|

Today, the Reserve Bank released the results of 28th round of its quarterly Bank Lending Survey[1], which captures qualitative assessment and expectations of major scheduled commercial banks on credit parameters (viz., loan demand as well as terms and conditions of loans) for major economic sectors[2]. The latest round of the survey, which was conducted during Q1:2024-25, collected senior loan officers’ assessment of credit parameters for Q1:2024-25 and their expectations for Q2, Q3 and Q4 of 2024-25.

Highlights:

A. Assessment for Q1:2024-25

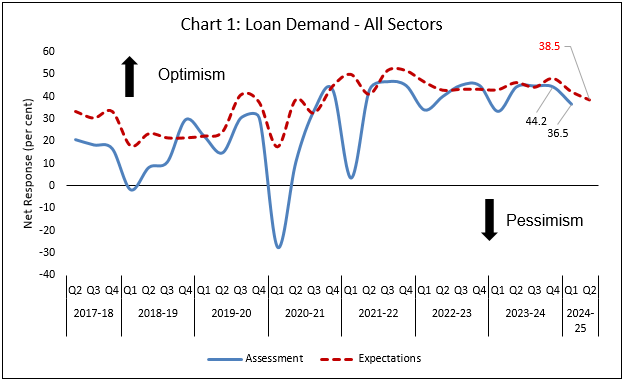

- Bankers’ growth assessment of loan demand recorded a seasonal moderation across major sectors during Q1:2024-25 (Chart 1 and Table 1).

- Respondents reported continuation of easy loan terms and conditions for major sectors, except mining; relative prudence was also reported for retail/personal loans and agricultural credit (Table 2).

B. Expectations for Q2:2024-25

- Bankers remained optimistic on loan demand across major sectors barring mining and quarrying (Table 1).

- Overall, easy loan terms and conditions are expected to prevail during the quarter; lower optimism is, however, reported for the retail/ personal loans (Table 2).

C. Expectations for Q3 and Q4 of 2024-25

- Bankers remain upbeat on loan demand across major sectors for the subsequent quarters of the financial year 2024-25 (Table 3).

- Easy loan terms and conditions are expected to continue in the second half of 2023-24, except for the mining sector; the infrastructure sector loans are perceived to witness relatively less softer loan terms.

|

Table 1: Sector-wise Loan Demand - Net Response[3]

|

|

(per cent)

|

|

Sector

|

Assessment Period

|

Expectations Period

|

|

Q4:2023-24

|

Q1:2024-25

|

Q1:2024-25

|

Q2:2024-25

|

|

All Sectors

|

44.2

|

36.5

|

42.3

|

38.5

|

|

Agriculture

|

35.0

|

28.3

|

31.7

|

36.7

|

|

Mining and Quarrying

|

13.3

|

1.7

|

6.7

|

1.7

|

|

Manufacturing

|

41.4

|

36.2

|

34.5

|

34.5

|

|

Infrastructure

|

35.0

|

15.0

|

26.7

|

30.0

|

|

Services

|

42.9

|

41.1

|

35.7

|

33.9

|

|

Retail/Personal

|

48.0

|

34.0

|

34.0

|

44.0

|

|

Table 2: Sector-wise Loan Terms and Conditions - Net Response

|

|

(per cent)

|

|

Sector

|

Assessment Period

|

Expectations Period

|

|

Q4:2023-24

|

Q1:2024-25

|

Q1:2024-25

|

Q2:2024-25

|

|

All Sectors

|

14.8

|

16.7

|

18.5

|

16.7

|

|

Agriculture

|

15.5

|

13.3

|

17.2

|

16.7

|

|

Mining and Quarrying

|

-5.2

|

-1.8

|

-3.4

|

1.8

|

|

Manufacturing

|

15.0

|

22.4

|

13.3

|

22.4

|

|

Infrastructure

|

10.0

|

10.3

|

13.3

|

13.8

|

|

Services

|

14.3

|

21.4

|

16.1

|

21.4

|

|

Retail/Personal

|

16.7

|

15.2

|

16.7

|

10.9

|

|

Table 3: Sector-wise Expectations for Extended Period - Net Response

|

|

(per cent)

|

|

Sector

|

Loan Demand

|

Loan Terms and Conditions

|

|

Q3:2024-25

|

Q4:2024-25

|

Q3:2024-25

|

Q4:2024-25

|

|

All Sectors

|

44.4

|

46.3

|

22.2

|

20.4

|

|

Agriculture

|

36.7

|

40.0

|

16.7

|

18.3

|

|

Mining and Quarrying

|

10.3

|

12.1

|

-1.7

|

-1.7

|

|

Manufacturing

|

43.3

|

48.3

|

15.0

|

15.0

|

|

Infrastructure

|

34.5

|

36.2

|

12.1

|

10.3

|

|

Services

|

44.6

|

48.2

|

19.0

|

19.0

|

|

Retail/Personal

|

48.2

|

55.4

|

23.2

|

19.6

|

Note: Please see the attached excel file for detailed time series data.

[1] The results of 27th round of the BLS with reference period as January-March 2024 were released on the RBI website on April 05, 2024. The survey results reflect the views of the respondents, which are not necessarily shared by the Reserve Bank.

[2] The survey questionnaire is canvassed among major 30 SCBs, which together account for over 90 per cent of credit by SCBs in India.

[3] Net Response (NR) is computed as the difference of percentage of banks reporting increase/optimism and those reporting decrease/pessimism in respective parameter. The weights of +1.0, 0.5, 0, -0.5 and -1.0 are assigned for computing NR from aggregate per cent responses on 5-point scale, i.e., substantial increase/ considerable easing, moderate increase/ somewhat easing, no change, moderate decrease/ somewhat tightening, substantial decrease/ considerable tightening for loan demand/loan terms and conditions parameters respectively. NR ranges between -100 to 100. Any value greater than zero indicates expansion/optimism and any value less than zero indicates contraction/pessimism. Increase in loan demand is considered optimism (Tables 1), while for loan terms and conditions, a positive value of net response indicates easy terms and conditions (Table 2).

|

IST,

IST,