. Take for example, the Chinese treasury yields which are generally low signifying investor confidence. In corporate debt, the defaults have been low so far. However, as more and more borrowers enter the market, the default rate is going to be higher. While the borrowing cost for highly rated companies has been low, bond market for the risky borrower is becoming expensive. From the investor’s perspective, credit derivative markets like CDS should be available so as to give confidence to investor to fund risky borrowers. Experience with CDS in India has been poor with few deals reported. It is of paramount importance to have an active credit derivative market to accurately price risk to take the bond market to the next stage.  c. Market Infrastructure 26. One of the prerequisite for a prospering bond market in any economy is an efficient and safe market infrastructure in place to make it easy for investors to buy or sell bonds. With DvP already in place, the concern of safety is by and large addressed. Efforts to go for CCP guaranteed settlement needs to weigh its advantages with the likely high cost of such guarantee. Similarly, electronic platforms for trading need to be developed, but one must keep in mind that the large number of bonds, compared to G-secs, would be a hindrance to order matching systems. Would quote-driven systems be preferable? d. Issuer Diversity 27. In India, currently more than 85% of the corporate bond issuance is undertaken by high rated (A and above) issuer. Our attention to credit enhancement mechanisms would go some way in channelling demand from entities like insurance and pension funds who need to protect their credit exposure. But what is also required is to create conditions to attract new investors into the market. Retail investors could absorb the credit risk through wider dissipation. We might also have to look at less risk averse external investors. e. Municipal Bonds 28. Unlike India, some of the BRICS nations especially South Africa has a well developed Municipal bond market.  29. With a stellar rise in urban population, India’s infrastructure has failed to keep pace with urbanization and the situation is ripe for Municipal corporations to look beyond conventional sources of funding (like grants, tax, etc). Munis can be explored as an option for infrastructure financing by addressing the various supply and demand side constraints. 30. To end this talk, I would like to emphasize that for a market to evolve a lot of things need to fall in place – investor interest, issuer preference, developments in the economy, legal conditions, etc. What Government and regulators can do is to create the enabling conditions, so that when issuer and investor enthusiasm coincides they are not discouraged by impeding regulation or poor infrastructure. 31. Thank you for your attention. Special address delivered by Shri R. Gandhi, Deputy Governor at the Seminar on “Challenges in Developing the Bond Market in BRICS” conducted jointly by CII and MoF, Government of India in Mumbai on Sep 27, 2016. Assistance provided by S/Shri T. Rabishankar, CGM, Manoj Kumar, DGM, Siddhartha Mishra, DGM and Vivek Singh, AGM is gratefully acknowledged. |

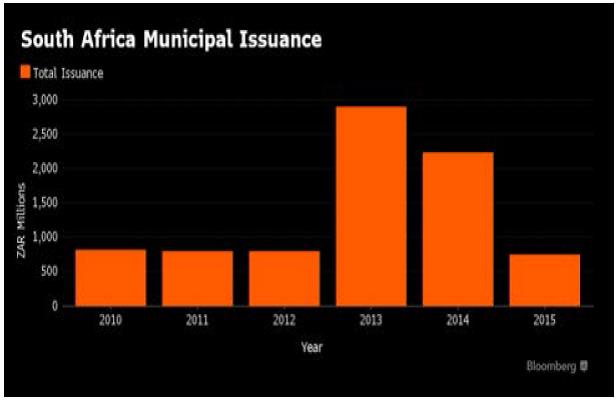

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: