IST,

IST,

Report of the High Level Task Force on Public Credit Registry for India

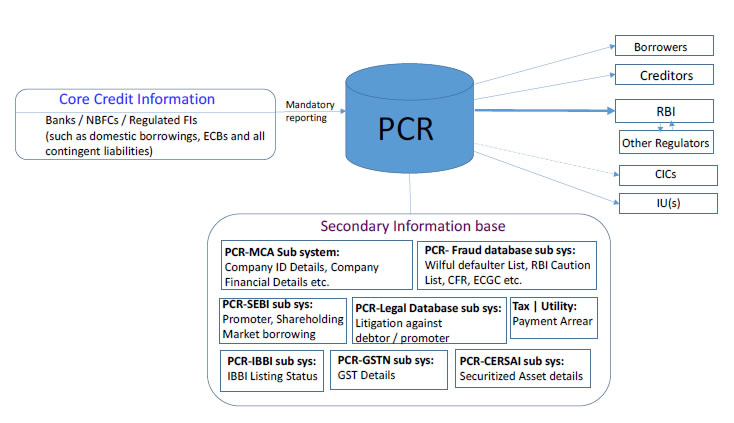

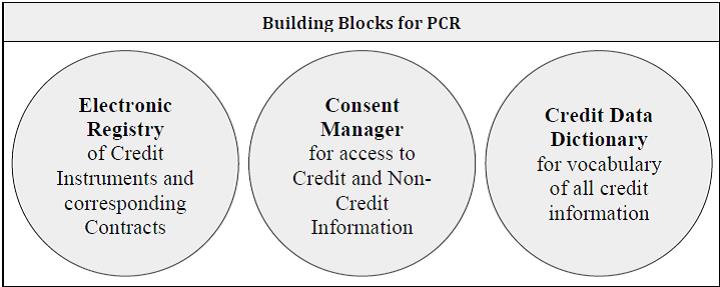

Three subgroups of the HTF studied the views / expectations of the stakeholders exhaustively while another one considered in depth the technical framework. The HTF would like to express its gratitude to all the members of the various subgroups with special thanks to Shri K Venkateswara Rao, CGM and Shri D K Mishra, GM, NABARD; Ms Prajna Ojha of ICICI Bank, and Shri Siddharth Shetty of iSPIRT. The HTF engaged actively with various stakeholders of the credit reporting ecosystem in India. The HTF would like to thank Shri Ravi Shankar, RBI; Shri Angshuman Hait, RBI ; Shri Parveen Kumar Sharma of CERSAI: Shri S Ramann of NeSL: Ms Harshala Chandorkar of TransUnion CIBIL: and Shri Prasenjit Ghosh of CRISIL for making presentations to the task force. The HTF has immensely benefitted from extended interactions through its secretariat with officials and experts from various departments of RBI; SEBI and other regulators; the four Credit Bureaus in India; and various other national and International organizations. The HTF would like to specially thank Ms Eloísa Ortega, Ms Lola Cano and the CCR team of Banco de España; Mr António Garcia, Mr Luís Teles Dias, Mr Homero Gonçalves and Ms Marta Veloso of Banco de Portugal; Ms Estela Marina and Mr Oscar A. del Rio of Banco Central de la República Argentina; Mr Loutfi Talal and his team of Bank Al-Maghrib; Mr Leonardo Gambacorta of BIS; Mr Paolo Emilio Mistrulli of Banca d'Italia; Mr Oscar Madeddu of International Finance Corporation; Dr Michael Turner of Policy & Economic Research Council; Mr Colin Raymond of the World Bank for knowledge sharing on International practice on PCR. The HTF would like to thank Shri R Ravikumar, CGM, RBI and Ms Kamala K, Group Chief Compliance & Governance Officer, Edelweiss Financial Services Limited, for their valuable contribution in the deliberations. The HTF has extensively used the facilities provided by the Department of Statistics and Information Management, RBI in its premises in Bandra Kurla Complex and it is thankful for the support and encouragement to its senior management - in particular, Dr. Anil K Sharma, Dr. O.P. Mall and Dr. Goutam Chatterjee – led by Dr Michael D. Patra, Executive Director, RBI. The HTF would like to place on record its appreciation for the valuable support extended to its work by its Secretariat, comprising Shri Indrajit Roy, Director; Dr Pulastya Bandyopadhyay, Research Officer; Shri Raja Ram Priyadarshi, Manager and Ms Jayasree G Kadkade, Assistant Manager, of the Department of Statistics and Information Management, RBI. The credit information reporting system is an institutional response to information asymmetry in the credit market. The two main types of credit reporting institutions are public credit registry and private credit bureau. By addressing the issues of ‘adverse selection’ and ‘moral hazard’, the credit information reporting system aims to bring efficiency in the credit market and benefit to both borrowers and lenders. Sharing of credit information by a credit institution to a central agency is in the public interest from financial stability, supervisory, financial inclusion and economic policy perspectives. That is why, in many countries, the task of organizing the collection and sharing of credit data through a PCR is entrusted to a public authority, mainly the Central Bank, by law. As reporting to the PCR is mandatory by law, high level of coverage of the credit market is ensured. In India, there are multiple granular credit information repositories, with each having somewhat distinct objective and coverage. Within the RBI, CRILC is a borrower level supervisory dataset with a threshold in aggregate exposure of INR 50 million, whereas the BSR-1 is a loan level statistical dataset without any threshold in amount outstanding and focus on the distribution aspects of credit disbursal. Also there are four privately owned CICs operating in India. RBI has mandated all its regulated entity to submit credit information individually to all four CICs. CICs offer, based on this unique access to the credit data, value added services like credit scoring and analytics to the member credit institutions and to the borrowers, for commercial purposes. At present, credit information is spread over multiple systems in bits and pieces. Information on borrowings from banks, NBFCs, market, ECBs, FCCBs, Masala Bonds, inter-corporate borrowings are not available in a single repository. This makes it very difficult to form a comprehensive view of total indebtedness of a borrower. Also, essentially the same information gets reported to multiple agencies in different formats leading to inefficiency in the credit reporting system and data quality issues while increasing the reporting burden on credit institutions. A comprehensive credit information repository covering all types of credit facilities (funded and non-funded) extended by all credit institutions – Commercial Banks, Cooperative Banks, NBFCs, MFIs – and also covering borrowings from other sources, including external commercial borrowings and borrowing from market, is essential to ascertain the total indebtedness of a legal or natural person. With technology acting as an enabler, this repository can make near real time monitoring of credit risk possible and also address legitimate privacy concerns of the borrowers by making all access to a borrower’s information contained in the repository dependent on the borrower’s consent. With a view to remove information asymmetry, to foster the level of access to credit, and to strengthen the credit culture in the economy, there is a need to establish a PCR. The PCR maybe the single point of mandatory reporting for all material events for each loan, notwithstanding any threshold in the loan amount or type of borrower. Thereby, the PCR will serve as a registry of all credit contracts, duly verified by reporting institutions, for all lending in India and any lending by an Indian institution to a company incorporated in India. By having a registry of all loans in the form of a PCR, and recording all material events for each loan during its life cycle, the credit delivery system can be tuned more efficiently so that the populace not having access to formal credit, or with limited or no credit history, can be brought within its ambit. The resulting increase in credit flow to the MSME sector and the underserved populace could propel the Indian economy to a higher growth path. With a PCR in place, and with full coverage of credit market ensured by mandatory reporting, the ease in getting credit and in turn the ranking of India in the World Bank’s ease of doing business index would also likely to be improved. For effective reduction of information asymmetry, the PCR should facilitate linkage to related ancillary credit information available outside the banking system, such as corporate balance sheet information, GSTN etc. subject to the extant legal provisions. The PCR, however, may not provide any service which involves elements of judgment like credit scoring services. The access to PCR data must adhere to the strictest measures of privacy and protection to sensitive information. All access to the PCR data must be on a need-to-know basis and be in sync with the extant data protection laws of the country. Any information gathered from the PCR may be used for the authorized purpose only and not for any other commercial purpose. The PCR may be backed by a suitable legal framework to ensure that it can achieve its objective. The way the PCR is being envisaged and the recommendations made may be appropriately examined from a legal point of view. The details of the legal framework, backing the PCR, including possible changes required in the extant legislation, may be formalized accordingly. In view of the envisaged benefits, the setting up of the PCR may be expedited. However, considering the broad scope of PCR, the project may be implemented in phases with maximum coverage to be achieved in the first phase itself by on-boarding all SCBs and top NBFCs which are already submitting CRILC and / or BSR-1 to RBI and all UCBs. 1.1 The Reserve Bank of India constituted a High Level Task Force (HTF) on Public Credit Registry (PCR) – “an extensive database of credit information for India that is accessible to all stakeholders – that would help in enhancing efficiency of the credit market, increase financial inclusion, improve ease of doing business, and help control delinquencies”. The HTF drew its representatives from all relevant stakeholders in the area of credit data. The memorandum for the HTF is placed in Annex 1. 1.2 This report is the outcome of deliberations within the HTF over the period October 2017 to April 2018. During this period, the HTF met eight times. 1.3 The role of staff members of the Reserve Bank was to facilitate discussions – by providing secretarial support to HTF in organizing and hosting the meetings, and contribution toward putting together the report. 1.4 This report shall not be interpreted as reflecting the position of the Reserve Bank. The analysis and recommendations of this report, as well as public opinion to this report may be taken into account by the Reserve Bank when developing its future stand point on Public Credit Registry. BACKGROUND 1.5 Credit information is essentially detailed information on borrowers’ past loan performance and is very important for the development of an efficient credit market. 1.6 In the absence of detailed and complete credit data, lenders cannot distinguish different shades of borrowers (good borrower, bad borrower etc.) and essentially can only observe the average risk of borrowers. This leads to a sub-optimum credit market, where lenders over-charge low risk borrowers and under-charge high risk borrowers -a phenomenon known as ‘adverse selection’. Also absence of comprehensive credit information leads to issues like ‘moral hazard’, which refers to the situation when the borrowers have more information about their intentions or actions than their counterparts i.e. lenders, and have an incentive to behave improperly. The credit reporting system is an institutional response to such issues through which the efficiency in the credit market is improved and both creditors and borrowers are benefited. Credit reporting system supplements the information supplied by the borrowers in their loan application which helps lenders to evaluate borrowers’ creditworthiness. 1.7 A well-established credit reporting system also helps creditors to price the loan appropriately and lend at more attractive rates when they can assess the credit risk of borrower and are confident about borrower’s ability to pay. However, borrowers with poor credit history may have to pay a premium for the credit. Fear of competition can sometimes make creditors cautious to share their borrower information. However, sharing of credit data to credit reporting system helps creditors to reduce their risk in screening the credit applications, monitoring borrowers, and also prevent the inefficient allocation of the credit. It helps creditors to acquire necessary credit information pertaining to a borrower more quickly and at a lower cost. This will also help bring more discipline among borrowers and reduce number of over-indebted borrowers (who draw credit simultaneously from many lenders) in the system. Existence of credit reporting system may also enable lenders to take objective credit decisions and may help them to shift from pure collateral-based lending policies to more information based lending policies and thus may impact the cost of credit. 1.8 The sharing of credit information is in the public interest from a financial stability, supervisory, financial inclusion as well as economic policy perspective. That is why, in many countries, by regulation, the task of organizing the collection and distribution of credit data through a public credit register is entrusted to a public authority. International experience shows that contribution to the PCR’s database is generally obligatory by virtue of national law. Mandatory reporting ensures a very high coverage of the credit market. The authority in charge of a PCR is generally endowed with the enforcement powers to ensure data quality (dealing with inaccurate data or missing data). Failure to maintain desired level of data quality can result in sanctions to the reporting institutions. Credit Information – the Indian Context 1.9 In India, there are multiple granular credit information repositories. Within the RBI, the CRILC is in operation since 2014-15. CRILC is a borrower level dataset targeted towards fulfilling supervisory requirement by focusing on systemically important credit exposures. Banks report to CRILC credit information on all their borrowers having aggregate fund based and non-fund based exposure of INR 50 million and above. Credit information to CRILC is submitted by all SCBs (excluding RRBs). There is a similar CRILC system for NBFCs with reporting of credit information by the top 70 NBFCs. RBI also has an elaborate statistical return system covering various aspects of credit and deposit. BSR-1 is a statistical dataset, maintained within RBI, with the objective of ascertaining the sectoral and spatial distribution aspects of credit and is in existence since 1972. BSR-1 does not have any borrower identification and all loans, without any threshold in the amount outstanding, get reported to BSR-1 by all SCBs including RRBs. Outside the central bank, there are four CICs in operation in India. RBI has mandated all its regulated credit institutions to submit the same granular credit information as per specified format individually to all four CICs. 1.10 In the credit decision making process, apart from pure credit history, other ancillary information are also critically important to ascertain total indebtedness of a borrower. For example, ancillary information like corporate balance sheet information, tax information, utility bill payments information, information of legal proceedings may result in efficient credit decision making. There are certain information that do not get reported currently as part of the credit information repository and hence many a times, lenders are dependent upon the borrower for providing key information. 1.11 In the Indian context, at present, it is very difficult to form a comprehensive view of a borrower’s indebtedness as credit information is currently available across multiple systems in bits and pieces and is not available in a single window. For example, information on borrowings from Banks, NBFCs, market, inter corporate borrowing, ECBs, FCCBs, Masala Bonds etc. are not available in a single repository. Also, essentially the same information gets reported to multiple agencies in multiple formats leading to inefficiency in reporting and data quality issues as well as increased reporting burden for the reporting entities. 1.12 In the Indian experience, the lack of adequate and easy access to business loans and its high cost are well-known hurdles for the growth of industry. The problem is particularly acute in the case of small industries, which are often denied timely credit due to the lack of desired credit history. Lending institutions often find it hard to service loans of smaller ticket size and higher risk. This leads to higher cost being passed on to the borrower not only in the form of high interest rates but also excessive paperwork and delays in disbursement of funds. The informal credit market also flourishes on this. This can now change, with increased use of digital payments leading to much greater availability of transactions data. The emergence of new-age lending practices is leading to the use of this data to assess creditworthiness of underserved customers and to deliver credit to them. Availability of data can therefore be considered a ‘public good’ that will enable increased credit access for smaller borrowers. Benefits of the envisaged PCR 1.13 Financial inclusion and access to credit are pre-requisites for inclusive growth. Recent reforms are targeted to bring in larger population into formal banking system. To assess the effectiveness of existing financial inclusion measures, all loans, ideally without any threshold in the loan amount, should get captured in the PCR. By having a registry of all loans in the form of a PCR, the credit delivery system can be tuned more efficiently so that the populace not having access to formal credit, or with limited or no credit history, can be brought within its ambit. The resulting increase in credit flow to the MSME sector and to the underserved populace could propel the Indian economy to a higher growth path. 1.14 PCR, as the single point of mandatory reporting of credit information, would not only reduce the reporting burden on the credit institutions, especially for the small sized credit institutions, but will automatically lead to removal of inconsistencies at the aggregate level stemming from multiple reporting, which will lead to improvement in data quality. 1.15 Since PCR will have full coverage of the credit market by mandate, including related ancillary credit information available outside the banking system, it can result in effective removal of information asymmetry. This would address the issue of ‘adverse selection’ in credit market leading to fair pricing of loans. Thus ‘good’ borrowers can be actually distinguished and rewarded accordingly. Moreover, as the information in PCR would work as ‘reputation collateral’ for the borrowers, it could prevent the ‘moral hazard’ in credit market to a great extent. 1.16 The World Bank ranks economies on their ‘ease of doing business’, where the rankings are determined by sorting the aggregate distance to frontier scores on ten topics, each consisting of several indicators, giving equal weight to each topics1. One of the ten topics considered in the exercise is ‘getting credit’, where the efficiency of the credit information systems in the country is measured by four indicators. These are strength of legal rights, depth of credit information, percentage of adults covered in public credit registry and in credit bureaus. As India does not have a PCR, performance in one of the four indicators of ‘getting credit’ stands at zero. With a PCR in place, and with full coverage ensured by mandatory reporting, performance in the ‘getting credit’ topic would improve and in turn the ranking of India in ease of doing business index would definitely improve. 1.17 From a regulation / supervision, policy making and financial stability point of view, the value of having a granular repository for the credit market in the form of a PCR is undeniable. With a PCR in place, the bottlenecks in effective transmission of policy recommendations can be identified and addressed accordingly. Transparent credit information is a necessity for sound risk management and financial stability. A PCR, with linkage to ancillary credit information systems, can help in effective supervision and help lenders to take timely corrective steps to prevent delinquencies wherever possible. Terms of Reference of the HTF 1.18 Accordingly, Reserve Bank of India constituted a High Level Task Force on 23rd October 2017 under the chairmanship of Shri Y. M. Deosthalee, ex-CMD, L&T Finance Holdings Limited, to examine the current availability of information on credit and data gaps in India that could be filled by a comprehensive and near-real-time PCR for India. The HTF had representation from various stakeholders. The memorandum constituting the HTF is placed in Annex 1. 1.19 The terms of reference of the HTF are as under:

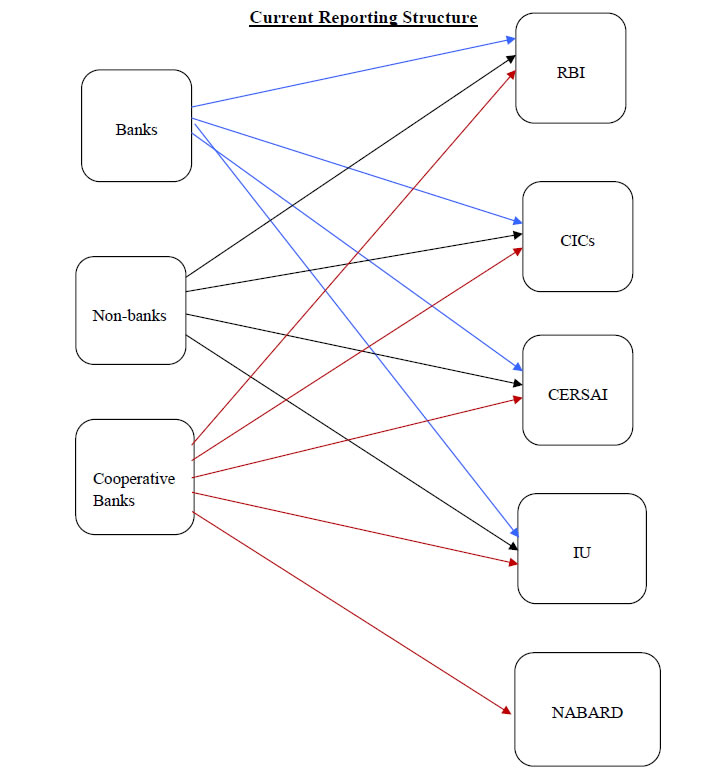

Committee’s approach 1.20 The HTF held eight meetings during October, 2017 to April, 2018. Pursuant to deliberations in the meetings of the Committee, separate meetings with all stake holders were also held. 1.21 The HTF engaged with multiple agencies to get a view of the challenges faced by them in terms of availability of Credit data and how PCR can help to bridge the gap. In order to further crystallize views of various stakeholders, five Subgroups of the HTF were formed. Each Subgroup catered to different class of stakeholders i.e., Commercial Banks, Non-Banks and Cooperative Banks, Regulators and Information Technology. Reports of these subgroups are given in Annex II. Also meetings were held with four CICs, IU (NeSL), expert from the World Bank and other central banks and think tanks. The Committee’s views evolved based on these deliberations. The report was finalised in the meeting of the Committee held on April 3rd, 2018. Overview of chapters 1.22 In Chapter 2, an overview of the current availability of information on credit information in India is presented. Chapter 3 examines international standards and best practices. Chapter 4 lists out the information need of the lenders for effective credit decision making pertaining to the full credit life cycle, and the expectation of all stakeholders from the PCR. Chapter 5 discusses and proposes high level information architecture of PCR. Finally, Recommendations of the HTF are given in Chapter 6. 2. Credit Information Infrastructure in India – Current Status Introduction 2.1 The existing structure for collection of Credit data in the country is highly fragmented. There is a plethora of agencies collecting credit information in the country. Prominent agencies which collect credit data in the country include Credit Information Companies, Reserve Bank of India, CERSAI, Information Utility, etc. There are other agencies also collecting data important for credit decision making, e.g. MCA. 2.2 A brief description of the credit information collected by these agencies is presented in this chapter. Credit Information Companies 2.3 The CICs have the widest mandate for collection and sharing of all sort of credit information from banks, non-banks and other credit providing agencies. They are regulated by RBI under the Credit Information Companies (Regulation) Act (CICRA), 2005. According to this Act, only certain entities are allowed to be members of the CICs. They are Credit Institutions under Section 2(f) and Credit information companies under section 2(e) of CICRA, 2005. History of Credit Bureau operations in India 2.4 The TransUnion CIBIL Limited (formerly Credit Information Bureau (India) Ltd. (CIBIL)) was incorporated in 2000 and started operations in April, 2004. Three other CICs were set up following the enactment of CICRA, 2005. Equifax Credit Information Services Private Limited and Experian Credit Information Company of India Private Limited were set up in 2010. CRIF High Mark (formerly High Mark Credit Information Services) was set up in 2011. All the four CICs are currently operational in India. Reporting to CICs 2.5 All credit institutions (as given in sec 2(f) of the CICRA, 2005) have been directed by the RBI to be members of all CICs. The institutions which report credit information to CICs include all banks (SCBs and cooperative banks), NBFCs, HFCs, State Financial Corporations, AIFIs and Credit card companies. Users of credit information 2.6 Users of credit information as listed in Reg 6 of CIC Regulations, 2006 include All credit institutions, Insurance companies, Telecom companies, Credit Rating Agencies, Registered stock brokers, Trading members registered with commodity exchanges, SEBI, IRDA, Resolution professionals and Information utilities. Permissible uses 2.7 Permissible uses of the credit information stored in CICs as mentioned in Reg 9 of CIC Regulations 2006 are - For taking credit decisions, for discharging statutory and regulatory functions, to enable a person to know his / her own credit information. In addition to providing credit history, CICs employ data analytics to provide useful insights about expected credit behaviour of an entity. They provide key inputs to credit appraisal process and help in making informed credit decisions at various lending institutions. Existing CICs 2.8 The four CICs currently operating in the country are TransUnion CIBIL, Equifax, Experian, and CRIF Highmark.

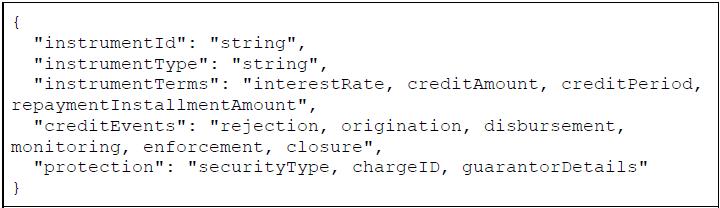

Reserve Bank of India 2.9 RBI maintains a large repository of Credit Information in the country. The Central Bank collects credit Information through mandatory report filings from its regulated entities. RBI derives its power from RBI Act, 1934 and BR Act, 1949. While these statutes enable RBI to collect accurate credit information from the entities in its ambit, they also place restrictions on the use of the collected data - mainly on sharing of data outside the banking system. RBI also collects granular account level credit data for purely statistical purposes. From regulatory & supervisory point of view, RBI is more concerned with systemically important accounts and bank level data which enables it in efficient and effective monitoring of the system. Central Repository of Information on Large Credits (CRILC) 2.10 Central Repository of Information on Large Credits (CRILC) was set up by Reserve Bank in 2014-15 for ease in offsite supervision. The CRILC database contains information from all SCBs (excluding RRBs) on all credit instruments for borrowers having aggregate fund-based and non-fund based exposure of INR 50 million and above. Although the CRILC database captures about 60 per cent of the entire bank credit and around 80 per cent of the non-performing loans of SCBs by value, its coverage is miniscule in terms of number of accounts. The reporting used to be on a quarterly basis and the slippages were required to be reported in another format on as-and-when basis. From April 01, 2018, the reporting is mandated to be on a monthly basis with reporting on weekly basis of all borrower entities in default. The CRILC is designed entirely for supervisory purposes and its focus is on the reporting entities’ exposure to the borrower (as individual and/or as a group) under various heads, such as bank’s exposure to a large borrower; the borrower’s current account balance; bank’s written-off accounts; and identification of non-co-operative borrowers, among others. However, CRILC captures only limited detail about the borrowers such as the industry to which they belong and their external and internal ratings. The pooled information under CRILC is shared with the reporting banks but is not shared with the CICs, larger lender community, or researchers, due to legal prohibition. Genesis 2.11 CRILC was created for early recognition of financial distress, enabling prompt action for resolution and fair recovery for lenders and as part of a framework for revitalising distressed assets in the economy. It became fully effective on April 01, 2014 with reporting starting since quarter ended June, 2014. All Scheduled Commercial banks and four All India Financial Institutions (NABARD, EXIM BANK, NHB and SIDBI) report to CRILC. CRILC Main 2.12 This comprises of four sections i.e., Section 1: Exposure to Large Borrowers (Global Operations), Section 2 - Reporting of Technically/Prudentially Written-off Accounts (Global Operations), Section 3 - Reporting of Balance in Current Account (Global Operations) and Section 4: Reporting of Non - cooperative Borrowers (Global Operations). Reporting frequency for CRILC Main is monthly now. 2.13 The CRILC system started with information on SMA2 (default for 61-90 days) to be submitted on as and when basis i.e., whenever repayment for a large borrower's account becomes overdue for 61 days it is to be reported by the bank immediately. In case the borrower has funded and non-funded exposure of INR 10 million and above, formation of a Joint Lenders Forum (JLF) is compulsory in respect of a SMA 2 classified borrower. With a new framework for resolution of stressed assets, as announced by RBI on 12th February 2018, instead of only SMA2 borrowers, banks are to report all defaulted borrowers on weekly basis effective 23rd February 2018. A separate mechanism of Resolution Plan was brought into effect withdrawing earlier mechanisms / schemes. Essential Objectives 2.14 CRILC serves following purposes:

Data Items 2.15 Qualitative / Descriptive data includes PAN as unique identifier and other borrower identification data such as name and group name. It also has information on Industry, subsector code, Wilful Default, Asset Classification, Fraud, RFA, Internal rating, external rating, etc. Quantitative data like Funded Credit exposure and limit sanctioned Amount, Non-Funded Credit exposure & outstanding are also captured. Other information like formation of Joint Lenders’ Forum is also reported. Sharing of Data 2.16 The CRILC data including details of SMA 2 / defaulters reported are shared in consolidated form with the reporting entities. Section 45E of RBI Act, 1934 and section 28 of BR Act, 1949 prohibits the sharing of data outside the banking system. As per legal provision, CRILC data is treated as confidential and can be shared in the public interest in such consolidated form as RBI may think fit without disclosing the name of any banking company or its borrowers. Information relating to borrower name is commercially sensitive and there is a possibility of misuse of information. Utility to Banks 2.17 Banks get email alert on any bank reporting of any borrower as SMA2, default, RFA/Fraud. This facilitates early identification of stress in the account and enables bank to take pre-emptive steps to safeguard their interests. Aggregate exposure of a select borrower along with names of lending banks and contact details are available to all reporting entities. This gives a larger picture of the borrower’s liabilities across the banking system. Assets classification and SMA2 and default history of a select borrower is shared with banks. List of SMA2 classified / defaulted borrowers during the selected period and list of RFA/Fraud reported borrowers and Non-cooperative borrowers are available in CRILC. Basic Statistical Returns (BSR1) 2.18 It is Basic Statistical Return on credit i.e., loan accounts information from bank branches. The BSR-1 data covers loan level credit information for all SCBs. It aims to measure distributional aspects of bank credit. Coverage 2.19 Only Scheduled Commercial Banks (including RRBs) submit BSR1 return. It includes only the fund based exposure for loans granted in India. The BSR1 is collected every quarter-end from Scheduled Commercial Banks, while RRBs submit yearly (March-end only). Data pertaining to 92 SCBs (excluding RRBs) having a branch network of more than 1,40,000 encompassing about 16 crore records is collected every quarter. The number is growing at the rate of 10-15 per cent per annum. 2.20 It is a statistical return which captures some metadata for the account such as district and the population group of the place of funds utilisation; type of account such as cash credit, overdraft, term loan, credit cards, etc., organisation type such as private corporate sector, household sector, microfinance institutions, Non-Profit Institutions Serving Households (NPISH) and non-residents; and occupation type such as agriculture, manufacturing, construction, and various financial and non-financial services. The interest rate charged along with the flag for floating vs. fixed is also reported here. These details are not present in CRILC which is a borrower-level dataset rather than a loan-level dataset. Though BSR1 contains a “health code” for each account, it is not comprehensive enough to cater to the supervisory needs as it is not feasible to aggregate all accounts maintained by a borrower in the absence of a unique identifier across the reporting banks. Due to a number of reasons, even bank-level aggregation of delinquency in BSR1 will not in general match with that reported through CRILC. Aggregated statistical information with spatial, temporal and sectoral distribution from BSR1 is shared in the public domain for researchers, analysts and commentators. Account-level data is, however, kept confidential but is shared by the Reserve Bank with researchers on a case to case basis under appropriate safeguards. Challenges 2.21 Timeliness suffers due to inconsistencies and misclassifications in initial data. No borrower identification is captured and therefore BSR1 cannot be linked with other datasets like CRILC or MCA database. Due to the very nature of return covering all bank branches, any change in format/ codes takes longer time to implement/stabilize. It comprises of millions of small borrowers for whom getting common identifier (PAN/CIN) number is challenging as it may not be available in banks’ CBS. Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) 2.22 The Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) was set up by the Govt. of India on 31st March 2011 under the provisions of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, to make available the data of all equitable mortgages in the country at one place, so that the frauds due to multiple financing against the same property may be prevented. 2.23 The objective of CERSAI is to maintain and operate a system for the registration of transactions of securitisation, asset reconstruction of financial assets and creation of security interest over property, as contemplated under the Chapter IV of the SARFAESI Act, 2002. CERSAI provides online facility for filing of Security Interest on Immovable properties, Movables and Intangibles, Factoring transactions, Securitization and Asset Reconstruction Transactions and Under Construction Properties. Information available with CERSAI 2.24 Details of the assets against which security interest has been created is available with the registry. For immovable assets, Identifiers/information issued by builder or Govt. Agencies and contained in registration documents like survey number, plot number, flat/house number, area of the unit, various fields related to address of the property is captured. For vehicles, registration number, engine number, chassis number, VIN/Serial number and for other movables/intangibles brief description of the asset, identification number (if any) is stored. Borrower’s details like type of borrower (whether Individual or Proprietorship/ Partnership Firms or Limited Liability Partnerships (LLPs) or Company/ Govt. Body or Co-operative Society or HUF or Trust) is captured. In case of individuals, their name, date of birth and provision to capture identifiers like PAN and Aadhar is present. In case of entities their name, identifiers like registration number, CIN/LLPIN are captured. And in all cases address of the borrower is captured. Details of security interest holder i.e., branch name and address is captured. For immovables, the details of the title document and the place of their registration is captured. Loan Account number, nature of loan, interest rate, loan amount, secured by asset, extent of charge also needs to be reported by the entities. Information Utility 2.25 Information Utility (IU) stores financial information that helps to establish defaults as well as verify claims expeditiously and thereby facilitate completion of transactions under the IBC in a time bound manner. It constitutes a key pillar of the insolvency and bankruptcy ecosystem, the other three being the Adjudicating Authority (National Company Law Tribunal and Debt Recovery Tribunal), the IBBI and Insolvency Professionals. 2.26 The IBC enabled the IBBI to lay down Technical Standards and thorough guidelines for the performance of core services and other services by IUs. The Technical Standards shall inter-alia provide for matters relating to authentication and verification of information to be stored with the IU, registration of users, data integrity and security, porting of information, inter-operability among information utilities etc. The Regulations require that each registered user and each debt information submitted to the IU shall have a unique identifier. 2.27 National E-Governance Services Limited (NeSL) is India’s first IU and is registered with the Insolvency and Bankruptcy Board of India (IBBI) under the aegis of the Insolvency and Bankruptcy Code, 2016 (IBC). The company has been set up by leading banks and public institutions and is incorporated as a union government company. The primary role of NeSL is to serve as a repository of legal evidence holding the information pertaining to any debt/claim, as submitted by the financial or operational creditor and verified and authenticated by the other parties to the debt. NeSL’s role is to facilitate time-bound resolution by providing verified information to adjudicating authorities that do not require further authentication. 2.28 NeSL was incorporated in June 2016 as a Union government company with equity fully held by financial institutions - public sector holds 65 per cent of the equity. There are 17 shareholders – 13 banks, 3 insurance companies and 1 depository. NADL (wholly owned subsidiary of NeSL) has received in-principle licence to serve as NBFC- Account Aggregator. A repository of financial information that is authenticated by the parties to debt and serves as legal evidence in NCLT and DRT may also be accepted in other Courts under the Civil Procedure Code. IU intends to hold legal evidence of both parties authenticating facts of debt, outstanding etc. IU report may be taken by creditor from debtor to view the exposure to credit system. MCA company finance database 2.29 The Ministry of Corporate Affairs (MCA) collects statutory information, both financial and non-financial, from registered companies on self-declaration basis. The reporting can be Annual or Event based. The key identifier is the CIN. The MCA database contains the audited or unaudited financial results of the companies submitted by them at various frequencies. Companies registered under Companies Act, 2013 are mandated to file all documents relating to incorporation, compliance, approvals, annual statutory returns, etc. electronically through MCA21 system. MCA21 an e-governance project being implemented by MCA since 2006 is now a large electronic repository of Indian corporate sector. As on September 2017, the MCA21 system has information of about 1.7million companies registered under the Companies Act.  3. Credit Information Infrastructure – International Practice INTRODUCTION 3.1 The best predictor of future behaviour is past behaviour or past performance in a similar situation. The utility of a credit information registry, which contains detailed granular information on borrowers’ past loan performances, is rooted in this principle. A country may have credit registries operated by the public sector or private sector or both2. 3.2 Jaffee & Russell3 (1991) and Stiglitz & Weiss4 (1981) demonstrated that asymmetric information between the lender and the borrower leads to problems of adverse selection and moral hazard, thus making it impossible for the price of the loan or interest rate to play a market clearing function. The more severe the asymmetric information problem, greater is the credit rationing likely to occur. 3.3 The lenders may rely on their interaction with borrowers and build a knowledge base. The importance of information developed over the course of a banking relationship is well documented in literature. However, this information is limited to one’s own borrowers only and their interaction with only one entity. Also, this proprietary information, not shared with other lenders, can lead to negative incentive in terms of higher loan prices for ‘good’ borrowers, as they cannot distinguish themselves from ‘bad’ borrowers. 3.4 Credit Registries – PCR and PCBs – makes a borrower’s credit history available for scrutiny to potential lenders. This helps lenders take better credit decisions in terms of avoiding making loans to high risk persons, natural or legal, identified based on their repayment histories. For borrowers, this acts as a positive incentive for timely repayments, as they know that their information in the credit registry works as part of their “reputation collateral”. PCR and PCB5 3.5 PCR and PCB are the two main types of credit reporting institutions across the world. In many countries, PCR and one or more PCBs coexist, whereas in others either a PCR or only PCB(s) operate. The differences in country wide practices may stem from a number of factors including maturity and size of the credit market, legal framework and so on, but primarily the practice is tuned to the particular requirement of the country. Public Credit Registries 3.6 The sharing of credit information is in the public interest from a financial stability and supervisory perspective. That is why in most countries the Credit Registries are generally owned and managed by the public sector, with the ownership mostly lying with the country’s banking sector regulatory / supervisory authority – generally the Central Bank. The terms central credit registry and public credit registry are thus used interchangeably. The PCR in turn makes the collected information about a borrower available to reporting institutions as a crucial input into making their own credit decisions. Traditionally, the PCR was tuned for assisting mainly in regulation / supervision of the credit institutions and thus, information were captured for loans above a certain threshold, in general. However, many PCR across the world have moved to a lower threshold, capturing as much of the whole information as possible, and also provide credit reports to lenders and borrowers (on their own situation) as part of their operation. PCRs however, do not generally provide additional services like credit scoring or portfolio monitoring to the lenders. 3.7 Submission of information to PCR is compulsory under national legislation. Regulations under the specific law defines the reporting institutions, the type of borrowers and the type of instruments to be covered as part of the reporting and the data fields to be provided. The authority in charge of the PCR is also generally endowed with certain enforcement powers to handle non-submission, wrong-submission or late-submission. Private Credit Bureaus 3.8 PCBs are generally owned by specialised firms and operate for profit. The PCBs also receive information from creditors, but the reporting tends to be voluntary in nature. Credit institutions enter into agreement with a PCB which specifies the data that the credit institution should contribute and can consult and also the fees for the same. PCBs augment this information with that gathered from other relevant sources like other public registries, tax authorities, utility bill payments database, legal proceedings database etc. and provide the data to creditors. Creditors and Borrowers can also get credit reports from the PCBs. Creditors can obtain the credit history of a credit applicant from a PCB on request. 3.9 PCBs offer their services to various parties, depending on the country’s law, other than the credit institutions - for example, leasing companies, utilities providers etc. In addition to this, PCBs also provide value added services like credit scoring, portfolio monitoring, fraud prevention and so on, tailored to the creditor’s need. PCR and PCB – features 3.10 As the reporting is compulsory to PCR by law, 100per cent of the population that receives credit, generally above a certain threshold, gets covered in PCR. PCBs collect information with a much lower threshold, or no threshold at all, but the voluntary nature of submission may lead to a lower coverage of the credit market. The credit information reporting ecosystem becomes more useful to creditors as the coverage of creditors reporting to the system - and hence coverage of borrowers – increases, as that would lead to near complete picture of a potential borrower’s credit activity resulting in higher confidence in taking a credit decision. Thus, better coverage of credit institutions is highly valued. 3.11 Both PCR and PCBs operate on the principal of reciprocity, lying at the core of all credit reporting system. Essentially this means that an entity can access information from a credit information database provided they contribute to the database by submitting credit information. 3.12 Both in case of PCR and PCBs, the credit institutions have to ensure the quality and accuracy of the data submitted. The borrowers in turn have the right to access their own data and review and correct accordingly. 3.13 Some of the salient features of PCR and PCBs are represented in the table below:

PCR around the World 3.14 PCR had its genesis in Europe. The first PCR was established in Germany in 1934. This was followed by France (1946), Italy (1962), Spain (1963) and Belgium (1967). The next wave of expansion was in the 1990’s where most countries in Latin America started their own PCR operation – Bolivia (1989), Colombia (1990), Argentina (1991), El Salvador (1994), Dominican Republic (1994), Costa Rica (1995), Guatemala (1996), Ecuador (1997) and Brazil (1997)6. As can be seen from Diagram 1, many African (Angola, Algeria, Libya, Morocco, Nigeria, Tunisia, Togo) and Asian (China, Mongolia, Malaysia, Indonesia, Philippines, Vietnam, Oman, Qatar, Bangladesh, Pakistan, Yemen) countries have also developed a PCR over the course of time. A survey conducted by the World Bank in 2012 reported that out of the 195 countries surveyed, 87 were having PCR. It has been observed that PCRs are more prevalent in countries with a French legal tradition (Civil Law), whereas countries with British legal tradition (Common Law) tend to have PCBs in operation. 3.15 The Western European countries have a rich tradition of PCR. 16 out of the 28 member countries of the European Union have a PCR7, mostly managed by the Central Bank. The European Central Bank (ECB) has initiated a project called AnaCredit (Analytical Credit Datasets) which is a project to set up a dataset containing detailed information on individual loans in the Euro area, harmonised across all member states8. The project was initiated in 2011, and it is scheduled to ‘go live’ in September, 2018. For compliance to the reporting requirements for this project, the countries not having a PCR are also setting up some form of a central credit registry. The countries which already had a PCR are taking two approaches for compliance – either enhancing their own PCR in the process (e.g. Spain, Portugal) or establishing a separate information system to fulfil reporting requirements to AnaCredit (e.g. Italy, Germany). 3.16 As good examples of implementation of PCR with excellent coverage of adult population in the respective countries, the PCR operations of Spain, Portugal and Argentina will be described in detail below. Spain 3.17 The main objectives of the Spanish PCR besides providing reporting entities with data on credit risk of their actual or potential clients are to help in prudential supervision of reporting entities, to produce statistics on credit and to contribute in other various legally defined tasks of the Bank of Spain. The PCR started operation in 1963 with consolidated reporting, moved to borrower-by-borrower reporting in 1995 and then to loan-by-loan reporting in 2013. The PCR was then further enhanced in 2017 to incorporate AnaCredit requirements. Spanish law defines the PCR as a public service and allows Bank of Spain to use the data in exercising its supervision and inspection role and also to provide reporting entities with data to conduct their business. All credit institutions (including branches of foreign entities operating in Spain) as well as guarantee companies report to the PCR. All loans, debt securities and financial guarantees and other off-balance sheet exposures are reported to the PCR on a loan-by-loan basis. Other than some exceptions of a specific nature, the reporting is mandated for all amounts and all type of borrowers. 3.18 There are four main categories of users with which PCR information is shared. Reporting institutions have access to PCR data which may be used only for credit risk management and assessing level of indebtedness of actual or potential borrowers. The borrowers have access to their own information contained in PCR to ensure right of access, rectification, deletion and objection. Judicial authorities and other public organizations can request access to PCR data. In-house central bank users also have access to PCR information, but on a strict need-to-know basis. The only exception to the above broad access framework applies to public administration organizations, information pertaining to whom can be made publicly available. 3.19 The reporting entities receive monthly detailed reports on all of their existing borrowers with the aggregate amount on the different types of credit risk in the whole system. The reporting entities can also request for ad-hoc reports on potential borrowers or entities which feature as bound to pay or as guarantors in bills of exchange or credit instruments which the reporting entity has been asked to acquire or discount. They have to inform the borrower in writing about the request being made. Both the regular monthly reports as well as the ad-hoc reports supplied to the reporting entities from PCR are aggregated in nature in so far as they do not disclose either the name or the number of lenders or the number of operations. The ad-hoc reports supply information pertaining to the latest reporting period and also that of six months prior to that for reference purpose. 3.20 The borrowers can obtain reports on all their data included in the PCR (breakdown of entities and by operations). They also receive the same aggregated information for themselves which is shared with reporting institutions. The borrowers can challenge wrong data on themselves by either addressing the reporting institutions themselves or asking Bank of Spain to transmit the request. The reporting institutions must reply to the borrower and the PCR within 15 working days in case of a natural entity or within 20 working days in case of a legal entity. During this interim period, dissemination of the controversial data is suspended. Portugal 3.21 The PCR in Portugal was created in 1978 by Banco de Portugal (BdP) with the purpose of providing information to the credit institutions and help them in their assessment of the risks of extending credit. It is regulated by a Government Law and all institutions granting loans in Portugal are obliged to participate in the PCR thus reporting all the loans they have granted or the guarantees they have provided. No exemptions are conceded by the BdP in this regard. The PCR contains information on actual credit liabilities of natural and legal entities as well as potential credit liabilities in the form of irrevocable commitments. The legal framework of the PCR guarantees the confidentiality of individual information and ensures it in the processing and dissemination of credit information. 3.22 The main objective of the PCR is to support the reporting entities in credit risk assessment by allowing them access to aggregated information about the indebtedness of their actual and potential borrowers. Under the law, the PCR information can also be used for essential functions of the central bank, namely banking supervision, financial stability, monetary policy, research and statistics. 3.23 The Portuguese PCR was completely rebuilt in 2009 in terms of type of credit operations covered, the participating institutions and other general rules concerning the PCR operation. At present the Portuguese PCR contains information on a borrower-by-borrower basis on all financial loans granted in Portugal and all financial loans granted abroad to residents of Portugal by branches of Portuguese banks. The reporting threshold on amount is 50 Euro. The BdP has also in place a system (BPLim) which is an onsite analytical platform where researchers / academics can query anonymised PCR data. 3.24 Each month all reporting institutions receive the credit report of all debtors that they have reported, which contains the latest information on their total indebtedness broken down by the different types of loans associated. No creditors are identified in the reports and only aggregate numbers are provided. All reporting institutions are also entitled to request a credit report regarding every new potential client applying for a loan. More than 6 million credit reports are issued annually by the PCR for this purpose. All natural and legal entity has the right to obtain its credit report for the last five years free of charge, which include a detailed breakdown by the creditor. 3.25 The PCR of Portugal is also undergoing major changes to incorporate AnaCredit requirements. The BdP has utilized this opportunity to completely overhaul and enhance the existing PCR, going to a loan-by-loan level reporting from the existing borrower-by-borrower one. The information content of the PCR has also been drastically enhanced (from existing 24 variables to 187 variables for each loan). The PCR will now contain information for all financial loans granted in Portugal and all financial loans granted abroad by branches of Portuguese banks. The new improved PCR is expected to ‘go live’ from September 2018 with the first AnaCredit reporting scheduled on November, 2018. Argentina 3.26 The Argentine PCR started its operation in 1991. The PCR covers 44.8per cent of the adult population in the country, the proportion being significantly higher than the corresponding Latin American and Caribbean proportion of 14per cent. In Argentina, submission of credit information to PCR is mandatory under law and the credit institutions also report the credit information to PCBs. The PCR covers both natural and legal entities and the credit history of the borrowers are made available over internet. Morocco 3.27 Prior to setting up of the PCR, Morocco grappled with three different “Credit Registries” (by banks, MFIs, NBFIs) leading to three “vertical silos” isolated, not integrated, incomplete and partial credit information set. This resulted in high risk of information fragmentation with quality deterioration of information/databases where no lender in Morocco would have ever had the complete picture of customers’ exposure. As no internal capacity and know-how inside banks, NBFIs, MFIs to run such projects were there, Bank Al-Maghrib (BAM), the Moroccan central bank, worked with IFC to overhaul the credit reporting system of Morocco in 2006. Under the advice of IFC, BAM took up the role of aggregator of data of all its regulated credit institutions and a private credit bureau was assigned the role of processing this raw data and provide all the services. This arrangement was operational since 2009 with minimum change in the legal framework. 3.28 The “Moroccan Model” had drawn appreciation and definite positive impact is observed on business climate (Doing Business rank). However, there were certain short-comings, notably, absence of non-traditional data from non-supervised entities to foster financial inclusion even further and scarce utilization of the Public Credit Registry by BAM to support the needs and responsibilities of the regulator. Therefore, BAM has embarked into phase 2 of its PCR project. In this phase, they plan to refocus the PCR more for the internal requirements of BAM including supervision and regulation. The Credit Bureaus may no longer get the data from the PCR and may require to compete and innovate with opening up of the credit information space. 4. Public Credit Registry in India - Expectations of Stakeholders BACKGROUND 4.1 The HTF engaged with multiple agencies to get a view of the challenges faced by them in terms of availability of Credit data and how PCR can help to bridge the gap. In order to further crystallize views of various stakeholders, three Subgroups of the HTF were formed. Each Subgroup catered to a different class of stakeholders i.e., Commercial Banks, Non-Banks and Cooperative Banks. The reports of these Subgroups are given in Annexure II. 4.2 The terms of reference of the Subgroups were set as follows:

SUBGROUP OF BANKS 4.3 The subgroup comprised of 11 members having representatives from public sector banks, private sector banks, foreign banks, small finance banks, Regional Rural Banks and Indian Banks’ Association (IBA). The Banking subgroup used the concept of use cases to approach the problem. The following three use cases were decided by the subgroup - Origination, Monitoring and Enforcement (pre and post) and Simplification/ Consolidation of reporting. The deliverables for the subgroup were creating a wish list of all necessary data fields and determining the current reporting being done by banks while identifying the data overlaps between various information systems. SUBGROUP OF NON BANKS 4.4 The subgroup also comprised of 11 members having representatives from prominent NBFCs, HFCs and ARCs. The Subgroup endeavoured to identify the key concerns that non-banking lending institutions face while collating the due diligence information about the borrower and the possible means of overcoming these challenges. SUBGROUP OF COOPERATIVE BANKS 4.5 The subgroup under the aegis of NABARD comprised of 18 members having representatives from UCBs, StCBs, DCCBs and PACs. The Subgroup made recommendations under its terms of reference. CHALLENGES IN THE CURRENT CREDIT INFORMATION SYSTEM 4.6 The challenges faced by stakeholders, as identified by the subgroups, were mostly common across commercial banks, cooperative banks and non-banks. The key challenges highlighted were as follows. Lack of comprehensive data 4.7 Credit information is currently available across multiple systems in bits and pieces and is not available in one window. There are certain key information that do not get reported currently but are essential for making effective credit decisions. Many a times, lenders are dependent upon the borrower for providing key information due to lack of a credit registry. The complete debt snapshot of a borrower is not currently available with the lenders. With financing happening from non-bank funding sources (viz. NBFCs, mutual funds, foreign portfolio investors, alternative investment funds etc.), complete debt details are not currently available in any system. Systems like MCA only have data of companies and limited liability partnerships. Data for other entities (viz. trusts, societies, AOPs, general partnerships, sole proprietorships etc.) is currently not available in any system. 4.8 The information about all individual and non-individual clients is not available at one place. While the information for companies or LLPs are available there is no central database available for verifying the structure or other constitution details for entities falling under the categories of AOPs, Partnership, HUF, Trusts etc. Further the status of the members of such entities and the updates in such status (e.g. Karta of an HUF, partners with any limitation on liability such as sleeping partner) is not available. Even verification from those separate data available in public domain is scattered and incomplete. At times, these limitations may result in inadequate and ineffective diligence of such entities. Therefore, a central repository capturing all the details including that of UBO of every constitution other than Companies or LLPs may be built and made available to all stakeholders. 4.9 However, the same is not available to NBFC e.g. information on financial delinquency like categorization as SMA 0, SMA 1 or SMA 2 etc. available in CRILC. Such information needs to be also made available through one database to all stakeholders (including NBFCs). Another challenge that lenders face at the time of appraisal is the assessment of the real beneficiary/ controlling person, associated with the complex chain of ‘shell’ entities, including companies/LLPs/Trusts etc. These entities on many occasions are controlled by the family members/associates of the main controlling person. It is a web which is very difficult to unravel through the currently available information platform/s. Information available in fragmented manner 4.10 Currently, the data is available in a scattered manner and non-uniform basis. The various sources from where such data can be accessed are CICs, CERSAI Registry, KRA registry etc. These databases provide different inputs and may be not updated on timely basis, thereby providing different information for the same client. Thus it becomes difficult to rely upon and verify the information provided by these clients. A single repository across these agencies capturing entire database of such clients, will ease out the due diligence process. Comprehensive information of borrower would help in making better credit decisions and also support sound risk management. It would also enable better governance controls through enhanced monitoring. Dependency on Self Disclosures by borrowers 4.11 Currently there is a lot of self-certified data taken from customers and relied upon e.g. client KYC, Income details, financial details (assets & liabilities), networth, contact numbers, nationality etc. These details especially financial details are important parameters for lending. In case of companies these details are available through audited financials; however the same does not provide a holistic view regarding the paying capacity of the client. With respect to the clients like individuals, HUF, Trusts, AOP, Partnerships the information is further limited with a lot of dependency on the client. Authenticity and Reliability 4.12 The various pieces of information are cross checked with the information available on MCA, Income Tax, Exchange website for listed company disclosures, Regulator’s website for regulated entities, CERSAI Portal, Judicial websites (for litigation) etc. However most of the time, the information is either not updated or inaccurate entries are passed. This leads to inaccuracy and thus affects the quality of lending. There should be a mechanism to raise queries on the observation and feedback from the other participants. There is no reliable validation tool for lender while taking credit decisions for a potential borrower. For example, in scenarios where a lender is extending fund based facilities against guarantees/letter of undertaking of other banks, the lender should be able to validate if the non-fund based facility has actually been assisted to the borrower. Inconsistencies in data cannot be easily identified and there is a high dependence on the information submitted by the borrower itself. For certain data, there exists no harmonized list leading to lack of uniformity among the lenders; for example, industry classification for a particular borrower. Time, dated information and cost 4.13 The various portals, as available today for cross verifying the information, are MCA, Income Tax, Exchange website for listed company disclosures, Regulator’s website for regulated entities, CERSAI Portal, Judicial websites (for litigation), Company website etc. However, many times the updated information is not available. For example the CERSAI portal takes lot of time lag to get the registration of collateral/security. Further at times such reports are not available in machine-readable format. Due to these limitations, lending institutions have to invest time and costs to get the same converted. 4.14 Post disbursement monitoring of the financial position of the entities is another challenge, especially in the light of change in ownership patterns/creation of new ‘shell’ structures, transfer of underlying assets including personal assets of borrowers to family members/associates/associated entities. It is virtually impossible under current system to ring-fence the personal assets from such diversion leading to situations where the borrowing entities go bankrupt, whereas promoters are virtually unaffected. 4.15 Additionally various aggregator portals like ‘world-check’, Watchout Investors, CIBIL are paid portals and each time a record is accessed, lender has to bear the cost. Multiple Reporting 4.16 Currently, multiple returns with multiple agencies are filed which contain similar information pertaining to loan amount, details of security, charge creation, borrower details etc. Such reporting is made to CIC, CRILC, CERSAI, ROC and IU. Further each agency has its own process and time lag to upload the information and make it available to the users. Due to multiple inputs and time lag there are difficulties to ascertain the up-to-date information. In the present reporting framework, banks have to provide more than 300 reports. Since there are many systems with data in bits and pieces, a lot of overlap also happens. A comprehensive data registry would not only simplify but also streamline and consolidate reporting. At the same time, it would also improve the quality of reporting. Recommendations and expectation from PCR 4.17 In view of the challenges present in the existing credit information system, following are the recommendations for PCR made by the stakeholders. Complete information 4.18 Data pertaining to entire life cycle of loan to be collected by PCR. Rationale is to make available complete information regarding loans, starting from origination of loan, its pricing, loan and security documentation, security obtained, defaults, monitoring, repayments, termination/ settlements/legal proceedings. This would enable use of data by all stakeholders whether they are banks, CICs, IUs, the regulator/supervisor etc. The PCR should capture entire banking footprint of the entity in terms of all credit relationships. 4.19 The primary focus behind designing a comprehensive PCR is to enable any stakeholder, who has access to the PCR, to obtain comprehensive information of the borrower, through a single portal. This will not only lead to sound credit decisions but would ultimately lead to development of a flow based lending. Access to credit information, including debt details and repayment history would drive innovation in lending. For example, currently most banks focus on large companies for loans and consequently the micro, small and medium enterprises are left with limited options for borrowing. With satisfactory payment history and validated debt details made available, it will increase the credit availability to micro, small and medium enterprises along with deepening of the financial markets. This will support the policy of financial inclusion. 4.20 An exhaustive dataset design was recommended by one of the subgroups (Refer report of the Banking Subgroup in Annex 2). Additionally, it was suggested that Non fund based data to be furnished by banks to PCR to track guarantees and other such off-balance sheet liabilities of banks. Information with respect to security valuation/LTV to be captured for secured loans. PCR should also capture details of guarantee provided by borrower group entities / third party including details of guarantees that are collateralised. Loan assignments including loan assignment to ARCs to be reported to PCR. Validation of Data 4.21 The members were of the view that a repository of data which is not validated cannot be relied upon. Hence, it is essential that whatever data goes into the PCR should be validated to ensure its accuracy. It was also proposed that additional validations be done for critical data – e.g. the total operating income of a company can be validated by checking the GST or income tax data. In certain data sections like news, litigation, it was suggested that no filters should be applied by PCR for deciding which data is material in nature. It should be a landing page which provides all information and it should be the responsibility of the entity accessing the data to apply their own criteria to the data repository in PCR. 4.22 Few of the data fields to be included in the PCR, viz. sector/sub-sector code and group code require harmonization. A harmonized list can help in removing inconsistencies in classification of customers, given that presently there is multitude of different lists maintained by different agencies/departments. Similar harmonization should be done for other data fields, wherever required. Unique Identifier 4.23 Unique borrower ID across all financing agencies along with unique account ID must be ensured. Aadhaar may be considered as unique ID for individuals. Portability of IDs across all financial institutions would enable quick and accurate retrieval of borrower information and facilitate swift credit decisions. 4.24 Another key challenge is to assess the real beneficiary/ controlling person, associated with the complex chain of ‘shell’ entities, including companies/LLPs/Trusts. In the current scenario, there is dependency on self-certification by borrower. There is a need to extend the uniform KYC requirements to non-individual entities specially non-individuals non-corporate customers in a structured format across regulators and products. The Legal Entity Identifier (LEI) may be considered to be extended and mandated for all types of non-corporate customers. LEI should be assigned on application from the legal entity and after due validation of data. For the organization, LEI will serve as a proof of identity for a financial entity, help to abide by regulatory requirements and facilitate transaction reporting to Trade Repositories. This will enable PCR to comprehensively integrate its database with other sources of information. Confidentiality and Privacy 4.25 In many countries, privacy laws have no provision for credit reporting or, in some cases, prohibit the disclosure of vital information to third parties altogether. PCR would be a registry of very sensitive and confidential data. Hence, the design and architecture of PCR should ensure that the data is not compromised at any point of time. Issues regarding confidentiality of data and privacy principles should be adequately addressed. Declaration should be made to customers regarding disclosure of data in PCR. PCR shall be responsible for electronically storing, safeguarding and retrieving the data-base and records. Robust technological infrastructure with adequate checks should be in place to ensure borrower authorization for accessing PCR platform by lending institution. It is proposed that access rights be given with adequate firewall so that separate stakeholders have access to requisite information only. Also, confidential information may be masked, wherever required. 4.26 Generally, the access to the information in PCR should be based on borrower's consent/ authorization. However, certain information providing negative credit flags such as payment delays/ defaults with lenders, encumbrances, judicial orders, FIU sanction list etc. should be available for access to regulators and lenders without specific borrower/ prospective borrowers' consent. Also, certain information may be required throughout the life cycle of a loan for monitoring purpose. Hence, a provision for one-time consent from the borrower valid for the lifetime of the loan should be made in the PCR. Standardization and Consolidation of Information 4.27 Currently, information is being sourced or verified by lending institutions through multiple platforms e.g. information pertaining to the Company or LLP is available on MCA portal, information pertaining to regulatory status or regulatory actions/orders is available on regulators’ website i.e., RBI, SEBI, IRDA, NHB etc., basic KYC data, for individual clients, is accessed through CERSAI. The regulators also keep on issuing various lists like wilful defaulter list (RBI), shell companies lists (FIU), struck off companies list (MCA), high risk NBFCs (FIU), etc. There is a need for financing institutions to have a common access at a single platform across all available public data-base of their customers/ customer groups. PCR should capture/access information in a standardized format through various existing platforms such as Credit Information Bureau, MCA, CERSAI, Exchange Website for listed corporates (both equity and debt listed), CRILC, FIMMDA, Income Tax for PAN / TAN database, Judicial database, etc. 4.28 PCR should have access / data feed from various regulatory websites and databases to have consolidated view of customers on tax compliances, regulatory orders and sanctions, credit defaults etc. This information would serve as early alert / warning system to financing entities in the process of their loan appraisal / loan monitoring. This platform should have access / data feed from following sources:

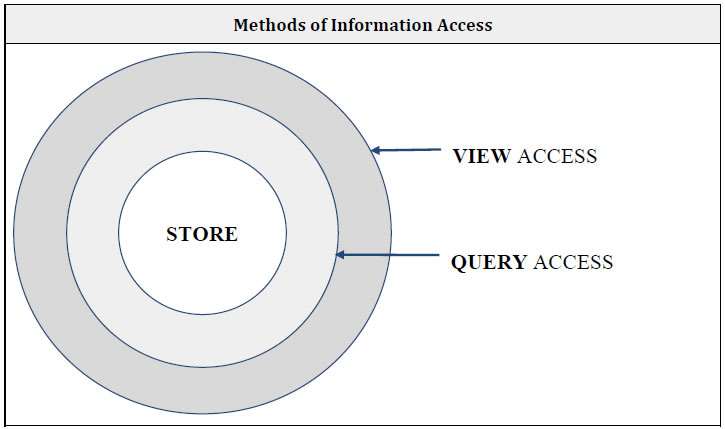

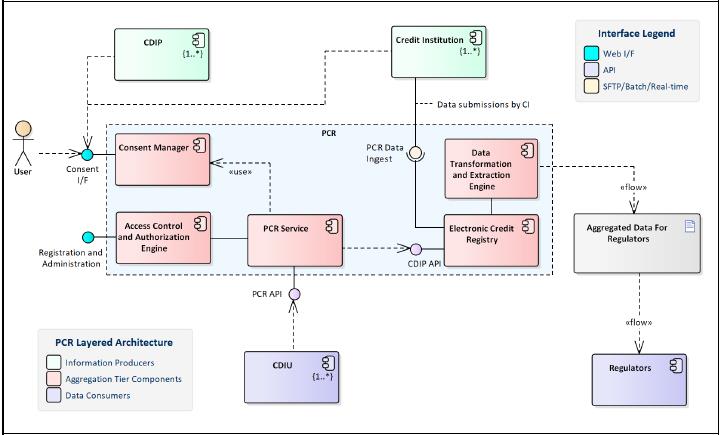

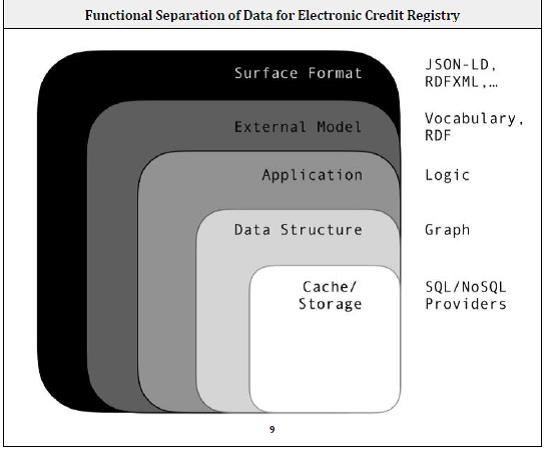

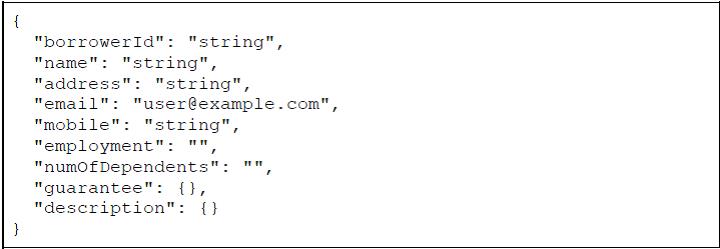

Single point of reporting 4.29 Currently, multiple returns with various agencies are filed which contain similar information pertaining to loan amount, details of security, charge creation, borrower details, etc. Such reporting is made to CICs, CRILC, CERSAI, ROC and IU(s). Further each agency has its own process and time lag to upload the information and make it available to the users. Due to multitude of inputs and presence of multiple versions of the same data it is difficult to ascertain the up-to-date information. 4.30 PCR should be single point for reporting of data by credit institutions in a standard format agreed upon by all stakeholders. It could be evolved to serve as a common reporting platform and data warehouse managed by a central agency that can be accessed by other stakeholders for their relevant data needs. Upon stabilisation, filing of information with PCR would also dispense with the mandatory requirement of filing information under various enactments. This would reduce multiple reporting requirements of similar data as well as ensure data consistency. It would enable PCR to cater to all classes of institutions whether credit providers, IU(s) or credit rating agencies. Data which is currently being submitted to CICs by their members need to be collected by PCR. Supplementary data can be collected by other agencies, if required. No minimum threshold 4.31 Loans issued by Cooperative Banks barring UCBs are generally small ticket loans. In order to have a 360 degree view, all credits regardless of size may be captured by the credit registry. It would also provide data on extent of financial inclusion. Alternate credit data 4.32 Certain data fields can act as surrogates for assessing the credit quality of a potential borrower; these include utility bills payment, provident fund payment, tax/statutory dues payment, etc. Linking of these individual systems with the PCR for capturing such data is thus recommended. Further, access to data such as GST etc. can be effectively used to validate financials of the borrower. 4.33 To begin with, data pertaining to utility payments e.g. mobile, internet, electricity bills, etc. in respect of societies/corporate entities to be collected, followed by information related to individual borrowers above a certain threshold to be incorporated in PCR. This would give pointers regarding the borrower’s financial situation and enable lenders to make informed credit decisions Legal Framework 4.34 A comprehensive legal framework including a parliamentary law, if required, to provide for regulation of Public Credit Registry and to facilitate efficient distribution of credit information and for matters connected therewith or incidental thereto, to be prescribed. Central Regulator may be mandated to oversee implementation and ensure compliance with PCR laws. Necessary amendments may be effected in the applicable acts, laws and regulations to make the Public Credit Registry an efficient and effective platform for all stakeholders. Default Reporting 4.35 Default by borrower being an important credit event would be captured and information to be available in PCR on real time basis. Alerts regarding other negative behaviour to be thrown up in data made available to PCR on real time basis. To alert loan delinquencies on real time basis: