IST,

IST,

Role of NBFCs in Financial Sector: Regulatory Challenges

Shri R. Gandhi, Deputy Governor, Reserve Bank of India

delivered-on జూన్ 17, 2014

Good evening Ladies and Gentlemen. 2. It is with a great feeling of pride that I stand before you to deliver this oration in memory of the legendary Frank Moraes. I congratulate the United Writers Association and Frank Moraes Foundation for regularly organizing the distinguished Frank Moraes Oration lecture. I join everyone here in congratulating Chevalier Dr. K. Thiagarajan on being accorded with the prestigious Celebrity Champion Honour instituted by Community Welfare Foundation, in recognition of his pioneering initiatives relating to birth-control and outstanding community service rendered for over four decades. 3. Frank Moraes was an eminent journalist who was known for having extended the realm of journalism to socio-political dimensions of development, fearless comment of the highest in the land and a broader vision of India, both within and outside the country. He was fiercely independent, with full faith in his own convictions. He is rumored to have kept his resignation letter in his pocket. Basically a lawyer, Moraes became a journalist and later a writer with a passion for writing contemporary Indian history. My heartful thanks to the United Writers Association and to Chevalier Dr. Thiagarajan in particular for giving me this privilege to deliver this oration in Frank Moraes’ memory. 4. I have chosen the Non-Banking Finance Companies (NBFCs): Regulatory Challenges as the subject for this oration. 5. If it looks like a duck, quacks like a duck, and acts like a duck, then it is a duck—or so the saying goes. What about an institution that looks like a bank, acts like a bank and behaves like a bank? Is it a bank? Often it is not a bank—it is a shadow bank. Shadow Banks 6. The term “shadow bank” was coined by economist Paul McCulley in a 2007 speech at the annual financial symposium hosted by the Kansas City Federal Reserve Bank in Jackson Hole, Wyoming. In McCulley’s talk, shadow banking had a distinctly U.S. focus though there were shadow banking institutions in the UK, Europe and even in China. He referred mainly to non - bank financial institutions that engaged in what economists call maturity transformation. Commercial banks engage in maturity transformation when they use deposits, which are normally short term, to fund loans that are longer term. Shadow banks do something similar. Further, they do much more. They are the hedge funds; they were the conduits for asset backed securities; they were the special purpose vehicles for highly leveraged activity, with serious asset liability mismatch. 7. The Financial Stability Board (FSB), an organization of financial and supervisory authorities from major economies and international financial institutions, developed a broader definition of shadow banks that includes all entities outside the regulated banking system that perform the core banking function of credit intermediation (that is, taking money from savers and lending it to borrowers). 8. Why are they called shadow banks? Because there was so little transparency, it often was unclear who owed (or would owe later) what to whom. Most of their liabilities were off balance sheet; so also most of their assets. As someone put it, the shadow banking entities were characterized by a lack of disclosure and information about the value of their assets (or sometimes even what the assets were); opaque governance and ownership structures; little regulatory or supervisory oversight of the type associated with traditional banks; virtually no loss-absorbing capital or cash for redemptions; and a lack of access to formal liquidity support to help prevent fire sales. 9. How did they come on scene? Why nobody bothered about them? That was because they did not mobilize demand deposits and did not engage in payment services. Maturity transformation i.e. raising funds and indulging in lending and investment activities is a legitimate economic activity. Since public funds were not to be called upon to rescue these institutions, they were not regulated. 10. However, during the financial crisis of 2007 and 08, these shadow banks received heightened attention, because of their role in precipitating the crisis. The world woke up rudely to the crisis and more specifically to the existence of shadow banks. 11. Demands for regulating them attained increasing crescendo. Economist Paul Krugman said that the shadow banking system was the core cause of the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realized that they were re-creating the kind of financial vulnerability that made the Great Depression possible—and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." 12. The International Monetary Fund (IMF) also voiced that the spillover effects of the shadow banking system onto systemic risk needs to be contained. The G-20, duly prodded by the FSB declared that the shadow banking system should be regulated. The USA brought them under regulation in 2010 under the Dodd Frank Act. The UK goes further to even accord them central bank liquidity. Shadow Banks in India 13. Do we have shadow banks in India? The answer is yes. It is yes, because we have financial institutions which accept deposits and extend credit like banks, but we do not call them shadow banks; we call them the Non-Banking Finance Companies (NBFCs). Are they in fact shadow banks? No, because these institutions have been under the regulatory structure of the Reserve Bank of India, right from 1963 i.e. 50 full years before the developed west is doing so. Evolution of Regulation of NBFCs in India 14. In the wake of failure of several banks in the late 1950s and early 1960s in India, large number of ordinary depositors lost their money. This led to the formation of the Deposit Insurance Corporation by the Reserve Bank, to provide guarantee to the depositors. (Later by adding a credit guarantee element, it became the DICGC). While this provided the necessary safety net for the bank depositors, the Reserve Bank did note that there were deposit taking activities undertaken by non-banking companies. Though they were not systemically as important as the banks, the Reserve Bank initiated regulating them, as they had the potential to cause pain to their depositors. 15. Later in 1996, in the wake of the failure of a big NBFC, the Reserve Bank tightened the regulatory structure over the NBFCs, with rigorous registration requirements, enhanced reporting and supervision. Reserve Bank also decided that no more NBFC will be permitted to raise deposits from the public. Later when the NBFCs sourced their funding heavily from the banking system, it raised systemic risk issues. Sensing that it can cause financial instability, the Reserve Bank brought asset side prudential regulations onto the NBFCs. NBFCs of India 16. The definition of the term ‘NBFC’ entails a very wide meaning. NBFCs include not just the finance companies that the general public is largely familiar with; the term also entails wider group of companies that are engaged in investment business, insurance, chit fund, nidhi, merchant banking, stock broking, alternative investments, etc. as their principal business. Today I would be concentrating only on those NBFCs that are under the regulatory purview of the Reserve Bank. 17. Traditionally, India has had a bank-dominated financial sector. Even so, there have always been NBFCs. These were in early times small family run businesses for deposits acceptance and lending activities. Even today, the sector may be ‘small’ as compared to banking sector with a total asset size of just around 14 percent of that of scheduled commercial banks (other than RRBs). However, there is no denying that the sector has grown tremendously over the years in size, form and complexity, with some of the NBFCs operating as conglomerates having business interests spread to sectors like insurance, broking, mutual fund and real estate. Concomitant with the above, interconnectedness and systemic importance of the NBFC sector also have increased. 18. NBFCs being financial intermediaries are engaged in the activity of bringing the saving and the investing community together. In this role they are perceived to be playing a complimentary role to banks rather than competitors, as it is a known fact that majority of the population in the country do not yet have access to mainstream financial products and services including a bank account and therefore the country needs institutions beyond banks for reaching out in areas where banks’ presence may be lesser. Thus NBFCs especially those catering to the urban and rural poor namely NBFC-MFIs and Asset Finance Companies have a complimentary role in the financial inclusion agenda of the country. Further, some of the big NBFCs viz; infrastructure finance companies are engaged in lending exclusively to the infrastructure sector and some are into factoring business, thereby giving fillip to the growth and development of the respective sector of their operations. Thus NBFCs have also carved niche business areas for them within the financial sector space and are also popular for providing customized products like second hand vehicle financing, mostly at the doorstep of the customer. In short, NBFCs bring the much needed diversity to the financial sector thereby diversifying the risks, increasing liquidity in the markets thereby promoting financial stability and bringing efficiency to the financial sector. 19. At the same time, their growing size and interconnectedness also raise concerns on financial stability. Reserve Bank’s endeavour in this context has been to streamline NBFC regulation, address the risks posed by them to financial stability, address depositors’ and customers’ interests, address regulatory arbitrage and help the sector grow in a healthy and efficient manner. Some of the regulatory measures include identifying systemically important non-deposit taking NBFCs as those with asset size of `100 crore and above and bringing them under stricter prudential norms (CRAR and exposure norms), issuing guidelines on Fair Practices Code, aligning the guidelines on restructuring and securitization with that of banks, permitting NBFCs-ND-SI to issue perpetual debt instruments etc. NBFCs as components of the financial sector: 20. A broad picture of the role of NBFCs and the interconnectedness they have in the financial sector can be gauged from the details given below: General: 21. The total number of NBFCs as on March 31, 2014 are 12,029 of which deposit taking NBFCs are 241 and non-deposit taking NBFCs with asset size of `100 crore and above are 465, non-deposit taking NBFCs with asset size between `50 crore and `100 crore are 314 and those with asset size less than `50 crore are 11009. As on March 31, 2014, the average leverage ratio (outside liabilities to owned fund) of the NBFCs-ND-SI stood at 2.94, return on assets (net profit as a percentage of total assets) stood at 2.3%, Return on equity (net profit as a percentage of equity) stood at 9.22 % and the gross NPA as a percentage of total credit exposure (aggregate level) stood at 2.8%. Asset Liability composition Liabilities* of the NBFC sector: 22. Owned funds (23% of total liabilities), debentures (32%), bank borrowings (21%), deposit (1%), borrowings from Financial Institutions (1%), Inter-corporate borrowings (2%), Commercial Paper (3%), other borrowings (12%), and current liabilities & provisions (5%). Assets* of the NBFC sector: 23. Loans & advances (73% of total assets), investments (16%), cash and bank balances (3%), other current assets (7%) and other assets (1%).  *The data pertains to only reported deposit taking NBFCs and those non-deposit taking NBFCs with asset size of `100 crore and above. All figures are as on end March, 2014. Role of NBFCs in financial inclusion 24. Financial inclusion has been defined as the “provision of affordable financial services” to those who have been left unattended or under-attended by formal agencies of the financial system. These financial services include “payments and remittance facilities, savings, loan and insurance services”. Micro finance has been looked upon as an important means of financial inclusion in India. Microfinance is not just provision of micro credit but also other services in small quantities to the poor i.e. providing essential financial services to the poor in an affordable way. Financial Inclusion also is aiming at the same by providing the poor with not only deposit accounts or credit but also insurance and remittance facility. 25. As articulated by the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households (Mor Committee) in its report, ‘on both Financial Inclusion (defined as the spread of financial institutions and financial services across the country) and Financial Depth (defined as the percentage of credit to GDP at various levels of the economy) the overall situation remains very poor and, on a regional and sectoral basis, very uneven. 26. While the Reserve Bank’s model for financial inclusion is essentially bank-led, we believe that non-bank entities do have space to partner banks in the financial inclusion initiatives. We have enabled non-bank entities as Business Correspondents of banks to achieve the larger goal of financial inclusion. Since September 2010, MFIs that are bank-SHGs, Trusts, Societies or Section 25 companies have been permitted to become Banking Correspondents (BCs). At the same time several non-bank entities on their own are part and parcel of this greater goal, for e.g. NBFC-MFIs that form the significant part of the MFI sector have deeper reach in the rural areas. NBFC-MFIs do not formally figure in the bank led model of financial inclusion but they by their wider and deeper reach can be catalysts in providing the necessary handhold to the poor borrowers to gain access to essential financial services. 27. While the new banks that are being envisaged would definitely give fillip to the country’s financial inclusion initiatives, juxtaposing the humungous task of complete financial inclusion against it also brings to focus the need for exploring alternative ways to achieve the goal. The Mor Committee has observed that each of the channels, be they large National Banks, regional cooperative banks, or Non-Banking Financial Companies (NBFCs) have a great deal of continuing value to add by focusing on its own differentiated capabilities and accomplish the national goals of financial inclusion by partnering with others that bring complementary capabilities to bear on the problem. Role of NBFCs in capital market 28. Investment activity of NBFC sector comprises around 16% of their total assets. These constitute mainly investments in capital market. There are specialized NBFCs that are exclusively engaged in capital market investment i.e. trading in securities. These NBFCs therefore help in giving liquidity to the capital market. Further, NBFCs also lend to investors for investing in capital market. Regulatory challenges in this regard might come in the form of probable overheating of the market, which could be addressed through appropriate regulatory measures including enhanced disclosures. Role of NBFCs in factoring 29. Factoring as defined in the Factoring Regulation Act, 2011 involves acquisition of receivables (by a Factor) thereby getting entitled to undivided interest on the receivables or financing against the security interest over any receivables but does not include credit facilities provided by a bank in its ordinary course of business against security of receivables. Subsequent to the notification of the Factoring Regulation Act by the Government, Reserve Bank formed a new category of NBFCs called NBFC-Factors and issued directions to them. NBFC-Factors are almost exclusively engaged in providing factoring service. Factoring service which is perceived as complimentary to bank finance is expected to enable the availability of much needed working capital finance for the small and medium scale industries especially those that have good quality receivables but may not be in a position to obtain enough bank finance due to lack of collateral or credit profile. By having a continuous business relationship with the Factor in place, small traders, industries and exporters get the advantage of improving the cash flow and liquidity of their business as also availing ancillary services like sales ledger accounting, collection of receivables, credit protection etc. Factoring helps them to free their resources and have a one stop arrangement for various business needs enabling smooth running of their business. 30. The Reserve Bank has recently also taken the initiative of mooting a ‘Trade Receivables and Credit Exchange’ for financing of Micro, Small and Medium Enterprises, which is under development stage. The exchange will bring together the MSMEs, the Factors and the corporate buyers under one platform whereby MSME’s bills against large companies can be accepted electronically and auctioned so that MSMEs are paid promptly. The objective is to build a suitable institutional infrastructure which will not only enable an efficient and cost effective factoring / reverse factoring process to be put in place, but also ensure sufficient liquidity is created for all stakeholders through an active secondary market for the same. Role of NBFCs in vehicle financing / second hand vehicle financing 31. Talking about the niche sectors that NBFCs cater to, vehicle financing especially second hand vehicles need special mention. Certain NBFCs that are classified as Asset Finance Companies have gained expertise in this segment and play a significant role in providing a livelihood to customers who are drivers. From the Reserve Bank’s side, to encourage the productive activity that these NBFCs are engaged in, we have accorded certain additional dispensations to them in the form of enhanced bank credit, higher exposure norm ceiling and provision of ECB under automatic route for leasing related to infrastructure. Role of NBFCs in infrastructure financing 32. Infrastructure Finance Companies and Infrastructure Debt Funds are NBFCs exclusively into financing the infrastructure sector. Some of these companies have asset books running to lakhs of crores of rupees and are experts in long term project financing. Recognising their significance, the Reserve Bank has given special dispensations in the form of enhanced bank credit, higher exposure norm ceiling and provision of ECB under automatic route for on-lending to infrastructure sector. The asset liability pattern however, is a matter of concern in the case of IFCs as these are lending long term against comparatively shorter term liabilities. The Regulatory Challenges 33. So, you may wonder, if the NBFCs are performing such a wonderful service to the economy, by being partners in financial inclusion, providing niche financing in the areas like infrastructure, factoring, asset financing, etc. what is the concern that the Reserve Bank can have? Why have you indicated in the title for this oration "Regulatory Challenges", you may ask me. Let me explain. 34. The need for regulating the financial institutions arise primarily because of the high leverage with which they operate that can cause financial instability, the asset liability mismatch which can pose serious risks to the investors and depositors, and their capacity to engender havoc to the real sectors of the economy. 35. Traditionally, regulation of banks has assumed greater importance than that of their non-banking counterparts. One reason, of course, is that protection of depositors has been traditionally an important mandate of banking supervisors. Banks are at the centre of payment and settlement systems and monetary policy transmission takes place through them. Banks play a critical role in credit intermediation through maturity transformation, i.e. acceptance of short term liabilities and converting them into long term assets viz. loans and advances. Along with economic value, this function also creates potential liquidity risk. Moreover, banks also operate on a significantly higher leverage compared to any other type of organisations which could amplify their vulnerability. For all these reasons, banks are subject to a detailed and a rigorous regulatory framework. 36. Non-banks also have depositors; these depositors also need some assurance about the safety of their funds. Non-banks also lend their resources as loans and advances, thus carrying out credit intermediation through maturity transformation and thereby creating liquidity risk. Further non-banks also operate on a significantly higher leverage than an ordinary commercial institution. Thus, when non - bank financial entities undertake bank-like functions, large risks are created which could potentially be destabilizing for the entire system. Moreover, the global financial crisis demonstrated many ways in which shadow banking can have an impact on the global financial system, both directly and through its interconnectedness with the regular banking system, prompting the move to overhaul the regulation of shadow banking system. Like banks, a leveraged and maturity-transforming shadow banking system can also be vulnerable to "runs" and generate contagion, thereby amplifying systemic risk. Shadow banking can also heighten pro-cyclicality by accelerating credit supply and asset price increases during upswings and exacerbating fall in asset prices during downswings. These effects were powerfully revealed during the global financial crisis in the form of dislocation of asset-backed commercial paper (ABCP) markets, the failure of an originate-to-distribute model employing structured investment vehicles (SIVs) and conduits, "runs" on MMFs and a sudden reappraisal of the terms on which securities lending and repos were conducted. 37. Now you may say "Yes, we agree that the NBFCs need to be regulated. But, why are you saying that there are challenges? Don't you have the law enabling you to regulate them?" 38. Yes, we have the law. And it has evolved over the time. The challenges today are as follows: 39. First, there are law related challenges i. there are a number of companies that are registered as finance companies, but are not regulated by the Reserve Bank, ii. there are unincorporated bodies who undertake financial activities and remain unregulated, iii. there are incorporated companies and unincorporated entities illegally accepting deposits, iv. there are entities who camouflage deposits in some other names and thus illegally accepting deposits. The law as it stands today is inadequate to deal with these issues. In order to correct these and initiate action against violations, we need to bring in suitable amendments to the statutory provisions. Reserve Bank is working with the government for such improvements in the law. 40. Secondly, as the entities, especially the unincorporated ones, can sprung in any nook and corner of the country and can operate with impunity unnoticed, but endangering their customers’ interest, we need arrangements and structured for effective market intelligence gathering. The Reserve Bank is restructuring its organisational setup, especially in its regional offices, for gathering market intelligence. 41. Thirdly, empowering law and gathering intelligence by themselves are not sufficient. Enforcement of the law is a challenge. This is primarily because of the various agencies involved in regulating the non-banking financial activities of entities. Right from the central government ministries like finance and corporate affairs, agencies like CBI and FIU-IND, regulatory agencies like the Reserve Bank, SEBI, the Registrar of Companies, the state government agencies like the police and others, all have to share information and coordinate and cooperate to bring in an effective, timely and unified enforcement of the law. The Reserve Bank's State Level Coordination Committees (SLCC) are being strengthened and a National level Coordination Committee is also being considered. 42. Fourthly, as was mentioned earlier, world over there is an increasing demand that the shadow banks be brought under tighter regulations. G-20 has already expressed it as a mission to be achieved by 2015. In our case, bringing them under regulation is not the issue, as they already are. The challenge for us is how differentially or how closely we should regulate the NBFCs? The demand from the NBFC sector is that they should be subjected to light touch regulation. As mentioned earlier, NBFCs were brought under regulatory ambit of the Reserve Bank since 1963; we brought them under prudential regulatory framework since 1997. Nevertheless, the NBFC sector came under pressure during the 2008 crisis due to the funding inter-linkages among NBFCs, mutual funds and commercial banks. NBFCs-ND-SI relied significantly on short term funding sources such as debentures (largely non - convertible short term debentures), and CPs, which constituted around 56.8 percent of the total borrowings of NBFCs-ND-SI as on September 30, 2008. These funds were used to finance assets which were reportedly largely a mix of long term assets, including hire purchase and lease assets, long term investments, investment in real estate by few companies, and loans and advances. These mismatches were created mainly as a business strategy for gaining from the higher spreads. However, there were no fall back alternatives in cases of potential liquidity constraints. The ripple effect of the turmoil in American and European markets led to liquidity issues and heavy redemption pressure on the mutual funds in India, as several investors, especially institutional investors, started pulling out their investments in liquid and money market funds. Mutual funds being the major subscribers to CPs and debentures issued by NBFCs, the redemption pressure on MFs translated into funding issues for NBFCs, as they found raising fresh liabilities or rolling over of the maturing liabilities very difficult. Drying up of these sources of funds along with the fact that banks were increasingly becoming risk averse, heightened their funding problems, exacerbating the liquidity tightness. The Reserve Bank undertook many measures, both conventional as well as un-conventional, to enhance availability of liquidity to NBFCs’. Conclusion 43. To conclude, I may say that the challenge therefore for the NBFC sector is to grow in a prudential manner while not stopping altogether on financial innovations. The key lies in having in place adequate risk management systems and procedures before entering into risky areas. As for the regulator, it is the constant endeavour of Reserve Bank to enable prudential growth of the sector, keeping in view the multiple objectives of financial stability, consumer and depositor protection, and need for more players in the financial market, addressing regulatory arbitrage concerns while not forgetting the uniqueness of NBFC sector. The Bank presently is in the process of reviewing the regulatory framework for NBFCs in the context of recent developments including the Nachiket Mor Committee and others. 44. Thank you very much for your patient attention. The Frank Moraes oration lecture delivered by Shri R. Gandhi, Deputy Governor, Reserve Bank of India on June 16, 2014 at Hotel Savera, Chennai. Assistance provided by Ms. Sindhu Pancholy is gratefully acknowledged. |

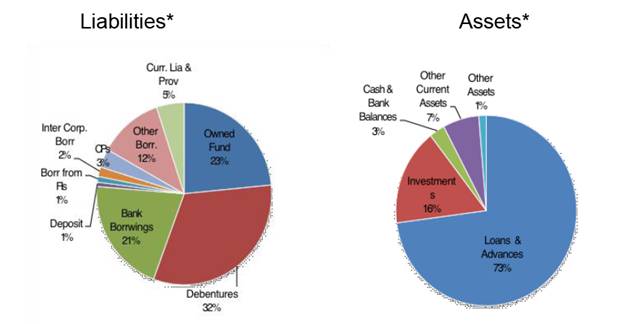

పేజీ చివరిగా అప్డేట్ చేయబడిన తేదీ: