| I. Introduction

The Invisibles account, as part of India's balance of payments comprises international trade in services, income from financial assets, labour and property and cross border transfers mainly workers' remittances. In recent years, India's balance of payments (BoP) developments in the current account have been characterised by two elem ents viz., (a) persistence of higher trade deficits, and (b) buoyant invisible surpluses. The persistent and growing invisible surpluses have provided cushion to higher trade deficits and minimised the risks to external payments position. Given the importance of invisibles, the developments in these areas are published by the Reserve Bank of India (RBI) in two stages viz., (i) standard presentation with broad heads on a quarterly basis to meet the IMF's Special Data Dissemination Standards (SDDS) in the RBI's website and subsequently in monthly Bulletin of the RBI, and (ii) detailed presentation with break-up of broad heads in an annual article titled 'Invisibles in India's Balance of Payments' in the RBI's monthly Bulletin1.

This article seeks to further contribute to the endeavour of providing the disaggregated information on India's trade in invisibles for the period 2005-06 (revised) and 2006-07 (partially revised) along with the time series data since 1999-2000. The organisation of the article is as follows. Section II presents magnitude and trends in the invisibles at the aggregate level. An analysis of the various components of invisibles is presented in Section III. The relevant policy initiatives regarding services and remittances are given in Section IV. Concluding observations are set out in Section V. II. Concepts, Magnitude and Recent Trends in Invisibles Under the BoP standard presentation, invisibles form part of the current account and have three major heads: services, transfers and income (Box 1). These three major heads are further disaggregated into minor heads (Statements 1 to 6). The definitional aspects of these minor heads are set out in Box 2. The resurgence of invisible surpluses in the 1990s, after a hiatus in the late 1980s, have in fact, restrained the current account deficits within a narrow corridor since the 1990s with surplus in intermittent years (Chart 1). Thus, a sustained rise in invisibles surplus has significantly minimised the risk to the external payments position. Furthermore, modest current account deficits with the persistence of current account surpluses during the period 2001-02 to 2003-04, together with significant capital inflows enabled further easing of payment restrictions on current and capital account transactions both for individuals and the corporates.

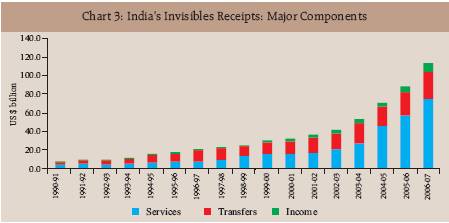

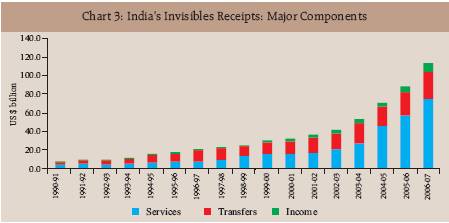

Another feature of India's invisibles account is that both gross receipts and payments have accelerated particularly since 2002-03. The growth in invisible receipts was led by a strong momentum in exports of software and information technology (IT) services, business services and remittances from overseas Indians. The growth in invisible payments was mainly led by interest payments relating to external debt, dividends/profits paid on foreign investment and payments relating to technology related and business services with growing demand for such services (Table 1).

Box 1: Compilation and Dissemination of India's Invisibles India's invisibles details form part of India's balance of payments (BoP) and are released in two stages viz., (i) standard presentation with broad heads, and (ii) detailed presentation with break-up of broad heads. In the first stage, major components of invisibles are released as part of BoP on a quarterly basis to meet the IMF's Special Data Dissemination Standards (SDDS). These quarterly details are released through the Reserve Bank of India (RBI) website and also published in the RBI Bulletin. In the first stage, the coverage is limited under broad heads of services (travel, transportation, insurance, government not included elsewhere and miscellaneous services including those of software services, business services, financial services and communication services), transfers (private and official transfers) and income (investment income and compensation of employees). In the second stage, when the data firm up and more details are available, the disaggregated details on invisibles are compiled and provided on an annual basis. These disaggregated data are published in an article titled "Invisibles in India's Balance of Payments" in RBI Bulletin.

The details on invisibles are extracted from India's balance of payments records and the balance of payments details are compiled in accordance with the guidelines in the IMF's Balance of Payments Manual, 5th Edition (BPM5), 1993, with minor modifications to adapt to the specifics of the Indian situation. The Manual defines BoP as a statistical statement that systematically summarises, for a specific time period, the economic transactions of an economy with the rest of the world. Transactions between residents and nonresidents consist of those involving goods, services and income; involving financial claims on and liabilities to the rest of the world; and those classified as transfers, involving offsetting entries to balance one-sided transactions.

In recognition of the growing importance of services and in order to meet the requirements of compilation under extended balance of payments statistics, the Reserve Bank based on the recommendations of a Technical Group on Statistics of International Trade in Services, which submitted its report in 2002, took the lead in putting in place an arrangement to collect comprehensive information on India's trade in services in the context of the ongoing negotiations on international trade in services under the GATS framework, The details regarding new reporting arrangements which were put in place in 2004-05, wherein a number of new purpose codes were introduced with a view to collect data separately for a number of emerging business services including those of merchanting services, trade related services, operational leasing services, legal services, accounting services, business and management services, advertising services, research and development services, architectural and engineering services, agricultural services, office maintenance services, environmental services and personal and cultural services, were published in the previous issue of the article published in the RBI Bulletin, November 2006. The revisions in the data for the financial years 2005-06 and 2006-07, inter alia, take into account the issue of potential overlap between business services and software services. Accordingly, the data reported by the 'Authorised Dealers' (ADs) were reviewed and based on the feedback, the revisions have been carried out in various components of business services.

Box: 2 Details on Definitional Aspect of Components of Invisibles |

Item |

Description |

1. |

Services |

|

|

(i) |

Travel |

‘Travel’ represents all expenditure by foreign tourists in India on the receipts side and all expenditure by Indian tourists abroad on the payments side. Travel receipts largely depend on the arrival of foreign tourists in India during a given time period. |

|

(ii) |

Transportation |

‘Transportation’ records receipts and payments on account of the carriage of goods and natural persons as well as other distributive services (such as port charges, bunker fuel, stevedoring, cabotage, warehousing) performed on the merchandise trade. |

|

(iii) |

Insurance |

‘Insurance’ consists of insurance on exports/imports, premium on life and non-life policies and reinsurance premium from foreign insurance companies. |

|

(iv) |

Government Not Included Elsewhere (GNIE) |

'Government not included elsewhere (GNIE)' represents remittances |

|

|

|

towards maintenance of foreign embassies, diplomatic missions and international/regional institutions, while payments record the remittances on account of maintenance of embassies and diplomatic missions abroad. |

|

(v) |

Miscellaneous |

'Miscellaneous services' encompass communication services, |

|

|

Services |

construction services, financial services, software services, news agency services, royalties, copyright and license fees, management services and business services. Business services comprise of merchanting services, trade related services, operational leasing services, legal services, accounting services, business and management services, advertising services, research and development services, architectural and engineering services, agricultural services, office maintenance services, environmental services and personal and cultural services. |

2. |

Investment |

'Investment income' represents the servicing of capital transactions |

|

Income |

(both debt and non-debt). These transactions are in the form of interest, dividend, profit and others for servicing of capital transactions. Interest payments represent servicing of debt liabilities, while the dividend and profit payments reflect the servicing of non- debt (foreign direct investment and portfolio investment) liabilities Investment income payments move in tandem with India's external liabilities, while investment income receipts get linked to India's external assets including foreign exchange reserves. In accordance with the BPM5, 'compensation of employees' has been shown under head, "income" with effect from 1997-98.. |

3. |

Transfers |

'Transfers' represent one-sided transactions, i.e., transactions that do not have any quid pro quo, such as grants, gifts, and migrants' transfers by way of remittances for family maintenance, repatriation of savings and transfer of financial and real resources linked to change in resident status of migrants. Official transfer receipts record grants, donations and other assistance received by the Government from bilateral and multilateral institutions. Similar transfers by Indian Government to other countries are recorded under official transfer payments. |

Table 1: Trends in India's Invisibles Receipts and Payments |

Year |

Invisibles Receipts |

Invisibles Payments |

Invisibles Net |

Amount

(US $ million) |

Growth(%) |

Amount

(US $ million) |

Growth(%) |

Amount

(US $ million) |

1 |

2 |

3 |

4 |

5 |

6 |

1990-91 |

7,464 |

-0.5 |

7,706 |

12.0 |

-242 |

1995-96 |

17,664 |

13.6 |

12,217 |

23.7 |

5,447 |

1999-00 |

30,312 |

17.6 |

17,169 |

3.7 |

13,143 |

2000-01 |

32,267 |

6.4 |

22,473 |

30.9 |

9,794 |

2001-02 |

36,737 |

13.9 |

21,763 |

-3.2 |

14,974 |

2002-03 |

41,925 |

14.1 |

24,890 |

14.4 |

17,035 |

2003-04 |

53,508 |

27.6 |

25,707 |

3.3 |

27,801 |

2004-05 |

69,533 |

29.9 |

38,301 |

49.0 |

31,232 |

2005-06 |

89,687 |

29.0 |

47,685 |

24.5 |

42,002 |

2006-07 |

115,074 |

28.3 |

61,669 |

29.3 |

53,405 |

During 2006-07, invisibles receipts and payments as a percentage of GDP stood at 12.5 per cent and 6.7 per cent, respectively. At this level, invisibles receipts and payments accounted for over 47 per cent and 24 per cent of current account receipts and payments, respectively (Chart 2). On an average, during the period 2000-01 to 2006-07, the invisibles receipts constituted around 45 per cent of current account receipts, while invisibles payments accounted for around 26 per cent of current account payments. The decomposition of invisible receipts shows that the services exports contributed to this rising invisible receipts, with services-GDP ratio rising to 8.3 per cent in 2006-07 from 1.4 per cent in 1990-91. At this level, services accounted for two-thirds of the total invisible receipts (Table 2).

The net invisibles surpluses (invisibles receipts minus payments) rose to 5.8 per cent of GDP in 2006-07 from 5.2 per cent in 2005-06 and 2.1 per cent in the beginning of the current decade. During 2006-07, the net surplus under invisibles financed around 85 per cent of the trade deficit (Table 3).

Table 2: Major Components of Invisibles Account in Terms of GDP |

(Per cent to GDP) |

Year |

Receipts |

Payments |

Net |

Services |

Transfers |

Income |

Total |

Services |

Transfers |

Income |

Total |

Services |

Transfers |

Income |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

1990-91 |

1.4 |

0.8 |

0.1 |

2.3 |

1.1 |

0.0 |

1.3 |

2.4 |

0.3 |

0.8 |

-1.2 |

-0.1 |

1995-96 |

2.1 |

2.5 |

0.4 |

5.0 |

2.1 |

0.0 |

1.3 |

3.4 |

0.0 |

2.5 |

-0.9 |

1.6 |

1999-00 |

3.5 |

2.8 |

0.4 |

6.7 |

2.6 |

0.0 |

1.2 |

3.8 |

0.9 |

2.8 |

-0.8 |

2.9 |

2000-01 |

3.5 |

2.9 |

0.6 |

7.0 |

3.2 |

0.0 |

1.7 |

4.9 |

0.3 |

2.9 |

-1.1 |

2.1 |

2001-02 |

3.6 |

3.4 |

0.7 |

7.7 |

2.9 |

0.1 |

1.6 |

4.6 |

0.7 |

3.3 |

-0.9 |

3.1 |

2002-03 |

4.1 |

3.5 |

0.7 |

8.3 |

3.4 |

0.2 |

1.4 |

5.0 |

0.7 |

3.3 |

-0.7 |

3.3 |

2003-04 |

4.5 |

3.8 |

0.6 |

8.9 |

2.8 |

0.1 |

1.4 |

4.3 |

1.7 |

3.7 |

-0.8 |

4.6 |

2004-05 |

6.2 |

3.1 |

0.7 |

10.0 |

4.0 |

0.1 |

1.5 |

5.6 |

2.2 |

3.0 |

-0.8 |

4.4 |

2005-06 |

7.1 |

3.2 |

0.8 |

11.1 |

4.3 |

0.1 |

1.5 |

5.9 |

2.8 |

3.1 |

-0.7 |

5.2 |

2006-07 |

8.3 |

3.2 |

1.0 |

12.5 |

4.8 |

0.2 |

1.7 |

6.7 |

3.5 |

3.0 |

-0.7 |

5.8 |

A marked feature of India's services exports, besides the shift in the level of its exports, has been the reduced volatility in services exports, which has provided stability to current receipts. Another feature of services exports is that India has emerged as a major software exporting country with a level of US $ 31.3 billion in 2006-07, expanding at a steady rate of over 30 per cent in the recent past despite a global IT slowdown. Again, with workers' remittances at US $ 29.0 billion in 2006-07, India continued to retain its position among the leading remittance receiving countries in the world with relative stability in such inflows. The sustained expansion in remittances since the 1990s was underpinned by structural reforms, including a market-based exchange rate, current account convertibility as well as shifts in the labour migration pattern to increasingly high skilled categories (Chart 3).

Table 3:

Selected Indicators on Invisibles Including Financing Trade Deficit |

(Per cent) |

Year |

Net Invisibles/

Trade Deficit |

Invisibles

Receipts/

Current Receipts |

Invisibles Payments/

Current Payments |

1 |

2 |

3 |

4 |

1990-91 |

-2.6 |

28.8 |

21.6 |

1995-96 |

48.0 |

35.3 |

21.9 |

1999-00 |

73.7 |

44.7 |

23.7 |

2000-01 |

78.6 |

41.5 |

28.0 |

2001-02 |

129.4 |

45.1 |

27.9 |

2002-03 |

159.4 |

43.8 |

27.9 |

2003-04 |

202.7 |

44.7 |

24.3 |

2004-05 |

92.7 |

44.9 |

24.4 |

2005-06 |

80.9 |

46.0 |

23.3 |

2006-07 |

84.5 |

47.3 |

24.4 |

Latest Trends

Growth in invisible receipts showed a deceleration from 31.0 per cent in April-September 2006 to 23.4 per cent in April-September 2007 mainly on account of deceleration in exports of software and business services (Table 4). The major components of invisible payments were travel payments, business service payments such as payments relating to business and management consultancy, engineering and other technical services and interest, dividend and profit payments. Invisible payments grew by 13.0 per cent during April-September, 2007 as against 31.2 per cent in April-September 2006. III. Composition of Invisibles

As explained above, the invisibles account comprises international trade in services, income from financial assets, labour and property and cross border transfers mainly workers' remittances. The invisibles receipts have been mainly dominated by software services, business services and private transfers. The invisibles payments were mainly led by interest payments relating to external debt, dividends/profits paid on foreign investment and payments relating to technology related and business services with growing demand for such services. The details of trade in services, private transfers and incomes are set out below.

Table 4: Invisible Gross Receipts and Payments: Recent Trends |

(US $ million) |

Items |

Invisible Receipts |

Invisible Payments |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

April- March |

April- March |

April- Sept |

April- Sept |

April- March |

April- March |

April- Sept |

April- Sept |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1. |

Travel |

7,853 |

9,123 |

3,504 |

4,336 |

6,638 |

6,685 |

3,300 |

3,960 |

2. |

Transportation |

6,325 |

8,050 |

3,725 |

4,280 |

8,337 |

8,068 |

3,975 |

5,594 |

3. |

Insurance |

1,062 |

1,202 |

553 |

788 |

1,116 |

642 |

283 |

475 |

4. |

Government not included elsewhere |

314 |

250 |

101 |

167 |

529 |

403 |

201 |

245 |

5. |

Transfers |

25,620 |

29,589 |

12,923 |

19,295 |

933 |

1,421 |

665 |

852 |

6. |

Income |

6,408 |

9,304 |

3,954 |

6,431 |

12,263 |

15,877 |

7,275 |

7,875 |

|

Investment Income Compensation of |

6,229 |

8,908 |

3,816 |

6,142 |

11,491 |

14,926 |

6,851 |

7,383 |

|

Employees |

179 |

396 |

138 |

289 |

772 |

951 |

424 |

492 |

7. |

Miscellaneous

Of Which: |

42,105 |

57,556 |

25,139 |

26,295 |

17,869 |

28,573 |

10,766 |

10,903 |

|

Software |

23,600 |

31,300 |

14,160 |

16,317 |

1,338 |

2,267 |

820 |

1,220 |

Total (1 to 7) |

89,687 |

115,074 |

49,899 |

61,592 |

47,685 |

61,669 |

26,465 |

29,904 |

III.1 Trade in Services The trade in services has been dominated mainly by software services and business services. An important feature of service exports has been a structural shift, driven by the emergence of new avenues of service exports. The traditional services have displayed sluggishness, while new services particularly high skill and technology intensive services are rising in importance

(Table 5). Reflecting these positive developments and continued buoyancy of services exports, India has emerged as an important service exporter. Services exports in recent years continued to be led by rapid growth in exports of software services and business and professional services. Within the services exports, the rising prominence of business services reflects high skill intensity of the Indian work force. There has also been a strong revival in international tourist interest in India in recent years.

Reflecting the positive developments in terms of comparative advantage in a number of services exports, India emerged as 11th important service exporter in the world in 2006 with a market share of 2.5 per cent as against 0.6 per cent in 1990 (Table 6).

III.1.1 Software Services

Exports of software and IT enabled services reached US $ 31.3 billion during 2006-07 (Table 7). Notwithstanding increasing competitive pressures, India remains an attractive source due to its low cost of operations, high quality of product and services and readily available skilled manpower. Furthermore, a favourable time zone difference with North America and Europe helps Indian companies achieve round the clock international operations and customer service (Box 3). To withstand global competition, Indian companies have started moving up the value chain by exploring untapped potential in IT consulting and system integration, hardware support and installation and processing services. Security concerns have also been duly recognised to maintain customer confidence. Globally, India is the leading exporter of computer and information services(Table 8).

Table 5: Composition of India's Services Exports (Receipts) |

(Per cent) |

Year |

Travel |

Transportation |

Insurance |

G.n.i.e. |

Software |

Non-software |

Total |

|

|

|

|

|

Services |

Miscellaneous |

Services |

|

|

|

|

|

|

Services* |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1990-91 |

32.0 |

21.6 |

2.4 |

0.3 |

- |

43.6 |

100.0 |

1995-96 |

36.9 |

27.4 |

2.4 |

0.2 |

- |

33.1 |

100.0 |

2000-01 |

21.5 |

12.6 |

1.7 |

4.0 |

39.0 |

21.3 |

100.0 |

2001-02 |

18.3 |

12.6 |

1.7 |

3.0 |

44.1 |

20.3 |

100.0 |

2002-03 |

16.0 |

12.2 |

1.8 |

1.4 |

46.2 |

22.4 |

100.0 |

2003-04 |

18.7 |

11.9 |

1.6 |

0.9 |

47.6 |

19.2 |

100.0 |

2004-05 |

15.4 |

10.8 |

2.0 |

0.9 |

40.9 |

29.9 |

100.0 |

2005-06 |

13.6 |

11.0 |

1.8 |

0.5 |

40.9 |

32.1 |

100.0 |

2006-07 |

12.0 |

10.6 |

1.6 |

0.3 |

41.1 |

34.5 |

100.0 |

G.n.i.e: Government not included elsewhere.

* Include business and professional services. |

Table 6: Comparative Position of India among Top Service Exporters, 2006 |

Sr.No. |

Country |

Amount

(US $ billion) |

Share (%) |

1 |

2 |

3 |

4 |

1 |

USA |

418.8 |

14.9 |

2 |

UK |

229.7 |

8.2 |

3 |

Germany |

173.1 |

6.1 |

4 |

France |

118.5 |

4.2 |

5 |

Japan |

117.3 |

4.2 |

6 |

Spain |

106.3 |

3.8 |

7 |

Italy |

98.6 |

3.5 |

8 |

China |

92.0 |

3.3 |

9 |

Netherlands |

84.8 |

3.0 |

10 |

Hong Kong |

72.7 |

2.6 |

11 |

India |

71.2 |

2.5 |

12 |

Ireland |

69.2 |

2.5 |

13 |

Belgium |

59.9 |

2.1 |

Source : Balance of Payments Statistics Year Book 2007, IMF. |

III.1.2 Business and Professional Services

The acceleration in non-software services exports partly emanating from underlying dynamism in export of business and professional services has been another important aspect of the invisibles receipts in recent years (Table 9). The category of business services comprises merchanting services, trade related services, operational leasing services without operating crew, including charter hire, legal services, accounting, auditing, book keeping and tax consulting services, advertising, trade fair, market research and public opinion polling service, research and development services, architectural, engineering and other technical services, agricultural, mining and on-site processing services, distribution services, audio-visual and related services, personal and cultural services. The management consultancy services have grown significantly in importance and have witnessed sustained growth (Box 4). The business services payments have also witnessed sharp increase in the recent period, reflecting the ongoing technological transformation of the economy and modernisation of Indian industry with a great deal of focus on technological up-gradation on a sustained basis.

Table 7: Software Services Exports of India |

(US $ million) |

Year |

IT Services Exports |

ITES-BPO Exports |

Total Software

Services Exports |

1 |

2 |

3 |

4 |

1995-96 |

754 |

- |

754 |

1999-00 |

3,397 |

565 |

3,962 |

2000-01 |

5,411 |

930 |

6,341 |

2001-02 |

6,061 |

1,495 |

7,556 |

2002-03 |

7,100 |

2,500 |

9,600 |

2003-04 |

9,200 |

3,600 |

12,800 |

2004-05 |

13,100 |

4,600 |

17,700 |

2005-06 |

17,300 |

6,300 |

23,600 |

2006-07 |

22,900 |

8,400 |

31,300 |

ITES: IT enabled services. BPO: Business Process Outsourcing.

Source: National Association of Software and Service Companies (NASSCOM). |

Box 3: India's IT-BPO Services Exports: Performance and Potential India offers a unique combination of attributes that have established it as the preferred offshore destination for Information Technology-Business Process Outsourcing (IT-BPO). According to the NASSCOM, over the fiscal year 2001-2006, India's share in global outsourcing is estimated to have grown from 62 percent to 65 percent for IT and 39 per cent to 45 percent for BPO. The NASSCOM has estimated that the India's IT-BPO sector is on track to achieve its aspired targets of US $ 60 billion in export revenues and US $ 13-15 billion in domestic revenues by 2010. The expected key drivers of growth are strong demand outlook, under-penetrated service lines and increasing emphasis on the role of information, communication and Technology (ICT) and innovation with regard to the exports of information technology and software services. The visibly higher preference for India is driven by its unmatched superiority when measured across a range of parameters that determine the attractiveness of a sourcing location. With over half the population of India aged less than 25 years, India's young demographic profile is unique and has an inherent advantage. This is complemented by a vast network of academic infrastructure and an unmatched mix and scale of educated, English-speaking talent (NASSCOM, 2007). According to the NASSCOM, the Indian IT-BPO sector is expected to grow by 28 percent in the fiscal year 2007-08. Taking into account the domestic revenues, the gross revenues are forecast to reach US $ 47.8 billion, and direct employment is projected to exceed 1.6 million. It may be mentioned that service and software exports remain the mainstay of the sector accounting for nearly two-third of the total. During the fiscal year 2007-08, the growth is likely to beat earlier forecasts and exceed 32 percent. The destination-wise analysis indicates that the United States accounts for 67 per cent of exports and United Kingdom accounts for 15 per cent of exports and remain the dominant markets. The recent analysis also indicates that firms are also keenly exploring new geographies for business opportunities and strengthening their global delivery footprint. The sector-wise analysis indicates that Information technology (IT) accounts for 55 per cent of exports.

BPO continues to grow in scale and scope, with firms increasingly adopting vertical focused approach. In this regard, the new areas of application and infrastructure management, and testing are gaining significance. Banking, Financial Services, Insurance, and Technology (Hi-tech/telecom) are the main verticals, accounting for nearly 60 percent of the total of the IT-BPO sector. Sectors like manufacturing, retail, media, utilities, healthcare and transportation are also growing rapidly. Service-line expansion is aiding service providers to take on larger and more complex deals, and is driving up the average ticket size of contracts awarded to Indian firms. High offshore component of delivery and superior execution in multi-location delivery continue to be key differentiators. Broad-based industry structure; IT led by large Indian firms, BPO by a mix of Indian and MNC third-party providers and captives, reflects the depth of the supply-base. The larger players continue to lead growth and their share continues to increase in the industry.

Source: NASSCOM (2007); Strategic Review 2007- The IT Industry in India. The details of key components of the business services receipts and payments viz., trade related services, business and management consultancy services, architectural, engineering and other technical services and services relating to maintenance of offices are set out in Table 10.

Table 8: Computer and Information

Services Exports |

(US $ billion) |

Sr. No |

Country |

2000 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

1 |

India |

6.3 |

17.7 |

23.6 |

31.3 |

2 |

Ireland |

7.5 |

18.8 |

19.6 |

21.0 |

3 |

U.K. |

4.3 |

11.7 |

11.2 |

12.0 |

4 |

Germany |

3.8 |

8.1 |

8.3 |

9.6 |

5 |

U.S.A. |

5.6 |

6.7 |

7.5 |

7.6 |

6 |

Israel |

4.2 |

4.4 |

4.5 |

5.3 |

7 |

Canada |

2.4 |

3.1 |

3.9 |

4.0 |

8 |

Spain |

2.0 |

3.0 |

3.6 |

4.0 |

9 |

Netherlands |

1.2 |

3.7 |

3.7 |

3.9 |

10 |

Belgium |

- |

2.4 |

2.6 |

2.8 |

Source : Balance of Payments Statistics Year Book, IMF and Reserve Bank of India. |

Engineering services mainly includes consultancy in designing and detailed designing services. With the rising demand for infrastructure and as a favourable destination for international companies for meeting the IT needs, India is emerging as an important country for trade in engineering services. According to NASSCOM (2006), global spending for engineering services is estimated at US $ 750 billion in 2006. By 2020, the worldwide spending on engineering services is expected to increase to more than US $ 1 trillion. Of the US $ 750 billion, only US $ 10-15 billion is currently being off-shored. It is envisaged that India has potential to tap this growing market in engineering services exports and off-shoring (Box 5).

Table 9: Break up of Non-Software Miscellaneous Services Receipts and Payments |

(US $ million) |

Item |

Receipts |

Payments |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

April- March |

April- March |

April- Sept |

April- Sept |

April- March |

April- March |

April- Sept |

April- Sept |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1. |

Communication |

|

|

|

|

|

|

|

|

|

Services |

1,575 |

2,099 |

1,056 |

896 |

289 |

659 |

269 |

281 |

2. |

Construction |

242 |

332 |

158 |

243 |

723 |

737 |

424 |

227 |

3. |

Financial |

1,209 |

2,913 |

935 |

1,510 |

965 |

2,087 |

628 |

1,481 |

4. |

News Agency |

185 |

334 |

147 |

237 |

130 |

219 |

74 |

212 |

5. |

Royalties, Copyrights & |

|

|

|

|

|

|

|

|

|

License Fees |

191 |

97 |

32 |

79 |

594 |

1,038 |

353 |

368 |

6. |

Business Services |

9,307 |

19,266 |

7,954 |

6,380 |

7,748 |

17,093 |

5,902 |

6,195 |

7. |

Personal, Cultural & |

|

|

|

|

|

|

|

|

|

Recreational Services |

189 |

173 |

59 |

168 |

84 |

116 |

58 |

81 |

8. |

Others |

5,607 |

1,042 |

638 |

465 |

5,998 |

4,357 |

2,238 |

838 |

Total (1 to 8) |

18,505 |

26,256 |

10,979 |

9,978 |

16,531 |

26,306 |

9,946 |

9,683 |

Note : Break-up of Business Services (item 6) is given in Table 10. |

Box 4: Export Potential of Management Consultancy Services of India Management consultancy includes services contracted for and provided to organisations by specially trained and qualified persons, who assist in an objective and independent manner, the client organisation to identify management problems, analyse such problems, recommend solutions to these problems, and help, when requested, in the implementation of solutions. Engineering consultancy is defined as application of physical laws and principles of engineering to a broad range of activities in the areas of construction, manufacturing, mining, transportation and environment.

Over the years, as the Indian industry started maturing, the Indian consulting industry also started expanding, not only in terms of size, but also in terms of the service offerings. Specialist consulting advice was being sought by clients in India and this opened the opportunity for a number of specialist organisations to draw on their specialist knowledge base and resources to meet the demand for specialist consulting services. Government's Initiatives

In the recent period, the trade policy in India reflects the strategic importance of India's comparative advantage of trade in services. The services sector has been identified as a thrust sector for trade policy. The Foreign Trade Policy, 2004-09 has announced the setting up of Services Export Promotion Council to map opportunities for key services in import markets and to develop strategic market access programme. Some of the key initiatives of the government in promoting exports of consultancy services are through Market Development Assistance (MDA), Market Access Initiative (MAI) scheme, proactive EXIM Policy and EXIM Bank schemes. Government also provides exemption on service tax for export of consultancy services. Growth potential for consulting services is envisaged to be high in South East Asian and East African countries as these countries are pursuing fast track development plans across diverse sectors. In the Commonwealth of Independent States (CIS) countries, although all of them have development agenda, they are comparatively not as fast paced as the East African countries and the development potential is limited to a few sectors. The key strategies and actionable plans are broadly categorised into four following divided: (i) market understanding includes conducting field based exploratory studies in the target markets, creation of database of local consultants, setting up the mechanism for gathering market intelligence, (ii) promotion includes organizing "Consultancy Trade Marts (CTM)" in the target countries, organizing delegations of Indian industry to target countries, creating awareness of Indian consulting capabilities within the Indian Embassies in these countries, tax benefits, identify and empower a nodal agency for sustainable promotion of Indian consulting business and developing closer ties with bilateral and multilateral institutions, (iii) focused marketing includes strategic alliances with local consulting firms, creation of Consultancy Development Fund (CDF) and merger & acquisition, (iv) quality assurance includes appointment of a regulator for quality assurance.

Source: Export Promotion of Consultancy and Management Services from India, Ministry of Commerce and Industry, Government of India.

Table 10: Business Services |

(US $ million) |

Item |

Receipts |

Payments |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

2005-06 |

2006-07 |

2006-07 |

2007-08 |

April-March |

April-

March |

April-Sept |

April-Sept |

April-March |

April-March |

April-Sept |

April-Sept |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1. |

Trade Related |

521 |

940 |

345 |

788 |

1,206 |

1,655 |

548 |

684 |

2. |

Business & Management Consultancy |

2,320 |

7,345 |

2,989 |

1,783 |

1,806 |

5,027 |

1,452 |

1,698 |

3. |

Architectural, Engineering and other technical |

3,193 |

6,134 |

2,329 |

1,392 |

1,414 |

3,673 |

1,194 |

973 |

4. |

Maintenance of offices |

1,577 |

2,335 |

1,199 |

975 |

2,074 |

3,424 |

1,349 |

882 |

5. |

Others |

1,696 |

2,512 |

1,092 |

1,442 |

1,248 |

3,314 |

1,359 |

1,958 |

Total |

9,307 |

19,266 |

7,954 |

6,380 |

7,748 |

17,093 |

5,902 |

6,195 |

Note : Business Services are part of Non-Software Miscellaneous Services, details of which are given in Table 9. |

The role of trade in services including those of financial services assumes significance in view of emphasis on increasing liberalisation of such services. Liberalisation of trade in financial services is one of the important aspects of negotiations on trade in services as a part of the General Agreement on Trade in Services (GATS), which mainly depends on the multilateral negotiations with WTO members. Keeping in view of the requirements for policy decisions and in conformity with international standards, the consistent and comparable information on financial services assumes importance (Box 6). III.1.2.1 Revision in Data in Business Services

The revisions in the data for the financial years 2005-06 and 2006-07, inter alia, take into account the issue of potential overlap between business services and software services. Accordingly, the data reported by the 'Authorised Dealers' (ADs) were reviewed and based on the feedback the revisions have been carried out in various components of business services. The revised data on business services are set out in Table 11. III.1.3 Travel

Receipts under travel represent expenditure by foreign tourists towards hotel expenses and goods and services purchased including domestic travel. Travel receipts continued to benefit from the robust growth in tourist arrivals (Table 12). Tourism earnings continued with their buoyancy witnessed since 2003-04, reflecting both business and leisure travel Liberalisation of payments system, growing globalisation, rising services exports and associated business travel, have led to sustained growth in outbound tourism from India through the 1990s. Concomitantly, travel payments also increased, reflecting rising business and leisure travel in consonance with (i) growing merchandise and services trade and (ii) growing disposable incomes of residents in an environment of liberalised payments regime. The potential for greater leisure tourism and business travel indicate the continuation of sustained growth in this segment in the near future. Travel receipts, as percentage of total services exports have been declining over the years as new form of services exports have emerged and accounted for 12.0 per cent of total services receipts during 2006-07 as compared to 32.0 per cent in 1990-91. The surplus on travel account increased from US $ 1.2 billion during 2005-06 to US $ 2.4 billion during 2006-07. India ranked 18th in the world tourist earnings in 2006 as against 23rd rank in 1990 (Table 13). Box 5: Engineering Services - Export Potential Engineering services mainly includes consultancy in designing and detailed designing, i.e., construction including the erection of plants, turn-key contracting and procurement of capital goods, and other information technology enabled services (ITES). According to the WTO, engineering services include work by engineering firms to provide blueprints and designs for buildings and other structures and by engineering firms to provide planning, design, construction and management services for building structures, installations, civil engineering work and industrial processes. In India, engineering services are reported under the head 'Business Services' which includes architectural, engineering and other technical services. Architectural firms provide blueprints and design for buildings and other structures, while engineering firms provide planning, design, construction and management services for building structures, installations, civil engineering works and industrial processes

.

According to a study by the NASSCOM in association with Booz Allen Hamilton, global spending on engineering services is large and rising - constituting about 2 per cent of World GDP (US $ 750 billion in 2006), which was projected to increase to $1.1 trillion by 2020. About US $ 10-15 billion of engineering services is off-shored, the market is expected to grow to US $ 150 -225 billion by 2020. Companies are increasingly moving these high-value services to emerging markets and India is having comparative advantage to outsource/offshore engineering services to meet the world demand. India is well-positioned to increase its market share of engineering off-shoring from 12 per cent to 30 per cent by 2020. India's current revenue base in the off-shored engineering services market is about US $ 1.5 billion. The potential engineering market in India could exceed US $ 60 billion by 2020. The main reason for expected increase of offshore engineering services has long been the desire to cut costs along with easier access to overseas markets. Engineering services are expensive, and the opportunities for reducing labor costs alone by moving services offshore are significant. While India outsources engineering services in aerospace, automotive, and industrial/plant automation, the major industries off-shoring engineering services are in the area of construction sector. According to the NASSCOM-Booz Allen Hamilton report on engineering services off-shoring, though the potential for India in engineering services is US $ 12-16 billion by 2010, the most likely scenario would be US $ 3-5 billion. Traditional, vertically integrated industries such as automotive, aerospace and marine engineering have been slow to make the move to outsourcing because of the lack of reliable technology linking engineering centers, the inherent complexity of the products being engineered, and competitive, legal or commercial issues. It is expected to change by 2010, as engineering collaboration technology improves and different industries come under increasing competitive pressure to develop products for worldwide markets.

A greater variety of industries are beginning to offshore their engineering services in part because of the trend to outsourcing increasingly complex engineering processes. Areas such as integrated product development of highly engineered goods such as cars and planes have lagged. But that is changing, as the engineering service offerings grow in complexity. Local engineering talent is becoming more sophisticated, and as local markets such as India begin to offer more and more complex products, they attract even more engineering talent. Box 6: Trade in Financial Services and Increasing Globalization Financial services are among those services which have attracted particular attention in international trade in services. Financial services broadly refer to the functions performed by financial institutions, viz., acceptance of deposits, lending, payment services, securities trading, asset management, financial advice/consultancy, settlement and clearing service, etc. and these functions are carried out collectively with nonresidents forming part of international trade in financial services. Financial services cover financial intermediation and auxiliary services, except those of life insurance enterprises and pension funds (which are included in life insurance and pension funding) and other insurance services that are conducted between residents and non-residents. Such services may be provided by banks, stock exchanges, factoring enterprises, credit card enterprises and other enterprises. In recognition of the growing importance of services and in order to meet the requirements of compilation under extended balance of payments statistics, the Reserve Bank of India formed a Technical Group on "Statistics of International Trade in Services" which submitted its report in March 2002. Based on the recommendation of this group, the reporting system was revamped by expanding the classification of transactions, facilitating the collection of disaggregated data in accordance with the extended balance of payments statistics during 2004-05. Accordingly, as a part of the administrative requirements under the Foreign Exchange Management Act (FEMA 1999), the authorised dealers (ADs) branches, which are authorised to deal in foreign exchange transactions, are needed to report all the foreign exchange transactions, dealt with them, on a fortnightly basis to RBI through Foreign Exchange Transactions Electronic Reporting System (FETERS). Information on financial services are collected, based on this AD reporting under, on three major heads viz., (i) Financial intermediation like Bank charges, collection charges, LC charges, cancellation of forward contracts, commission on financial leasing, etc., (ii) Financial intermediation for investment banking like brokerage, underwriting commission, etc., and (iii) Auxiliary services like charges on operation & regulatory fees, custodial services, depository services, etc. With the improvements in economic integration of financial markets and activities, the international trade in banking services has significantly increased. Further more, foreign direct investment in banking in the form of branches, agencies and subsidiaries or by means of cross-border mergers and acquisitions, increased between early 1980s and the late 1990s (Gkoutzinis, 2005). The GATS framework envisages that the delivery of any commercial services can be through four different modes. In the Mode 1 of service, the bank is not present in the territory of the service importing country, but the service is provided to the customer in his/ her country of residence. Defining the place where the service is delivered is often very difficult and, therefore, the cross-border banking service may get mixed up with Mode 2 of service. In Mode 2 supply of service (consumption abroad), the consumer receives the service outside the territory of the resident country. Even though the definition does not say about the movement of the consumer, it is often believed that Mode 2 refers to services provided to consumers traveling abroad. In the Mode 3 of supply of service, the bank has a commercial presence in the territory of the service importing country and the service is delivered therein. The commercial presence can be through various investment vehicles like representative offices, bank branches, subsidiaries, associates and correspondents. In the Mode 4 of supply of service, the bank is commercially present in the importing country and the service is delivered through nationals of the exporting country.

References: 1. Reserve Bank of India (2007), 'Report of the Technical Group on Statistics for International Trade in Banking Services', March.

2. United Nations (2002), Manual on Statistics of International Trade in Services.

Table 11: Revisions in the Data on Business Services |

(US $ million) |

Item |

2005-06 |

2006-07 |

|

Published |

Revised |

Published |

Revised |

1 |

2 |

3 |

4 |

5 |

1. Business Services Receipts |

12,858 |

9,307 |

23,459 |

19,266 |

2. Business Services Payments |

10,496 |

7,748 |

20,200 |

17,093 |

3. Net (1 - 2) |

2,362 |

1,559 |

3,259 |

2,173 |

III.1.4 Transportation

With the rising merchandise trade over the years, the receipts and payments towards transportation which mainly represent carriage of goods and natural persons as well as other distributive services (such as port charges, bunker fuel, stevedoring, cabotage, warehousing) have also shown increase over the years. Both, the receipts and payments towards transportation are increasing, however, the net amount is marginal. During the period 2000-01 to 2006-07, transportation receipts constituted around 12 per cent of total services exports. As proportion of total services exports, the share of transportation receipts has declined from 21.6 per cent in 1990-91 to 10.6 per cent in 2006-07 with emergence of new vistas of services exports.

III.1.5 Insurance

Insurance consists of insurance on exports/imports, premium on life and non-life policies and reinsurance premium from foreign insurance companies. Insurance receipts and payments are generally associated with movement in India's merchandise trade. The share of insurance receipts in total services receipts remained in a narrow range of around 2 per cent of total services exports since the early 1990s.

Table 12: Foreign Tourist Arrivals In India |

Year |

Arrivals (millions) |

1 |

2 |

1991 |

1.68 |

1995 |

2.12 |

2000 |

2.65 |

2001 |

2.54 |

2002 |

2.38 |

2003 |

2.73 |

2004 |

3.46 |

2005 |

3.90 |

2006 |

4.40 |

Source : Ministry of Tourism and Culture, Government of India. |

III.1.6 ‘Miscellaneous Services’ Component

In addition to the software services, business services, travel, transportation and insurance, the ‘miscellaneous services’ component under trade in services includes a host of other commercial services such as communication, financial, construction and personal, cultural and recreational services. These services, both receipts and payments, have witnessed significant increase in the recent years, mainly linked to technological transformation of the domestic economy

(see Table 9).

Table 13: Comparative Position of India among Top Travel Earnings Countries, 2006 |

Sr. No |

Country |

US $ billion |

Share in World Travel Earnings (%) |

1 |

2 |

3 |

4 |

1 |

USA |

106.7 |

14.5 |

2 |

Spain |

51.3 |

7.0 |

3 |

France |

46.5 |

6.3 |

4 |

Italy |

38.3 |

5.2 |

5 |

China |

33.9 |

4.6 |

6 |

U.K. |

33.9 |

4.6 |

7 |

Germany |

32.8 |

4.5 |

8 |

Australia |

17.9 |

2.4 |

9 |

Turkey |

16.9 |

2.3 |

10 |

Canada |

14.7 |

2.0 |

11 |

Greece |

14.4 |

2.0 |

12 |

Thailand |

12.4 |

1.7 |

13 |

Mexico |

12.2 |

1.6 |

14 |

Netherlands |

11.5 |

1.6 |

15 |

Belgium |

11.4 |

1.5 |

16 |

Malaysia |

10.4 |

1.4 |

17 |

Sweden |

9.1 |

1.2 |

18 |

India |

8.6 |

1.2 |

19 |

Portugal |

8.4 |

1.1 |

III.2 Transfers

Transfers comprise official transfers and private transfers. Private transfers, mainly workers' remittances, have remained buoyant in recent years on the back of robust global output growth, amidst constant improvement in remittance infrastructure domestically. The details of private transfers are set out below.

III.2.1 Private Transfers: Remittances for Family Maintenance and Local Withdrawals from NRI deposits

Inflows from overseas Indians are mainly in the form of: (i) inward remittance towards family maintenance, and (ii) deposits in the Non-Resident Indian (NRI) deposits schemes with the banks in India. However, remittances from overseas Indian include the inflows towards family maintenance and the funds domestically withdrawn from the Non-Resident Indian (NRI) rupee deposits (NRE(R)A and NRO deposit schemes). Such remittances from overseas Indians are treated as private transfers, which are included in the current account of the balance of payments. As against this, the inflows from overseas Indians for deposits in the NRI deposit schemes are treated as capital account transactions.

According to the IMF's Balance of Payments Manual, 5th Edition (1993), 'transfers' represent one-sided transactions, i.e., transactions that do not have any quid pro quo, such as grants, gifts, and migrants' transfers by way of remittances for family maintenance, repatriation of savings and transfer of financial and real resources linked to change in resident status of migrants.

III.2.1.1 Trends in Private Transfers (Workers' Remittances)

Workers' remittances have remained buoyant in recent years. The surge in workers' remittances to India, responding to oil boom in the Middle East during the 1980s, and the information technology revolution in the 1990s, has put India among the highest remittance receiving countries in the World. Demand for semi-skilled/unskilled labour from Middle East started in mid-1970s and peaked in the early 1980s, which was followed by the second wave in mid-1990s, led by information technology boom. Remittance inflows from overseas Indians reached US $ 29.0 billion in 2006-07 from US $ 2.1 billion in 1990-91 as the second wave of migrant workers started in the mid-1990s towards information technology sectors in the America (Table 14). Thus, the migration pattern changed from unskilled/semi-skilled to highly skilled workers to America. Workers' remittances have been around three per cent of India's GDP since 1999-2000 and have provided considerable support to India's balance of payments. They have offset India's merchandise trade deficit to a large extent, thereby keeping the current account deficits at modest levels since the 1990s. Private transfers were also less volatile in relation to other capital account items such as NRI deposits, foreign direct investment and portfolio investment. A significant share of remittances to India continues to be contributed by inflows from the oil exporting countries of Middle East. Thus, the behaviour of remittances to India is likely to be influenced by growth patterns in these countries, best represented in the form of oil prices. Another important source of remittance inflows to India is the US. In the Indian context, a major part of funds remitted by expatriate workers is channelised through inflows to non-resident deposits in the form of local withdrawals. Several factors account for the remarkable increase in workers' remittances. First, in the 1990s, migration to Australia, Canada, and the United States, increased significantly, particularly among information technology (IT) workers on temporary work permits. Second, the swelling of migrants' ranks coincided with better incentives to send and invest money regulations and controls, more flexible exchange rates, and gradual opening of the capital account. The convenient remittance services provided by Indian and international banks have also shifted such remittance flows from informal hawala channels to formal channels. Third, nonresident Indians have also responded to several attractive deposit schemes.

Table 14: Select Indicators of Private Transfers to India |

Year |

Amount

(US $ billion) |

Share in Current Receipts(Per cent) |

Private Transfers(Per cent to GDP) |

1 |

2 |

3 |

4 |

1990-91 |

2.1 |

8.0 |

0.7 |

1995-96 |

8.5 |

17.1 |

2.4 |

1999-00 |

12.3 |

18.3 |

2.7 |

2000-01 |

13.1 |

16.8 |

2.8 |

2001-02 |

15.8 |

19.4 |

3.3 |

2002-03 |

17.2 |

18.0 |

3.4 |

2003-04 |

22.2 |

18.5 |

3.7 |

2004-05 |

21.1 |

13.6 |

3.0 |

2005-06 |

25.0 |

12.8 |

3.1 |

2006-07 |

29.0 |

11.9 |

3.2 |

III.2.1.2 Composition of Remittances

The details of private transfers comprising those of remittances for Family Maintenance, Local Withdrawals from Non-Resident Rupee Account, Gold and Silver brought through Passenger Baggage, and Personal gifts/donations to charitable/religious institutions are set out below. III.2.1.2.1 Remittances for Family Maintenance

The share of remittances repatriated by the overseas Indians for family maintenance, which contributed a significant share of remittance flows to India at about 60 per cent in 1999-2000 declined to 47 per cent in 2006-07 (Table 15). In the first half of 2007-08, the share of remittances repatriated for family maintenance was about 50 per cent of total remittance flows to India.

An analysis of the high value transactions under remittances for family maintenance route was undertaken for the quarter July-September 2007. It may be mentioned that total private transfers during this quarter amounted to US $ 10.4 billion out of which US $ 5.5 billion was due to remittances for family maintenance. The share of high value transaction (US $ 1.2 billion) in total remittance inflows for family maintenance is relatively small (about 20 per cent). Thus, such remittances are mainly low value transfers from NRIs to their families and are stable flows.

Table 15: Trend and Composition of Private Transfers to India |

(US $ million) |

Year |

Inward remittances for family maintenance |

Local withdrawals/ redemptions from NRI Deposits |

Gold and silver brought through passenger baggage |

Personal gifts/donations to charitable/ religious institutions in India |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

1999-00 |

7,423 |

4,120 |

13 |

734 |

12,290 |

2000-01 |

7,747 |

4,727 |

10 |

581 |

13,065 |

2001-02 |

6,578 |

8,546 |

13 |

623 |

15,760 |

2002-03 |

9,914 |

6,644 |

18 |

613 |

17,189 |

2003-04 |

10,379 |

10,585 |

19 |

1,199 |

22,182 |

2004-05 |

9,973 |

8,907 |

27 |

2,168 |

21,075 |

2005-06 |

10,455 |

12,454 |

16 |

2,026 |

24,951 |

2006-07 |

13,561 |

13,208 |

27 |

2,155 |

28,951 |

2007-08 (April-Sep) |

9,434 |

8,300 |

17 |

1,241 |

18,992 |

2006-07 (April-Sep) |

6,607 |

5,123 |

11 |

992 |

12,733 |

III.2.1.2.2 Local Withdrawals from Non-Resident Rupee Deposit Schemes

Local withdrawals from non-resident rupee deposit schemes, as part of worker remittances, are the withdrawals from Non-Resident (External) Rupee Account [NR(E)RA] and Non-Resident Ordinary (NRO) Rupee Account by the nonresidents or his dependent for local use. Since 2003-04, there has been relatively rising significance of local withdrawal route as a conduit to remittance inflows to India. Although the average contribution of local withdrawals to total private transfers declined from 50 per cent in the first half of 1990s to only 29 per cent in the latter half of 1990s a reversal in this trend has been witnessed in the recent period. The phenomenon of local withdrawals from non-resident rupee deposits schemes exceeding those through direct remittances for family maintenance and savings was particularly pronounced in 2005-06 and 2006-07 (Table 16) as a significant part of the redemption of IMDs was repatriated to India in the form of rupee deposits, which were subsequently withdrawn in local currency. The gross inflows to NRI deposits and steady trend in local withdrawal indicate that remittance inflows may be sustainable over a medium term (Box 7). III.2.1.2.3 Gold and Silver brought through Passenger Baggage

Under the liberalised policy for imports, Government of India permitted import of gold by certain nominated agencies for sale to jewellery manufacturers, exporters, NRIs, holders of special import licences and domestic users. Nominated agencies/banks were permitted to import gold under different arrangements such as suppliers/buyers credit basis, consignment basis and outright purchase. Thus, after 1997-98 gold imports through passenger baggage by the returning Indians lost its importance as a conduit of remittance flows.

Table 16: Inflows and Outflows from NRI Deposits and Local Withdrawals |

(US $ million) |

Year |

Inflows |

Outflows |

Local Withdrawals |

1 |

2 |

3 |

4 |

1999-00 |

7,405 |

5,865 |

4,120 |

2000-01 |

8,988 |

6,672 |

4,727 |

2001-02 |

11,435 |

8,681 |

8,546 |

2002-03 |

10,214 |

7,236 |

6,644 |

2003-04 |

14,281 |

10,639 |

10,585 |

2004-05 |

8,071 |

9,035 |

8,907 |

2005-06 |

17,835 |

15,046 |

12,454 |

2006-07 |

19,914 |

15,593 |

13,208 |

2007-08(Apr-Sep) |

10,768 |

10,846 |

8,300 |

2006-07(Apr-Sep) |

8,431 |

6,221 |

5,123 |

III.2.1.2.4 Personal gifts/donations to charitable/religious institutions

In the recent years, the inflows under this channel have also increased. The money repatriated is predominantly donations to charitable/religious institutions/NGOs. III.2.1.3 Cross Country Position on Remittances

In recent years, there has been significant increase in the workers' remittances particularly in developing countries. Remittances provide a safety net to migrant households in times of hardship and these flows typically do not suffer from the governance problems that may be associated with official aid flows. According to available estimates, officially recorded data for workers' remittances to developing countries are expected to exceed US $ 240 billion in 2007, up from US $ 221 billion in 2006 and more than double the level reached in 2002. In 2007, India and Mexico are likely to be the top two recipients of remittances, accounting for nearly one-third of remittances received by the developing countries. In India, remittances accounted for 3.2 per cent of GDP during 2006-07. Remittances as a share of GDP amounted to 3.5 per cent in low income countries in 2005 and 1.5 per cent in middle income countries (World Bank, 2007). Remittances are the largest source of external financing in many poor countries. Also remittances have been less volatile than other sources of foreign exchange earnings in developing countries (World Bank, 2006). A cross country comparison of recent flow of remittances to developing countries reveals that India is the leading remittance receiving country in the world with relative stability in such inflows (Table 17). Box 7: Remittances Growth and Local Withdrawals The Non-Resident (External) Rupee Account [NR(E)RA] and Non-Resident Ordinary (NRO) Rupee Account deposits have facility of domestic withdrawal either by the NRI or his dependent family members. A part of the inflows to such deposits are subsequently locally withdrawn, which becomes a part of workers remittances. It is observed that NRI deposits are held by two categories of NRIs (a) those who want to come back to India, and (b) others who have acquired permanent interest abroad. The local withdrawal component is significant in the former category. Secondly, safety and cost are important consideration for repatriation of remittances to India through the NRE deposit route. Thus, the funds credited to NR(E)RA and NRO deposits get quickly withdrawn domestically by the dependents for domestic investment.

Since 2003-04, there has been relatively rising significance of local withdrawal route as a conduit to remittance inflows to India. Although the average contribution of local withdrawals to total private transfers declined from 50 per cent in the first half of 1990s to only 29 per cent in the latter half, a reversal in this trend has been witnessed in the recent period. The share of local withdrawals in private transfers has again risen to about 45 per cent, on an average, during the period 2000-01 to 2006-07.

In the recent past, a rising trend of local withdrawals can be attributed to the income levels of migrants, ease of transferring money through NRE deposits and rising investment opportunities domestically. It may be noted that a major part of outflows from NRI deposits (on the average 85 per cent of total outflows) is in the form of local withdrawal from NRI deposits. These outflows, however, are not actually repatriated and are utilised domestically. Furthermore, given the better investment opportunities domestically and higher interest rates, it is expected that the inflows may continue through the route of local withdrawals. Therefore, the issue of local withdrawals assumes significance. III.3 Investment income

Investment income receipts mainly include interest and discount earnings on RBI investment of foreign exchange reserves and reinvested earnings of the Indian companies investing abroad and dividends and profits received by Indian companies on foreign investment. Investment income receipts rose significantly since the late 1990s due to build up of foreign exchange reserves (Table 18). The rise in reinvested earnings reflects the upward trend in Indian overseas investment by the Indian companies to take advantage of access to markets, natural resources, distribution networks, foreign technologies and other strategic assets such as brand names.

Investment income payments mainly include interest payments on external commercial borrowings (ECBs), external assistance, NRI deposits and other short term liabilities. In addition, it includes dividend and profit payments on liabilities such as foreign direct investment and portfolio investment and reinvested earnings of the foreign direct investment (FDI) enterprises operating in India. While interest payments depend on the level of debt and the interest rate environment, the reinvested earning payments are influenced by the profitability and reinvestment decisions of FDI enterprises operating in India. A shift in the level of investment income payments since 2000-01 partly reflects the inclusion of reinvested earnings of FDI enterprises as per the revised procedure of recording FDI in India in line with the international best practices. The details of receipts and payments of

investment income are set out in Table 18.

Table 17: Workers' Remittances- Top Ten Remittance Receiving Countries |

(US $ million) |

Sr. No. |

Country |

1996 |

2004 |

2005 |

2006 |

1 |

2 |

3 |

4 |

5 |

6 |

1 |

India* |

8,453 |

20,012 |

23,518 |

27,607 |

2 |

Mexico |

4,224 |

16,613 |

20,035 |

23,054 |

3 |

Philippines |

569 |

8,617 |

10,668 |

12,481 |

4 |

China |

1,672 |

4,627 |

5,495 |

6,830 |

5 |

Spain |

2,749 |

5,196 |

5,339 |

6,057 |

6 |

Indonesia |

796 |

1,700 |

5,296 |

5,560 |

7 |

Romania |

10 |

18 |

3,754 |

5,506 |

8 |

Morocco |

2,165 |

4,221 |

4,589 |

5,454 |

9 |

Egypt |

3,107 |

3,341 |

5,017 |

5,330 |

10 |

Pakistan |

1,284 |

3,943 |

4,277 |

5,113 |

Source : Balance of Payments Statistics Yearbook, IMF. * Sourced from data on India’s

balance of payments published in RBI Monthly Bulletin. |

Table 18: Investment Income |

(US $ million) |

Year |

Receipts |

Payments |

Net |

1 |

2 |

3 |

4 |

1990-91 |

368 |

4,120 |

-3,752 |

1995-96 |

1,429 |

4,634 |

-3,205 |

1999-00 |

1,783 |

5,478 |

-3,695 |

2000-01 |

2,554 |

7,218 |

-4,664 |

2001-02 |

3,254 |

7,098 |

-3,844 |

2002-03 |

3,405 |

6,370 |

--2,965 |

2003-04 |

3,774 |

7,531 |

-3,757 |

2004-05 |

4,124 |

8,219 |

-4,095 |

2005-06 |

6,229 |

11,491* |

-5,262 |

2006-07 |

8,908 |

14,926 |

-6,018 |

2007-08 (Apr-Sep) |

6,142 |

7,383 |

-1,241 |

2006-07(Apr-Sep) |

3,816 |

6,851 |

-3,035 |

* Includes, inter alia, interest payments (US$ 1,718 million) of India Millennium Deposits (IMDs) |

Though both investment income receipts and payments are rising, the excess of investment income payments over investment income receipts led to deficit on net basis in the investment income. During 2006-07, the deficit in net investment income stood at US $ 6.0 billion as compared with a deficit of US $ 5.3 billion in 2005-06. The growth in investment income receipts is mainly led by interest earnings on foreign exchange reserves, dividend and profits and reinvested earnings, while investment income payments increased mainly on account of reinvested earnings and dividends and profits (Table 19). IV. Policy Initiatives IV.1 Trade in Services Among the measures to facilitate services exports, the Services Export Promotion Council set up by the Government of India aims to: (i) map opportunities for key services in key markets and develop strategic market access programmes for each component of the matrix, (ii) co-ordinate with sectoral players in undertaking intensive brand building and marketing programmes in target markets, (iii) make necessary interventions with regard to policies, procedures and bilateral/ multilateral issues, in co-ordination with recognised nodal bodies of the services industry. In the Foreign Trade Policy (2004-09), the Government announced to promote the establishment of Common Facility Centres in state and district-level towns for use by home-based service providers, particularly in areas like engineering and architectural design, multi-media operations and software developers. This would help to draw in a vast multitude of home-based professionals into the services export arena. The objective is to accelerate the growth in export of services so as to create a powerful and unique 'Served from India' brand. Service providers of services listed in Handbook of Procedures who has a total foreign exchange earning or earning in Indian rupees which are otherwise considered as having been paid for in free foreign exchange by RBI, of at least Rs. 10 lakh in the preceding or current financial year shall be eligible to qualify for duty credit scrip. All service providers, including healthcare and educational service providers, engineering process outsourcing (EPO) and knowledge process outsourcing (KPO) service providers, of services listed in the Handbook of Procedures shall be entitled to duty credit scrip equivalent to 10 per cent of the foreign exchange earned by them in the preceding financial year .

AD category-I banks were permitted to allow BPO companies in India to make remittances towards the cost of equipment to be imported and installed at their overseas sites, subject to the following conditions: (i) the BPO company should have obtained necessary approval from the Ministry of Communications and Information Technology, Government of India and other authorities concerned for setting up of the International Call Centre (ICC); (ii) the remittance is made directly to the account of the overseas supplier; and (iii) obtain a certificate as evidence of import from the Chief Executive Officer (CEO) or auditor of the importer company that the goods for which remittance was made have actually been imported and installed at overseas sites.

Table 19 : Details of Receipts and Payments of Investment Incomes |

(US $ million) |

Item |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Investment Income Receipts |

1. |

Interest receipts on |

|

|

|

|

|

|

|

|

loans to non-residents |

84 |

201 |

154 |

198 |

65 |

101 |

159 |

2. |

Dividend and profit |

11 |

57 |

34 |

40 |

92 |

225 |

464 |

3. |

Reinvested Earning |

340 |

700 |

1,104 |

552 |

248 |

1,092 |

1,076 |

4. |

Interest/discount Earnings on RBI investment |

1,950 |

1,757 |

1,835 |

2,115 |

3,014 |

4,519 |

6,640 |

5. |

Others |

169 |

539 |

278 |

869 |

705 |

292 |

569 |

6. |

Total Receipts (1 to 5) |

2,554 |

3,254 |

3,405 |

3,774 |

4,124 |

6,229 |

8,908 |

Investment Income Payments |

1. |

Interest Payment on NRI deposits |

1,811 |

1,808 |

1,413 |

1,642 |

1,353 |

1,497 |

1,971 |

2. |

Interest Payment on ECBs |

2,020 |

1,945 |

1,486 |

2,584 |

1,283 |

3,148 |

1,685 |

3. |

Interest Payments |

|

|

|

|

|

|

|

|

on External Assistance |

827 |

792 |

1,111 |

822 |

710 |

825 |

982 |

4. |

Interest on others(ST) Loans/Bonds |

80 |

80 |

22 |

80 |

400 |

347 |

635 |

5. |

Dividends and Profits |

1,047 |

711 |

462 |

878 |

1,991 |

2,502 |

3,485 |

6. |

Reinvested Earnings |

1,350 |

1645 |

1,832 |

1,459 |

1,903 |

2,760 |

5,091 |

7. |

Others |

83 |

117 |

44 |

66 |

579 |

412 |

1,077 |

8. |

Total Payments (1 to 7) |

7,218 |

7,098 |

6,370 |

7,531 |

8,219 |

11,491 |

14,926 |

In order to give proper direction, guidance and encouragement to the services sector, the Government on the recommendations of a Task Force constituted in this regard has announced setting up of an exclusive Export Promotion Council for Services (SEPC). The Government has initially identified the following 11 services sectors being supported through the SEPC. These includes Health Care Services; Educational Services; Entertainment Services; Consultancy Services; Architectural Services/Interior Decoration; Distribution Services; Accounting/ Auditing and Book Keeping Maritime Transport Services; Marketing Research & Management Services and Printing and Publishing Legal Services.

IV. 2 Remittances from Overseas Indians

A number of initiatives have been undertaken in the past to facilitate remittances. These include market-based exchange rate, current account convertibility2, regulatory measures to facilitate the institutional development for wider access to remittance services, policy initiatives to facilitate speedier and cost effective money transfer arrangements.

In the recent past, measures have been taken in the forms of facilitating infrastructure for receiving remittances. The bulk of the inward remittances to India now take place through the banking channels. Two schemes, viz., Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangements (RDA) have recently gained momentum on account of their speed and ease of operation. (Table 20A and Table 20B)

Under MTSS, only personal remittances such as remittances towards family maintenance and remittances favouring foreign tourists visiting India are permissible. The system envisages a tie-up between reputed money transfer companies abroad and agents in India who have to be an Authorised Dealer, Full Fledged Money Changer (FFMCs), registered NBFC or International Air Transport Association (IATA) approved travel agent with a minimum net worth of Rs. 25 lakh. The Indian agent requires the Reserve Bank approval to enter into such an arrangement. Remittances up to Rs.50,000 can be paid in cash, while any amounts in excess of this amount have to be necessarily paid by cheque/demand draft.

Table 20A :Remittances Received Under Rupee |

Drawing Arrangements (RDA) |

|

(US $ million) |

Period |

Amount |

October - December 2005 |

2,094 |