IST,

IST,

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

No, the definition of “companies in the group” is only for the purpose of determining the applicability of prudential norms on multiple NBFCs in a group.

Core Investment Companies

D. Miscellaneous:

Ans: The period of 10 years was specified as a prudential measure not necessarily in alignment with a provision of the Companies Act. Moreover, the issue here is not public deposits but Outside Liabilities.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

Updated: دسمبر 01, 2023

Special instructions for banks

Ans: No, investments made by branches of your bank located outside India should not be included in PIP.

FAQs on Non-Banking Financial Companies

Classification of NBFCs into sub-groups

Retail Direct Scheme

Investment and Account holdings related queries

While the primary auctions are conducted generally on specified days of the week as given in the table below, these days may differ due to holidays or other considerations. Half yearly indicative calendars are published on RBI website for Government of India’s dated securities and Sovereign Gold Bonds whereas quarterly indicative calendars are published for Treasury Bills and State Development loans. For details visit /en/web/rbi

| S. No. | Government security | Primary auction usually held on |

| 1 | Government of India Treasury Bills (T-Bills) | Wednesdays |

| 2 | Government of India dated securities (dated G-Sec) | Fridays |

| 3 | State Development Loans (SDLs) | Tuesdays |

| 4 | Sovereign Gold Bonds (SGB) | Weekly windows announced by RBI in its press release |

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans:

Foreign Subsidiary: An Indian entity is called as a Foreign Subsidiary if a non-resident investor owns more than 50% of the voting power/equity capital OR where a non-resident investor and its subsidiary(s) combined own more than 50% of the voting power/equity capital of an Indian enterprise.

Foreign Associate: An Indian entity is called as Foreign Associate if non-resident investor owns at least 10% and no more than 50% of the voting power/equity capital OR where non-resident investor and its subsidiary(s) combined own at least 10% but no more than 50% of the voting power/equity capital of an Indian enterprise.

Special Purpose Vehicle: A special purpose Vehicle (SPV) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfil narrow, specific or temporary objectives. SPV have little or no employment, or operations, or physical presence in the jurisdiction in which they are created by their parent enterprises, which are typically located in other jurisdictions (economies). They are often used as devices to raise capital or to hold assets and liabilities and usually do not undertake significant production.

Domestic Deposits

III. Advances

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Money Transfer through UPI/ IMPS

Government Securities Market in India – A Primer

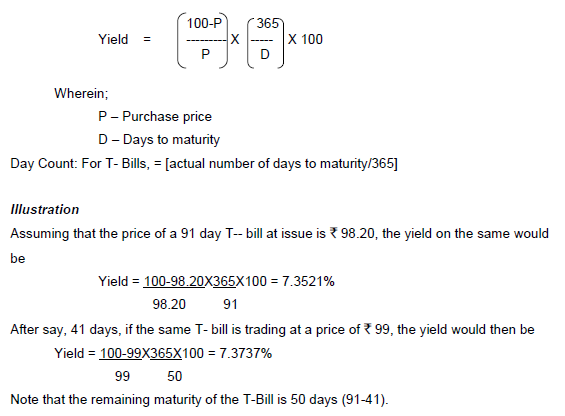

It is calculated as per the following formula

External Commercial Borrowings (ECB) and Trade Credits

G. END-USES

Foreign Investment in India

Indian Currency

C) Different Types of Bank Notes and Security Features of banknotes

The security features in MG Series 2005 and MG (New) Series banknotes are as under:

i. Security Thread: The silver-coloured machine-readable security thread in ₹10, ₹20 and ₹50 denomination banknotes is windowed on front side and fully embedded on reverse side. The thread fluoresces in yellow on both sides under ultraviolet light. The thread appears as a continuous line from behind when held up against light. ₹100 and above denomination banknotes have machine-readable windowed security thread with colour shift from green to blue when viewed from different angles. It fluoresces in yellow on the reverse and the text will fluoresce on the obverse under ultraviolet light.

ii. Intaglio Printing: The portrait of Mahatma Gandhi, Reserve Bank seal, Guarantee and promise clause, Ashoka Pillar emblem, RBI’s Governor's signature and the identification mark for the visually impaired persons are printed in intaglio in denominations ₹100 and above.

iii. See through register: On the left side of the note, a part of the numeral of each denomination is printed on the obverse (front) and the other part on the reverse. The accurate back-to-back registration makes the numeral appear as one when viewed against light.

iv. Water Mark and electrotype watermark: The banknotes contain the portrait of Mahatma Gandhi in the watermark window with a light and shade effect and multi-directional lines. An electrotype mark showing the denominational numeral in each denomination banknote also appears in the watermark widow and these can be viewed better when the banknote is held against light.

v. Colour Shifting Ink: The numeral 200, 500 & 2000 on the ₹200, ₹500, and ₹2000* banknotes are printed in a colour-shifting ink. The colour of these numerals appears green when the banknotes are held flat but would change to blue when the banknotes are held at an angle.

vi. Fluorescence: The number panels of the banknotes are printed in fluorescent ink. The banknotes also have dual-coloured optical fibres. Both can be seen when the banknotes are exposed to ultra-violet lamp.

vii. Latent Image: In the banknotes of ₹20 and above in the MG-2005 Series, the vertical band next to the (right side) Mahatma Gandhi’s portrait contains a latent image, showing the denominational value. The value can be seen only when the banknote is held horizontally, and light allowed to fall on it; otherwise, this feature appears only as a vertical band. In the MG (New) Series banknotes, the latent image exists in denominations ₹100 and above.

viii. Micro letterings: This feature appears at different places on the banknotes and can be seen better under a magnifying glass.

ix. Additional Features introduced since 2015:

• New Numbering Pattern

The numerals in both the number panels of the banknotes are in ascending size from left to right while the first three alpha-numeric characters (prefix) will remain constant in size.

• Angular Bleed Lines and Increase in the size of Identification Marks

Angular Bleed Lines have been introduced in banknotes - 4 lines in 2 blocks in ₹100, 4 angular bleed lines with two circles in between in ₹200, 5 lines in 3 blocks in ₹500, 7 in ₹2000*. In addition, the size of the identification marks in denominations ₹100 and above have been increased by 50 percent.

Information about the above security features present in the Indian banknotes denomination-wise is also available on the website www.rbi.org.in>>press releases. Alternately, information can also be accessed from https://website.rbi.org.in/web/rbi/-/notifications/master-circular-detection-and-impounding-of-counterfeit-notes-11610.

*₹2000 denomination notes continue to be legal tender. For more details, please refer to our press release 2023-2024/851 dated September 01, 2023 (https://rbi.org.in/web/rbi/-/press-releases/withdrawal-of-%E2%82%B92000-denomination-banknotes-status-56301).

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Yes, prior approval would be required in all cases of acquisition/ transfer of shareholding of 26 per cent or more of the paid up equity capital of an NBFC.

Core Investment Companies

D. Miscellaneous:

Ans: The term used in the CIC Master Direction is block sale and not block deal which has been defined by SEBI. In the context of the Master Direction, a block sale would be a long term or strategic sale made for purposes of disinvestment or investment and not for short term trading. Unlike a block deal, there is no minimum number/value defined for the purpose.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

Updated: دسمبر 01, 2023

Special instructions for banks

Ans: Yes, it should be included.

Domestic Deposits

III. Advances

An illustrative list of Intermediary Agencies is as under;

-

State Sponsored organizations for on-lending to Weaker Sections@

-

Distributors of agricultural inputs/ implements.

-

State Financial Corporations (SFCs)/ State Industrial Development Corporations (SIDCs) to the extent they provide credit to weaker sections.

-

National Small Industries Corporation (NSIC).

-

Khadi and Village Industries Commission (KVIC)

-

Agencies involved in assisting the decentralized sector.

-

Housing and Urban Development Corporation Ltd. (HUDCO)

-

Housing Finance Companies approved by National Housing Bank (NHB) for refinance.

-

State sponsored organization for SCs/STs (for purchase and supply of inputs to and/or marketing of output of the beneficiaries of these organizations).

-

Micro Finance Institutions/ Non-Government Organizations (NGOs) on lending to SHGs.

@ ‘Weaker Sections’ in Priority Sector includes following:

-

Small and marginal farmers with land holdings of 5 acres and less, landless labourers, tenant farmers and share-croppers;

-

Artisans, village and cottage industries where individual credit requirements do not exceed Rs.25,000/-.

-

Small and marginal farmers, sharecroppers, agricultural and non-agricultural labourers, rural artisans and families living below the poverty lines are the beneficiaries. The family income should not exceed Rs.11,000/- per annum.

-

Scheduled Castes and Scheduled Tribes.

-

Beneficiaries are persons whose family income from all sources does not exceed Rs.7200/- per annum in urban or semi urban areas or Rs.6400/- per annum in rural areas. They should not own any land or the size of their holding does not exceed one acre in the case of irrigated land and 2.5 acres in the case of unirrigated land (land holding criteria do not apply to SC/ST).

-

Beneficiaries under Scheme of Liberation and Rehabilitation of Scavengers (SLRs).

-

Advances granted to Self-Help Groups (SHGs) for reaching the rural poor.

FAQs on Non-Banking Financial Companies

Time frame for compliance of regulations

Retail Direct Scheme

Investment and Account holdings related queries

G-Secs are credit risk free instruments in domestic currency. However, there are market risks if you sell before maturity. You may refer to ‘Government Securities Market- A primer’, published on RBI website, to understand various risks associated with government securities.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Participating preference shares are those shares which have one or more of the following rights:

(a) To receive dividend, out of surplus profit after paying the dividend to equity shareholders.

(b) To have share in surplus assets remaining after the entire capital is paid in case of winding up of the company.

On the other hand, non-participating preference shares are those shares which do not have any of the above said rights.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Business Correspondent

صفحے پر آخری اپ ڈیٹ: