Quarterly Industrial Outlook Survey: October- December 2009 (48th Round)* This article presents the survey findings of Industrial Outlook Survey conducted for October-December 2009 quarter, the 48th round in the series. It gives the assessment of business situation of companies in manufacturing sector, for the quarter October- December 2009, and their expectations for the ensuing quarter January-March 2010. The survey findings indicate that India’s manufacturing sector continued to strengthen, with business conditions improving at a robust pace. Further gains in output and new orders led companies in the sector to expand their input purchases and replenish their raw material stocks. The Business Expectation Index– a measure that gives a single snapshot of the industrial outlook in each quarter- registered further increase from 107.2 to 112.8 which indicates further strong improvement in the health of the manufacturing sector. Highlights The survey conducted in October- December 2009 signals continued improvement in the sentiments of the manufacturing sector which indicates that Indian manufacturing sector continued to recover further after a turnaround in April- June 2009, pointing towards a robust growth in the overall performance of the manufacturing sector.

-

The demand conditions show signs of further pick up in the survey quarter signalling towards sustained economic expansion. This is reflected from the improved growth in production, order books and export and import orders compared to previous quarter. This is also in line with the decrease in pending orders over previous quarters and the upward turn of capacity utilisation in current quarter. Moreover, a large proportion of respondents expected an average level in the inventory (both raw material and finished goods) for the current and ensuing quarters.

-

The financial conditions show a further convalescence as more respondents assessed ‘betterment’ of overall financial situation during the quarters under review. The working capital finance requirement has grown further during the last quarter of 2009-10, which suggests that demand for short term funds from the private sector may rise in the coming months. The availability of finance is expected to improve further. In a turnaround, the pressure on profit margins is expected to be relieved in the coming months; but with the return of pricing power, inflationary pressure may increase. As a sign of gradual return of the pricing power, the selling prices are expected to increase for the second successive quarter, albeit at a lower rate as compared to the previous quarter. According to the survey findings, the outlook for employment is also improving and firms are expected to increase their workforce on the back of expected increase in demand.

-

The recovery of economic growth appears to be more robust in view of the continuing consolidation of business confidence. The business expectations indices based on assessment for October- December 2009 and on expectations for next quarter were both in growth terrain and reached to 112.8 and 120.6 from 107.2 and 116.4 respectively.

-

The industry-wise break-up shows that while all the industry groups have positive overall business sentiments in the present quarter, specifically few industry groups, viz., Transport Equipment, Rubber & Plastic products, Electrical machinery, Basic Metals and Metal Products transport, Food products, and Pharmaceuticals and Fertilisers are more optimistic than the others. Food companies see high pricing power and high profits whereas Cement industry shows low order book and capacity utilisation, and the pressure on the profits and prices.

-

Size wise analysis shows that the improvement is seen across all size groups, but the bigger companies with annual production of Rs. 1000 crore or more are most optimistic and they expect high order book, building up inventory and return of pricing power. The smaller companies (annual production less than Rs 100 crore) though have improved; their growth is at a lower rate as compared to bigger companies.

Introduction The Reserve Bank of India has been conducting the Industrial Outlook Survey (IOS) on a quarterly basis since 1998. The Survey gives insight into the perception of the public and private limited companies engaged in manufacturing activities about their own performance and prospects. The survey covers selected non-financial private and public limited companies with a sufficient size/industry representation. The assessment of business sentiments for the current quarter and expectations for the ensuing quarter are based on qualitative responses on 20 major parameters covering overall business situation, financial situation, demand indicators, price and employment expectations, profit margins, etc. The survey provides useful forward looking inputs for policymakers, analysts and business alike. II. Data Coverage and Methodology1 II.1. Sample Size The sample covers about 3000 nonfinancial public and private limited companies, mostly with paid up capital above Rs. 50 lakh, in the manufacturing sector. The fieldwork for the survey was carried out by outsourcing it during the two-month period ending November 2009. The panel of respondents is kept uniform to the extent possible except for periodic updation in the case of addition of new companies or deletion of closed/merged companies. The sample is chosen so as to get a good representation of size and industry. II.2. Response to the Survey The survey elicited response from 1272 companies (44 per cent of the sample) within the stipulated time. Companies with incomplete or improperly filled-in schedules were excluded for the analysis. The study is based on responses of 1256 companies which were included in the analysis. II.3. The Survey Schedule The survey schedule predominantly consists of qualitative questions and the target respondents are senior management personnel or finance heads of the companies. The schedule canvassed on quarterly basis runs into two pages containing five blocks (Annex). III. Survey Findings The survey results are being published in a concise form in the Reserve Bank’s quarterly publication ‘Macroeconomic and Monetary Developments’ since 2005 and Monetary Policy statements. The survey findings of the 48th round conducted for October- December 2009 quarter are presented in this article. III.1. Demand conditions Survey collects perceptions of the Indian manufacturers about prominent demand related parameters namely Production, Order Books, Capacity Utilisation, Inventory, Exports and Imports. III.1.1. Production The questions on production seek the company’s assessment for October- December 2009 and expectations for January- March 2010 of Production (for all products), whether it will increase, decrease, or there will be no change. On the output front, the net responses on the assessment and expectations, for the quarter under study, went up to 28.9 and 40.0 per cent respectively from 22.6 and 35.0 per cent levels observed in the previous survey round. This shows a remarkable improvement in the demand condition.

Table 1 : Assessment & Expectations for Production |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

42.5 |

17.3 |

40.2 |

25.2 |

53.4 |

9.9 |

36.6 |

43.5 |

Oct-Dec 08 |

1178 |

36.0 |

24.9 |

39.1 |

11.1 |

48.8 |

9.0 |

42.1 |

39.8 |

Jan-Mar 09 |

1225 |

27.1 |

35.1 |

37.7 |

-8.0 |

41.8 |

15.8 |

42.3 |

26.0 |

Apr-Jun 09 |

1242 |

33.1 |

26.2 |

40.6 |

6.9 |

32.5 |

22.6 |

44.9 |

9.9 |

Jul-Sep 09 |

1180 |

40.9 |

18.3 |

40.8 |

22.6 |

38.5 |

16.1 |

45.5 |

22.4 |

Oct-Dec 09 |

1256 |

44.0 |

15.2 |

40.8 |

28.9 |

46.0 |

11.0 |

43.0 |

35.0 |

Jan-Mar 2010 |

|

|

|

|

|

48.8 |

8.8 |

42.3 |

40.0 |

III. 1. 2. Order Books The demand position of the manufacturing companies, as directly measured by order books, has marked improvement over the previous quarter; the net response going up from 20.5 per cent to 25.9 per cent. A similar sentiment was reflected in the expectation for the next quarter also. III. 1. 3. Pending orders The question was asked to the manufacturing companies to seek information whether pending orders for current and next quarter will be above normal, normal or below normal. It is seen that the assessment level for maintaining pending order ‘below normal’ for both assessment and expectations has decreased over preceding quarters as more companies shifted from below normal to normal level of pending order.

|

Table 2: Assessment & Expectations for Order books |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

40.8 |

16.4 |

42.8 |

24.4 |

47.5 |

9.0 |

43.5 |

38.5 |

Oct-Dec 08 |

1178 |

32.6 |

25.1 |

42.2 |

7.5 |

44.8 |

9.1 |

46.1 |

35.7 |

Jan-Mar 09 |

1225 |

22.9 |

39.7 |

37.4 |

-16.8 |

37.3 |

16.7 |

46.1 |

20.6 |

Apr-Jun 09 |

1242 |

28.4 |

29.3 |

42.3 |

-0.9 |

31.0 |

24.6 |

44.4 |

6.4 |

Jul-Sep 09 |

1180 |

38.2 |

17.7 |

44.1 |

20.5 |

35.5 |

18.7 |

45.8 |

16.8 |

Oct-Dec 09 |

1256 |

39.5 |

13.6 |

46.8 |

25.9 |

43.5 |

11.2 |

45.3 |

32.3 |

Jan-Mar 2010 |

|

|

|

|

|

44.8 |

9.1 |

46.1 |

35.8 |

III. 1. 4. Capacity Utilisation Another important economic variable indicative of demand in the economy is the utilisation of installed capacity. The survey has three questions on capacity utilisation. It collects views of manufacturing companies about Capacity Utilisation of main product (increase/ decrease/ no change), Level of capacity utilisation compared to the average in the last four quarters (above normal/ below normal/ normal) and Assessment of production capacity with regard to expected demand in next six months (more than adequate/ less than adequate/ adequate). More companies reported an increase in capacity utilisation compared to previous quarter, indicating further improvement in Capacity Utilisation, and this level of capacity utilisation is above normal seen in the context of capacity level attained in the last four quarters. The expectation for the next quarter echoed the similar sentiment with higher degree. Assessment of Production capacity with regard to expected demand in next six months shows that there will be adequate capacity as proportion of companies that expressed about adequate production capacity in meeting the demand for the next 6 months has remained same.

|

Table 3: Assessment & Expectations for Pending Orders |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Above Normal |

Below Normal |

Normal |

Net response (3-4) |

Above Normal |

Below Normal |

Normal |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

16.7 |

7.4 |

76.0 |

9.3 |

10.6 |

8.4 |

80.9 |

2.2 |

Oct-Dec 08 |

1178 |

19.2 |

5.6 |

75.2 |

13.6 |

11.3 |

6.7 |

82.0 |

4.6 |

Jan-Mar 09 |

1225 |

36.3 |

4.3 |

59.4 |

32.0 |

16.9 |

5.4 |

77.8 |

11.5 |

Apr-Jun 09 |

1242 |

29.1 |

4.5 |

66.5 |

24.6 |

28.0 |

4.8 |

59.4 |

23.2 |

Jul-Sep 09 |

1180 |

21.1 |

3.7 |

75.2 |

17.4 |

22.9 |

3.8 |

73.4 |

19.1 |

Oct-Dec 09 |

1256 |

17.1 |

5.6 |

77.3 |

11.6 |

15.2 |

4.2 |

80.6 |

11.0 |

Jan-Mar 10 |

|

|

|

|

|

12.2 |

6.5 |

81.3 |

5.7 |

III.1.5. Inventory of Raw materials & finished goods (in quantity terms) Survey questionnaire includes two questions about inventory level of the companies during current and ensuing quarter. Manufacturers are solicited to opine on the extent of raw material and finished goods inventory (both in quantity terms) in the form of 3-point scale, above average, average or below average level, where below average inventory was considered an optimistic response as it reflected better inventory management. The average level is computed as average of the levels at the end of four quarters during the corresponding preceding year.

|

Table 4: Per cent responses under Expectations for Capacity Utilisation |

(Percentage responses) |

Parameter |

Options |

Assessment for quarter |

Expectations for quarter |

July-Sep 2009 |

Oct-Dec 2009 |

Oct-Dec 2009 |

Jan-March 2010 |

1 |

2 |

3 |

4 |

5 |

6 |

Capacity Utilisation (main product) |

Increase |

28.3 |

31.3 |

32.9 |

34.3 |

No Change |

53.5 |

53.9 |

56.2 |

56.9 |

Decrease |

18.2 |

14.8 |

10.9 |

8.9 |

Net Response |

10.1 |

16.5 |

22.0 |

25.4 |

Level of Capacity Utilisation (compared to the average in last 4 quarters) |

Above normal |

10.2 |

12.3 |

10.1 |

12.6 |

Normal |

68.4 |

71.5 |

76.0 |

76.1 |

Below Normal |

21.4 |

16.2 |

13.9 |

11.3 |

Net Response |

-11.2 |

-3.9 |

-3.8 |

1.3 |

Assessment of Production Capacity (with regard to expected demand in next 6 months) |

More than adequate |

13.4 |

12.9 |

13.4 |

11.9 |

Adequate |

79.0 |

79.6 |

79.7 |

81.2 |

Less than adequate |

7.6 |

7.5 |

6.9 |

6.9 |

Net Response |

5.8 |

5.3 |

6.5 |

5.0 |

Majority of the respondents (81-85 per cent) reported no change in the level of Inventory of raw materials and Inventory of finished goods for the current quarter as well as ensuing quarter. The responses on level of Inventory (raw material and finished goods) in the current quarter shifted marginally from ‘below average’ to ‘average’ as compared to the previous quarter.

Table 5: Assessment & Expectations for Cost of raw material for Inventory |

(Percentage responses) |

Parameter |

Options |

Assessment for quarter |

Expectations for quarter |

July-Sep |

Oct-Dec |

Oct-Dec |

Jan-Mar |

|

|

2009 |

2009 |

2009 |

2010 |

1 |

2 |

3 |

4 |

5 |

6 |

Inventory of raw material |

Below average |

8.8 |

6.7 |

6.9 |

5.9 |

|

Average |

80.3 |

82.4 |

85.0 |

84.7 |

|

Above average |

10.9 |

10.9 |

8.1 |

9.4 |

|

Net Response |

-2.1 |

-4.2 |

-1.2 |

-3.6 |

Inventory of Finished goods |

Below average |

8.6 |

7.4 |

5.5 |

6.3 |

|

Average |

78.5 |

81.0 |

85.3 |

85.4 |

|

Above average |

12.9 |

11.6 |

9.2 |

8.2 |

|

Net Response |

-4.3 |

-4.3 |

-3.7 |

-1.9 |

Below average is optimistic |

III.1.6. Exports and Imports The external demand of manufacturing companies is gauged by the survey through their assessment and expectation of Exports and Imports. The companies report their perceptions in the form; increase, no change and decrease in Exports and Imports. The survey results show that the assessment and expectations about Export growth shows a speedy recovery in the respective quarters. The net responses for the current quarter has improved sharply as compared to previous quarter turning from negative to positive (-2.9 per cent to 9.2 per cent). A similar trend is echoed for the ensuing quarter where in the net response showed an increased to 20.2 per cent as compared to 12.5 per cent reported in July-September 2009 quarter. The net response on assessment and expectation for Import is also in the growth terrain. The sentiments have increased further from the preceding rounds for both the quarters under review (13.0 and 16.9 per cent respectively). The optimistic outlook for export and import gives an indication that the demand (external and domestic) for manufactured products is moving up in the current quarter as well as for the next quarter.

Table 6: Assessment & Expectations for Exports |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

36.0 |

13.6 |

50.4 |

22.4 |

36.4 |

8.7 |

54.9 |

27.7 |

Oct-Dec 08 |

1178 |

27.6 |

20.0 |

52.4 |

7.6 |

36.5 |

9.2 |

54.3 |

27.3 |

Jan-Mar 09 |

1225 |

17.8 |

34.8 |

47.4 |

-17.0 |

30.6 |

14.6 |

54.8 |

16.0 |

Apr-Jun 09 |

1242 |

17.4 |

30.9 |

51.7 |

-13.5 |

19.5 |

23.3 |

57.3 |

-3.8 |

Jul-Sep 09 |

1180 |

20.9 |

23.8 |

55.3 |

-2.9 |

20.6 |

20.5 |

59.0 |

0.1 |

Oct-Dec 09 |

1256 |

27.3 |

18.1 |

54.6 |

9.2 |

27.0 |

14.5 |

58.5 |

12.5 |

Jan-Mar 10 |

|

|

|

|

|

31.2 |

11.0 |

57.8 |

20.2 |

Table 7: Assessment & Expectations for Imports |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

28.5 |

7.8 |

63.8 |

20.7 |

27.4 |

6.1 |

66.5 |

21.3 |

Oct-Dec 08 |

1178 |

20.2 |

13.5 |

66.3 |

6.7 |

26.7 |

5.3 |

67.9 |

21.4 |

Jan-Mar 09 |

1225 |

13.7 |

22.1 |

64.2 |

-8.4 |

19.7 |

10.6 |

69.7 |

9.1 |

Apr-Jun 09 |

1242 |

17.1 |

18.4 |

64.5 |

-1.3 |

14.9 |

16.3 |

68.8 |

-1.4 |

Jul-Sep 09 |

1180 |

21.8 |

14.0 |

64.2 |

7.8 |

17 |

12.4 |

70.6 |

4.6 |

Oct-Dec 09 |

1256 |

23.3 |

10.3 |

66.5 |

13.0 |

21.3 |

9.8 |

68.9 |

11.5 |

Jan-Mar 10 |

|

|

|

|

|

23.4 |

6.5 |

70.1 |

16.9 |

III.2. Financial Situation The survey assesses sentiments about financial condition through five parameters, viz., Overall Financial Situation, Working Capital Finance Requirement (excluding internal sources of funds), Availability of Finance (both internal and external sources), Cost of External Finance and Profit Margin. III.2.1. Overall Financial Situation Indubitably corporates gauge a positive assessment about the Overall Financial Situation for the current quarter (October- December 2009), as more respondents assessed ‘betterment’ of overall financial situation during the current quarter. The net response showed further improvement (29.5 per cent from 21.8 per cent) as compared to preceding quarter. The expectations for the ensuing quarter (January-March 2010) also registered an improvement of optimism (net response of 39.3 per cent as compared to 33.5 per cent). The chart below reveals that there was a continuous sliding optimism on Overall Financial Situation since the beginning of 2008, which has rebounded from the 46 round of the survey (July - September 2009).

|

Table 8: Assessment & Expectations for Overall Financial Situation |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Better |

Worsen |

No change |

Net response (3-4) |

Better |

Worsen |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

31.0 |

15.7 |

53.3 |

15.3 |

39.9 |

7.2 |

53.0 |

32.7 |

Oct-Dec 08 |

1178 |

22.0 |

24.9 |

53.1 |

-2.9 |

37.6 |

9.9 |

52.5 |

27.7 |

Jan-Mar 09 |

1225 |

20.3 |

29.9 |

49.9 |

-9.6 |

31.6 |

15.2 |

53.2 |

16.4 |

Apr-Jun 09 |

1242 |

26.4 |

19.4 |

54.2 |

7.0 |

27.8 |

19.4 |

52.7 |

8.4 |

Jul-Sep 09 |

1180 |

34.3 |

12.5 |

53.2 |

21.8 |

32.8 |

12.8 |

54.4 |

20.0 |

Oct-Dec 09 |

1256 |

38.8 |

9.3 |

51.8 |

29.5 |

40.5 |

7.0 |

52.5 |

33.5 |

Jan-Mar 10 |

|

|

|

|

|

44.3 |

5.0 |

50.6 |

39.3 |

III.2.2. Working Capital Finance requirement and Availability of Finance The assessment and expectations on the Working capital finance requirement (excluding internal source of funds) for the period under review registered marginal improvement. The net response for assessment increased from 23.8 per cent to 28.8 percent and 30.4 per cent to 32.7 per cent for expectation. Although about 63 per cent of respondents do not see any change in Availability of Finance (from both internal as well as external sources) during the quarters under study, the net optimism has been enhanced. The quarterly movements of Working Capital Finance Requirements (WCFR) and Availability of Finance (both internal and external sources), presented in the chart 7 below, shows that for ensuing quarter, the manufacturers’ expect their WCFR and availability of finance to improve marginally.

|

Table 9: Assessment & Expectations for Working capital finance requirement |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

41.4 |

6.5 |

52.0 |

34.9 |

38.1 |

4.5 |

57.3 |

33.6 |

Oct-Dec 08 |

1178 |

41.1 |

6.8 |

52.1 |

34.3 |

38.1 |

4.3 |

57.7 |

33.8 |

Jan-Mar 09 |

1225 |

36.0 |

11.9 |

52.1 |

24.1 |

37.9 |

5.0 |

57.1 |

32.9 |

Apr-Jun 09 |

1242 |

57.0 |

24.6 |

9.2 |

24.6 |

31.1 |

7.9 |

61.0 |

23.2 |

Jul-Sep 09 |

1180 |

31.2 |

7.4 |

61.4 |

23.8 |

32.3 |

6.0 |

61.7 |

26.3 |

Oct-Dec 09 |

1256 |

35.2 |

6.4 |

58.4 |

28.8 |

34.7 |

4.3 |

61.0 |

30.4 |

Jan-Mar 10 |

|

|

|

|

|

36.8 |

4.0 |

59.2 |

32.7 |

III.2.3 Cost of External Finance The cost of external finance was included in the survey schedule from the current survey (Round 48) onwards. The respondents are asked to express their opinion on a three point scale viz; Increase/ Decrease/ No change about their perceptions of cost of funds. About two third of the respondents opined ‘no change’ in cost of external finance for both the quarters under review. III.2.4. Profit margin Survey asks manufacturing companies whether in their opinion profit margin (gross profits as percentage at net sales) is expected to increase, decrease or remain same. The sentiments on Profit margin for the current quarter of the survey though improving, are still in the contraction terrain. However, the extent of pessimism has declined compared to preceding quarter. The sentiments on expectation for the ensuing quarter has moved from negative to positive (-2.8 per cent to 1.1per cent).

Table 10: Assessment & Expectations for Availability of Finance |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Improve |

Worsen |

No change |

Net response (3-4) |

Improve |

Worsen |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

27.7 |

11.5 |

60.8 |

16.2 |

36.1 |

5.9 |

57.9 |

30.2 |

Oct-Dec 08 |

1178 |

21.4 |

23.1 |

55.5 |

-1.7 |

32.1 |

8.8 |

59.0 |

23.3 |

Jan-Mar 09 |

1225 |

19.2 |

21.7 |

59.1 |

-2.5 |

28.7 |

15.0 |

56.3 |

13.7 |

Apr-Jun 09 |

1242 |

24.8 |

13.6 |

61.6 |

11.2 |

23.8 |

14.5 |

61.7 |

9.3 |

Jul-Sep 09 |

1180 |

28.0 |

8.8 |

63.2 |

19.2 |

27.0 |

10.4 |

62.6 |

16.6 |

Oct-Dec 09 |

1256 |

30.3 |

7.2 |

62.5 |

23.0 |

31.7 |

5.6 |

62.7 |

26.1 |

Jan-Mar 10 |

|

|

|

|

|

33.7 |

4.5 |

61.8 |

29.2 |

III.3. Price and Employment Expectation Prices related three questions were canvassed in the survey. The questions sought increase, decrease or no change in the Cost of Raw Material and those of Selling Prices (ex-factory unit prices); and if there was an increase expected on Selling Prices and if so, about the rate of increase in the Selling Prices (at higher/lower/similar rate). III.3.1. Cost of raw material The net response on cost of raw material of the reporting companies declined further in both the quarters under review, as compared to the previous round indicating that the manufactures are more concerned about the cost of raw material. This is due to the reason that more respondents opine ‘increase’ in raw material prices as compared to preceding quarter. Thus the manufacturing corporates feel that their input price inflation is likely to increase. The murk that prevailed in profit margin had reduced as compared to previous round, which in turn will have an influence in the selling price.

Table 11: Assessment & Expectations for Profit margin |

(Percentage responses) |

Survey Quarter |

Total response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

18.1 |

32.8 |

49.0 |

-14.7 |

22.0 |

18.2 |

59.8 |

3.8 |

Oct-Dec 08 |

1178 |

14.4 |

41.0 |

44.6 |

-26.6 |

20.8 |

24.4 |

54.7 |

-3.6 |

Jan-Mar 09 |

1225 |

11.3 |

48.8 |

39.8 |

-37.5 |

16.9 |

29.8 |

53.3 |

-12.9 |

Apr-Jun 09 |

1242 |

13.4 |

38.5 |

48.1 |

-25.1 |

15.4 |

34.0 |

50.6 |

-18.6 |

Jul-Sep 09 |

1180 |

16.9 |

32.0 |

51.1 |

-15.1 |

16.0 |

29.4 |

54.5 |

-13.4 |

Oct-Dec 09 |

1256 |

18.1 |

28.0 |

54.0 |

-9.9 |

20.2 |

23.0 |

56.8 |

-2.8 |

Jan-Mar 10 |

|

|

|

|

|

21.1 |

20.1 |

58.8 |

1.1 |

III.3.2. Selling price Survey seeks responses from manufacturing corporate about ex-factory Selling Prices. In case of multi-product companies, they are requested to take into account the average of the price changes. Optimism level for Selling prices (‘increase in selling price’) for the current quarterthough registered a minor fall, the net response has increased from 0.2 to 2.6 percent. However, corporates expected the optimism level to increase in the ensuing quarter which is mainly due to increase in proportion of ‘no change in selling price’ as a decline in the percentage of respondents who opined a decrease in selling price as compared to previous round is seen. While 15.9 percent corporates opined about a ‘decline’ in the selling prices in the current quarter, only 10.9 expected this decline to continue inJanuary- March 2010 as well. Among the respondents that viewed an ‘increase’ in selling prices, 29.1 per cent of respondents viewed the increase to be ‘at lower rate’.

Table 12: Assessment & Expectations for Cost of raw material |

(Percentage responses) |

Survey Quarter |

Total

response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

1.4 |

80.8 |

17.8 |

-79.4 |

3.1 |

57.8 |

39.1 |

-54.7 |

Oct-Dec 08 |

1178 |

14.1 |

60.1 |

25.8 |

-46.0 |

3.3 |

64.4 |

32.3 |

-61.1 |

Jan-Mar 09 |

1225 |

29.1 |

37.2 |

33.7 |

-8.1 |

12.3 |

48.0 |

39.7 |

-35.7 |

Apr-Jun 09 |

1242 |

14.3 |

40.6 |

45.1 |

-26.3 |

14.3 |

30.5 |

33.7 |

-16.2 |

Jul-Sep 09 |

1180 |

8.1 |

49.8 |

42.1 |

-41.7 |

8.7 |

35.8 |

55.5 |

-27.1 |

Oct-Dec 09 |

1256 |

6.3 |

53.4 |

40.3 |

-47.1 |

5.0 |

43.4 |

51.6 |

-38.4 |

Jan-Mar 10 |

|

|

|

|

|

3.6 |

47.9 |

48.5 |

-44.3 |

Table 13: Assessment & Expectations for Selling Price |

(Percentage responses) |

Survey Quarter |

Total

response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

41.7 |

8.2 |

50.1 |

33.5 |

29.7 |

8.7 |

61.5 |

21.0 |

Oct-Dec 08 |

1178 |

23.2 |

23.7 |

53.1 |

-0.5 |

34.3 |

8.1 |

57.6 |

26.2 |

Jan-Mar 09 |

1225 |

12.5 |

38.0 |

49.5 |

-25.5 |

21.2 |

17.1 |

61.7 |

4.1 |

Apr-Jun 09 |

1242 |

17.0 |

24.4 |

58.0 |

-7.4 |

14.5 |

23.6 |

61.9 |

-9.1 |

Jul-Sep 09 |

1180 |

19.4 |

19.2 |

61.4 |

0.2 |

17.2 |

17.2 |

65.6 |

0.0 |

Oct-Dec 09 |

1256 |

18.6 |

15.9 |

65.5 |

2.6 |

19.2 |

13.2 |

67.6 |

6.0 |

Jan-Mar 10 |

|

|

|

|

|

20.7 |

10.9 |

68.4 |

9.8 |

III.3.3. Employment Industrial Outlook Survey seeks from the companies their perceptions on employment change at their company. Employment includes all cadres comprising full-time, part-time and casuallabour. The employment outlook of Indian manufacturing has continued its U-turn recovery in the current quarter (October- December 2009). The companies perceived to be net hirer in the current quarter compared to the last quarter (net response from 4.1 percent to 10.3 percent). Marked improvement also observed in the employment expectation for the January- March 2010. Around 74-76 per cent of companies did not expect any change in their employment position.

|

Table 14: Assessment & Expectations for Employment outlook |

(Percentage responses) |

Survey Quarter |

Total

response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Increase |

Decrease |

No change |

Net response (3-4) |

Increase |

Decrease |

No change |

Net response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

23.5 |

9.4 |

67.1 |

14.1 |

22.2 |

6.4 |

71.5 |

15.8 |

Oct-Dec 08 |

1178 |

18.7 |

9.3 |

72.0 |

9.4 |

23.1 |

6.5 |

70.4 |

16.6 |

Jan-Mar 09 |

1225 |

11.2 |

19.5 |

69.3 |

-8.3 |

16.0 |

8.3 |

75.7 |

7.7 |

Apr-Jun 09 |

1242 |

11.9 |

15.2 |

72.9 |

-3.3 |

10.5 |

15.6 |

74.0 |

-5.1 |

Jul-Sep 09 |

1180 |

14.2 |

10.1 |

75.7 |

4.1 |

11.5 |

10.0 |

78.6 |

1.5 |

Oct-Dec 09 |

1256 |

18.2 |

7.9 |

73.9 |

10.3 |

15.8 |

7.0 |

77.2 |

8.8 |

Jan-Mar 10 |

|

|

|

|

|

18.2 |

6.1 |

75.6 |

12.1 |

III.4. Overall business conditions III.4.1: Overall Business Situation The Overall Business Situation is a parameter that provides the overall confidence of manufacturing companies. The companies are enquired if their overall business situation would become better/ worse /remain same. The net response for assessment about the Overall business situation during the current quarter October- December 2009 shows marked improvement from 26.3 per cent to the levelof 36.0 per cent in the previous quarter. Similarly the net response for expectation has also shown a rising trend (from 39.8 per cent to 44.9 per cent). The net response assessment and expectation for the last six quarters, presented in Table:15, shows the trend of sharp improvement in business sentiments from the previous quarters. These upward movements of assessment and expectations with respect to previous periods under comparison are statistically significant. The movement of the overall business situation is presented in chart 11.

|

Table 15: Assessment & Expectations of Overall Business Situation |

(Percentage responses) |

Survey Quarter |

Total

response |

Assessment for Current Quarter |

Expectation for Next Quarter |

Better |

Worsen |

No

change |

Net

response (3-4) |

Better |

Worsen |

No

change |

Net

response (7-8) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Jul-Sep 08 |

1032 |

39.3 |

16.7 |

44.0 |

22.6 |

49.6 |

7.8 |

42.6 |

41.8 |

Oct-Dec 08 |

1178 |

30.2 |

26.2 |

43.6 |

4.0 |

44.8 |

11.1 |

44.1 |

33.7 |

Jan-Mar 09 |

1225 |

24.1 |

35.2 |

40.7 |

-11.1 |

38.6 |

17.5 |

43.9 |

21.1 |

Apr-Jun 09 |

1242 |

30.7 |

21.4 |

47.9 |

9.3 |

31.8 |

20.6 |

47.6 |

11.2 |

Jul-Sep 09 |

1180 |

39.3 |

13.0 |

47.7 |

26.3 |

38.8 |

14.6 |

46.7 |

24.2 |

Oct-Dec 09 |

1256 |

46.0 |

10.1 |

43.9 |

36.0 |

47.2 |

7.4 |

45.4 |

39.8 |

Jna-Mar 10 |

|

|

|

|

|

50.4 |

5.5 |

44.2 |

44.9 |

III.4.2: Business Expectation Index Business Expectation Index gives a single snapshot of the industrial outlook in each study quarter. This index is computed based on weighted average of responses from different industries on selected 9 out of the 20 performance parameters. These parameters are Overall Business Situation, Production, Order Books, Inventory of Raw Materials, Inventory of Finished Goods, Profit Margin, Employment, Exports, and Capacity Utilization. The present round of the survey shows further improvement in the BEI by 5 per cent over the preceding round (July- September 2009). The BEI for October- December 2009 at 112.8 increased from 107.2; and for ensuing quarter, it has increased to 120.6 as compared to 116.4 seen in the previous quarter. III.5: Industry-wise analysis2 Transport Equipment (86), Rubber & Plastic products (91), Electrical machinery (86), Basic Metals and Metal Products (150), Food Products (116), Pharmaceuticals & Medicines (70) and Basic Chemicals (107) industries are generally optimistic about their overall business situation for January- March 2010. They expect demand conditions to improve, and thus higher levels of production and capacity utilization. Their overall financial situation is good, working capital finance requirement will go up and availability of finance is expected to be comfortable. Paper and Paper Product industry is expecting an increase in their input prices. The industries having weak, though positive, overall business sentiments are Paper and paper products (35), Cement (25) and Other Industries (98).

|

|

Table 16: Industry-wise analysis |

Net Response (%) for January-March 2010 |

|

Industry |

Production |

Financial

Situation |

Profit

margin |

Employment |

Overall Business

Situation |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

1 |

Transport Equipment |

56.8 |

61.2 |

-2.4 |

25.9 |

62.4 |

2 |

Rubber & Plastic products |

54.7 |

48.9 |

6.8 |

23.3 |

56.8 |

3 |

Electrical machinery |

57.0 |

44.2 |

3.5 |

21.4 |

52.3 |

4 |

Other Machinery & Appratus |

49.7 |

46.2 |

3.9 |

12.0 |

51.3 |

5 |

Basic Metals & Metal products |

43.0 |

41.6 |

1.4 |

15.6 |

49.7 |

6 |

Food products |

36.9 |

42.5 |

11.6 |

11.4 |

49.6 |

7 |

Pharmecutical & Medicines |

39.1 |

45.7 |

2.9 |

11.6 |

47.1 |

8 |

Basic Chemicals |

35.0 |

35.2 |

2.9 |

5.6 |

43.4 |

9 |

Fertilisers |

30.4 |

13.6 |

9.1 |

4.3 |

34.8 |

10 |

Textiles |

24.9 |

27.4 |

-4.1 |

13.1 |

34.7 |

11 |

Wood & wood products |

20.0 |

37.5 |

-6.3 |

6.3 |

31.3 |

12 |

Diversified companies |

69.2 |

30.8 |

8.3 |

7.7 |

30.8 |

13 |

Cement |

44.0 |

32.0 |

-8.0 |

0.0 |

28.0 |

14 |

Other industries |

19.1 |

27.6 |

-7.3 |

-5.3 |

27.6 |

15 |

Paper & Paper products |

26.5 |

17.1 |

-17.6 |

-5.7 |

20.0 |

All Industries |

40.0 |

39.3 |

1.1 |

12.1 |

44.9 |

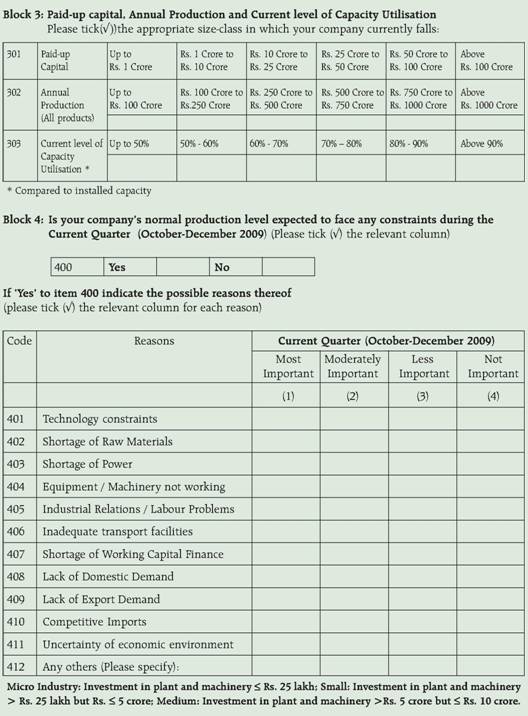

III.6: Size-wise analysis Annual production and Paid-up Capital (PUC) Bigger companies (annual production above Rs. 1000 crore) are more positive about overall business & financial situation and working capital finance requirement. The smaller companies (annual production less than Rs. 100 crore) are less optimistic about demand conditions as observed from their net responses on production, order books and capacity utilization which are at lower level than that of the larger ones. They also expect a contraction in their exports. Bigger companies are more positive about domestic and external demand. The smaller companies feel more pressure on the input price and availability of finance than their bigger counterparts. Bigger companies are expected to be net hirer; the smaller firms will continue to shed jobs. Though all firms expect a net decline in their profit margins, the small and medium firms are the worst hit. A similar trend is inferred based on the PUC size wise analysis also. III.7. Constraints for attaining the normal production level The net responses for attaining the normal production level during the quarter October- December 2009 has remained at 52 per cent which is slightly lower compared to last survey round (56 per cent). The constraints reported are due to ‘Lack of domestic demand’, ‘Lack of export demand’, ‘Shortage of Power’, ‘Uncertainty of economic environment’, and Shortage of Working Capital Finance. The major industry groups for which higher proportion of companies reported production constraints are ‘Paper and paper products’ (66 per cent) ‘Diversified’ (62 per cent) and ‘Fertilizers’ (61 per cent). On the other end of the spectrum, only 31 per cent of ‘Wood and wood products’, 34 per cent of ‘Pharmaceutical’ companies had reported production constraints. Smaller companies, in terms of their annual production, paid-up capital and lower level of capacity utilisation felt production constraints more than the bigger ones.

Table 17: Size-wise analysis: Annual production and Paid-up Capital (PUC) |

|

Production- wise

Net response(%) for Jan-March 2010 |

PUC- wise

Net response(%) for Jan-March 2010 |

Small firms-

(Production less than Rs. 100 Crore) |

Medium

firms-

(Production more than

Rs. 100 Crore& less than 1000Cr) |

Large firms-

(Production Rs. 1000 Crore or more) |

Small Firms-(PUC

|

Medium firms-(PUC>1Cr& < 100Cr) |

Large firms- (PUC > Rs. 100 Cr) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

|

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Rd |

Characteristic |

47 |

48 |

47 |

48 |

47 |

48 |

47 |

48 |

47 |

48 |

47 |

48 |

Production |

28.4 |

32.6 |

38.9 |

45.7 |

47.4 |

47.1 |

23.6 |

26.0 |

35.1 |

41.4 |

55.0 |

43.3 |

Order book |

28.1 |

29.7 |

35.2 |

40.7 |

41.3 |

42.9 |

26.4 |

19.6 |

32.2 |

38.1 |

46.9 |

28.1 |

Exports |

3.2 |

15.6 |

18.2 |

23.0 |

27.0 |

27.4 |

-1.0 |

3.9 |

13.9 |

22.6 |

14.9 |

11.1 |

Raw material inventory |

1.1 |

-1.8 |

-4.1 |

-4.9 |

-1.5 |

-5.6 |

-5.9 |

-10.7 |

-0.4 |

-2.6 |

-4.9 |

-5.9 |

Finished goods inventory |

-2.6 |

0.9 |

-4.8 |

-3.2 |

-3.9 |

-8.9 |

-4.4 |

-0.8 |

-3.6 |

-1.7 |

-3.5 |

-6.3 |

Capacity utilisation |

16.7 |

17.5 |

25.1 |

31.3 |

31.3 |

35.2 |

14.4 |

9.8 |

22.4 |

27.2 |

30.0 |

26.1 |

Input price |

-41.9 |

-43.9 |

-35.5 |

-47.2 |

-35.2 |

-33.3 |

-39.4 |

-53.8 |

-39.0 |

-43.6 |

-27.8 |

-37.7 |

Output price |

4.0 |

5.6 |

9.2 |

12.8 |

3.2 |

14.5 |

2.5 |

8.1 |

6.9 |

10.0 |

-1.6 |

8.7 |

Employment |

5.3 |

8.1 |

11.7 |

14.9 |

12.1 |

17.1 |

3.3 |

-0.8 |

9.5 |

14.3 |

8.2 |

1.4 |

Overall financial situation |

26.4 |

31.5 |

39.4 |

45.1 |

41.2 |

49.2 |

23.8 |

28.8 |

34.6 |

40.9 |

35.0 |

40.3 |

Working capital finance requirement |

28.3 |

27.5 |

31.7 |

36.2 |

34.4 |

41.9 |

18.0 |

22.8 |

31.7 |

33.6 |

34.5 |

35.5 |

|

III.8. Business Confidence Surveys of other Agencies Comparison of other business indices are briefly outlined below.

Business Confidence Surveys of other Agencies |

Parameter |

Dun & Bradstreet |

NCAER |

FICCI |

PMI |

RBI |

1 |

2 |

3 |

4 |

5 |

6 |

Coverage |

Service and Manufacturing companies in both Public and Private Sector |

Manufacturing

companies |

Manufacturing

companies in

Private &

Public Sector |

Sample size |

– |

545 |

358 |

<420 |

1256 |

Index |

Business

Optimism

Index |

Business

Confidence

Index |

Overall

Business

Confidence

Index |

Purchasing

Managers'

Index |

Business

Expectations

Index |

Period |

Oct-Dec 2009 |

Sep-09 |

Q2 2009-10 |

Oct-Dec 2009 |

Jan-Mar 2010 |

Index based on current survey |

143.2 |

143.7 |

72.4 |

54.4 |

120.6 |

Index based on previous survey |

132.1 |

118.6 |

67.2 |

54.5 |

116.4 |

Index based on one year back survey |

138.9 |

119.9 |

37.8 |

47.5 |

111.9 |

% change q-o-q |

8.4 |

21.2 |

7.7 |

-0.2 * |

3.6 |

% change y-o-y |

3.1 |

19.8 |

91.5 |

14.5 |

7.8 |

* Change over previous month. |

III.9. Survey Results and Official Statistics The Business Expectations Indices (BEI) based on the information gathered on critical parameters in the Industrial Outlook Survey provides the private manufacturing sector’s aggregate assessment of the current quarter and outlook for the ensuing quarter. Chart 14 shows the co-movements of annual growth rates of quarterly GDP-Manufacturing (at 1999-00 prices), IIP-Manufacturing (base: 1993-94=100) and the BEI based on assessment and expectations. Movements in BEI appear to be closely leading the official output indicators in general as well as imminent upturn in growth released subsequently.

|

Statement 1 : Assessment of the Industrial performance for the October-December 2009 &

Expectations of the Industrial performance for the quarter January-March 2010 |

(Percentage of responding companies) |

Parameter |

Assessment

(October-December 2009)

Scenario |

Expectations

(January-March 2010)

Scenario |

Optimistic

(Positive) |

Pessimistic

(Negative) |

No

Change |

Net

response

(Col. 2 -

Col. 3) |

Optimistic

(Positive) |

Pessimistic

(Negative) |

No

Change |

Net

response

(Col. 6 -

Col. 7) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1 |

Overall Business Situation |

46.0 |

10.1 |

43.9 |

36.0 |

50.4 |

5.5 |

44.2 |

44.9 |

2 |

Financial Situation |

38.8 |

9.3 |

51.8 |

29.5 |

44.3 |

5.0 |

50.6 |

39.3 |

3 |

Working Capital Finance requirement |

35.2 |

6.4 |

58.4 |

28.8 |

36.8 |

4.0 |

59.2 |

32.7 |

4 |

Availability of Finance |

30.3 |

7.2 |

62.5 |

23.0 |

33.7 |

4.5 |

61.8 |

29.2 |

5 |

Cost of external finance |

9.0 |

23.8 |

67.2 |

-14.7 |

6.8 |

25.1 |

68.1 |

-18.3 |

6 |

Production |

44.0 |

15.2 |

40.8 |

28.9 |

48.8 |

8.8 |

42.3 |

40.0 |

7 |

Order Books |

39.5 |

13.6 |

46.8 |

25.9 |

44.8 |

9.1 |

46.1 |

35.8 |

8 |

Pending Orders, if applicable |

17.1 |

5.6 |

77.3 |

11.6 |

12.2 |

6.5 |

81.3 |

5.7 |

9 |

Cost of raw material |

6.3 |

53.4 |

40.3 |

-47.1 |

3.6 |

47.9 |

48.5 |

-44.3 |

10 |

Inventory of Raw Material |

6.7 |

10.9 |

82.4 |

-4.2 |

5.9 |

9.4 |

84.7 |

-3.6 |

11 |

Inventory of Finished goods |

7.4 |

11.6 |

81.0 |

-4.3 |

6.3 |

8.2 |

85.4 |

-1.9 |

12 |

Capacity Utilisation (Main product) |

31.3 |

14.8 |

53.9 |

16.5 |

34.3 |

8.9 |

56.9 |

25.4 |

13 |

Level of Capacity Utilisation (Compared to the average in preceding four quarters) |

12.3 |

16.2 |

71.5 |

-3.9 |

12.6 |

11.3 |

76.1 |

1.3 |

14 |

Assessment of the Production Capacity (With regard to expected demand in next six months) |

12.9 |

7.5 |

79.6 |

5.3 |

11.9 |

6.9 |

81.2 |

5.0 |

15 |

Employment in the Company |

18.2 |

7.9 |

73.9 |

10.3 |

18.2 |

6.1 |

75.6 |

12.1 |

16 |

Exports, if applicable |

27.3 |

18.1 |

54.6 |

9.2 |

31.2 |

11.0 |

57.8 |

20.2 |

17 |

Imports, if any |

23.3 |

10.3 |

66.5 |

13.0 |

23.4 |

6.5 |

70.1 |

16.9 |

18 |

Selling Prices |

18.6 |

15.9 |

65.5 |

2.6 |

20.7 |

10.9 |

68.4 |

9.8 |

19 |

If Increase Expected in Selling Prices, rate of increase |

29.1 |

9.8 |

61.1 |

19.3 |

27.2 |

10.4 |

62.3 |

16.8 |

20 |

Profit Margin |

18.1 |

28.0 |

54.0 |

-9.9 |

21.1 |

20.1 |

58.8 |

1.1 |

Statement 2: Net Response on Assessment of Industrial Performance Over

the Latest Six Quarterly Rounds of the Industrial Outlook Survey |

(Per cent) |

Parameter |

Optimistic

Response |

Apr-Jun

2008

(1039) |

July-Sep

2008

(1032) |

Oct-Dec

2008

(1178) |

Jan-Mar

2009

(1225) |

Apr-Jun

2009

(1242) |

July-Sep

2009

(1180) |

Oct-Dec

2009

(1256) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1 |

Overall business situation |

Better |

31.0 |

22.6 |

4.0 |

-11.1 |

9.3 |

26.3 |

36.0 |

2 |

Financial situation |

Better |

25.1 |

15.3 |

-2.9 |

-9.6 |

7.0 |

21.8 |

29.5 |

3 |

Working capital finance requirement |

Increase |

35.7 |

34.9 |

34.3 |

24.1 |

24.6 |

23.8 |

28.8 |

4 |

Availability of finance |

Improve |

26.4 |

16.2 |

-1.7 |

-2.5 |

11.2 |

19.2 |

23.0 |

5 |

Cost of external finance * |

Decrease |

|

|

|

|

|

|

-14.7 |

6 |

Production |

Increase |

33.6 |

25.2 |

11.1 |

-8.0 |

6.9 |

22.6 |

28.9 |

7 |

Order books |

Increase |

29.7 |

24.4 |

7.5 |

-16.8 |

-0.9 |

20.5 |

25.9 |

8 |

Pending Orders, if applicable |

Below normal |

5.8 |

9.3 |

13.6 |

32.0 |

24.6 |

17.4 |

11.6 |

9 |

Cost of raw material |

Decrease |

-68.9 |

-79.4 |

-46.0 |

-8.1 |

-26.3 |

-41.7 |

-47.1 |

10 |

Inventory of raw material |

Below average |

-4.3 |

-7.0 |

-4.8 |

-1.8 |

-2.4 |

-2.1 |

-4.2 |

11 |

Inventory of finished goods |

Below average |

-3.9 |

-4.0 |

-8.4 |

-13.1 |

-4.2 |

-4.3 |

-4.3 |

12 |

Capacity utilization (Main product) |

Increase |

17.7 |

13.6 |

1.7 |

-16.3 |

-3.7 |

10.1 |

16.5 |

13 |

Level of capacity utilization (Compared to the average in preceding four quarters) |

Above normal |

-1.5 |

-4.1 |

-12.0 |

-29.3 |

-19.2 |

-11.2 |

-3.9 |

14 |

Assessment of the production capacity (With regard to expected demand in next six months) |

More than adequate |

4.0 |

5.0 |

12.1 |

8.3 |

4.6 |

5.8 |

5.3 |

15 |

Employment in the company |

Increase |

16.4 |

14.1 |

9.4 |

-8.3 |

-3.3 |

4.1 |

10.3 |

16 |

Exports, if applicable |

Increase |

20.0 |

22.4 |

7.6 |

-17.0 |

-13.5 |

-2.9 |

9.2 |

17 |

Imports, if any |

Increase |

20.5 |

20.7 |

6.7 |

-8.4 |

-1.3 |

7.8 |

13.0 |

18 |

Selling prices are expected to |

Increase |

23.6 |

33.5 |

-0.5 |

-25.5 |

-7.4 |

0.2 |

2.6 |

19 |

If increase expected in selling prices |

Increase atlower rate |

-2.4 |

-0.5 |

1.2 |

31.7 |

11.0 |

23.2 |

19.3 |

20 |

Profit margin |

Increase |

-5.3 |

-14.7 |

-26.6 |

-37.5 |

-25.1 |

-15.1 |

-9.9 |

* : This parameter has been included in the schedule from the current survey round (Rd 48).

Note: Italicised figures in bracket represent number of companies covered in the report. |

Statement 3: Net Response on Expectations of Industrial Performance Over

the Latest Seven Quarterly Rounds of the Industrial Outlook Survey |

(Per cent) |

Parameter |

Optimistic

Response |

July-Sep

2008

(1039) |

Oct-Dec

2008

(1032) |

Jan-Mar

2009

(1178) |

Apr-Jun

2009

(1225) |

July-Sep

2009

(1242) |

Oct-Dec

2009

(1180) |

Jan-Mar

2010

(1256) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

1 |

Overall business situation |

Better |

41.8 |

33.7 |

21.1 |

11.2 |

24.2 |

39.8 |

44.9 |

2 |

Financial situation |

Better |

32.7 |

27.7 |

16.4 |

8.4 |

20.0 |

33.5 |

39.3 |

3 |

Working capital finance requirement |

Increase |

33.6 |

33.8 |

32.9 |

23.2 |

26.3 |

30.4 |

32.7 |

4 |

Availability of finance |

Improve |

30.2 |

23.3 |

13.7 |

9.3 |

16.6 |

26.1 |

29.2 |

5 |

Cost of external finance * |

Decrease |

|

|

|

|

|

|

-18.3 |

6 |

Production |

Increase |

43.5 |

39.8 |

26.0 |

9.9 |

22.4 |

35.0 |

40.0 |

7 |

Order books |

Increase |

38.5 |

35.7 |

20.6 |

6.4 |

16.8 |

32.3 |

35.8 |

8 |

Pending Orders, if applicable |

Below normal |

2.2 |

4.6 |

11.5 |

23.2 |

19.1 |

11.0 |

5.7 |

9 |

Cost of raw material |

Decrease |

-54.7 |

-61.1 |

-35.7 |

-16.2 |

-27.1 |

-38.4 |

-44.3 |

10 |

Inventory of raw material |

Below average |

-3.8 |

-7.6 |

-3.3 |

1.1 |

-0.5 |

-1.2 |

-3.6 |

11 |

Inventory of finished goods |

Below average |

-1.5 |

-4.3 |

-4.4 |

-4.4 |

-1.8 |

-3.7 |

-1.9 |

12 |

Capacity utilization (Main product) |

Increase |

22.2 |

26.4 |

12.3 |

-0.7 |

10.7 |

22.0 |

25.4 |

13 |

Level of capacity utilization (Compared to the average in preceding four quarters) |

Above normal |

3.6 |

-0.5 |

-7.4 |

-20.8 |

-12.1 |

-3.8 |

1.3 |

14 |

Assessment of the production capacity (With regard to expected demand in next six months) |

More than adequate |

4.6 |

5.7 |

11.8 |

8.9 |

5.5 |

6.5 |

5.0 |

15 |

Employment in the company |

Increase |

15.8 |

16.6 |

7.7 |

-5.1 |

1.5 |

8.8 |

12.1 |

16 |

Exports, if applicable |

Increase |

27.7 |

27.3 |

16.0 |

-3.8 |

0.1 |

12.5 |

20.2 |

17 |

Imports, if any |

Increase |

21.3 |

21.4 |

9.1 |

-1.4 |

4.6 |

11.5 |

16.9 |

18 |

Selling prices are expected to |

Increase |

21.0 |

26.2 |

4.1 |

-9.1 |

0.0 |

6.0 |

9.8 |

19 |

If increase expected in selling prices |

Increase at lower rate |

3.0 |

0.6 |

0.9 |

25.9 |

-100.0 |

19.4 |

16.8 |

20 |

Profit margin |

Increase |

3.8 |

-3.6 |

-12.9 |

-18.6 |

-13.4 |

-2.8 |

1.1 |

* : This parameter has been included in the schedule from the current survey round (Rd 48).

Note: Italicised figures in bracket represent number of companies covered in the report. |

Statement 4: Comparative scenarios pertaining to Assessment for the Current Quarter and

Expectations for the Expectation Quarter based on the Net Responses for all parameters from a year

ago, previous and current quarter surveys (i.e. Round 44, 47 and 48 respectively) |

Parameter Optimism |

Assessment

Criteria |

Assessment |

Expectation |

Net Response (%) |

Differences in net

response of current

quarter of current

survey over current

quarter of |

Net Response (%) |

Differences in net

response of

Expectation quarter

of current survey

over Expectation

quarter of |

Assess

ment

quarter

of a year

ago

survey |

Assess

ment

quarter

of

previous

survey |

Assess

ment

quarter

of

current

survey |

A year

ago

survey |

Pervious

quarter

survey |

Expecta-

tion

quarter

of a year

ago

survey |

Expecta-

tion

quarter

of

previous

survey |

Expecta-

tion

quarter

of

current

survey |

A year

ago

survey |

Pervi

ous

quarter

survey |

Oct-Dec 08 |

July-Sept 09 |

Oct-Dec09 |

(5) -

(3) |

(5) -

(4) |

Jan-Mar 09 |

Oct-Dec 09 |

Jan-Mar 10 |

(10) -

(8) |

(10) -

(9) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

1 |

Overall business situation |

Better |

4.0 |

26.3 |

36.0 |

32.0 |

9.7 |

21.1 |

39.8 |

44.9 |

23.8 |

5.1 |

2 |

Financial situation |

Better |

-2.9 |

21.8 |

29.5 |

32.4 |

7.7 |

16.4 |

33.5 |

39.3 |

22.9 |

5.8 |

3 |

Working capital finance requirement |

Increase |

34.3 |

23.8 |

28.8 |

-5.5 |

5.0 |

32.9 |

30.4 |

32.7 |

-0.2 |

2.3 |

4 |

Availability of finance |

Improve |

-1.7 |

19.2 |

23.0 |

24.7 |

3.8 |

13.7 |

26.1 |

29.2 |

15.5 |

3.1 |

5 |

Cost of external finance * |

Decrease |

— |

— |

-14.7 |

-14.7 |

-14.7 |

— |

— |

-18.3 |

— |

— |

6 |

Production |

Increase |

11.1 |

22.6 |

28.9 |

17.8 |

6.3 |

26.0 |

35.0 |

40.0 |

14.0 |

5.0 |

7 |

Order books |

Increase |

7.5 |

20.5 |

25.9 |

18.4 |

5.4 |

20.6 |

32.3 |

35.8 |

15.2 |

3.5 |

8 |

Pending Orders,if applicable |

Below normal |

13.6 |

17.4 |

11.6 |

-2.0 |

-5.8 |

11.5 |

11.0 |

5.7 |

-5.8 |

-5.3 |

9 |

Cost of raw material |

Decrease |

-46.0 |

-41.7 |

-47.1 |

-1.1 |

-5.4 |

-35.7 |

-38.4 |

-44.3 |

-8.6 |

-5.9 |

10 |

Inventory of raw material |

Below average |

-4.8 |

-2.1 |

-4.2 |

0.6 |

-2.1 |

-3.3 |

-1.2 |

-3.6 |

-0.3 |

-2.4 |

11 |

Inventory of finished goods |

Below average |

-8.4 |

-4.3 |

-4.3 |

4.1 |

0.0 |

-4.4 |

-3.7 |

-1.9 |

2.5 |

1.8 |

12 |

Capacity utilization (Main Product) |

Increase |

1.7 |

10.1 |

16.5 |

14.8 |

6.4 |

12.3 |

22.0 |

25.4 |

13.1 |

3.4 |

13 |

Level of capacity utilization(Compared to the average in preceding four quarters) |

Abovenormal |

-12.0 |

-11.2 |

-3.9 |

8.1 |

7.3 |

-7.4 |

-3.8 |

1.3 |

8.7 |

5.1 |

14 |

Assessment of the production capacity (With regard to expected demand in Expectation six months) |

More than adequate |

12.1 |

5.8 |

5.3 |

-6.8 |

-0.5 |

11.8 |

6.5 |

5.0 |

-6.8 |

-1.5 |

15 |

Employment in the company |

Increase |

9.4 |

4.1 |

10.3 |

0.9 |

6.2 |

7.7 |

8.8 |

12.1 |

4.4 |

3.3 |

16 |

Exports, if applicable |

Increase |

7.6 |

-2.9 |

9.2 |

1.6 |

12.1 |

16.0 |

12.5 |

20.2 |

4.2 |

7.7 |

17 |

Imports, if any |

Increase |

6.7 |

7.8 |

13.0 |

6.3 |

5.2 |

9.1 |

11.5 |

16.9 |

7.8 |

5.4 |

18 |

Selling prices are expected to |

Increase |

-0.5 |

0.2 |

2.6 |

3.1 |

2.4 |

4.1 |

6.0 |

9.8 |

5.7 |

3.8 |

19 |

If increase expected in selling prices |

Increase at lower rate |

1.2 |

23.2 |

19.3 |

18.1 |

-3.9 |

0.9 |

19.4 |

16.8 |

15.9 |

-2.6 |

20 |

Profit margin |

Increase |

-26.6 |

-15.1 |

-9.9 |

16.7 |

5.2 |

-12.9 |

-2.8 |

1.1 |

14.0 |

3.9 |

* : This parameter has been included in the schedule from the current survey round (Rd 48). |

Statement 5: Business Expectations Index based on Assessment and Expectations |

Quarter |

Assessment |

Expectations |

Index |

Change over

previous

quarter |

Change over

previous

year |

Index |

Change over

previous

quarter |

Change over

previous

year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Jan-Mar 2000 |

122.8 |

— |

— |

— |

— |

— |

Apr-Jun 2000 |

115.2 |

-7.6 |

— |

125.5 |

— |

— |

Jul-Sep 2000 |

116.1 |

0.9 |

— |

126.1 |

0.6 |

— |

Oct-Dec 2000 |

113.9 |

-2.2 |

— |

124.4 |

-1.7 |

— |

Jan-Mar 2001 |

115.2 |

1.3 |

-7.6 |

122.5 |

-1.8 |

— |

Apr-Jun 2001 |

109.9 |

-5.3 |

-5.3 |

120.7 |

-1.8 |

-4.8 |

Jul-Sep 2001 |

108.7 |

-1.3 |

-7.4 |

118.9 |

-1.8 |

-7.2 |

Oct-Dec 2001 |

100.7 |

-8.0 |

-13.2 |

119.5 |

0.6 |

-4.9 |

Jan-Mar 2002 |

108.4 |

7.7 |

-6.8 |

105.3 |

-14.2 |

-17.3 |

Apr-Jun 2002 |

110.8 |

2.4 |

0.9 |

112.3 |

7.0 |

-8.5 |

Jul-Sep 2002 |

113.2 |

2.4 |

4.5 |

116.7 |

4.4 |

-2.2 |

Oct-Dec 2002 |

113.8 |

0.6 |

13.1 |

121.2 |

4.6 |

1.7 |

Jan-Mar 2003 |

118.4 |

4.6 |

10.0 |

119.7 |

-1.6 |

14.4 |

Apr-Jun 2003 |

109.8 |

-8.6 |

-1.0 |

117.8 |

-1.8 |

5.6 |

Jul-Sep 2003 |

114.3 |

4.5 |

1.1 |

117.2 |

-0.7 |

0.5 |

Oct-Dec 2003 |

119.8 |

5.4 |

5.9 |

122.1 |

4.9 |

0.8 |

Jan-Mar 2004 |

121.4 |

1.7 |

3.0 |

122.2 |

0.2 |

2.6 |

Apr-Jun 2004 |

118.4 |

-3.0 |

8.6 |

121.5 |

-0.7 |

3.7 |

Jul-Sep 2004 |

116.9 |

-1.5 |

2.6 |

120.0 |

-1.5 |

2.9 |

Oct-Dec 2004 |

122.0 |

5.1 |

2.2 |

121.5 |

1.5 |

-0.6 |

Jan-Mar 2005 |

122.5 |

0.5 |

1.1 |

123.2 |

1.7 |

1.0 |

Apr-Jun 2005 |

117.5 |

-5.0 |

-0.9 |

120.7 |

-2.5 |

-0.8 |

Jul-Sep 2005 |

114.9 |

-2.6 |

-2.0 |

119.6 |

-1.1 |

-0.4 |

Oct-Dec 2005 |

124.3 |

9.4 |

2.3 |

122.7 |

3.1 |

1.2 |

Jan-Mar 2006 |

120.7 |

-3.6 |

-1.8 |

125.7 |

3.0 |

2.5 |

Apr-Jun 2006 |

121.8 |

1.1 |

4.3 |

120.5 |

-5.2 |

-0.2 |

Jul-Sep 2006 |

120.7 |

-1.1 |

5.8 |

126.5 |

6.0 |

6.9 |

Oct-Dec 2006 |

123.9 |

3.2 |

-0.4 |

125.3 |

-1.2 |

2.6 |

Jan-Mar 2007 |

127.7 |

3.8 |

7.0 |

126.5 |

1.2 |

0.8 |

Apr-Jun 2007 |

115.8 |

-11.9 |

-6.0 |

127.5 |

1.0 |

7.0 |

Jul-Sep 2007 |

118.9 |

3.1 |

-1.8 |

121.1 |

-6.4 |

-5.4 |

Oct-Dec 2007 |

115.9 |

-3.0 |

-8.0 |

124.4 |

3.3 |

-0.9 |

Jan-Mar 2008 |

122.8 |

6.9 |

-4.9 |

118.6 |

-5.8 |

-7.9 |

Apr-Jun 2008 |

116.2 |

-6.6 |

0.4 |

123.2 |

4.6 |

-4.3 |

Jul-Sep 2008 |

113.4 |

-2.8 |

-5.5 |

122.1 |

-1.1 |

1.0 |

Oct-Dec 2008 |

104.1 |

-9.3 |

-11.8 |

118.9 |

-3.2 |

-5.5 |

Jan-Mar 2009 |

82.6 |

-21.5 |

-40.2 |

111.9 |

-7.0 |

-6.7 |

Apr-Jun 2009 |

99.4 |

16.8 |

-16.8 |

96.4 |

-15.5 |

-26.8 |

Jul-Sep 2009 |

107.2 |

7.8 |

-6.2 |

109.9 |

13.5 |

-12.2 |

Oct-Dec 2009 |

112.8 |

5.6 |

8.7 |

116.4 |

6.5 |

-2.5 |

Jan-Mar 2010 |

|

|

|

120.6 |

4.2 |

8.7 |

Annex

* Prepared in the Survey Division of Department of Statistics and Information Management. The previous article on the subject based on 47th Round (July- September 2009) was published in January 2010 Bulletin. 1 The methodology used for the analysis has been provided in the article Quarterly Industrial Outlook Surveys: Trends since 2001 in October 2009 Bulletin. 2 (Figures in bracket represent number of companies) |