Agri-tech Startups and Innovations in Indian Agriculture - RBI - Reserve Bank of India

Agri-tech Startups and Innovations in Indian Agriculture

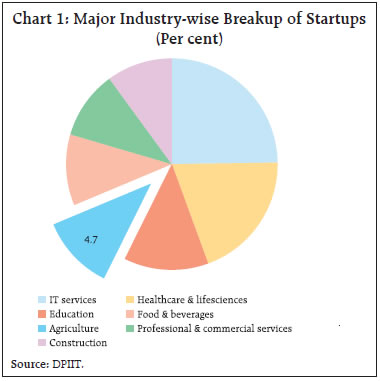

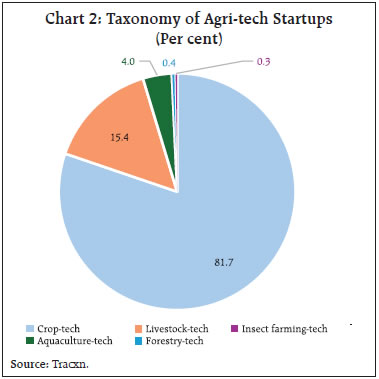

| by D. Suganthi, Jobin Sebastian and Monika Sethi This article examines the evolution of Indian agri-tech landscape, which has significant growth potential to emerge as an institutional innovation for bridging the technological gap. Advanced technologies, access to accelerators and incubators, founders’ education and past experience, funding status and access to both domestic and foreign institutional investors positively influence the likelihood for a startup to develop innovative on-farm technologies. A survey of agri-tech startups shows that they benefit from government’s funding support, research and development and state support in the form of digital infrastructure, while lack of adequate funding, fragmented land holdings and longer time to revenue matrix are the major factors hindering their growth prospects. Introduction The agriculture sector contributes around 15 per cent to the Gross Value Added (GVA) and employs 46 per cent of the total workforce in India. Technology adoption can successfully address impediments that the sector faces, such as low productivity, escalating input costs, climate change-related threats, price volatility, value chain inefficiencies, fragmented landholdings, and resource depletion. In recent years, agri-tech startups in India have evolved as an institutional innovation for bridging the technological gap and for enhancing farm incomes. Despite being in its nascent stage, the agri-tech startup ecosystem is accelerating and has been attracting private corporate funds. Emerging technologies such as the Internet of Things (IoT), big data analytics, artificial intelligence (AI), blockchain, remote sensing, biotechnology, drones, robotics and automation are being employed by several startups (Agarwal et al., 2022). The policy support rendered by the government in the form of ‘Digital India’, ‘Make in India’, startup funds and accelerator and incubator1 support initiatives, further accentuated by opportunities generated during the pandemic, have been essential facilitators of agri-tech startups’ growth. The early focus of Indian agri-techs was on developing innovative business models for disintermediation in the fragmented supply chain in the agriculture sector. Now, they are in many sectors like input and advisory platforms, in-farm traceability solutions and farm management solution providers to enable seed-to-fork traceability (Agarwal et al., 2022; Adhya and Sahoo, 2022). Several startups are currently adopting the ‘phygital’ model, which blends a digital and physical strategy to foster trust among farmers. The existing literature on agri-techs in India is generally limited to providing an overview of the sector, nature of innovations and technologies, diversity in the startup ecosystem, stages of evolution of the startups and policy thrusts provided by both state and central governments (Nuthalapati and Nuthalapati, 2021; Adhya and Sahoo, 2022). There is, however, limited focus on the factors that drive agri-techs’ developing innovative on-farm technologies and fundraising. To bridge this gap in the literature, the present study attempts to analyse the existing startup environment in India with special reference to its drivers, diversity, impediments, and policy alternatives. The article also discusses the agri-tech startups’ perspectives on fundraising, growth and scalability impediments using data from a primary survey on agri-tech startups in India.2 The analysis in this article suggests that employing advanced technologies (AI or blockchain), access to accelerators and incubators, founders’ past experience in the area of agriculture, founder’s education, funding status and access to both domestic and foreign institutional investors positively and significantly influence the likelihood for a startup to develop innovative on-farm technologies. Furthermore, the age of the firm, support rendered by accelerators and incubators, founders’ association with premier institutions and their experience positively influence the probability of funding, and hence act as drivers of agri-tech startup funding. The remainder of the article is organised into five sections. Section II presents a review of the literature; Section III provides an overview of the agri-tech startup ecosystem; Section IV undertakes an empirical exploration of factors influencing the development of on-farm technologies; Startups’ perspectives through a primary survey on impediments to their growth and scalability are discussed in Section V with concluding remarks in Section VI. Innovation enables the success of organisations, irrespective of their size and sector. Creative destruction, put forth by Joseph Schumpeter3, postulates innovation as the driving force of market economies. According to open innovation theory (Chesbrough, 2003), inter-firm collaboration and knowledge spillovers are facilitated by the proliferation of new digital technologies, globalisation and advancement of engineering technology innovation (Tambe et al., 2012; Roper et al., 2017; Knoben and Bakker, 2019). The idea of open innovation is acquiring traction among agri-techs in India, especially in the food value chain sector (Nuthalapati and Nuthalapati, 2021; Nuthalapati et al., 2020). Open innovation has led to an intricate web of interdependence among startups and their business partnerships with input companies, processors, e-commerce companies, research organisations, universities, incubators, accelerators and state and central governments. These rapidly expanding knowledge transfers have spawned several cutting-edge innovations in the agricultural sector. Rising innovation costs and resource scarcity also force startups to look outside for strategic partnerships to jointly produce knowledge (Korreck, 2019). III. Startups in India -An overview According to the Department of Promotion of Industry and Internal Trade (DPIIT), an Indian startup is defined based on criteria such as the company’s age, type, annual turnover, original entity innovation and scalability4. Around 1.3 lakh startups have been recognised by DPIIT; within that, the agricultural sector constitutes around 4.7 per cent of the startups (as on May 27, 2024) [Chart 1]. Within the agricultural sector, tech startups primarily include crop-tech, followed by livestock-tech and others (Chart 2).

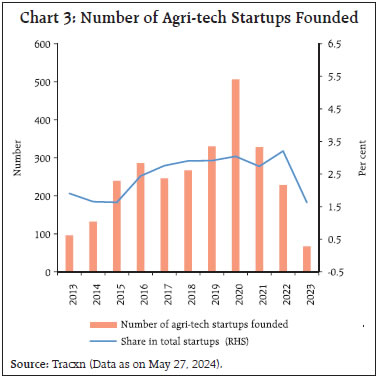

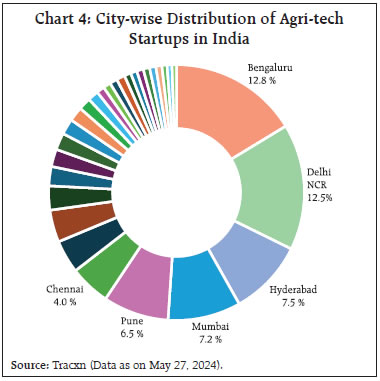

The number of agri-techs founded peaked in 2020 (Chart 3). Location-wise, six major cities account for half of the agri-tech startups (Chart 4). a. Startup Lifecycle and Funding The lifecycle of a startup comprises five stages - ideation, validation, early traction, scaling and exit options. The ideation stage is the starting point where ideas are converted into a business opportunity. The validation stage focuses on orienting the company to broader customers. The early traction stage involves crafting a minimum viable product and refining the same to gain traction. The subsequent growth stages are the scaling and exit stages that involve scaling to the bigger market, generating long-term profitability and expanding to other market segments. The exit stage options include getting acquired or becoming publicly listed companies.

Similarly, the funding stages of startups involve five stages - pre-seed/bootstrapping, seed, early stage, late stage and fundraising through initial public offers (IPO) [Salamzadeh and Kesim, 2015]. The bootstrapping stage is characterised by self-financing or through family and friends or angel investors. At the seed stage, funding comes from family and friends, incubators, angel investors and crowdfunding. This is followed by the early stage, involving funding from venture capitalists, institutional investors, and accelerators. In the late stage, funding is obtained from private equity firms and institutional investors.

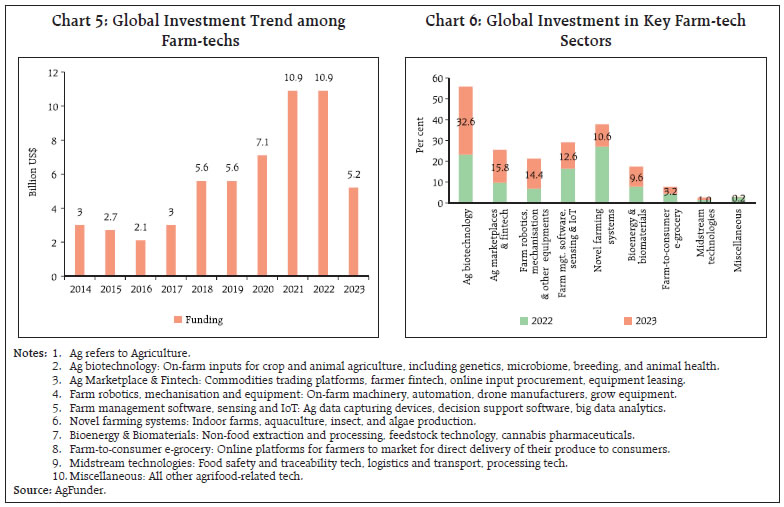

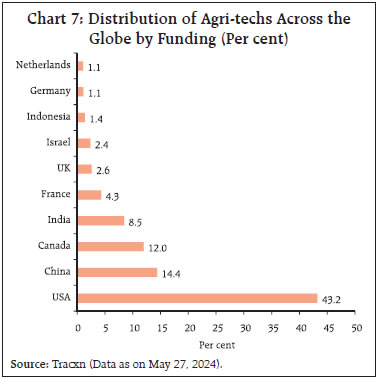

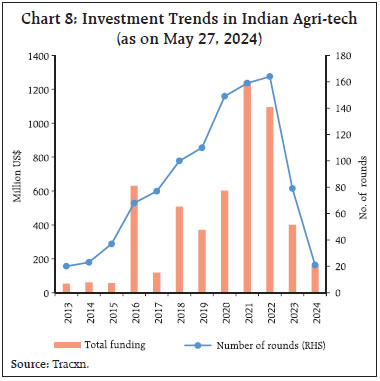

b. Global Funding to Agri-techs Global funding to agri-techs reached a peak of US$ 10.9 billion in 2021 and 2022, thereafter moderated sharply to US$ 5.2 billion in 2023 (Chart 5). In the global farm-tech space, biotechnology (sustainable inputs), novel farming system and farm management software are the key sectors (Chart 6). The investments in novel farming solutions and sustainable inputs have prioritised enhancement in crop productivity and bolstering disease resistance and climate shocks (Goh, 2022). Similarly, in the in-farm category, technology advancements (robotics, AI, IoT, and data analytics) have facilitated the automation of farms, precision agriculture, remote sensing, advisory services, and farm management. Traceability and agri-carbon are emerging areas in the agri-tech space worldwide (Goh, 2022). As regards the share of agri-tech companies by funding, the US holds the highest share (43.2 per cent), followed by China (14.4 per cent), Canada (12 per cent) and India (8.5 per cent) [Chart 7]. The Indian agri-tech ecosystem has thus garnered a significant share of global funding. c. Growth of India’s Agri-tech Ecosystem and Government’s Support to Agri-techs India’s agri-tech ecosystem witnessed a huge surge in investor interest. With investments increasing from US$ 370 million in 2019 to US$ 1.25 billion in 2021; the investor interest moderated thereafter, mirroring global trends (Chart 8). Although only a single unicorn is identified in the Indian agri-tech landscape, the total number of agri-tech soonicorns5 and minicorns6 is estimated at 19 and 40, respectively.

The development of innovative agri-tech products and the pace of technology commercialisation and farmer adoption benefit from the support of the government (Newell et al., 2021; Saroy et al., 2023). The central government promotes agri-preneurship and innovation through initiatives that reduce regulatory barriers, develop innovation-driven infrastructure facilities, and promote active collaboration among entrepreneurs (Anand and Raj, 2019). It plays a significant role in building a robust ecosystem for nurturing innovation and facilitating agri-tech mainstreaming by developing agri-stack.7 National Strategy on AI recognises agriculture as one of the priority sectors for implementing AI-driven solutions (Mahindru, 2019). The inception of Agribusiness Incubator Centres (ABIs)8, establishing investor networks, accelerators, and Agri India Hackathons9 support the growth of the agri-tech ecosystem. Furthermore, a special fund for agri-techs, reducing the barriers to the use of drones for agricultural activities and several state government initiatives (such as Telangana’s Agri-hub sandbox, Karnataka’s E-Sahamathi and Maharashtra’s Maha-Agri-tech project) are encouraging agri-preneurship.

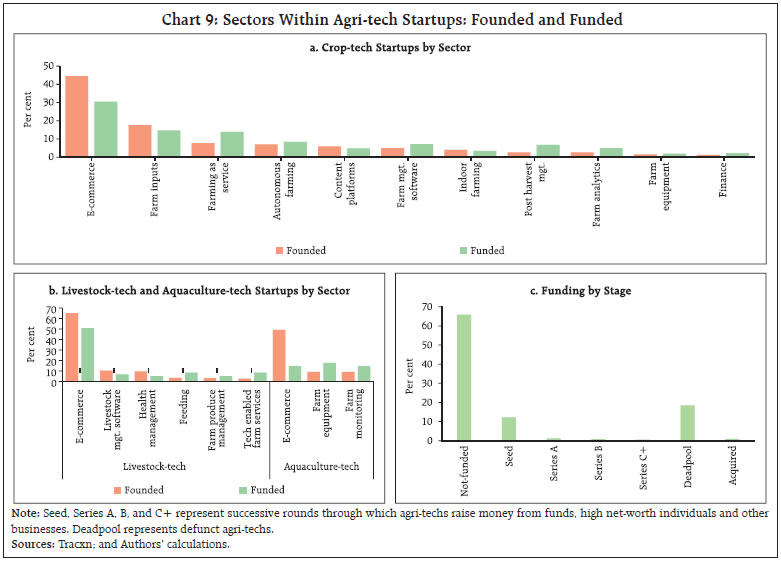

d. Funded Agri-tech Startups across Sectors Venture capital firms are the primary source of funding available for startups at all stages, alongside private equity firms and individual investors known as angels (Saroy et al., 2023).10 Among agri-techs, the share of e-commerce startups founded and funded is substantially higher than others (Charts 9a and 9b). Nevertheless, the share of startups that have not raised funds stands at 66 per cent (Chart 9c). The inability to raise sufficient funds is found to be the major reason behind failure of start-ups (Anand and Raj, 2019). Also, not all startups reach the scaling-up stage; while some get acquired, others end up in the deadpool (18 per cent).

IV. Factors Driving Development of On-farm Productivity Enhancing Technologies by Agri-techs The drivers of the development of innovative productivity-enhancing on-farm technologies are examined in this section using cross-sectional data on 780 firms.11 The underlying factors driving the development of on-farm technology startups are very different from those driving e-commerce startups. Some of these are unobservable factors (entrepreneur abilities or network effects of founders) that lead to a non-random selection of startups developing on-farm technologies. These unobservable factors could also be correlated with other observable characteristics, such as funds raised or employing advanced technologies like AI or blockchain. So, an instrument that is highly correlated with funding or use of advanced technologies is required and should affect firms’ decision to develop on-farm technology only indirectly through these variables. The variables, such as the founder’s past experience in a similar field as that of the current startup and their agricultural experience, are possible instruments. The founder’s experience, however, influences both firms’ fundraising capabilities as well as their investment decisions directly. Hence, it is not easy to disentangle the effect of experience on the decision to develop on-farm technology and fundraising capabilities. The estimation is based on logistic regression and the results of determinants of firms’ decision to develop on-farm technologies should, therefore be interpreted as correlation rather than causation. The following multivariate regression equation was estimated using logistic regression to identify drivers of on-farm technologies:

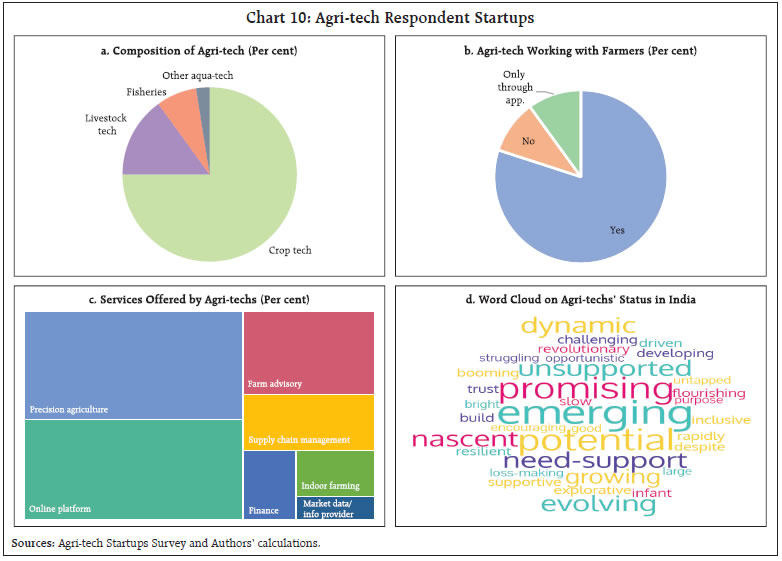

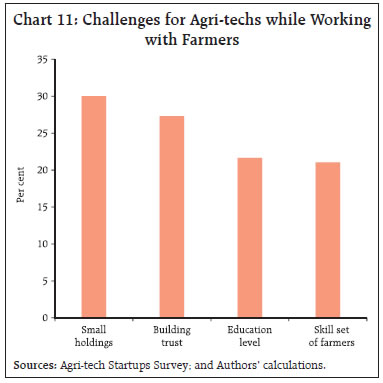

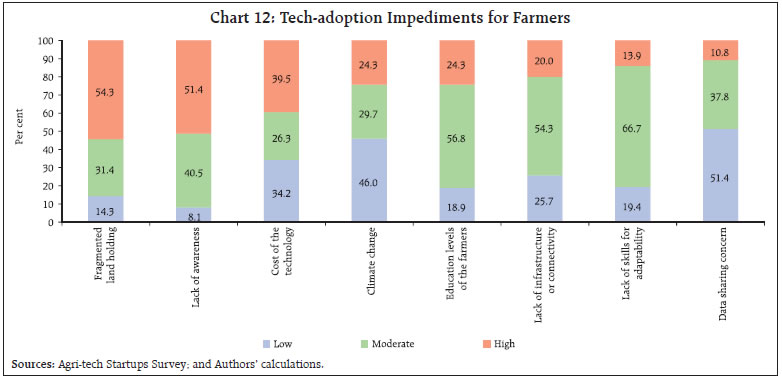

where i represent the firm. Where Ii denote the dichotomous indicator for a firm i’s status of investment and Ii* is a continuous latent variable to determine the status. The dependent variable is binary, taking value 1 if the startup operates in innovative productivity enhancing on-farm technologies (non-e-commerce) and 0 if the firm is an exclusive online marketplace for output and/or input. Xi represents a vector of founder-specific characteristics such as their human capital (including Ph.D. degree of the founders), their association with premier institutions (IITs and IIMs or studied overseas), and previous work experience similar to the present startup operations - at least one of the founders has worked or founded a firm similar in nature of the present startup (e-commerce or non-e-commerce) and their experience in the agriculture sector. These variables are in line with the previous empirical work undertaken by Honjo et al. (2022). Zi represents a vector of a firm i’s characteristics including age of the firm, location and multiple indicators of funding status. These include whether a firm is funded or not, the stage of funding and the type of institutional investors (domestic or foreign). The funding stage categories are: early (Seed), mid (Series A and B), and late (Series C and above) companies. To account for the use of advanced technologies by the firms, a dummy variable was created. It takes value 1 if the companies use technologies such as AI, blockchain, genomics, software for operating precision technology, drones, sensors, and weather forecasts and 0 otherwise. To gauge the central or state government’s policy support, another dummy variable capturing access to accelerators and incubators was employed and Ɛi is an error term. The results show that the age of the firm employing advanced technologies and access to accelerators and incubators positively influence the likelihood of developing innovative productivity-enhancing on-farm technologies (Table 1). Founders’ experience increases the probability of investment in on-farm technologies; however, experience in agriculture has no significant influence. Founders with both management and engineering degrees are positively associated with investment in e-commerce, while founders with Ph.D are positively associated with the likelihood of developing on-farm technologies. Having funding and access to both domestic and foreign institutional investors is positively and significantly associated with the likelihood of developing on-farm technologies. At the same time, startups in the seed stage of funding or new startups are positively associated with developing on-farm technologies, indicating growth momentum. Given the fact that only 34 per cent of agri-techs are funded, understanding the characteristics of the firms and founders that attract funding assumes significance from a public policy perspective. The analysis shows that the age of the firm, support rendered by accelerators and incubators, founders’ association with premier institutions and their experience are positively associated with the probability of funding (Table A1). V. Identifying Challenges: Perspective from Agri-tech Startups Survey Despite the progress made so far, agri-techs in India face challenges in scaling up their operations. The sustainability of agri-techs is directly proportional to the adoption of modern technologies by the farmers. The impediments to scaling up their operations include fragmentation, lack of standard data architecture and cross-platform interoperability alongside lower revenues, financing issues, regulatory and taxation complexities, lack of skilled workforce and customer awareness (Peram and Koteswari, 2018; David et al., 2020; Fiocco et al., 2023). Farmers are increasingly getting more open to innovation, although the adoption among them is slow (Fiocco et al., 2023). While agri-techs have received high private equity investments in the past few years (GoI, 2023), funding remains a critical challenge for tech startups. To further explore these aspects, an online primary survey was conducted to get the perspectives of agri-tech startups in India. A questionnaire covering issues related to challenges faced by agri-techs, difficulties in working with the farmers and perspectives on existing and required policy support was sent online to around 300 agri-techs.12 The responses received from 40 agri-techs are summarised below. Brief Overview of Respondents Around 75 per cent of the respondents were working in crop-tech, followed by livestock-tech, fisheries and other aqua-tech (Chart 10a). Further, around 80 per cent of them were working with the farmers directly and another 10 per cent through mobile applications (Chart 10b). Regarding the type of services provided, around 32 per cent were providing precision agriculture services, followed by online platforms, farm advisory and supply chain management (Chart 10c). The word cloud highlights that the sector is promising and dynamic, although still nascent and requires support (Chart 10d). Survey Findings According to the survey, the major challenges that the Indian agri-techs face while working with the farmers include small landholdings of farmers and difficulties in building trust with them (Chart 11). Fragmented land holdings, lack of awareness about the technology and cost of technology were seen as major impediments to technology adoption by the farmers in India (Chart 12). This is consistent with the findings of Fiocco et al. (2023) that technology adoption was higher only among large farms, even in developed countries. Furthermore, the article highlights that the high one-time cost of technology and uncertain rate of return due to weather and climate uncertainties discourage technology adoption. To address the same, agri-techs are encouraging flat-fee annual renewals and leasing or renting instead of upfront one-time purchases.

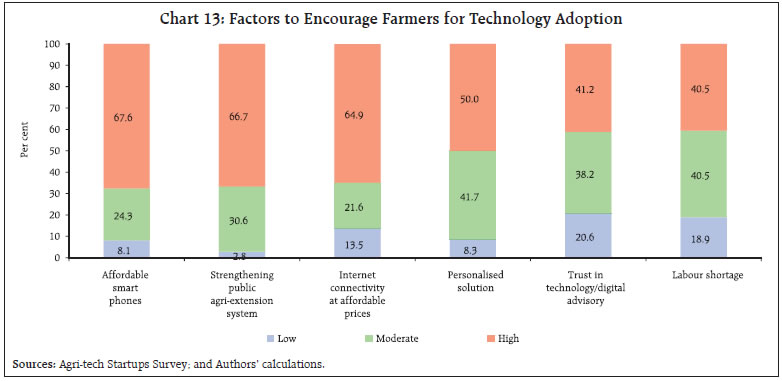

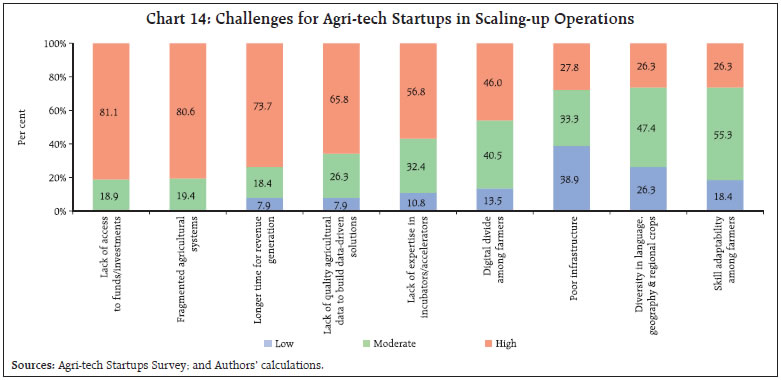

Around 63 per cent of the respondent agri-techs noted that farmers are willing to adopt new technology. Affordable smartphones, robust public agriculture extension system and the availability of internet connectivity at affordable prices encourage technology adoption by farmers (Chart 13).13 Agri-techs can exploit the public agricultural extension system to facilitate ease of access to timely information, provision of innovative technologies blended with local knowledge and tailored recommendations for farmers (Fiocco et al., 2023). Most survey respondents highlighted access to funds/investments, fragmented agricultural systems and longer time to revenue matrix as major challenges in scaling up their operations (Chart 14). One-month waiting period for compliance between valuation (agreed by the investors and directors) and fundraising from investors was also a challenge, according to a few respondents.

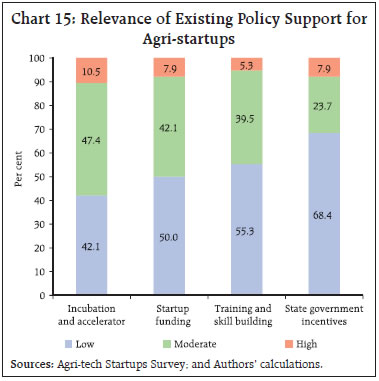

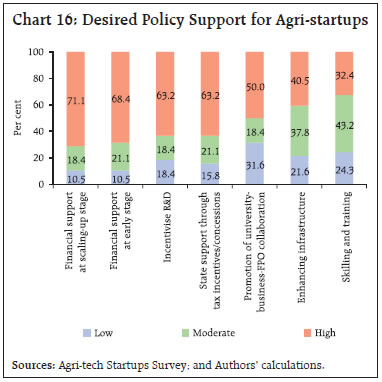

In terms of the support from the existing policy structure, around three-fifth of the respondents identified the Incubation and Accelerator scheme as highly or moderately supportive, followed by startup funding schemes (Chart 15). Further, they regarded financial support at the early and scaling-up stage, incentivising research and development and state support in the form of tax incentives and concessions as relevant policy support for increasing their operations (Chart 16). The findings are consistent with the earlier evidence that government support during the initial stages of startups is important for enhancing their longer-term viability, equipping them for expansion and enticing investor capital in the future (Bhooshan and Kumar, 2020).

While the agri-tech ecosystem in India is at a nascent stage, it shows significant dynamism and potential in addressing conventional agricultural obstacles. Indian agri-tech startups witnessed a funding spurt during the COVID-19 period, but it has ebbed thereafter. Most agri-techs are unfunded, and the share of mid-to late-stage startups raising funds is lower compared to the seed stage, which holds back their expansion and scaling up. At the same time, there is a marked shift in the focus of agri-techs from innovative disintermediation business models to productivity improving business models such as traceability, agri-carbon harvesting, and scientific storage solutions having transformative potential. There is a notable increase in the number of agri-techs engaging directly with farmers. The empirical analysis suggests that employing advanced technologies (AI or blockchain), access to accelerators and incubators, founders’ past experience and education, funding status and access to both domestic and foreign institutional investors are associated with a higher likelihood for a startup to develop innovative on-farm technologies. Furthermore, the probability of fundraising increases with the age of the firm, support rendered by accelerators and incubators, founders’ association with premier institutions and their experience.

The survey of agri-tech startups highlighted that the agri-techs benefit from governments’ funding support, research and development and state support in the form of digital infrastructure, while lack of access to funds/investments, fragmented agricultural systems and long gestation periods to realise profits are seen as impediments. The survey respondents also noted that encouraging agri-techs to identify niche and underleveraged sectors for providing real-time tailored solutions based on advanced technologies and reducing the technology costs can lay the foundation for a more sustainable, and productive agricultural sector. References: Adhya, P. S., and Sahoo, S. K. (2022). The Evolving Scenario of Climate Finance in India–A Scoping Study. Gradiva Review Journal, 8(12), 634-646. Agarwal, R., Gupta, H., and Kholi, A. (2022). What’s Next for Indian Agri-Tech? Emerging Opportunities and The Way Forward for India’s Agricultural Technology Sector, FSG, Reimagining Social Change. Anand, A., and Raj, S. (2019). Agritech Startup: The Ray of Hope in Indian Agriculture. Discussion Paper 10, MANAGE Centre for Agricultural Extension Innovation, Reforms and Agripreneurship, MANAGE, Hyderabad, India. Bhooshan, N., and Kumar, A. (2020). How did Agri-Start-Ups Fare during the COVID-19 Pandemic? Challenges and the Way Forward. Economic and Political Weekly, Vol. 55(50), 13-17. Chesbrough, H. W. (2003). Open Innovation: The New Imperative for Creating and Profiting from Technology. Harvard Business Press. David, D., Gopalan, S., and Ramachandran, S. (2020). The Startup Environment and Funding Activity in India. ADBI Working Paper 1145, Asian Development Bank Institute. Fiocco, D., Ganesan, V., Lozano, M., and Sharifi, H. (2023). Agtech: Breaking Down the Farmer Adoption Dilemma. Mckinsey And Company. Honjo, Y., Kwak, C., and Uchida, H. (2022). Initial Funding and Founders’ Human Capital: An Empirical Analysis Using Multiple Surveys for Start-Up Firms. Japan And the World Economy, 63 (2022) 101145. Goh, L. (2022). How Agritech Is Transforming Traditional Agriculture in Emerging Markets. In H. Kharas, J.W. Aurther and I. Ohno (Eds.), Breakthrough: The Promise of Frontier Technologies for Sustainable Development. Brookings, Washington D.C. Korreck, S. (2019). The Indian Startup Ecosystem: Drivers, Challenges and Pillars of Support. ORF Occasional Paper, 210. Knoben, J., and Bakker, R. M. (2019). The Guppy and The Whale: Relational Pluralism and Start-Ups’ Expropriation Dilemma in Partnership Formation. Journal Of Business Venturing, 34(1), 103-121. Mahindru, T. (2019). Role Of Digital and AI Technologies In Indian Agriculture: Potential and Way Forward. Niti Aayog, Government of India. GoI. (2023). Economic Survey 2022-23. Chapter 12: Physical and Digital Infrastructure: Lifting Potential Growth. Newell, R., Newman, L., and Mendly-Zambo, Z. (2021). The Role of Incubators and Accelerators In The Fourth Agricultural Revolution: A Case Study Of Canada. Agriculture, 11(11), 1066. Nuthalapati, C. S., and Nuthalapati, C. (2021). Has Open Innovation Taken Root in India? Evidence From Startups Working in Food Value Chains. Circular Economy and Sustainability, 1(4), 1207-1230. Nuthalapati, C. S., Srinivas, K., Pandey, N., and Sharma, R. (2020). Startups With Open Innovation: Accelerating Technological Change and Food Value Chain Flows in India. Indian Journal of Agricultural Economics, 75(4), 415-437. Peram, P., and Koteswari, B. (2018). A Study on Challenges Faced by Start-Ups In India. International Journal of Innovative Science and Research Technology, Volume 3, Issue 7, July – 2018. Roper, S., Love, J. H., and Bonner, K. (2017). Firms’ Knowledge Search and Local Knowledge Externalities in Innovation Performance. Research Policy, 46(1), 43-56. Salamzadeh, A., and Kawamorita Kesim, H. (2015). Startup Companies: Life Cycle and Challenges. In 4th International Conference on Employment, Education and Entrepreneurship (EEE), Belgrade, Serbia. Saroy, R., Khobragade, A., Misra, R., Awasthy, S., and Dhal, S. (2023). What Drives Startup Fundraising in India? RBI Bulletin. Tambe, P., Hitt, L. M., and Brynjolfsson, E. (2012). The Extroverted Firm: How External Information Practices Affect Innovation and Productivity. Management Science, 58(5), 843-859. Annex ^ The authors are from the Department of Economic and Policy Research (DEPR), Reserve Bank of India (RBI). The authors are grateful to Shri. Rajib Das, Smt. Rekha Misra and editorial committee for their valuable inputs. The authors are thankful to respondents of online Agri-tech Startups Survey. The views expressed in the article are those of the authors and do not represent the views of the RBI. 1 An incubator is a programme that provides access to mentorship, investors, and other forms of assistance to help establish very early-stage startup. An accelerator is an initiative that provides developing startups access to mentorship, investment capital and additional resources to assist them in establishing themselves as self-sufficient stable firms. 2 An online primary survey was conducted using a pre-structured questionnaire to get the perspectives of agri-tech startups in India regarding the nature of difficulties they face. 3 Schumpeter, J. A. (1942). Capitalism, Socialism and Democracy, Harper & Brothers, United States of America. 4 https://www.startupindia.gov.in/, The Gazette of India No. 111, February 19, 2019. 5 Startup having growth potential and the possibility of joining a unicorn club is called Soonicorn. 6 Minicorn startups are companies with valuations of more than US$ 1 million, and they are still on the rise to become a unicorn business. 7 Agri-stack is a government’s initiative to establish an ecosystem that streamlines the provision of digital agriculture services, such as access to high-quality inputs and responsible advisories. It is also a collection of databases, registries, data standards, application programming interfaces (APIs), and policies. 8 https://www.manage.gov.in/managecia/ViewAgriResources.aspx 9 The Agri India Hackathon is the preeminent virtual programme dedicated to fostering discourse and expediting agricultural innovation. 10 Saroy et al. (2023) provides detailed discussion of the mechanisms through which venture capitalists invest in startups and the advantages of their association with firms. 11 The data was accessed from Tracxn database on June 26, 2023. Although 3,111 companies are covered in the research, a sub-sample was selected to ensure data completeness. In the resulting sample, the share of Early (seed stage), Mid (series A and B) and Late-stage (series C+) startups was 29 per cent, 10.4 per cent and 5 per cent, respectively. The share of unfunded startups was 56 per cent from a variety of sectors within agri-tech startups. This is a fairly representative sample. 12 Using Tracxn data, the companies were chosen based on ranking funds raised and a questionnaire was shared with them over founders’ or generic email ids. Based on the total fund raised by the sector, the share of the sample agri-tech startups is 38 per cent, therefore, the sample is representative. 13 It may be mentioned here that data charges in India are one of the lowest. |