Green Finance in India: Progress and Challenges - RBI - Reserve Bank of India

Green Finance in India: Progress and Challenges

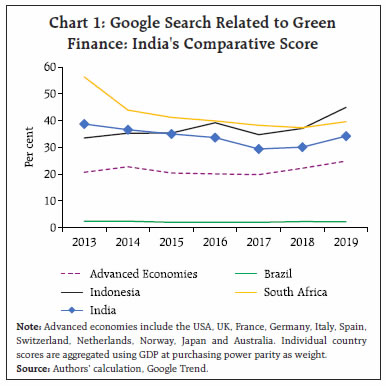

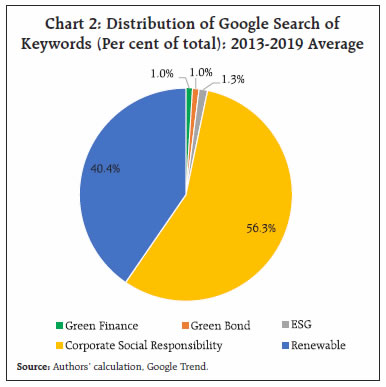

Green finance is fast emerging as a priority for public policy. This paper reviews the developments in green finance globally and in India. We use a variety of data sources to assess both the extent of public awareness (Google Trends) and financing options (bank credit and bond issuances) for green projects. Our findings indicate that while there have been improvements in public awareness and financing options in India, a reduction in asymmetric information through better information management systems and increased coordination amongst stakeholders could pave the way towards a greener and sustainable long term economic growth. Introduction Green finance refers to the financial arrangements that are specific to the use for projects that are environmentally sustainable or projects that adopt the aspects of climate change. Environmentally sustainable projects include the production of energy from renewable sources like solar, wind, biogas, etc.; clean transportation that involves lower greenhouse gas emission; energy efficient projects like green building; waste management that includes recycling, efficient disposal and conversion to energy, etc. Moreover, project defined sustainable under the disclosure requirement for Green Debt Securities include climate change adaptation, sustainable waste and water managements, sustainable land use including sustainable forestry and agriculture, and biodiversity conservation (SEBI 2017). In order to meet the financial needs for these types of projects, new financial instruments such as green bonds; carbon market instruments (e.g. carbon tax); and new financial institutions (e.g. green banks and green funds) are being established. They together constitute green finance1. Green finance is central to the overall discussion on sustainability of economic growth. Rapid economic development is often achieved at the cost of environment. Dwindling natural resources, degraded environment and rampant pollution are hazardous to public health and pose challenges to the sustainable economic growth. In order to protect and substantially improve the environment, nations around the world have been increasingly focusing on the use of eco-friendly technologies. However, it requires appropriate incentive structure for increased allocation of funds towards setting up or adopting environmentally sustainable projects. Once funds are freed from the conventional industries and are channeled into the green and environment- friendly sectors, other resources including land and labour may also follow. This eventually leads to an optimal allocation of resources2 that support sustainable growth in the long run. In order to achieve these objectives, targeted policies on green finance have been formed in major countries involving all stakeholders of economic growth, viz., corporates, governments and central banks. In this article, we assess the progress of green finance in India. In Section II, we briefly discuss some of the best practices followed across the globe for promoting green finance and some of the major initiatives taken in India. In Section III, we outline the progress of green finance in India. In Section IV, we discuss the challenges and way forward and Section V concludes. II. Public Policy towards Green Finance (a) International best practices Climate change has been on the G20 agenda ever since its first summit in 2008, though more recently the focus has been on circular carbon economy (CCE) to deal with harmful emissions. There are several flagship programmes that aim at increasing the awareness and promoting the funding of green initiatives across the globe. These programmes encourage financial and non-financial firms to embed environmental considerations into their financing. Major flagship programmes like Principles for Responsible Investment (PRI), Equator Principles (EP) for financial institutions, United Nation’s Environment Programme (UNEP) and Statement of Commitment by financial institutions on sustainable development suggest ways for implementing green finance among the signatories. Several entities from India are signatory to these programmes (Table 1). However, it is possible to ensure a steady flow of finance into sustainable projects only if there is any reliable source of information on the entities’ overall management of environmental and social risks, track record on entities’ identification of opportunities that bring both a decent rate of return and environmental benefits (UNEP)3. In this regard, Sustainable Stock Exchange is an initiative that recommends the signatory countries’ stock exchanges to come up with stock price indices that track the stock performance of a set of companies operating in these countries, which are leaders in recognising the Environmental, Social and Governance (ESG) principles4 into their financing aspects . These indices are aimed at guiding investors who are interested in investing in green activities. Two major stock exchanges in India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are part of this initiative and publish separate ESG indices. The regulatory framework across the globe can be broadly categorised into four. First is the sustainability disclosure by financial and non-financial companies, by which the companies are asked to periodically report their exposure to the ESG related risks from their operations. Such disclosures have picked up following the thrust given by G20 by encouraging a voluntary adoption by corporates of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). As of June 2020, 60 per cent of the world’s 100 largest public companies committed supporting the TCFD recommendation5. The leading stock exchanges, financial market regulators and the ministries dealing with the corporate affairs in China (2008)6, Hong Kong (2012), UK (2012), India (2012), the Philippines (2013), Vietnam (2013), Singapore (2016) were among the nations to implement the framework for disclosure of ESG-related risks by the listed companies in their jurisdiction (Volz, 2018)7. Bangladesh mandated bi-annual reporting of Corporate Social Responsibilities (CSR) undertaken by the commercial banks in 2008, incentivised systematic environmental risk analysis as part of the credit appraisal by the banks in 2011 with the extension of the norm to Non-Banking Financial Institutions (NBFIs) in 2013 and further included assessment of social risks in 2017 (Volz, 2018). Bangladesh released a uniform risk reporting format for the banks as early as 2013. The Energy Transition for Green Growth Law passed by France in 2015 mandated the asset owners and managers to report on how physical and transition risks impact their activities and assets. This policy aims to link disclosures to the broader efforts to decarbonise the energy sector in France8. Second is the directed and concessional lending, that is practised in several countries. For example, a ‘revolving fund’ of US$26mn was set up under the green re-financing scheme in Bangladesh in 2009 to disburse low interest loans to over 50 renewable energy and green industries. Further, an additional fund of US$200mn was set up for the leather-textile industry for switching to green technology in 2016. Since 2015, Bangladesh mandated the commercial banks to allocate at least 5 per cent of their lending to the renewable energy sector and other green technologies (Volz, 2018). Third are the micro and macro-prudential regulations of financial and non-financial institutions. In 2006, China introduced credit restriction to the companies based on their environmental compliances. Lebanon implemented the policy of differential reserve requirement for the commercial banks in 2010, wherein the banks with larger share of green projects in their loan portfolio are required to hold less reserves (Dikau and Volz, 2018). In 2011, Brazil embedded environmental considerations into the banks’ Internal Process of Capital Adequacy Assessment by considering lending exposure to the projects containing environmental and social risks (Dikau and Volz, 2018). Eventually, Brazil recommended banks to outline their risk assessment methods and exposure to social and environmental damages into their annual reports in 2017. Fourth is the establishment of green financial institutions. The UK Green Investment Bank plc, a GBP 3 billion (USD 3.9 bn) institution, fully owned by the UK government was established in 2012 (Geddes et al., 2018). Since 2013, Nordic Countries formed alliances of local and regional governments which issued bonds in the financial market and distributed the proceeds to its sub-national members (Kommuninvest (Sweden), Kommunalbanken and KLP Kommunekreditt AS (Norway), KommuneKredit (Denmark), and MuniFin (Finland)) (Nassiry, 2018). Asian Development Bank and United States Agency for International Development provide partial credit and bond guarantees to the partner banks and countries in their respective jurisdiction for green finance. In line with these international practices, India has also implemented several policy tools during the last decade as detailed in the following sections. (b) Public policy in India India has started emphasising on green finance as early as 2007. In December 2007, the Reserve Bank issued a notification on “Corporate Social Responsibility, Sustainable Development and Non-financial Reporting – Role of Banks” and mentions the importance of global warming and climate change in the context of sustainable development. In 2008, The National Action Plan on Climate Change (NAPCC) was formulated with a vision to outline the broad policy framework for mitigating the impact of climate change (Jain, 2020). The Climate Change Finance Unit (CCFU) was formed in 2011 within the Ministry of Finance as a coordinating agency for the various institutions responsible for green finance in India. The major strategic move since 2012 included implementation of the sustainability disclosure requirements. Security and Exchange Board of India (SEBI) made it mandatory for top 100 listed entities based on market capitalisation at BSE and NSE to publish annual business responsibility reports since 2012 and revised it from time to time. In May 2017, SEBI issued guidelines for green bond issuance specifying the disclosure requirements. In addition, the Ministry of Corporate Affairs imposed mandatory reporting of the progress on Corporate Social Responsibilities (CSR) under the Companies Act, 2013.9 In October 2017, Report of the Committee on Corporate Governance has proposed that the board of directors shall meet at least once a year to specifically discuss strategy, budgets, board evaluation, risk management, ESG and succession planning. There have been several fiscal and financial incentives at work in India. These incentives are in line with India’s commitments under the 2015 Paris Agreement to reduce greenhouse gas emission intensity by 33 to 35 per cent below 2005 levels, and to achieve 40 per cent of installed electric power capacity from non-fossil sources by 203010. The Government of India (GoI) offers 30 per cent of the installation cost of the rooftop solar panels as subsidy to the institutional, residential and social sectors in most states11. In some of the special category states12, the subsidy is up to 70 per cent of the installation cost. In addition, beneficiaries can avail a generation-based incentive wherein they can receive ₹ 2 per unit of generation, if the generation exceeds 1100kWh-1500kWh per year. Further, the excess power can be sold at a tariff set by the government. Moreover, the GoI launched two phases of Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme in 2015 and 2019, to enhance the flow of credit, reducing the up-front purchase price of all vehicles and developing the infrastructures (such as charging stations) to encourage green vehicle production and sales (Jain, 2020). In order to counter the high up-front cost of such vehicles, the State Bank of India has introduced a ‘green car loans’ scheme for electric vehicles with 20 basis points lower interest rate and longer repayment window, compared to the existing car loans (Jain, 2020). The Government has also brought in a Production Linked Incentive (PLI) Scheme for manufacturing of high efficiency modules in the arena of renewable energy. The Reserve Bank has also been taking proactive policy measures to promote and support green finance initiatives. It has included the small renewable energy sector under its Priority Sector Lending (PSL) scheme in 2015. Under this scheme, firms in renewable energy sector13 are eligible for loans upto ₹ 30 crore (increased from ₹ 15 Crore since September 4, 2020) while the households are eligible for loans upto ₹ 10 lakh for investing into renewable energy. In September 2019, India announced a target to reach 450 GW of renewable energy generation by 2030. The Reserve Bank is sensitising public, investors and banks regarding the need, opportunities, and challenges of green finance through its regular reports and other communications. For instance, in its Annual Report (2015-16), the Reserve Bank has mentioned the findings of the G20 Green Finance Study Group (GFSG14) on the need for development of local green bond markets, facilitating cross-border investments in green bonds, knowledge sharing on environmental risks, and improving overall green finance activities. The annual report further mentions the broader issues related to green finance that need future consideration. These include definition of green activities, aspects of intellectual property rights in development and transfer of technology from developed countries, and environmental risk assessment by the banks. In its Report on Trend and Progress of Banking in India (2018-19), the Reserve Bank noted the risk of a climate change on financial assets and the need to accelerate the green finance for environment-friendly sustainable development. It acknowledges the challenges in the development of green finance, such as “greenwashing” or false claims of environmental compliance, plurality of definitions, maturity mismatches between long-term green investment and short-term interests of investors. It further notes the need for policy action to establish a framework that promotes the green finance ecosystem in India by fostering awareness through coordinated efforts. In the context of green financial institutions, Indian Renewable Energy Development Agency (IREDA), a government-backed agency for promoting clean energy investments, announced plans to become India’s first Green bank in May 2016. India Infrastructure Finance Corporation Limited (IIFCL) also launched a dedicated scheme known as the ‘credit enhancement scheme’ for funding viable infrastructure projects with bond tenors above five years (Jain, 2020). Considering these steps, we will assess the progress of green finance in India, including the general awareness about environmental sustainability in the next section. III. Progress and Challenges of Green Finance in India a) Improvements in general awareness There is a paucity of data for assessing the awareness regarding green finance and sustainable development from conventional sources. In this regard, Google Trends can be a powerful tool for understanding the pattern of google searches made in different locations at different point in time. It can help us understand the interest on a given topic, based on the number of searches made in Google. In Google Trends, the information on the number of searches made in Google on any topic is normalised as the proportion of the number of searches made on all topics in a region during the specified period. This normalisation removes the bias caused due to the change in overall search activities on Google across time. For example, the number of overall search volume today is much larger than it was in 2004 on account of general expansion of internet accessibility across the globe. Therefore, the absolute number of searches in any topic may not give an insightful comparison of general interest in that topic over time. Evidence based on Google Trends suggests an increase in awareness in green finance and its role in sustainable economic development. We extract the search intensity, i.e. the number of searches as proportion to the overall searches in a country over time, for five keywords: green finance, green bond, ESG, corporate social responsibility and renewable. Chart 1 shows that the intensity of Google searches related to the climate change and green finance in India is no less than those in the advanced and major emerging economies. Chart 1 shows that India’s comparative score is higher than the advanced economies. As mentioned above, Google Trends reports the normalised search intensities for the chosen keywords. While normalising, the country with maximum value of the search intensity is set to 100. Then the search intensity for other countries are proportionately adjusted. The country scores in Chart 1 represent the weighted average of these scores for the five keywords, where the weights are the percentage shares of searches on a particular keyword in the total number of searches across these five keywords. Chart 2 shows that the topics related to corporate social responsibility and renewable sources of energy dominate the public interest in India. Web-search related to the specific instruments such as green finance and green bonds, however, are still limited (about 2 per cent of all five keyword searches).

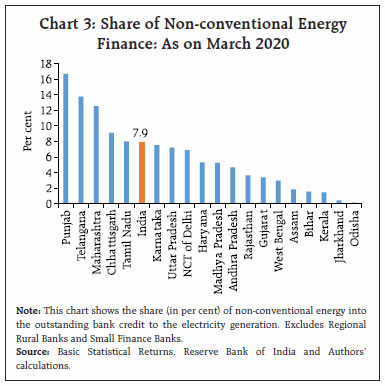

b) Green lending For the data on bank lending to the sustainable projects, we move to the conventional sources such as Database on the Indian Economy by the Reserve Bank that contains publicly available data on policy rates, aggregate credit, sectoral credit and key financial ratios relating to Scheduled Commercial Banks (SCBs) in India. The number of individual SCBs in the sample varies from 88 in 2005 to 95 in 2019. As part of the green finance initiative, the Reserve Bank has included the small renewable energy sector under its Priority Sector Lending (PSL) scheme in 2015. As at end-march 2020, the aggregate outstanding bank credit to the non-conventional energy sector was around ₹36,543 crore, constituting 7.9 per cent of the outstanding bank credit to the power generation (Table 2) compared to 5.4 per cent in March 2015. The commercial banks’ exposure to the non-conventional energy sector varied among bank groups (Table 2) and the major states in India (Chart 3).

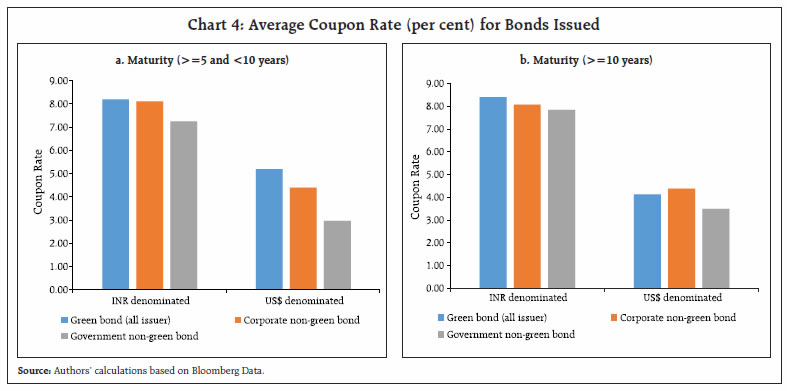

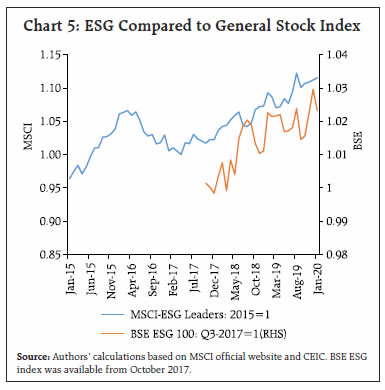

c) Green bonds Green bonds are the bonds issued by any sovereign entity, inter-governmental groups or alliances and corporates with the aim that the proceeds of the bonds are utilised for projects classified as environmentally sustainable. We have used Bloomberg for the detailed information on green bonds issued in India and in other countries by the corporates and governments. For India, we first extracted most bonds issued by the corporate and government since January 21, 2015, irrespective of whether they are green bonds or not. In this regard, we have taken those bonds where the country of risk has been marked as India, irrespective of the issuers’ country of incorporation. Our data includes the initial issuance amount in US$, coupon rate, debt to total assets ratio, and we then looked at whether the bond proceed was to be utilised for green projects or not, for over 5000 bonds issued in Indian market since 2015. For the international comparison, we have extracted the summary information using Bloomberg terminal, without extracting detailed information. India started issuing green bonds since 2015. As of February 12, 2020, the outstanding amount of green bonds in India was US$16.3 billion India issued green bonds of about US$8 billion since January 1, 2018, which constituted about 0.7 per cent of all the bonds issued in the Indian financial market. Although the value of green bonds issued in India since 2018 constituted a very small portion of the total bond issuance, India maintained a favourable position compared to several advanced and emerging economies (Table 3). Most of the green bonds issued since 2015 had maturities of five years or above, but less than 10 years. However, some issuers such as Yes Bank Ltd. (2015), Indian Renewable Energy Development Agency Ltd. (2017, 2019), Rural Electrification Corporation Limited or REC Ltd. (2017), Power Finance Corporation Ltd. (2017), Indian Railway Finance Corporation Ltd. (2017), Adani Renewable Energy Ltd. (2019)15 have issued green bonds with the maturity of 10 or more years. ReNew Power Pvt. Ltd. has issued green bonds with maturity period of less than 5 years in 2019. Around 76 per cent of the green bonds issued in India since 2015 were denominated in US$. In addition to corporates and government, the World Bank has issued green bonds towards several projects in India from time to time (Appendix Table 1). Based on the Green Bond Impact report (2019) by the World Bank, it is estimated that the outstanding amount of Green Bond proceeds allocated to support the financing of such projects in India is US$640mn, as on June 30, 201916. In sum, green finance in India is still at the nascent stage. Green bonds constituted only 0.7 per cent of all the bonds issued in India since 2018, and bank lending to the non-conventional energy constituted about 7.9 per cent of outstanding bank credit to the power sector, as on March 2020. In the next section, we will highlight some of the major challenges faced by the green bond market in India. IV. Challenges and Way forward Existing literature and global experiences suggest that integrated policy approach towards green finance is gradually gaining momentum. In India, while there have been improvements in public awareness and financing options, the major challenges could be high borrowing costs, false claims of environmental compliance, plurality of green loan definitions, maturity mismatches between long-term green investment and relatively short-term interests of investors. In this section, we elaborate some of these challenges and discuss a few possible policy measures. Borrowing costs The cost of issuing green bonds has generally remained higher than the other bonds in India. Panel a in chart 4 shows that the average coupon rate for green bonds issued since 2015 with maturities between 5 to 10 years have generally remained higher than the corporate and government bonds with similar tenure. Panel b in chart 4 shows a similar pattern for the INR denominated green bonds. For the US$ denominated green bonds with tenure of more than or equal to 10 years, the coupon rate was, however lower than the corporate bonds. It may be mentioned that most of the green bonds in India are issued by the public sector units17 or corporates with better financial health. It is evident from the fact that the private sector issuers of green bonds, on average, reported lower debt-to-assets ratio compared to the non-issuers of green bonds18 (Table 6). Their better financial health is also evident from their stock prices. Chart 5 shows that the ratio of ESG leaders’ stock price indices to the headline stock price indices have been consistently rising in the recent period. This implies that the stock prices of the entities that generally focussed in ESG-related initiatives are the ones that outperformed others in the market19.

Despite being relatively secured, the higher borrowing cost of green bonds in India could be on account of asymmetric information (discussed later in this section), higher risk perception and other governance issues. Existing literature suggests that green projects often have a high up-front cost with some cost-saving features only applicable in the long-term. Maturity-mismatches in green projects and their financing increase the cost of borrowing (G20 GFSG, 2016)20. Absence of a universal definition of green finance and information asymmetry often result in “green-washing”, wherein the investors end up receiving false signals about the green bonds (Berensmann and Lindenberg, 2016). Several of these issues are also likely to be present in India, where the financial market is still emerging as compared to the developed markets.

Borrowing cost and information asymmetry High borrowing cost has been perhaps the most important challenge and our analysis indicates that it could be due to the asymmetric information. Therefore, developing a better information management system in India may help in reducing maturity mismatches, borrowing costs and lead to efficient resource allocation in this segment. It may be mentioned that to overcome such information gap, several countries including Australia, China, India and the United States have database related to green building projects in the country (Shen et al 2020). While India does monitor green house gas emissions through various reporting mechanisms including PAT (perform-achieve trade) and RPO (renewable purchase obligations), like many other countries it does not have a national measurement, reporting and verification platform for tracking climate finance (Jain, 2020). Market infrastructure development Given the large size of domestic market and much smaller penetration of green instruments so far, there remain vast opportunities to be tapped. In this context, some of the studies noted the importance of (a) increased coordination between investment and environmental policies and (b) an implementable policy framework for both national and state levels in addressing the existing frictions. In this vein, some of the policy measures such as deepening of corporate bond market, standardisation of green investment terminology, consistent corporate reporting, and removing information asymmetry between investors and recipients can make a significant contribution in addressing some of the shortcomings of the green finance market (RBI, 2019). Other public policies Other approach could be engaging with industry bodies that have taken initiatives towards expanding ‘green buildings’ that are designed to consume less water and energy resources, maintain better waste management and provide healthier spaces for living. The Government at all levels can possibly engage with these bodies to better assess their financial and operational needs. It may also undertake policies that make production and distribution of non-conventional energy profitable, especially for smaller firms. There is a scope of well calibrated policies for providing fiscal incentives for green projects in India, while taking cognisance of their impact on supply-chain, inflationary pressure and fiscal consolidation. Green finance is fast emerging as a priority for public policy. In this study we review the developments of green finance in India and our findings indicate that there have been some improvements in public awareness and financing options in India in recent years. Existing literature suggests that a reduction in the asymmetric information regarding Green Projects through better information management systems and increased coordination amongst stakeholders could pave the way towards sustainable long term economic growth. At this juncture, the world is fighting COVID-19 and its impact on global economic growth. Undoubtedly, the immediate policy challenge is to kick-start the global economy. However, the pandemic has also offered an opportunity to all stakeholders to rethink about the policies, and financial and operational strategies that they have adopted so far and espouse an approach that is more environmentally sustainable in the long run. Green finance is definitely an important mean that can facilitate such a shift towards sustainable economic growth. References Berensmann, K., & Lindenberg, N. (2016), “Green finance: actors, challenges and policy recommendations”, German Development Institute/ Deutsches Institut für Entwicklungspolitik (DIE) Briefing Paper, 23 Dikau, S., & Volz, U. (2018, September), “Central Banking, Climate Change and Green Finance”, ADBI Working Paper Series(867). Geddes A., Schmidt T. S. and Steffen, B. (2018), “The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany”, Energy Policy, 115 (2018), 158-170 Jain, S. (2020), “Financing India’s green transition”, ORF Issue Brief No. 338, January 2020, Observer Research Foundation. Nassiry, D. (2018), “Green Bond Experiences in Nordic Countries”, ADBI Working Paper, No. 816, March Olga, B., & Smorodinov, O. (2017), “Challenges to green finance in G20 countries”, Mirovaya ekonomika i mezhdunarodnye otnosheniya, 61(10), 16-24 RBI (2019), “Opportunities and Challenges of Green Finance”, Report on Trend and Progress of Banking in India (2018-19), 17-18. Reddy, A. S. (2018), “Green Finance- Financial Support for Sustainable Development”, International Journal of Pure and Applied Mathematics, 118(20), 645-650. Shen, C., Zhao, K., & Ge, J. (2020), “An Overview of Green Building Performance Database”, Journal of Engineering. Volz, U. (2018, March), “Fostering green finance for sustainable development in Asia”, ADBI Working Paper Series(814) * This article is prepared by Saurabh Ghosh, Siddhartha Nath and Abhishek Ranjan of the Strategic Research Unit of Department of Economic and Policy Research (DEPR). The views expressed in this article are those of the authors and do not necessarily represent the views of the Bank. Support extended by the research interns are acknowledged. 1 https://development.asia/explainer/green-finance-explained (Asian Development Bank) 2 Establishing China’s Green Financial System, Report of the Green Finance Task Force, April 2015. 3 See https://www.unenvironment.org/regions/asia-and-pacific/regional-initiatives/supporting-resource-efficiency/green-financing 4 Environmental, social and governance (ESG) principles are a set of standards for a company’s operations that are compliant with certain social, environmental and governance standards. It is a benchmark that many investors use to assess sustainability of their potential investments. Environmental criteria consider how a company balances its operation with environmental costs. Social criteria deal with companies’ relationships with their employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. 5 Third TCFD Status Report Shows Progress & Highlights Need for Greater Climate-Related Disclosures and Transparency 7 Parentheses indicate the years of adoption of the sustainability disclosure by these stock exchanges. 8 Future of Finance, (2019), Bank of England, June. 9 https://www.mca.gov.in/Ministry/pdf/FAQ_CSR.pdf 10 https://climateactiontracker.org/countries/india/pledges-and-targets/ 11 https://economictimes.indiatimes.com/small-biz/productline/power-generation/solar-subsidies-government-subsidies-and-other-incentives-for-installing-rooftop-solar-system-in-india/articleshow/69338706.cms?from=mdr 12 Uttarakhand, Sikkim, Himachal Pradesh, Jammu and Kashmir, Lakshadweep, as of May 2019. 13 Renewable energy comprises of solar energy, biomass energy, wind-based energy, and micro-hydel energy. 14 The G20 Green Finance Study Group (GFSG)’s work supports the G20’s strategic goal of strong, sustainable and balanced growth. It was set up post G20 Finance and Central Bank Deputies Meeting at Sanya, China in December 2015. 15 The parentheses indicate the year of issuance. 16 The aggregate amount for active projects. 17 For instance, Indian Railway Finance corporation ltd., Rural Electrification Corporation Limited or REC Ltd. and Power Finance Corporation Ltd. 18 These entities, however, issued other bonds. 19 We took the ratio of MSCI ESG Leaders’ index to the MSCI overall index for India with 2015 as base. Similarly, we have plotted the ratio of BSE ESG 100 index to the BSE 100 index with Q3 2017 as base. All years are calendar years. 20 https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2017/the-banks-response-to-climate-change.pdf?la=en&hash=7D F676C781E5FAEE994C2A210A6B9EEE44879387. |