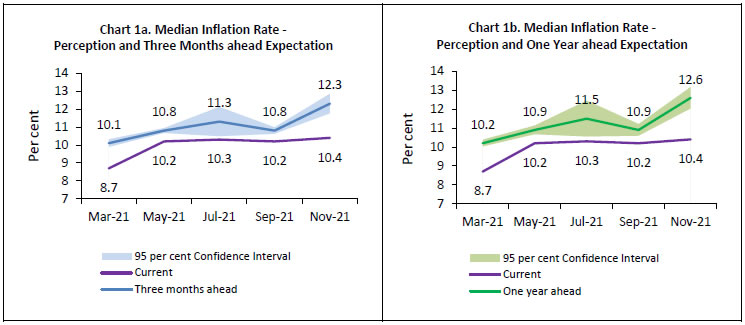

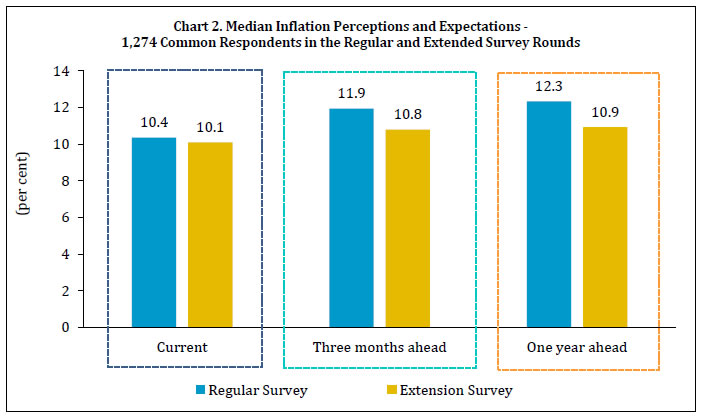

Today, the Reserve Bank released the results of the November 2021 round of the Inflation Expectations Survey of Households (IESH)1. The survey was conducted during October 25 to November 3, 2021 in 18 major cities through field interviews. The results2 are based on responses from 5,910 urban households3. As global and domestic price sentiments are assessed to have changed considerably in the wake of a cut in domestic excise duty on petrol and diesel and international crude oil and other commodity prices declining after ‘Omicron’ emerged as a COVID-19 variant of concern, a follow-up survey of these respondents (hereinafter called the ‘extension survey’) was conducted telephonically in early December 2021 to canvas their updated assessments. In the extension survey, responses were received from 1,274 of the 5,910 households who had participated in the regular survey. Highlights: A. Regular Survey Round i. Households’ median inflation perceptions for the current period increased by 20 basis points, reaching 10.4 per cent in November 2021, while three months and one year ahead median inflation expectations increased by 150 and 170 basis points, respectively, from the previous survey round [Charts 1a and 1b; Table 3(a)]. ii. Households expected inflation to harden in the near and medium term, as the gap between current perceptions and future expectations widened for both time horizons [Charts 1a and 1b; Table 3(a)]. iii. The proportion of respondents expecting higher inflation in the next three months and over the year ahead rose in November 2021 [Tables 1(a) and 1(b)]. iv. Expectations for overall prices and inflation were generally aligned to those for non-food commodities [Table 4]. B. Extension Survey v. Median inflation perceptions of the households that responded in the extension survey conducted in early December 2021 declined by 30 basis points for current inflation vis-à-vis their assessment in the regular survey round conducted a month earlier [Chart 2; Table 3(b)]. vi. Median inflation expectations of households three months and one year ahead declined by 110 basis points and 140 basis points, respectively, vis-à-vis their expectations a month ago [Chart 2; Table 3(b)]. vii. The proportion of households expecting general prices and inflation to rise over both the time horizons was lower in the extension survey round when compared with the regular survey round [Table 1(c)]. Note: Please see the excel file for time series data.

| Table 1(a): Product-wise Expectations of Prices for Three Months ahead | | (Percentage of Respondents) | | Survey period ended | Nov-20 | May-21 | Jul-21 | Sep-21 | Nov-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 83.3 | 0.85 | 83.7 | 0.68 | 85.9 | 0.79 | 84.9 | 0.77 | 89.3 | 0.64 | | Price increase more than current rate | 55.4 | 1.14 | 58.5 | 0.91 | 63.0 | 1.15 | 61.5 | 1.14 | 67.0 | 1.17 | | Price increase similar to current rate | 23.6 | 0.95 | 21.2 | 0.76 | 19.6 | 0.90 | 19.9 | 0.88 | 19.1 | 0.94 | | Price increase less than current rate | 4.4 | 0.46 | 4.0 | 0.37 | 3.3 | 0.38 | 3.5 | 0.40 | 3.3 | 0.42 | | No changes in prices | 14.2 | 0.81 | 14.0 | 0.63 | 11.3 | 0.70 | 12.9 | 0.72 | 8.2 | 0.55 | | Decline in prices | 2.4 | 0.32 | 2.3 | 0.30 | 2.8 | 0.40 | 2.2 | 0.29 | 2.5 | 0.30 | | Food Product | | | | | | | | | | | | Prices will increase | 81.5 | 0.83 | 84.4 | 0.72 | 84.0 | 0.81 | 84.8 | 0.74 | 86.0 | 0.70 | | Price increase more than current rate | 54.7 | 1.10 | 60.2 | 0.92 | 61.0 | 1.15 | 61.4 | 1.08 | 63.7 | 1.17 | | Price increase similar to current rate | 20.3 | 0.90 | 19.4 | 0.75 | 17.6 | 0.89 | 18.2 | 0.80 | 17.0 | 0.82 | | Price increase less than current rate | 6.5 | 0.59 | 4.8 | 0.38 | 5.4 | 0.53 | 5.3 | 0.50 | 5.2 | 0.46 | | No changes in prices | 11.6 | 0.67 | 11.8 | 0.63 | 10.5 | 0.65 | 10.8 | 0.64 | 8.2 | 0.52 | | Decline in prices | 6.9 | 0.54 | 3.9 | 0.39 | 5.5 | 0.53 | 4.4 | 0.40 | 5.8 | 0.46 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 74.8 | 0.99 | 78.6 | 0.79 | 82.6 | 0.85 | 82.1 | 0.82 | 86.3 | 0.67 | | Price increase more than current rate | 48.0 | 1.11 | 53.1 | 0.95 | 59.0 | 1.17 | 58.8 | 1.15 | 62.7 | 1.17 | | Price increase similar to current rate | 20.3 | 0.87 | 19.8 | 0.75 | 18.8 | 0.92 | 18.2 | 0.83 | 18.7 | 0.86 | | Price increase less than current rate | 6.4 | 0.57 | 5.6 | 0.44 | 4.7 | 0.50 | 5.1 | 0.45 | 4.9 | 0.48 | | No changes in prices | 20.1 | 0.92 | 17.1 | 0.72 | 12.3 | 0.73 | 13.6 | 0.73 | 8.9 | 0.54 | | Decline in prices | 5.2 | 0.48 | 4.3 | 0.42 | 5.1 | 0.51 | 4.3 | 0.42 | 4.7 | 0.43 | | Household Durables | | | | | | | | | | | | Prices will increase | 60.3 | 1.09 | 58.8 | 0.96 | 65.6 | 1.10 | 67.3 | 0.97 | 68.6 | 0.90 | | Price increase more than current rate | 38.2 | 1.11 | 37.7 | 0.94 | 45.1 | 1.19 | 46.5 | 1.09 | 47.8 | 1.11 | | Price increase similar to current rate | 16.2 | 0.82 | 16.4 | 0.70 | 16.6 | 0.86 | 16.2 | 0.78 | 15.9 | 0.77 | | Price increase less than current rate | 5.8 | 0.59 | 4.7 | 0.40 | 4.0 | 0.43 | 4.6 | 0.43 | 4.9 | 0.44 | | No changes in prices | 27.4 | 1.00 | 32.2 | 0.90 | 25.3 | 0.99 | 25.0 | 0.87 | 22.7 | 0.82 | | Decline in prices | 12.3 | 0.71 | 9.0 | 0.56 | 9.1 | 0.66 | 7.7 | 0.53 | 8.7 | 0.54 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 60.7 | 1.12 | 54.9 | 0.94 | 64.7 | 1.13 | 68.7 | 0.95 | 74.3 | 0.94 | | Price increase more than current rate | 40.4 | 1.14 | 36.5 | 0.92 | 45.9 | 1.21 | 49.6 | 1.07 | 55.1 | 1.16 | | Price increase similar to current rate | 15.9 | 0.80 | 14.4 | 0.67 | 14.5 | 0.79 | 15.1 | 0.77 | 15.5 | 0.78 | | Price increase less than current rate | 4.4 | 0.50 | 3.9 | 0.36 | 4.2 | 0.46 | 4.0 | 0.42 | 3.7 | 0.39 | | No changes in prices | 25.9 | 1.01 | 30.5 | 0.89 | 23.7 | 0.99 | 21.9 | 0.85 | 19.0 | 0.82 | | Decline in prices | 13.4 | 0.84 | 14.6 | 0.69 | 11.6 | 0.74 | 9.4 | 0.59 | 6.7 | 0.51 | | Cost of Services | | | | | | | | | | | | Prices will increase | 70.4 | 1.02 | 67.6 | 0.89 | 74.3 | 1.02 | 73.3 | 0.93 | 76.5 | 0.87 | | Price increase more than current rate | 44.8 | 1.10 | 44.6 | 0.94 | 52.5 | 1.19 | 52.1 | 1.10 | 53.9 | 1.20 | | Price increase similar to current rate | 20.3 | 0.88 | 18.0 | 0.71 | 17.3 | 0.83 | 16.8 | 0.75 | 17.6 | 0.80 | | Price increase less than current rate | 5.3 | 0.50 | 5.0 | 0.40 | 4.5 | 0.45 | 4.4 | 0.41 | 5.0 | 0.49 | | No changes in prices | 25.2 | 0.98 | 29.2 | 0.87 | 22.0 | 0.95 | 23.7 | 0.90 | 20.2 | 0.81 | | Decline in prices | 4.4 | 0.44 | 3.2 | 0.35 | 3.7 | 0.43 | 3.0 | 0.33 | 3.2 | 0.34 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(b): Product-wise Expectations of Prices for One Year ahead | | (Percentage of Respondents) | | Survey period ended | Nov-20 | May-21 | Jul-21 | Sep-21 | Nov-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 86.5 | 0.77 | 86.9 | 0.65 | 86.8 | 0.78 | 87.7 | 0.72 | 90.5 | 0.59 | | Price increase more than current rate | 59.5 | 1.09 | 62.4 | 0.91 | 65.6 | 1.18 | 66.5 | 1.10 | 70.6 | 1.16 | | Price increase similar to current rate | 22.9 | 0.92 | 20.3 | 0.75 | 18.3 | 0.93 | 18.0 | 0.85 | 16.6 | 0.92 | | Price increase less than current rate | 4.1 | 0.44 | 4.2 | 0.38 | 2.9 | 0.38 | 3.3 | 0.36 | 3.3 | 0.39 | | No changes in prices | 10.3 | 0.69 | 10.4 | 0.58 | 10.1 | 0.68 | 9.3 | 0.61 | 6.4 | 0.46 | | Decline in prices | 3.2 | 0.39 | 2.7 | 0.33 | 3.1 | 0.41 | 2.9 | 0.36 | 3.1 | 0.35 | | Food Product | | | | | | | | | | | | Prices will increase | 77.7 | 0.97 | 81.7 | 0.76 | 80.8 | 0.87 | 81.6 | 0.79 | 84.5 | 0.74 | | Price increase more than current rate | 48.4 | 1.10 | 53.5 | 0.95 | 55.9 | 1.18 | 57.4 | 1.12 | 60.3 | 1.21 | | Price increase similar to current rate | 24.0 | 0.93 | 22.6 | 0.77 | 20.7 | 0.98 | 19.5 | 0.89 | 19.9 | 0.92 | | Price increase less than current rate | 5.4 | 0.48 | 5.6 | 0.43 | 4.2 | 0.45 | 4.7 | 0.45 | 4.4 | 0.42 | | No changes in prices | 14.3 | 0.82 | 12.5 | 0.64 | 12.6 | 0.73 | 11.9 | 0.66 | 9.5 | 0.58 | | Decline in prices | 8.0 | 0.58 | 5.8 | 0.46 | 6.6 | 0.54 | 6.5 | 0.47 | 6.0 | 0.47 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 75.0 | 0.98 | 79.2 | 0.78 | 80.3 | 0.91 | 81.5 | 0.81 | 85.1 | 0.72 | | Price increase more than current rate | 45.6 | 1.13 | 51.8 | 0.96 | 56.8 | 1.21 | 57.9 | 1.13 | 61.8 | 1.20 | | Price increase similar to current rate | 23.5 | 0.93 | 21.8 | 0.76 | 19.0 | 0.91 | 19.5 | 0.85 | 18.9 | 0.87 | | Price increase less than current rate | 5.9 | 0.55 | 5.7 | 0.44 | 4.6 | 0.48 | 4.1 | 0.40 | 4.4 | 0.46 | | No changes in prices | 19.3 | 0.89 | 15.8 | 0.70 | 13.4 | 0.76 | 13.2 | 0.71 | 9.6 | 0.57 | | Decline in prices | 5.8 | 0.51 | 5.0 | 0.44 | 6.2 | 0.57 | 5.3 | 0.42 | 5.4 | 0.44 | | Household Durables | | | | | | | | | | | | Prices will increase | 65.0 | 1.08 | 64.7 | 0.94 | 69.1 | 1.06 | 71.5 | 0.98 | 75.0 | 0.88 | | Price increase more than current rate | 39.9 | 1.08 | 41.2 | 0.94 | 47.0 | 1.18 | 49.4 | 1.10 | 52.4 | 1.17 | | Price increase similar to current rate | 19.7 | 0.88 | 18.6 | 0.72 | 18.3 | 0.88 | 17.5 | 0.83 | 18.1 | 0.86 | | Price increase less than current rate | 5.4 | 0.54 | 4.9 | 0.39 | 3.8 | 0.41 | 4.5 | 0.45 | 4.5 | 0.45 | | No changes in prices | 24.6 | 1.01 | 26.7 | 0.86 | 22.7 | 0.97 | 22.3 | 0.89 | 18.0 | 0.75 | | Decline in prices | 10.3 | 0.68 | 8.6 | 0.55 | 8.2 | 0.62 | 6.2 | 0.47 | 6.9 | 0.48 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 72.1 | 1.01 | 65.4 | 0.93 | 71.8 | 1.08 | 76.5 | 0.87 | 82.4 | 0.78 | | Price increase more than current rate | 47.8 | 1.10 | 43.5 | 0.97 | 50.9 | 1.21 | 55.2 | 1.09 | 60.6 | 1.16 | | Price increase similar to current rate | 19.8 | 0.87 | 17.5 | 0.71 | 16.6 | 0.87 | 16.8 | 0.81 | 17.8 | 0.86 | | Price increase less than current rate | 4.5 | 0.44 | 4.5 | 0.40 | 4.2 | 0.44 | 4.5 | 0.43 | 3.9 | 0.40 | | No changes in prices | 19.2 | 0.86 | 23.3 | 0.83 | 19.8 | 0.92 | 17.3 | 0.78 | 12.8 | 0.67 | | Decline in prices | 8.7 | 0.65 | 11.2 | 0.62 | 8.4 | 0.68 | 6.2 | 0.47 | 4.8 | 0.41 | | Cost of Services | | | | | | | | | | | | Prices will increase | 77.2 | 0.98 | 76.5 | 0.82 | 80.9 | 0.88 | 79.8 | 0.85 | 83.6 | 0.73 | | Price increase more than current rate | 49.0 | 1.11 | 50.0 | 0.94 | 55.9 | 1.17 | 56.7 | 1.14 | 59.6 | 1.21 | | Price increase similar to current rate | 22.2 | 0.87 | 21.3 | 0.75 | 20.5 | 0.91 | 18.8 | 0.85 | 19.0 | 0.89 | | Price increase less than current rate | 6.1 | 0.55 | 5.2 | 0.43 | 4.5 | 0.47 | 4.3 | 0.43 | 5.0 | 0.47 | | No changes in prices | 18.6 | 0.91 | 20.1 | 0.77 | 15.7 | 0.80 | 16.6 | 0.77 | 13.4 | 0.66 | | Decline in prices | 4.2 | 0.45 | 3.4 | 0.36 | 3.4 | 0.42 | 3.6 | 0.38 | 3.1 | 0.34 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(c): General Prices for Three Months and One Year ahead – Expectations of Common Respondents in the Regular November 2021 Survey and Extended Survey of early December 2021 | | (Percentage of Respondents) | | General | Three Months Ahead | One Year Ahead | | Regular | Extension | Regular | Extension | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 89.6 | 1.50 | 80.3 | 1.94 | 90.9 | 1.53 | 85.8 | 1.71 | | Price increase more than current rate | 64.8 | 2.41 | 54.3 | 2.43 | 68.0 | 2.37 | 59.1 | 2.49 | | Price increase similar to current rate | 20.7 | 1.98 | 21.1 | 2.07 | 18.6 | 1.91 | 21.9 | 2.11 | | Price increase less than current rate | 4.0 | 0.98 | 4.9 | 1.01 | 4.3 | 1.07 | 4.8 | 1.03 | | No changes in prices | 8.4 | 1.42 | 12.2 | 1.69 | 5.7 | 1.11 | 9.1 | 1.45 | | Decline in prices | 2.1 | 0.79 | 7.5 | 1.29 | 3.4 | 1.06 | 5.1 | 1.03 |

| Table 2: Inflation Expectations of Various Groups: November 2021 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Overall | 10.7 | 0.11 | 10.4 | 0.05 | 11.9 | 0.11 | 12.3 | 0.28 | 11.5 | 0.12 | 12.6 | 0.29 | | Gender-wise | | | | | | | | | | | | | | Male | 11.2 | 0.14 | 10.6 | 0.07 | 12.3 | 0.13 | 13.2 | 0.46 | 11.7 | 0.17 | 13.5 | 0.71 | | Female | 10.2 | 0.15 | 10.2 | 0.07 | 11.6 | 0.15 | 11.3 | 0.45 | 11.4 | 0.17 | 12.1 | 0.49 | | Category-wise | | | | | | | | | | | | | | Financial Sector Employees | 10.9 | 0.44 | 10.5 | 0.62 | 11.1 | 0.40 | 10.4 | 0.75 | 11.3 | 0.54 | 12.9 | 1.93 | | Other Employees | 11.0 | 0.20 | 10.5 | 0.10 | 12.1 | 0.20 | 12.8 | 0.66 | 11.9 | 0.22 | 13.4 | 0.85 | | Self Employed | 11.4 | 0.21 | 10.7 | 0.09 | 12.6 | 0.20 | 14.7 | 0.75 | 11.8 | 0.24 | 14.4 | 0.92 | | Homemaker | 10.1 | 0.18 | 10.2 | 0.08 | 11.6 | 0.18 | 11.4 | 0.50 | 11.2 | 0.22 | 11.9 | 0.60 | | Retired Persons | 11.9 | 0.34 | 12.1 | 1.67 | 12.7 | 0.35 | 15.0 | 1.02 | 12.1 | 0.50 | 15.6 | 0.54 | | Daily Workers | 10.8 | 0.27 | 10.5 | 0.14 | 12.0 | 0.27 | 12.7 | 0.68 | 11.3 | 0.37 | 13.0 | 0.98 | | Other category | 10.6 | 0.27 | 10.3 | 0.12 | 11.8 | 0.26 | 11.7 | 0.59 | 11.7 | 0.29 | 12.7 | 0.68 | | Age Group-wise | | | | | | | | | | | | | | Up to 25 years | 10.1 | 0.21 | 9.9 | 0.24 | 11.4 | 0.21 | 11.0 | 0.37 | 11.3 | 0.26 | 11.9 | 0.59 | | 25 to 30 years | 10.4 | 0.21 | 10.2 | 0.10 | 11.7 | 0.21 | 11.8 | 0.57 | 11.3 | 0.24 | 11.8 | 0.58 | | 30 to 35 years | 10.6 | 0.22 | 10.3 | 0.10 | 11.7 | 0.21 | 11.4 | 0.54 | 11.4 | 0.26 | 12.1 | 0.65 | | 35 to 40 years | 10.8 | 0.21 | 10.4 | 0.09 | 11.9 | 0.20 | 12.3 | 0.59 | 11.5 | 0.25 | 13.0 | 0.91 | | 40 to 45 years | 10.8 | 0.23 | 10.4 | 0.09 | 12.1 | 0.23 | 12.4 | 0.78 | 11.8 | 0.28 | 13.5 | 0.96 | | 45 to 50 years | 11.0 | 0.26 | 10.5 | 0.09 | 12.3 | 0.25 | 13.5 | 1.01 | 11.6 | 0.33 | 13.7 | 1.13 | | 50 to 55 years | 11.4 | 0.30 | 10.7 | 0.16 | 12.5 | 0.29 | 14.2 | 1.03 | 11.6 | 0.37 | 14.0 | 1.14 | | 55 to 60 years | 11.1 | 0.29 | 10.6 | 0.12 | 12.3 | 0.29 | 13.6 | 0.99 | 11.8 | 0.35 | 14.0 | 1.09 | | 60 years and above | 11.7 | 0.29 | 10.9 | 0.44 | 12.6 | 0.29 | 14.6 | 0.91 | 11.5 | 0.35 | 14.4 | 1.17 | | City-wise | | | | | | | | | | | | | | Ahmedabad | 10.6 | 0.55 | 9.9 | 1.10 | 11.8 | 0.52 | 11.5 | 1.53 | 11.7 | 0.52 | 11.8 | 1.49 | | Bengaluru | 11.0 | 0.32 | 10.6 | 0.12 | 12.3 | 0.30 | 14.6 | 1.01 | 11.9 | 0.34 | 15.4 | 0.53 | | Bhopal | 9.4 | 0.74 | 9.0 | 1.67 | 10.9 | 0.68 | 11.0 | 1.65 | 10.1 | 0.59 | 10.3 | 0.97 | | Bhubaneswar | 8.7 | 0.87 | 7.6 | 1.37 | 9.9 | 0.95 | 9.0 | 1.41 | 8.8 | 0.82 | 9.1 | 1.19 | | Chennai | 10.0 | 0.39 | 10.3 | 0.20 | 12.0 | 0.39 | 13.5 | 1.17 | 11.9 | 0.41 | 14.8 | 0.93 | | Delhi | 11.5 | 0.23 | 10.7 | 0.11 | 12.5 | 0.25 | 14.4 | 1.05 | 12.0 | 0.34 | 15.1 | 0.83 | | Guwahati | 7.5 | 0.57 | 6.7 | 0.50 | 8.1 | 0.40 | 7.8 | 0.50 | 8.3 | 0.75 | 8.2 | 0.86 | | Hyderabad | 10.8 | 0.54 | 10.6 | 0.40 | 12.3 | 0.49 | 13.9 | 1.36 | 11.8 | 0.57 | 14.7 | 1.12 | | Jaipur | 10.6 | 0.45 | 10.1 | 0.34 | 11.6 | 0.53 | 11.2 | 0.70 | 11.6 | 0.61 | 11.9 | 1.03 | | Kolkata | 10.7 | 0.35 | 10.4 | 0.16 | 11.9 | 0.31 | 12.0 | 0.62 | 11.7 | 0.30 | 12.3 | 0.65 | | Lucknow | 12.2 | 0.42 | 12.7 | 1.89 | 13.1 | 0.39 | 15.4 | 0.65 | 12.2 | 0.53 | 14.9 | 1.39 | | Mumbai | 11.0 | 0.22 | 10.2 | 0.19 | 12.2 | 0.21 | 12.1 | 0.61 | 11.3 | 0.27 | 12.0 | 0.55 | | Nagpur | 10.9 | 0.72 | 10.4 | 0.91 | 12.1 | 0.81 | 13.3 | 2.04 | 11.4 | 0.66 | 12.7 | 1.93 | | Patna | 10.6 | 0.64 | 10.2 | 0.51 | 11.6 | 0.69 | 11.8 | 1.59 | 12.1 | 0.68 | 12.7 | 1.74 | | Thiruvananthapuram | 6.7 | 0.48 | 5.5 | 0.19 | 8.7 | 0.56 | 7.8 | 0.66 | 10.6 | 0.56 | 10.5 | 0.71 | | Chandigarh | 9.2 | 0.61 | 8.7 | 0.68 | 9.9 | 0.55 | 9.7 | 0.43 | 9.3 | 0.80 | 9.7 | 0.49 | | Ranchi | 8.1 | 0.33 | 7.2 | 0.40 | 8.8 | 0.37 | 8.0 | 0.40 | 8.3 | 0.66 | 8.4 | 0.70 | | Raipur | 7.0 | 0.58 | 6.5 | 0.75 | 8.1 | 0.76 | 7.7 | 0.90 | 8.6 | 1.10 | 8.2 | 2.05 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3(a): Households’ Current Perception, Three Months and One Year Ahead Expectations | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Nov-20 | 9.5 | 0.11 | 8.8 | 0.18 | 10.4 | 0.11 | 10.1 | 0.09 | 9.8 | 0.13 | 10.1 | 0.11 | | May-21 | 10.4 | 0.09 | 10.2 | 0.04 | 11.4 | 0.09 | 10.8 | 0.07 | 10.7 | 0.11 | 10.9 | 0.12 | | Jul-21 | 10.5 | 0.11 | 10.3 | 0.06 | 11.7 | 0.11 | 11.3 | 0.42 | 11.0 | 0.13 | 11.5 | 0.49 | | Sep-21 | 10.4 | 0.11 | 10.2 | 0.06 | 11.4 | 0.11 | 10.8 | 0.10 | 10.8 | 0.13 | 10.9 | 0.16 | | Nov-21 | 10.7 | 0.11 | 10.4 | 0.05 | 11.9 | 0.11 | 12.3 | 0.28 | 11.5 | 0.12 | 12.6 | 0.29 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3(b): Current Perception, Three Months and One Year Ahead Expectations of Common Respondents in the Regular November 2021 Survey and Extended Survey of early December 2021 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Regular | 10.8 | 0.23 | 10.4 | 0.12 | 12.0 | 0.22 | 11.9 | 0.65 | 11.5 | 0.26 | 12.3 | 0.67 | | Extension | 10.5 | 0.25 | 10.1 | 0.24 | 11.2 | 0.25 | 10.8 | 0.27 | 10.5 | 0.28 | 10.9 | 0.31 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 4: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three Months Ahead and One Year Ahead | | (Percentage of Respondents) | | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three Months Ahead | | Nov-20 | 62.7 | 63.5 | 52.4 | 54.0 | 60.7 | | May-21 | 68.0 | 65.1 | 51.8 | 50.3 | 60.5 | | Jul-21 | 67.6 | 69.0 | 58.4 | 56.9 | 65.0 | | Sep-21 | 68.9 | 69.0 | 59.4 | 59.9 | 66.5 | | Nov-21 | 69.7 | 70.4 | 58.8 | 63.3 | 65.5 | | One Year Ahead | | Nov-20 | 66.4 | 65.9 | 56.7 | 62.1 | 68.9 | | May-21 | 68.3 | 67.1 | 57.7 | 57.1 | 67.2 | | Jul-21 | 70.1 | 71.0 | 63.3 | 63.5 | 71.4 | | Sep-21 | 71.4 | 72.8 | 64.7 | 67.0 | 73.6 | | Nov-21 | 73.6 | 74.7 | 66.1 | 70.0 | 73.1 | | Note: Figures are based on sample observations |

| Table 5(a): Cross-tabulation of Number of Respondents by Current Inflation Perception and Three Months Ahead Inflation Expectations: November 2021 | | Three Months Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 3 | 2 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8 | | 1-<2 | 1 | 15 | 8 | 5 | 2 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 33 | | 2-<3 | 0 | 6 | 32 | 48 | 34 | 21 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 145 | | 3-<4 | 1 | 1 | 7 | 38 | 41 | 46 | 17 | 1 | 3 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 157 | | 4-<5 | 0 | 0 | 2 | 3 | 55 | 78 | 28 | 8 | 8 | 0 | 4 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 188 | | 5-<6 | 0 | 1 | 6 | 19 | 18 | 246 | 121 | 157 | 69 | 9 | 113 | 3 | 2 | 2 | 0 | 16 | 4 | 0 | 786 | | 6-<7 | 0 | 0 | 0 | 3 | 3 | 5 | 100 | 57 | 67 | 11 | 22 | 1 | 3 | 2 | 0 | 1 | 1 | 0 | 276 | | 7-<8 | 0 | 0 | 0 | 3 | 1 | 4 | 11 | 109 | 82 | 61 | 64 | 3 | 11 | 1 | 0 | 4 | 1 | 0 | 355 | | 8-<9 | 1 | 0 | 0 | 0 | 3 | 2 | 6 | 4 | 113 | 63 | 130 | 18 | 23 | 3 | 2 | 6 | 3 | 0 | 377 | | 9-<10 | 0 | 0 | 0 | 0 | 0 | 3 | 0 | 4 | 0 | 62 | 68 | 37 | 33 | 8 | 3 | 2 | 3 | 0 | 223 | | 10-<11 | 0 | 0 | 0 | 0 | 1 | 26 | 4 | 10 | 16 | 7 | 339 | 52 | 203 | 64 | 24 | 329 | 183 | 0 | 1258 | | 11-<12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 11 | 10 | 12 | 3 | 6 | 1 | 0 | 45 | | 12-<13 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 2 | 0 | 28 | 15 | 22 | 39 | 20 | 0 | 127 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 4 | 7 | 8 | 2 | 0 | 22 | | 14-<15 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 6 | 1 | 17 | 0 | 25 | | 15-<16 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 2 | 0 | 5 | 1 | 0 | 1 | 3 | 90 | 229 | 0 | 333 | | >=16 | 1 | 0 | 0 | 0 | 0 | 7 | 0 | 1 | 1 | 0 | 31 | 1 | 0 | 3 | 0 | 26 | 1480 | 1 | 1552 | | Total | 7 | 25 | 56 | 121 | 158 | 441 | 291 | 352 | 362 | 215 | 779 | 127 | 316 | 115 | 70 | 529 | 1945 | 1 | 5910 | | Note: Figures are based on sample observations |

| Table 5(b): Cross-tabulation of Number of Respondents by Current Inflation Perception and One Year Ahead Inflation Expectations: November 2021 | | One Year Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 3 | 0 | 1 | 2 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8 | | 1-<2 | 5 | 7 | 6 | 4 | 3 | 7 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 33 | | 2-<3 | 20 | 2 | 16 | 23 | 33 | 31 | 3 | 5 | 3 | 2 | 6 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 145 | | 3-<4 | 14 | 1 | 4 | 25 | 28 | 33 | 21 | 9 | 7 | 2 | 8 | 1 | 0 | 1 | 0 | 3 | 0 | 0 | 157 | | 4-<5 | 21 | 1 | 2 | 1 | 35 | 37 | 42 | 12 | 18 | 2 | 9 | 1 | 1 | 0 | 0 | 4 | 2 | 0 | 188 | | 5-<6 | 84 | 0 | 3 | 10 | 10 | 144 | 69 | 136 | 75 | 27 | 126 | 5 | 16 | 2 | 4 | 44 | 26 | 5 | 786 | | 6-<7 | 36 | 0 | 0 | 0 | 2 | 3 | 59 | 36 | 59 | 25 | 32 | 3 | 9 | 0 | 1 | 3 | 8 | 0 | 276 | | 7-<8 | 19 | 0 | 0 | 1 | 2 | 7 | 7 | 65 | 47 | 59 | 97 | 13 | 13 | 6 | 3 | 6 | 10 | 0 | 355 | | 8-<9 | 25 | 0 | 0 | 0 | 0 | 3 | 2 | 1 | 72 | 36 | 121 | 30 | 43 | 4 | 8 | 15 | 17 | 0 | 377 | | 9-<10 | 19 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | 31 | 43 | 33 | 46 | 12 | 5 | 20 | 10 | 0 | 223 | | 10-<11 | 98 | 0 | 0 | 0 | 1 | 9 | 1 | 7 | 7 | 8 | 216 | 26 | 133 | 48 | 39 | 302 | 362 | 1 | 1258 | | 11-<12 | 8 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 4 | 10 | 6 | 8 | 5 | 0 | 45 | | 12-<13 | 12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 2 | 0 | 15 | 8 | 17 | 27 | 45 | 0 | 127 | | 13-<14 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 0 | 9 | 6 | 0 | 22 | | 14-<15 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 5 | 0 | 18 | 0 | 25 | | 15-<16 | 30 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 9 | 0 | 1 | 0 | 1 | 52 | 239 | 0 | 333 | | >=16 | 170 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 1 | 1 | 16 | 0 | 0 | 0 | 0 | 12 | 1349 | 1 | 1552 | | Total | 568 | 11 | 32 | 66 | 114 | 278 | 204 | 274 | 293 | 193 | 685 | 116 | 283 | 95 | 89 | 505 | 2097 | 7 | 5910 | | Note: Figures are based on sample observations |

|  IST,

IST,