LIBOR: The Rise and the Fall - RBI - Reserve Bank of India

LIBOR: The Rise and the Fall

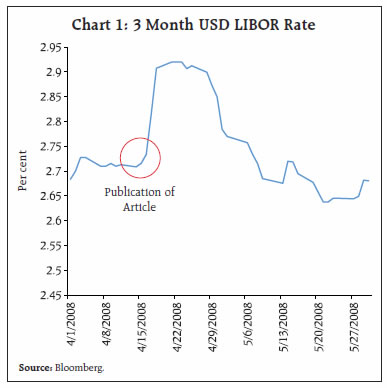

The publication of the most widely used financial benchmark, the London Interbank Offered Rate (LIBOR), is expected to cease after end-2021. Issues around the transition from LIBOR to alternative benchmarks pose challenges as well as opportunities and stakeholders need to be aware and prepared. Introduction 2012 was a landmark year in the world of financial benchmarks. The most widely used financial benchmark, the LIBOR, was found to have been manipulated by individuals at various financial institutions. The event created shock waves in the financial system – the credibility of a financial reference used to price and determine payoffs for trillions of dollars of loans/bonds/derivatives came under a cloud. The crux of the problem lay in the fact that LIBOR prices a market – the market for unsecured wholesale term lending for banks – in which dwindling volumes rendered efficient pricing difficult (Bailey, 2017)1. Structural changes in the financial markets, especially since the global financial crisis, meant that transaction-based submissions leading to LIBOR formation tapered off and what is left are estimates. In affirmative action, in 2017, the Financial Conduct Authority (FCA), UK, announced that it would not use its legal power to mandate banks to poll LIBOR beyond end-2021. The search for alternative reference rates has begun by shifting away from a benchmark that has been almost universally used in financial contracts globally for nearly five decades is a formidable challenge worldwide and in India even as the end date is fast approaching. Against this backdrop, this article looks at the evolution of LIBOR, the events leading to the decision to replace it, the search for alternative benchmarks and the issues involved in transition. Section II of the article traces the origin of LIBOR and the efforts at reforming it over the years. Section III delves into the search for alternate benchmarks and the issues around the transition to alternate benchmarks. Section IV examines how the transition affects the Indian jurisdiction. Section V concludes with policy perspectives. The use of LIBOR interest rates can be traced to the rise of the Eurodollar market (US dollar denominated deposits held outside of the US) in branches of banks outside the US in the 1960s. The origin of the term ‘LIBOR’ has been credited to a Greek banker called Minos Zombanakis, who was running the London branch of Manufacturer’s Hanover, now part of JPMorgan.2 In 1969, he organised an $80 million syndicated loan for the Shah of Iran, referenced to what he called a London interbank offered rate. These rates were initially computed for three currencies – the US dollar, the British pound and the Japanese yen. Over time, more currencies / maturities got added and, at its peak, LIBOR rates were announced for ten currencies in 15 maturity terms ranging from overnight to one year. At present, 35 LIBOR rates are posted each day for seven maturities each for five major currencies, viz., the Swiss franc, the Euro, the Pound sterling, the Japanese yen, and the US dollar. LIBOR rates are computed as a ‘trimmed mean’ of polled rates elicited from major banks based on responses to the question: ‘At what rate could you borrow funds were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m.?’ The subjective nature of the question, especially related to timing and size – ‘reasonable market size’ and ‘just before 11 a.m.’ – leave LIBOR vulnerable to manipulation. Concerns about LIBOR and its governance process are, however, not new. As the use of LIBOR grew during the 1970s and 1980s, polling banks started accepting Euordollar deposits at interest rates linked to LIBOR, leading to adverse incentives to report lower rates. In view of these concerns, the British Bankers’ Association took over the governance process of LIBOR in 1986. Over time, the evolution of the repo market led to a decline in the volumes of unsecured interbank transactions. As these transactions dwindled, LIBOR rates became increasingly un-verifiable and increasingly reliant on expert judgement of banks. Conflicts of interest were inherent – the polling banks have ‘significant’ presence in related markets, but they also hold large derivative and loan contracts that are priced by using LIBOR rates. Discrepancies were first observed during 2007-08 when the polled rates were found to be not reflecting the actual rates at which banks lent to each other. The possibility that banks were reporting LIBOR quotes significantly lower than those implied by prevailing credit default swap (CDS) spreads was highlighted in a Wall Street Journal article and in various research papers in 2008 (Mollenkamo, 2008; Abrates-Metz et. al., 2008). This brought attention to the fact that there were incentives for banks to manipulate LIBOR rates as instruments through which banks signal their perceived credit-worthiness, especially in periods of stress or through which trading positions could be influenced. Post this publication, there was an immediate spike in the 3-month USD LIBOR rate (Chart 1). This triggered off investigations into the LIBOR fixation process. By 2012, manipulations in LIBOR fixations were established and banks were levied with fines totalling about $ 9 billion for misconduct.

In response to these developments, the UK commissioned a review of the structure and governance of LIBOR. The Wheatley Review (as the review undertaken in 2011-12 under Mr. Martin Wheatley, the former Chief Executive Officer of the Financial Conduct Authority (FCA), came to be called) concluded that LIBOR should be retained as a benchmark but that it should be comprehensively reformed. It made wide-ranging recommendations about improvements in the benchmark governance process for LIBOR. It also recommended that publication of LIBOR in certain currencies and maturities in which the volumes of trades were particularly low should be discontinued. Several reforms to the governance process were undertaken in the wake of the recommendations. In particular, the responsibility of benchmark administration was moved to the Intercontinental Exchange (ICE), an oversight committee to independently challenge the benchmark processes was put in place and governance reforms were carried out in the submitting banks. Notwithstanding the reforms, the key deficiency of the LIBOR process – that of insufficient transactions on which submissions were based – persisted. In 2017, this was highlighted by Andrew Bailey, then Chief Executive of the FCA, with an example of a currency–tenor combination for which benchmark reference rates were published daily by banks who, between them, executed just fifteen transactions of potentially qualifying size in that currency and tenor in the whole of 2016. Against this backdrop, the FCA concluded that the journey to transaction-based benchmarks would not be completed if the markets continue to rely on LIBOR. The FCA thus announced that it would not compel panel banks to submit LIBOR beyond 2021. III. In Search of an Alternative Benchmark LIBOR serves as a reference rate at which financial instruments can contract upon to establish the terms of agreement and also as a benchmark rate that reflects a relative performance measure for investment returns (Hou and Skeie, 2014). LIBOR is used almost ubiquitously in global financial markets for a wide array of financial instruments in different kinds of loan and derivative products, thereby enabling non-rival consumption properties akin to a public good in terms of reducing complexity, increased standardisation, enhanced liquidity and lower transaction costs. Beyond the pricing of financial instruments, LIBOR is also extensively used for valuation and accounting purposes. An Alternative Reference Rate (ARR) – one which retains the desirable features of LIBOR while ensuring that it is based on transactions in liquid markets – has to satisfy several key attributes; (a) it should provide a robust and accurate representation of interest rates in core money markets that is not susceptible to manipulation; (b) it should offer reference rates for financial contracts that extend beyond the money market; and (c) serve as a benchmark for term lending and funding (BIS, 2019).3 Jurisdictions where LIBOR is the domestic interbank interest rate benchmark have identified alternative benchmarks linked to actual transactions in liquid markets. In practice, this has resulted in ARRs based on shorter-tenor contracts – essentially overnight repo markets, which are the most liquid - and secured rather than unsecured transactions. Additionally, the ARRs have moved beyond pure interbank markets to include non-bank wholesale participants such as money market and investment funds and insurance companies in a bid to garner a wider participant base (Table 1). In addition, several jurisdictions where LIBOR forms one component of the local interest rate benchmarks have also identified or are identifying new benchmarks. For example, in Singapore, the existing benchmark – the Singapore Dollar Swap Offer Rate (SOR) – uses LIBOR as one of its components. The jurisdiction has identified the Singapore Dollar Overnight Rate Average (SORA) - a transaction-based benchmark with no term component – as its ARR and a few SORA based transactions have already been contracted. In Thailand, the Thai Baht Interest Rate Fixing (THBFIX) relies on LIBOR. The Thai Overnight Repurchase Rate (THOR) has been identified as the ARR for the jurisdiction. The LIBOR is a combination of interbank rates comprising credit risk premia, term premia and liquidity premia. As against this, ARRs are overnight benchmark rates, which lack a term structure and a credit risk component. For the transition from LIBOR to ARR to succeed, term rates will need to emerge to enable ARRs to serve as reference rates for new financial contracts. Also, the development of liquid financial markets linked to the new rates will be critical. Both these aspects present significant challenges. Development of term benchmarks should ideally be based on actual transactions in line with the overall thrust of benchmark reforms. The simplest construct of term structures will be to compound overnight interest rates, i.e., ‘compounding in arrears’. These term structures will, however, be backward looking in contrast to the LIBOR, which is forward-looking. By design, therefore, the ARRs will not reflect market expectations about future interest rates or financial conditions. Policy makers across the world, including the Financial Stability Board (FSB), have been emphasising that overnight ARRs compounded in arrears will and should become the norm and that transition efforts should not await the emergence of forward-looking term versions of risk-free rates (FSB, 2019). Nevertheless, there will be some parts of the market, which will need forward-looking term reference rates. Development of liquidity in contracts that reference ARRs remains a challenge, and is, in many ways, a chicken-and-egg problem. Deep markets are likely to develop only when new contracts start referencing the ARRs.

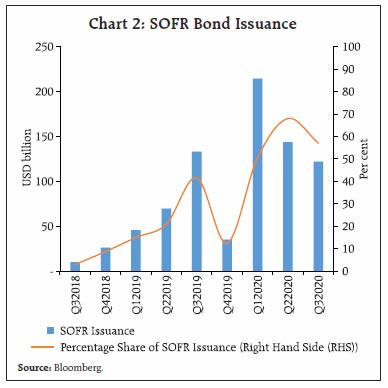

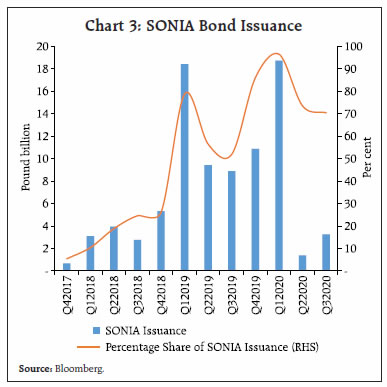

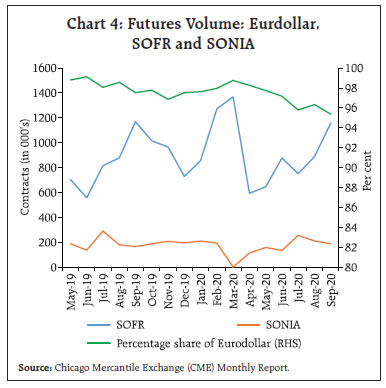

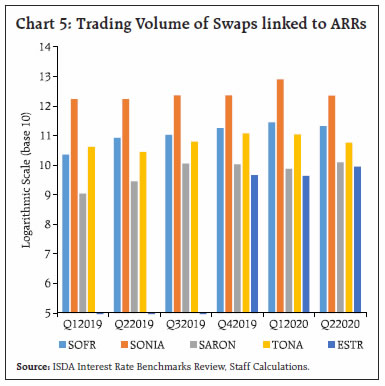

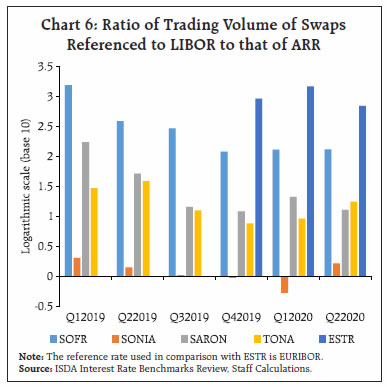

At present, bond issuances linked to Secured Overnight Financing Rate (SOFR) and Sterling Overnight Interbank Average Rate (SONIA), in particular, have begun and now constitute a significant share of total floating rate bond issuances (Charts 2 and 3). Trading in derivatives has also begun. Trading volume in SOFR and SONIA futures has been increasing over the months. However, Eurodollar futures still account for a major portion of the total interest rate futures market (Chart 4). Trading in swaps referencing SOFR and SONIA are also growing (Charts 5 and 6). In particular, there is now a significant volume of trading in swaps referencing SONIA. In the loan segment, however, new loan contracts referencing ARRs remain limited with only 23 loan contracts currently referencing ARRs (Loan Markets Association, 2020).

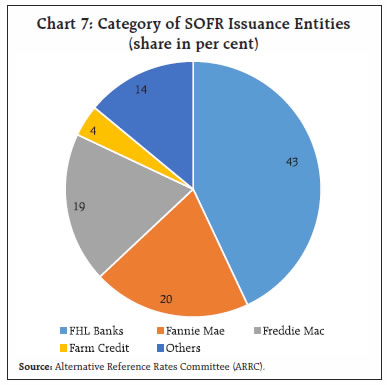

Several regulatory initiatives are being taken globally to provide greater liquidity to ARR- referenced contracts. Bond referencing ARRs have primarily been issued by quasi-government entities. Most SOFR referenced issuances are by entities like Fannie Mae, Freddie Mac and Federal Home Loan (FHL) banks (Chart 7). The decision to use Euro Short Term Rate (ESTR) instead of Euro Overnight Index Average (EONIA) in the discounting methodology used by European exchanges to value Euro-denominated Interest Rate Swap (IRS) contracts from July 2020 and SOFR instead of the Fed Funds Rate in the discounting methodology used by the Chicago Mercantile Exchange (CME) and London Clearing House (LCH) for the valuation of USD-denominated IRS contracts from October 2020 are expected to provide a fillip to derivatives referencing ARRs. The trading volume in swap contracts referenced to ESTR has more than doubled form USD 9 bn in Q2 2020 to USD 24.2 bn in Q3 20205. Going forward, liquidity in ARR-referenced contracts is likely to increase as deadlines provided by regulatory authorities in USA and UK, beyond which entities have to stop issuing contracts that reference LIBOR, come into effect. From April, 2021, higher haircuts will be applied by the Bank of England (BOE) for collaterals referenced to LIBOR and such collateral maturing beyond 2021 will not be eligible for use in the Bank of England’s operations under the Sterling Monetary Framework (BOE, 2020).

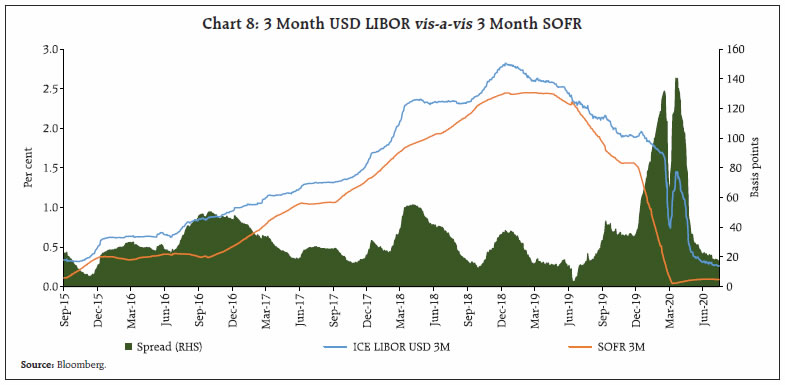

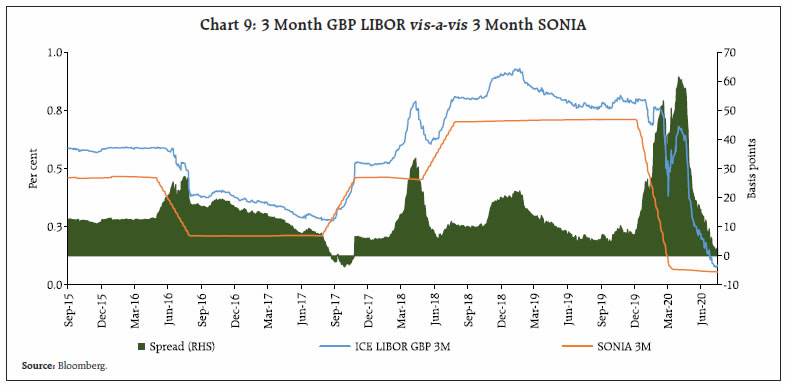

A large book of bonds, loans and financial instruments referenced to LIBOR will continue beyond the cessation of LIBOR on January 1, 2022. Fresh contracts referencing LIBOR are still being contracted every day. Many of these will also outlive the cessation of LIBOR. Dealing with such contracts is a key transition challenge. In most cases, there are no fallback arrangements which cater to such cessation. These give rise to two specific sets of issues. First, the contracts will need to be individually renegotiated and fallback clauses inserted. Industry bodies such as the International Swaps and Derivatives Association (ISDA) and the Loan Market Association have been working towards developing such fallback options in consultation with stakeholders. On October 23, 2020, the ISDA published the Fallback protocol. The main goal is to agree ex ante rather than ex post on the fallbacks so as to ensure efficient pricing and smooth transition. In derivative markets, conventions for the adoption of fallbacks are more standardised due to actions by bodies such as the ISDA. The challenges are trickier in case of cash market contracts, including loan contracts, which are typically customised, leading to potential basis risks between the loan and underlying derivative and requiring separate renegotiation of each contract. Many such contracts contain non-standardised features, which may make them difficult to negotiate (‘tough legacy’ contracts). In the UK, a legislation to deal, inter-alia, with such contracts has been proposed (RFRWG, 2020)6. A similar legislation has been recommended in the US as well (ARRC, 2020) The second challenge arises from the fact that the development of a fallback mechanism notwithstanding, there will be winners and losers as a result of contract renegotiation. Spreads between term LIBOR and term ARR could vary for various reasons. The renegotiation and conversion at wide spreads may lead to the requirement of substantial pay-outs by one of the counterparties to a contract. For example, disruptions in financial markets in March 2020 led to a widening of spreads between 3-month LIBOR and 3 Month SOFR / SONIA (Charts 8 and 9). With large changes in fair value, the modified contract may be seen as a deemed sale and the creation of a fresh contract, potentially imparting risk to associated tax liabilities. Hedge re-designation of contracts cannot be ruled out if the qualifying standards for hedge effectiveness assessment are not met. Tax and accounting issues will need to be addressed, necessitating widespread customer sensitisation. They could engender significant legal and conduct risks. A number of efforts are ongoing globally to create awareness and clarify issues, where possible. For example, jurisdictions such as UK, Hong Kong, Japan and Australia have issued ‘Dear CEO’ letters, requesting, inter-alia, financial institutions to sensitise customers, set internal deadlines for the transition from LIBOR, assess LIBOR exposures and manage associated risks. Tax authorities in the US have published guidance on issues that could arise on account of the transition. The Financial Accounting Standards Board has issued guidance on certain accounting aspects that could arise at the time of contract renegotiation.

The use of benchmarks in the Indian financial system is not new. A range of foreign exchange and interest rate benchmarks have been in use, primarily by the banking sector, to price contracts and value assets and liabilities. The Reserve Bank has been taking steps to preserve the integrity of such benchmarks.

In the context of manipulation of LIBOR, it constituted a Committee on Financial Benchmarks (Chair: Shri P Vijaya Bhaskar) in June 2013, to review the systems governing financial benchmarks in India.7 Pursuant to the recommendations of the Committee, an independent entity, i.e., Financial Benchmark India Pvt. Ltd (FBIL), was set up to act as an administrator for benchmarks in debt, interest rates and foreign exchange markets. The FBIL now administers various benchmarks - Overnight Mumbai Interbank Outright Rate (MIBOR); Mumbai Interbank Forward Outright Rate (MIFOR); Market Repo Overnight Rate (MROR); Forward Premia Curve; Foreign Currency Rupee Options Volatility Matrix; and Rupee reference rates. In June 2019, the Reserve Bank put in place a regulatory framework for financial benchmark administrators, aimed at ensuring acceptable standards of governance and accountability as well as the quality of benchmarks and of the computation methodology in the benchmark administration process. Six financial benchmarks, viz, MIBOR, MIFOR, USD/INR Reference Rate, Treasury Bill rates, valuation of Government Securities and valuation of State Development Loans (SDL) were notified as significant benchmarks in January 2020. In India, exposures to LIBOR arise from loan contracts (e.g. External Commercial Borrowings (ECBs)) linked to LIBOR; FCNR (B) deposits with floating rates of interest linked to LIBOR; and derivatives linked to LIBOR or to the MIFOR - a domestic benchmark based on LIBOR. Preliminary estimates suggest that about $50 billion of debt contracts in the form of ECB/FCCBs and $281 billion of derivative contracts will expire beyond 2021 (Table 2). These figures are, however, not static as new contracts referencing LIBOR continue to be signed. In addition, there are Government exposures linked to LIBOR. These include LIBOR-referenced loans availed by the Government from multilateral / bilateral agencies and Lines of Credit offered to other countries. A large number of trade contracts also reference LIBOR but most of these are short term and existing contracts may not continue after the cessation of LIBOR. The challenges for India and milestones for preparing for the cessation of LIBOR at the end of December 2021 are similar to those faced by other jurisdictions, especially those which are, in some sense, ‘LIBOR-takers’, i.e., they rely on LIBOR interest rates of major jurisdictions. In India, MIFOR – which has LIBOR as one of its components – is a key benchmark used in the interest rate swap (IRS) markets. An alternate benchmark based on global ARRs will need to be developed in place of the MIFOR. At present, the Clearing Corporation of India Limited provides guaranteed settlement for IRS contracts that reference the MIFOR. The clearing and settlement arrangements will also need to be modified to provide for the alternate benchmark. A scrutiny of existing loan/derivative contracts show that contractual fallback clauses catering to cessation of LIBOR are not available in existing contracts, which will continue beyond 2021. Fallback clauses customised to domestic markets but based on global practices will, therefore, need to be developed. These contracts may have to adopt the country specific ARR as a substitute once LIBOR ceases to exist, beyond 2021. As we move closer to the transition date, all contracts which will continue after LIBOR cessation will need to be renegotiated and replaced. Critical for this will be the creation of adequate stakeholder awareness across all classes of financial market participants. Related accounting and tax issues will also need to be addressed. Existing regulations, which reference LIBOR will need to be amended to provide for contracts referencing ARRs. As is being planned in most jurisdictions globally, a cut-off date after which no new contracts can be entered using LIBOR will need to be notified. This will, of course, largely be dependent on development of liquid debt and derivative markets linked to ARR and the cut-off date announced by the advanced economies. The MIFOR benchmark is a synthetic benchmark, a composite rate with the USD LIBOR and USD INR forward premia as its components. Essentially, the MIFOR represents the cost of borrowing in US dollars and swapping the same to INR, thus synthetically representing the domestic term interest rate. IRS contracts referenced to MIFOR are used by banks to price and cover currency swaps offered to ECB borrowers. At present, about a fifth of outstanding IRS contracts in the country are referenced to the MIFOR. With the cessation of LIBOR, an alternate to MIFOR will also need to be developed. Several alternative benchmarks based on daily SOFR (compounded in arrears) in place of LIBOR along with USD INR forward premium; daily SOFR with USDINR cash / Tom swap rate (both compounded in arrears); MIBOR (an unsecured daily benchmark based on call money market transactions) and MROR (a secured daily benchmark based on repo transactions) or Treasury Bills rate are possible. Each of the alternate benchmarks has advantages and issues. The use of the SOFR with the forward premia, for example, will closely mimic the MIFOR but will involve the use of one forward-looking and one backward-looking component. Use of the SOFR and the USD INR Cash/Tom Swap Rate, both of which are compounded in arrears, will address this issue but a benchmark based on cash / tom swap rates is likely to be more volatile than one based on forward premia. The MROR is a benchmark based on secured overnight transactions in a liquid market encompassing both bank and non-bank participants and hence closely shares the features of international ARRs. At present, however, IRS contracts referencing the MROR are not prevalent. The MIBOR is based on a less liquid interbank call market but MIBOR-based swaps account for the bulk of outstanding IRS contracts in the country. In any case, MIBOR, MROR and T-bill rates are domestic rates and their use as an ARR will need the development of a market for cross currency basis swaps. Issues associated with deriving a term structure for the ARR, as in global markets, will also need to be addressed. As is the case globally, financial contracts referencing LIBOR – both loan and derivative contract - which will outlive the cessation will need to be re-negotiated to ensure insertion of appropriate fallback language. Customer sensitisation and addressing of legal, taxation and accounting issues will also be crucial. Transition arrangements for MIFOR-linked IRS contracts will be unique to the country but could be relatively less tricky to handle, as such contracts are traded only in the interbank market. Beyond these issues is the need for preparation of the banking and the broader financial system for the transition. A large number of business processes that will be impacted by the transition will need to be re-engineered. All IT systems that use LIBOR will need to be changed. With financial institutions in India often using a mix of inhouse and third-party vendors, IT changes will be far from easy. Most importantly, personnel at different levels will need to be made aware and even trained. The Reserve Bank has been participating in and monitoring global developments related to LIBOR transition and has tasked the Indian Banks’ Association (IBA) to consult on relevant issues. The IBA has since formed three workstreams on (i) LIBOR transition arrangements, (ii) rates and methodology and (iii) outreach to market participants. IBA has also circulated a guidance note among its member banks to enable them assess their preparedness for LIBOR transition on various parameters, viz., exposure assessment and assessment of the accounting, tax, information technology (IT) related implications. The rates and methodology workstream is developing an acceptable alternative for MIFOR while the outreach workstream is reaching out to stakeholders through webinars and conferences to create awareness about the upcoming challenge. In August 2020, the Reserve Bank issued a ‘Dear CEO’ letter to all scheduled commercial banks sensitising the banks about the need to be prepared for the LIBOR cessation. Banks were asked to identify exposures that reference LIBOR and which are likely to continue beyond cessation date; assess preparedness for the transition and identify associated risks; and ensure customer sensitisation on the subject. The transition away from LIBOR to a new benchmark will be full of challenges. Every stakeholder – the financial sector; regulators; tax, legal and accounting systems; and real sector participants needs to play a role. Alternative reference rates have been identified in major jurisdictions, but development of liquidity markets in these rates – a sine quo non for ensuring smooth transition - remains at a nascent stage. The FSB has laid out a global transition roadmap for LIBOR, emphasising that firms should be in a position to assess their LIBOR exposures and encouraging firms to adhere to the ISDA protocol for the transition. The FSB has also suggested that by end-2020, firms should be in a position to offer non-LIBOR linked loans to their customers. Achieving this roadmap will, however, require significant efforts from all stakeholders. The transition arrangements for a benchmark embedded in the financial system involve multiple stakeholders across market bodies, regulators, governmental agencies and financial entities. A coordinated approach will be necessary to enable the smooth transition from LIBOR. References Bailey, A. (2017), “The Future of LIBOR”, Speech delivered by Mr. Andrew Bailey, former Chief Executive of the FCA, at Bloomberg London, July 27, 2017. Abrantes-Metz, R M., Kraten, M., Metz, A., and Seow, G. (2008), “LIBOR Manipulation?”, Mimeo, Accessed from SSRN 1201389. Mollenkamp, C. (2008, April 16), “Bankers cast doubt on key rate amid crisis”, The Wall Street Journal, https://www.wsj.com/articles/SB120831164167818299. Hou, D and Skeie, D. (2014), “LIBOR Origins, Economics, Crisis, Scandal, and Reform”, Federal Reserve Bank of New York Staff Reports, no. 667. HM Treasury (2012), “The Wheatley Review of Libor: Final Report”, September. Schrimpf, A and Sushko, V. (2019), “Beyond LIBOR: a primer on the new benchmark rates”, BIS Quarterly Review, March. FSB (2019), “Reforming major interest rate benchmarks: Progress Report”, December. BOE (2020), “The Bank’s risk management approach to collateral referencing LIBOR for use in the Sterling Monetary Framework – Market Notice”, May. RFRWG (2020), “Paper on the identification of Tough Legacy issues”, May. ARRC (2020), “Proposed Legislative Solution to Minimize Legal Uncertainty and Adverse Economic Impact Associated with LIBOR Transition”, July. RBI (2014), “Report of the Committee on Financial Benchmarks”, February. FSB (2020), “Global Transition Roadmap for LIBOR”, October. * This article is prepared by Vasudev Hemachandran of the Financial Markets Regulation Department. The author is grateful to Manoj Kumar for valuable guidance. The views expressed in this article are those of the author and do not represent the views of the Reserve Bank of India. 1 https://www.fca.org.uk/news/speeches/the-future-of-libor 2 https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr667.pdf 3 https://www.bis.org/publ/qtrpdf/r_qt1903e.pdf 5 ISDA Publication: Transition to RFRs Review: Third Quarter of 2020 and Year-to-September 30, 2020 6 The Working Group on Sterling Risk-Free Reference Rates 7 https://www.rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=761 |