FAQ Page 1 - RBI - Reserve Bank of India

FAQs on Master Directions on Priority Sector Lending Guidelines

A. Computation of Adjusted Net Bank Credit (ANBC)

Clarification: The net PSLC outstanding (PSLC Buy minus(-) PSLC Sell) is added to the Net Bank Credit, as mentioned in para 6 of the Master Directions on PSL, 2020 (updated from time to time). Further, a PSLC remains outstanding until its expiry (s. no. ix of Notification on Priority Sector Lending certificates dated April 07, 2016, All PSLCs will expire by March 31st and will not be valid beyond the reporting date (i.e. March 31st), irrespective of the date it was first bought/sold. Accordingly, the effect of PSLC buy is increase in ANBC and conversely the effect of PSLC sell is decrease in ANBC and the net of PSLC buy/sell is adjusted to the ANBC for every quarter. Thus, a PSLC bought or sold in any quarter will have to be taken into account in all subsequent quarters till the end of the FY to which it pertains.

Clarification: The Master Directions on Priority Sector Lending, 2020 under para 6 provides for computation of Adjusted Net Bank Credit. The face value of securities availed under TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits) are to be reduced (as given in ‘IX’ of para 6.1 of the Master Directions on PSL). Since these securities are considered as HTM investments, the banks have to add them as Bonds/debentures in Non-SLR categories under HTM category (as given in ‘X’ of para 6.1 of the Master Directions on PSL). It is envisaged that the Priority Sector Lending target/sub-targets should not increase on account of securities acquired under TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits). By adding the face value of securities (X) and reducing the face value of securities (IX) there will be no increase in ANBC due to investments in TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits.)

Clarification: The bills purchased/ discounted/ negotiated (payment to beneficiary not under reserve) under LC is allowed to be treated as Interbank exposure only for the limited purpose of computing exposure and capital requirements. It should not be excluded from the computation of ‘bank credit in India’ [As prescribed in item No.VI of Form 'A’ under Section 42(2) of the RBI Act, 1934] which allows for exclusion of interbank advance. While exposure may be to the LC issuing bank, the bills purchased/discounted amounts to bank credit to its borrower constituent. If this advance is eligible for priority sector classification, then bank can claim it as PSL. Banks have to take note of the above aspect while reporting Net Bank Credit in India as well as computing the Adjusted Net Bank Credit for PSL targets and achievement

B. Adjustment for Weights in PSL Achievement

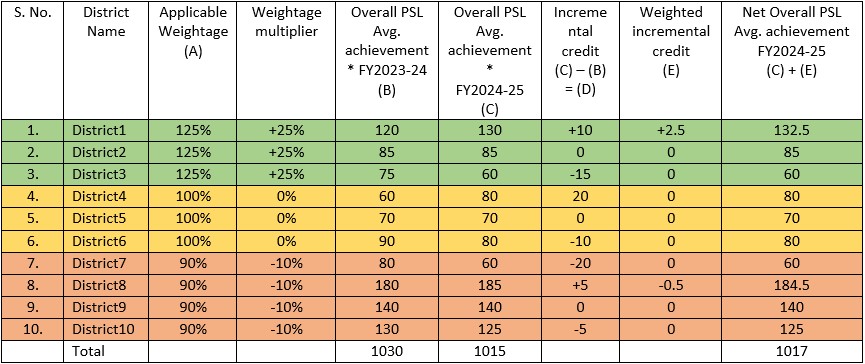

Clarification: As detailed in Para 7 of the Master Directions on Priority Sector lending, 2020 on “Adjustments for weights in PSL Achievement”, differential weightage in the incremental credit to the priority sector areas shall be reckoned from FY 2021-22 onwards. From, FY2024-25, there will be 125% weightage on incremental credit to select 196 districts with low per capita PSL credit and 90% weightage on incremental credit to select 198 districts with high per capita PSL credit. The PSL achievement against the applicable PSL target/sub-targets will be calculated after applying weightages on the incremental credit for each low/high per capita PSL credit district and PSL shortfall will be arrived at accordingly.

Clarification: If there is a decline in credit, the weighted incremental credit will be zero (0). The methodology as given below will be considered for all the districts for which data is reported in ADEPT and District-QPSA statement. Further, based on the methodology detailed above, banks are expected to monitor their own PSL achievement during the year taking into account the prescription of differential weights for credit in identified districts, for the purpose of trading in PSLCs.

* Avg. achievement will be the average of four quarters of a year, as on reporting dates of District-QPSA. Similar calculations will be done for other PSL targets.

Clarification: While calculating district-wise incremental credit for assigning weights, the organic credit i.e. only the credit directly disbursed by banks and for which the actual borrower/beneficiary wise details are maintained in the books of the bank will be considered. Credit disbursed through the following inorganic routes shall not be considered for incremental weights.

-

Investments by banks in securitised assets

-

Transfer of Assets through Direct Assignment /Outright purchase

-

Inter Bank Participation Certificates (IBPCs)

-

Priority Sector Lending Certificates (PSLCs)

-

Bank loans to MFIs (NBFC-MFIs, Societies, Trusts, etc.) for on-lending

-

Bank loans to NBFCs for on-lending

-

Bank loans to HFCs for on-lending

C. Agriculture

Clarification: The PSL guidelines are activity and beneficiary specific and are not based on type of collateral. Therefore, bank loans given to individuals/ businesses for undertaking agriculture activities do not automatically become ineligible for priority sector classification, only on account of the fact that underlying asset is gold jewellery/ornament etc. It may, however, be noted that as per FIDD Circular dated February 7, 2019 and updated from time to time, it has been advised that banks may waive margin requirements for agricultural loans upto ₹1.6 lakh. Therefore, bank should have extended the loan based on scale of finance and assessment of credit requirement for undertaking the agriculture activity and not solely based on available collateral in the form of gold. Further, as applicable to all loans under PSL, banks should put in place proper internal controls and systems to ensure that the loans extended under priority sector are for approved purposes and the end use is continuously monitored.

Page Last Updated on: December 10, 2022