IST,

IST,

RBI WPS (DEPR): 05/2014: Impact of Real Exchange Rate Volatility on Use-Based Industrial Production in India

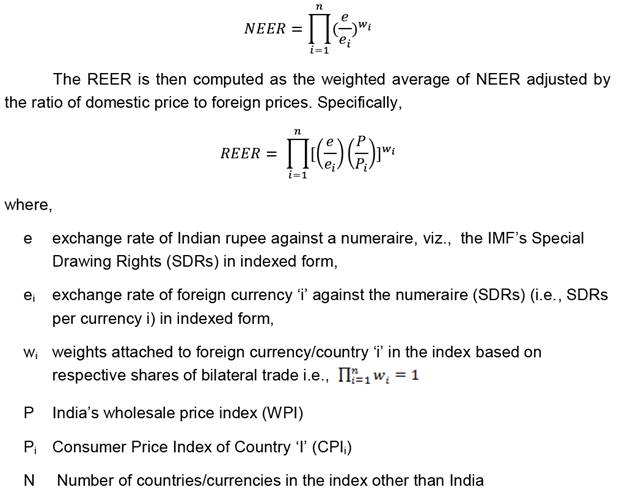

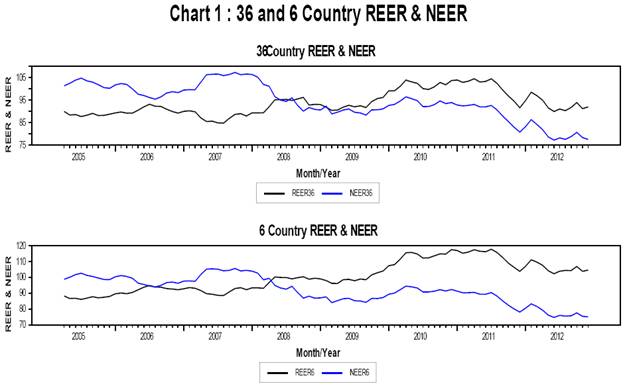

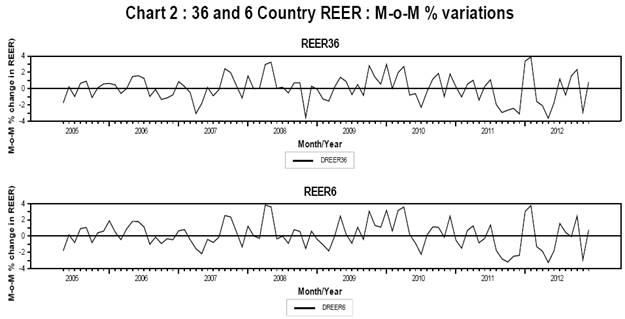

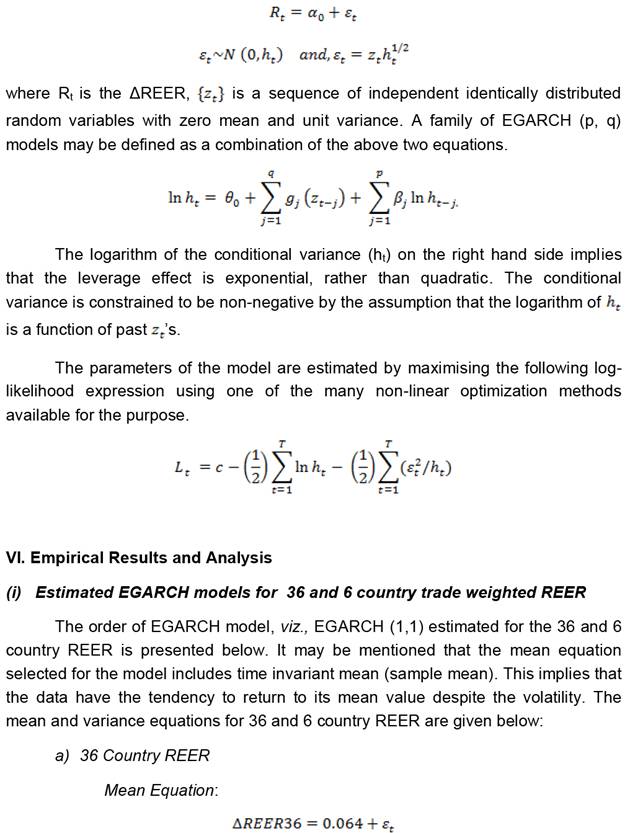

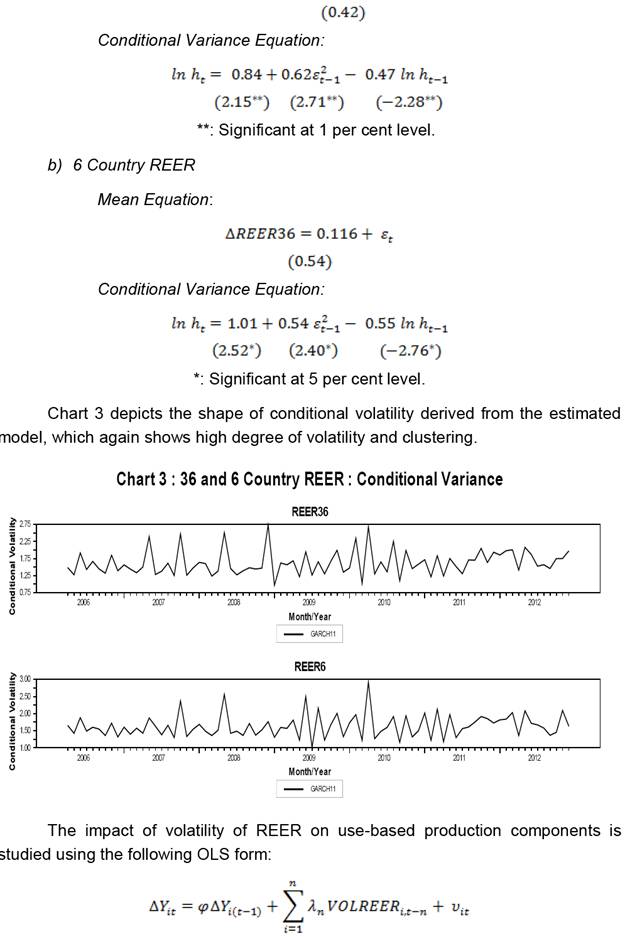

| Press Release RBI Working Paper Series No. 5 Abstract 1Theoretically, it is assumed that exchange rate volatility increases risk and hence dampens economic activity through well identified channels. Internationally, there have been empirical evidences in this regard that lent support to the adverse effect of exchange volatility/risk on growth. Based on the EGARCH methodology for calculating volatility of REER, this paper explores the implications of exchange rate volatility on the use based components of the index of industrial production (IIP) in India. The empirical evidence for 36 country REER suggest that barring consumer goods, the adverse impact of REER volatility is uniformly evident in the remaining use based sub-components of IIP, namely, basic, capital and intermediate goods. In case of 6 country REER, barring basic goods, the adverse impact of exchange rate volatility was visible in all other use based components of IIP. These differences may be ascribed to the varying extent of the direction, quantum and composition of trade, competitiveness and the sufficiency of domestic demand. The implication of this finding is that the adverse impact of REER volatility on industrial production can be assuaged by moderating the volatility of both the nominal exchange rate and domestic inflation. JEL Classification: F41, E23 Key Words: Nominal Effective Exchange Rate, Real Effective Exchange Rate, Index of Industrial Production, Autoregressive Conditional Heteroscedasticity (ARCH), Generalized Autoregressive Conditional Heteroscedasticity (GARCH), Exponential Generalised Autoregressive Conditional Heteroscedasticity (EGARCH). Introduction According to the neoclassical growth model and its extension to situations of dynamic economies of scale, elimination of the exchange risk leads to an increase in economic growth. Elimination of exchange risk reduces systemic risk which in turn lowers the real interest rate. Since investors would require a lower risk premium, a less risky environment, due to lower discounted rate for investment, facilitates accumulation of capital and thus provides space for domestic manufacturers to adjust to a changing economic environment to support economic growth (European Commission, 1990). Exchange rate volatility hinders the flow of international trade as it represents uncertainty and hence imposes costs on risk-averse commodity traders (Ethier, 1973). This is because exchange rate is agreed upon at the time of contract agreement while payment is made at delivery. Therefore, unpredictability in exchange rate creates uncertainty about profits and by implication, reduces the benefits of international trade and the growth potential of an economy. According to the study by Cote (1994), risk aversion does not necessarily imply exchange rate volatility diminishing the amount of trade. Rather, exchange rate risk has two effects, namely substitution effect (SE) and income effect (IE), each working in opposite directions. While the SE of exchange rate volatility adversely affects trade activity, the IE offsets the negative impact of SE by infusing additional resources in export activity to compensate for that plunge. In the process, with a view to avoid the possibility of a decline in revenues, as risks increase, risk-averse traders engage in more export activities. In general, there are four main channels through which exchange rate volatility affects growth. These are: trade, foreign direct investment (FDI), currency crisis, and debt servicing. Exchange rate uncertainty may lead to a reduction in the volume of trade as commodity traders are risk adverse (Brodsky, 1984). As regards FDI, higher exchange rate volatility increases uncertainty over the return of investment and reduces capital flows that eventually affect the country’s ability to increase investment and hence growth. Further, high exchange rate volatility that affects foreign direct investment adversely could increase the instability in currencies of small countries causing financial instability. In addition, the instability of exchange rate also may lead to weakening of relative price competiveness of smaller currencies, thus contributing to a deterioration of their external accounts and even currency crisis and collapse of growth. Similarly, changes in exchange rates affect the real cost of servicing debts. A strong appreciation of the dollar, for example, implies a higher cost of servicing dollar denominated external debt which, in turn, affects allocation of funds for development purpose thereby affecting prospects of longer term growth. This paper attempts to elicit the empirical evidence about the impact of real exchange rate on Indian industry and its use based components. Section II surveys the literature on empirical studies on the impact of exchange rate volatility on indicators of economic activity. Section III contains a brief of such studies pertaining to India. Section IV and V describe the data and methodology used in the study, respectively. Section VI devotes to empirical results and analysis and finally, Section VII has concluding observations. Internationally, there is a large body of literature on empirical studies and evaluation of the impact of exchange rate volatility on various indicators of real economy. However, most of these studies are focused more on the appropriateness of exchange rate regime namely, fixed, flexible and pegged though the motivation behind most studies remains the same – that increase in exchange rate volatility leads to uncertainty having different impacts for different countries on both domestic and foreign investment decisions, trade, and other sources of economic growth. Studies have also found that uncertainty decreases investment in the presence of adjustment costs. In case of projects that are irreversible, the uncertain environment leads to delay in investment decisions as investors obtain more information about the real exchange rates. This exerts negatively on economic performance. Campa and Goldberg (1995) report a negative impact of exchange rate volatility on investment. Similarly, Barlevy (2004) shows that volatility of the exchange rate lowers growth through the volatility of investment. The most widely discussed impact of exchange rate volatility is on trade. However, both the theoretical and empirical studies do not offer a firm conclusion on the effect of exchange rate volatility on trade. Among the earlier works, study by Hooper and Kohlhagen(1978) could not establish a significant link regarding the impact of exchange rate volatility on international trade. Studies by Gotur (1985), Bailey et al.(1987), Asseery and Peel (1991), and Bacchetta and Wincoop (2000) also did not report of the existence of significant impact of exchange rate volatility on trade. However, studies by Kenen and Rodrick (1986), De Grauwe (1988), Pere and Steinherr (1989), and Arize (1995) support the hypothesis that the volatility of exchange rate decreases the volume of international trade. In a study by Jamil (2012), the impact of exchange rate volatility on industrial production in Europe before and after the introduction of common currency was found to be negative. This indicates that an increase in the nominal exchange rate volatility generates an extra risk that hampers industrial production. However, intensity of the negative impact of the exchange rate volatility on industrial production decreased after the introduction of Euro. In general, the negative impact of volatility in exchange rate on industrial production remained higher for the countries that have not adopted common currency after its introduction. III. Impact of Exchange Rate Volatility - The case of India With the opening of the external sector and other economic reforms, Indian economy has gained considerable momentum over the last one decade, by achieving an annual average GDP growth rate of over 7 per cent. This high growth rate can be partly attributed to the growing contribution of the export sector to the economy whose share in GDP went up significantly from 6 per cent in 1990 to 12 per cent in 2000, and to 17.5 per cent in 2012. In tandem, the overall share of India in total world exports increased from 0.5 per cent in 1990 to about 1.7 per cent in 2012. As Indian economy has opened over the years, there has emerged an integral relationship between exports and industrial production. This is because manufactured exports currently account for about 61 per cent of India’s total exports, and hence are important, particularly, for the overall performance of the industrial sector. The National Manufacturing Policy (NMP), 2011 announced by the Government has also emphasised on the impact of trade on domestic production level and proposes to align the tariffs and export promotion measures to the best advantage for shaping India’s production profile. On the other hand, imports which stands at 26.4 per cent of GDP during 2012-13 included a significant proportion of raw and intermediate input imports consumed by the industry to subserve domestic demand, are subject to price fluctuations on account of both changes in global market prices and exchange rate which can influence profit margins. A key element of the effect of REER on trade is the relative price ratios between the host and trading partners. Ceteris paribus, higher rate of domestic inflation leads to appreciation of the real exchange rate and vice versa which affects both imports and exports in opposite directions. The relative price ratios are incorporated by the REER metric and it is hence more suitable for analysing the actual impact of exchange rate on trade and industrial growth. Increased real exchange rate volatility poses risk/uncertainty for both exporters and importers unless managed efficiently. Most academic studies on India have focused on studying the impact of exchange rate volatility on exports while little attention has been devoted to study its impact on industrial growth. The country has experienced increased volatility of its exchange rate ever since it has shifted to a more market oriented exchange rate system after the launch of the economic reforms in 1991. It is in this background that an attempt has been made in this study to empirically examine the impact of exchange rate fluctuations on the performance of the industrial sector which is dependent on export growth and on imports. This study essentially attempts to examine the impact of real exchange rate volatility on industrial growth, even while reviewing the available research on the influence of exchange rate on trade. In the Indian context, studies by Srinivasan and Wallack (2003) Virmani (1991), Joshi and Little (1994), Srinivasan (1998) and Veeramani (2008) found a negative and significant relationship between the real exchange rate and merchandise aggregate exports in India. Bal (2012) examined the effects of exchange rate volatility on India's exports and found no statistical and significant relationship. But, he suggests that the short term disequilibrium of exchange rate negatively affects the exports of the country. Dhasmana (2012) analysed the relationship between India’s real exchange rate and its trade balance with major trading partners using quarterly trade data for 15 countries. She found that real exchange rate volatility is negatively correlated with India’s trade balance in the long run. Cheung and Sengupta (2012) found that a one standard deviation (SD) decline in REER volatility was accompanied by 13 per cent rise, on average during 2000-10, in export shares of Indian non-financial sector firms while a one SD rise in REER volatility dampens exports by as much as 26 per cent. Appreciation in the Indian context in general, as for the paper, is associated with a negative and stronger volatility effect on trade than the positive effect of depreciation. Srinivasan and Kalaivani (2012) examine the impact of exchange rate volatility on the real export growth in India using the Autoregressive Distributed Lag (ARDL) bounds testing approach for the period 1970 to 2011. They indicate that the exchange rate volatility has significant negative impact on real exports both in the short run and long-run, which further suggests that higher exchange rate fluctuation tends to reduce India’s real exports. One possible explanation for the fall in the volume of exports is the absence of hedging opportunities which causes risk-averse profit maximisation firms to reduce their exports in the face of high uncertainty. The monthly data on 36 country and 6 country trade weighted REER, and Indices use-based industrial production employed in this study cover a period from April 2005 to December 2012. The data for use-based industrial production, namely, basic, intermediate, capital and consumer goods were deseasonalised prior to the empirical analysis. Further the data used in the study have been transformed into month-on-month (M-o-M) percentage changes for the purpose of analysis. As indicated above, the REER is the real counterpart of the nominal effective exchange rate (NEER) which is defined as the weighted geometric average of the bilateral nominal exchange rates of the home currency in terms of foreign currencies as follows: Chart 1 suggests two distinctive phases of relative movements in REER and NEER. These phases were broadly the same and comparable both for the 36 and 6 country REER and NEER. Between 2005 and 2008, REER and NEER for both set of countries were moving in opposite directions, while the period in the aftermath of the Lehman crisis saw them moving in similar direction. The period between 2005 and 2008 indicates that the real exchange rate was either generally stable or appreciating until 2008, where after it began appreciating sharply consequent upon a surge of foreign capital on the back of liquidity generated by loose monetary policy in high income countries. It is also noteworthy that during this period of surge in foreign capital, the REER appreciated at a much faster rate than NEER, essentially until mid-2011 because of higher domestic consumer price inflation. The REER thereafter depreciated almost near the end of calendar 2011. A sharp turnaround was thereafter seen both in REER and NEER at the beginning of calendar year 2012 as a result of partial relaxation of tensions in high-income Europe and the stabilisation of global financial markets which resulted in falling investor’s risk aversion. Chart 2 depicts the M-o-M percentage variations in the 36 and 6 country REER which seems to have moved in the maximum range of 4 per cent on either side for 36 country REER and 4 to (-) 3 for 6 country REER during the period under review. The standard deviation of 1.64 for 36 country REER and 1.65 for 6 country REER across the sample were at close proximity while the sample mean were 0.02 per cent and 0.18 per cent, respectively, for 36 and 6 country REER. The M-o-M variation in REER shows that there is evidence of volatility and clustering which is suitable for modeling the data generating process (DGP) as the EGARCH process.2 Volatility has been calculated using different methods in empirical work. However, models such as Autoregressive Conditional Heteroscedasticity (ARCH) and Generalized Autoregressive Conditional Heteroscedasticity (GARCH) which have evolved in the last two decades or so have proved to be very successful in predicting the volatility changes. These kinds of the volatility models are more acceptable because of their capability to capture most stylized facts of volatility, such as leptokurtosis (fat tails) and volatility clustering where large observations tend to be followed by other large observations and vice versa. In ARCH model, the conditional variance changes over time as a function of past squared deviations from the mean. As the extension of ARCH model, GARCH processes take changes in variance over time as a function of past squared deviations from the mean and past variances as suggested by Engle (1982) and Bollerslev (1986). A more useful form of the GARCH model owing to Nelson (1991) is written down in the form of exponential GARCH (EGARCH) which is more powerful and more advantageous than other models for quantifying volatility. The EGARCH is preferred over other models because of the following reasons: First, unlike GARCH, an EGARCH does not impose the non-negativity constraints on the parameters and second, by modeling uncertainty in logarithms form the EGARCH reduces the effects of outliers on the estimation results. EGARCH (p,q) model for returns (variations) of exchange rate can be expressed as follows: where,

(ii) Empirical Evidence for 36 country trade weighted REER Table 1 below presents the results from the estimation of the above equation for 36 country REER on the use-base classification of the indices of industrial production (IIP), namely, basic goods, capital goods, intermediate good and consumer goods. The empirical evidence based on the statistical significance of the negative coefficient of volatility points to the adverse effect of real exchange rate volatility on overall index of industrial production and on use-based industry outputs (with the exception of consumer goods). Table 1 suggests that 36 currency REER volatility affects industrial production with long lags of upto 18 months. The lags in case of use-based components vary from a minimum of 7 months to a maximum of 18 months. Although some of these lags appear long (up to 2 years), they can be expressed as the sum of impact over the time horizon covered by the lags as identified in given data. The process of identification of lags is robust as the data have been first differenced (M-o-M per cent variation) at each stage of analysis. The long-term impact of exchange rate volatility on industrial growth could arise on account of unhedged exposures of borrowings raised in foreign currency with longer maturities. It may be mentioned that large part of corporate foreign exchange exposures in India remain unhedged.3 As such, they tend to have adverse impact on the overall economic exposure/balance sheet of corporates when exchange rate becomes volatile as interest/principal re-payments are made in multiple installments all throughout the tenure of the external borrowings. This phenomenon was observed in recent years wherein companies with unhedged ECB (as well as FCCBs) exposures were adversely affected owing to episodes of exchange market fluctuations at various points of time. Notably, empirical evidence on longer term implication of lagged exchange rate variability (up to 3 years) on corporate balance sheets has been documented in international studies as well (Gonenc et al., 2004). Further, corporates with such foreign exchange exposures also suffer when global economic slowdown affects their exports and the ability to earn foreign exchange for external debt servicing. (iii) Empirical Evidence for 6 country trade weighted REER The results for 6 country trade weighted real exchange rate are presented in Table 2 below: The results for 6 country REER are somewhat different from results for 36 country REER. Unlike the case of 36 country REER, while consumer goods sector is observed to be adversely affected by volatility of 6 country REER, its impact on basic goods production is insignificant. Other constituents of IIP, especially, capital and intermediate goods sector are adversely affected by 6 country REER in a manner similar to the case of 36 country REER. Empirical results suggest that all categories of use based industries with the exception of consumer goods sector are adversely affected by real exchange rate volatility of 36 country REER. On the other hand, while the 6 country REER volatility affects intermediate, capital and consumer goods adversely, it does not have any impact on the production of basic goods. Magnitude-wise, the largest impact of REER volatility is seen in case of capital goods output in both the cases. Barring the large negative impact of REER volatility on capital goods, the impact on other use based industries is limited. Although the observed differences in impact of volatility based on 6 country REER and 36 country REER are empirical in nature, they should be seen by way of the interrelationship of trade with different countries, namely, direction, quantum and composition, competitiveness and the sufficiency of domestic demand which is affected by changes in nominal exchange rate and relative prices. For example, India’s trade in basic goods such as electricity, urea, cement copper, granite and sponge iron is small. Accordingly, the impact of real exchange rate volatility on production of basic goods is small. Similarly, production of consumer goods which comprise both durables and non-durables such as passenger cars, apparels, antibiotics, and sugar, having large weights in the group, are also not much affected by REER volatility due to their low import content, and production supported by sufficiency of domestic demand. For example, passenger cars are being increasingly manufactured and sold competitively within the country, while gems and jewellery have the advantage of natural exchange rate hedge. As regards capital goods, production of which is highly dependent on imports, the observed high negative influence of exchange rate volatility on production can be ascribed to the impact arising from unexpected changes in both exchange rate and relative prices.4 Besides, competing trade partners also sometimes gain on account of maintaining undervalued exchange rate and/or by way of special concessions to exporting sectors that distort competitiveness leading to import substitution and consequent loss of domestic production. A readily observed case in point is the substitution of domestic production by competitive imports, particularly, telecom and power plant equipments. The empirical evidence underscores that, by and large, the stability of REER is important for sustaining the growth of industrial production, in particular, of capital goods which support investments, underlining the need for appropriate management of volatility of both the nominal exchange rate and domestic inflation. @ This paper is written by Alice Sebastian (Research Officer), Upasana Sharma (Research Officer), Thangzason Sonna (Assistant Adviser) and Dr. Himanshu Joshi (Director) of the Development Studies Division (DSD) of the Department of Economic and Policy Research (DEPR), Reserve Bank of India (RBI). 1 The authors are grateful to Smt. Balbir Kaur, Adviser, DEPR for her unstinted encouragement and guidance. The paper reflects personal views of the authors. 2 Engle’s ARCH test for 36 country REER [chisq 7.08 (sig 0.0077)] and 6 country REER [chisq7.88 (sig0.0049)] substantiates ARCH effects in data. 3 Unhedged forex exposure of corporates is a source of risk to them as well as to the financing banks and the financial system. Large unhedged forex exposures have resulted in accounts becoming NPAs in some cases (Extract from The Reserve Bank of India Second Quarter Review of Monetary Policy 2012-13 announced on October 30, 2012). 4 As per the 12th Five Year Plan Working Group on Capital and Engineering Goods, import content for capital goods ranged between 10-78 per cent, mainly due to absence of technology used in critical assemblies and subsystems, and share of imports of capital goods has remained at around 30 per cent of domestic demand in recent years. Import content with respect to demand for metallurgical machinery, machine tools and textile machinery remained at around 50 per cent (Report of the Working Group for the 12th Five Year Plan 2012-17 on Capital Goods and Engineering Sector). The dependency of domestic production of capital goods on imports was also highlighted in the Annual Report of the Reserve Bank of India 2011-12 namely, “In general, the import-intensity of domestic capital goods is high and empirical tests confirm the integral link of imports as inputs to capital goods production. In 2011-12, however, even as production of capital goods declined, imports remained high. This could be indicative of gradual loss of comparative advantage in production of capital goods (Extract from RBI Annual Report 2011-12, para II.1.33 page 25).” References Arize, A.C., (1995), ‘The effects of exchange rate volatility on US exports: an empirical investigation’, Southern Economic Journal, volume 62, issue 1, pp. 34–43. Asseery, A., and Peel, D. A. (1991), ‘The effects of exchange rate volatility on exports’, Economics Letters, volume 37, issue 2, pp. 173-177. Bacchetta, P., and van-Wincoop, E. (2000), ‘Does Exchange-Rate Stability Increase Trade and Welfare?’, American Economic Review, volume 90, issue 5, pp. 1093 – 1109. Badri Narayanan G. and Pankaj V (January 2008), “Determinants of Competitiveness of theIndian Auto Industry”, ICRIER Working Paper No. 102. Bailey, M. J., Tavlas, G. S., and Ulan, M. (1987), ‘The Impact of Exchange Rate volatility on Export Growth: Some Theoretical considerations and empirical results’, Journal of Policy Modeling, volume 9, issue 1, pp.225-43. Bal, D. (2012), ‘Exchange Rate Volatility and Its Effect on Export of India; An Empirical Analysis’, The Indian Journal of Economics, volume 88, number 367, pp. 68-79. Barlevy, G. (2004), ‘The Cost of Business cycles Under Endogenous Growth’, American Economic Review volume 94, issue 4, pp. 964-990. Bollerslev, T. (1986), ‘Generalized Autoregressive Conditional Heteroskedasticity’, Journal of Econometrics, volume 31, issue 3, pp. 307-327. Brodsky, D. A. (1984), ‘Fixed versus flexible exchange rates and the measurement of exchange rate instability’, Journal of International Economics, volume 16, issue 3-4, pp. 295-306. Broll, U. and Eckwert, B. (1999), ‘Exchange rate volatility and international trade’, Southern Economic Journal, volume 66, issue 1, pp. 178-85. Campa, J., and Goldberg L. (1995) ‘Investment, Exchange Rates and External Exposure’, Journal of International Economics, volume 38, issue 3-4, pp. 297-320. Cheung, Y.W. and Sengupta, R. (2012), ‘Impact of exchange rate movements on exports: an analysis of Indian non-financial sector firms’ MPRA Paper No. 43118. Cote, A. (1994), ‘Exchange rate volatility and trade: A survey’, Working Paper no. 94-5, Bank of Canada. De Grauwe, P., and Schnabl G. (2004), ‘Exchange Rate Regimes and Macroeconomic Stability in Central and Eastern Europe’, CESifo Working Paper No. 1182. Dhasmana A. (2012), ‘India’s Real Exchange Rate and Trade Balance: Fresh Empirical Evidence’, IIM Bangalore Research Paper No. 373. Engel R.F. (1982), ‘Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation’, Econometrica, volume 50, issue 4, pp. 987-1007. Ethier, W. (1973), ‘International trade and the forward exchange market’, American Economic Review, volume 63, issue 2, pp. 494-503. European Commission (1990), “One market, One Money. An Evaluation of the Potential Benefits and Costs of forming an Economic and Monetary Union” European Economy, 44. October 1990. 347 pp. Franke, G. (1991), ‘Exchange rate volatility and international trading strategy’, Journal of International Money and Finance, volume 10, issue 2, pp. 292-307. Gonenc H., Buyukkara G.Z., Koyuncu O. (2004), ‘Balance Sheet Exchange Rate Exposure, Investment and Firm Value: Evidence from Turkish Firms’, Central Bank Review, issue 3/2, pp. 1-25. Gotur, P. (1985), ‘Effects of exchange rate volatility on trade’, IMF Staff Papers, volume 32, number 3, pp. 475-512.Hooper, P., and Kohlhagen, S. W. (1978), ‘The effect of exchange rate uncertainty on the prices and volume of international trade’, Journal of International Economics, volume 8, issue 4, pp. 483-511. Jamil M., Streissler E.W., and Kunst R.M. (2012), ‘Exchange Rate Volatility and its Impact on Industrial Production, Before and After the Introduction of Common Currency in Europe’, International Journal of Economics and Financial Issues volume 2, number 2, pp. 85-109 Joshi, V., and Little, I. M. D. (1994), ‘India: Macroeconomics and Political Economy, 1964-1991’, World Bank and Oxford University Press, Washington DC and New Delhi. Kenen, P. T., and Rodrik, D. (1986), ‘Measuring and analyzing the effects of short-term volatility in real exchange rates’, The Review of Economics and Statistics, volume 68, issue 2, pp. 311-315. Nelson, D.B (1991) Conditional heteroskedasticity in asset returns: A new approach, Econometrica 59: 347-370. Peree, E., and Steinherr, A. (1989), ‘Exchange rate uncertainty and foreign trade’, European Economic Review, volume 33, issue 6, pp. 1241-1264. Report of the Working Group for the 12th Five Year Plan 2012-17 on Capital Goods and Engineering Sector, available at http://planningcommission.nic.in/aboutus/committee/wrkgrp12/wg_capital1704.pdf Reserve Bank of India (RBI), Annual Report 2011-12, Chapter II Economic Review, available at /en/web/rbi/-/publications/reports/annual_report/ii.-economic-review-1039 Srinivasan P. and Kalaivani M. (2012), ‘Exchange Rate Volatility and Export Growth in India: An Empirical Investigation’, MPRA Paper No. 43828. Srinivasan, T.N. (1998), ‘India’s Export Performance: A Comparative Analysis’, in I. J. Ahluwalia and I. M. D. Little (eds), India’s Economic Reforms and Development: Essays for Manmohan Singh, Oxford University Press, New Delhi. Srinivasan, T.N. and Wallack, J. (2003), ‘Export Performance and the Real Effective Exchange Rate’, in A.O. Krueger and S.Z. Chinoy (eds), Reforming India’s External, Financial, and Fiscal Policies, Stanford: Stanford University Press. Subbarao D. (2013), ‘India’s Macroeconomic Challenges Some Reserve Bank Perspectives’, Fifth I.G. Patel Memorial Lecture delivered at London School of Economics on March 13, 2013. Veeramani C. (2008), ‘Impact of Exchange Rate Appreciation on India's Exports’, Economic and Political Weekly, volume 43, number 22, pp. 10-14. Virmani, A. (1991), ‘Demand and Supply Factors in India’s Trade’, Economic and Political Weekly, volume 26, number 6, pp. 309-314. |

पेज अंतिम अपडेट तारीख: