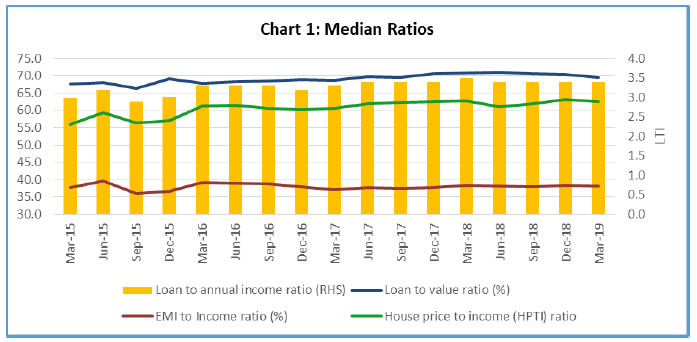

The Reserve Bank has been conducting a quarterly residential asset price monitoring survey (RAPMS) since July 2010 on housing loans disbursed by select banks/ housing finance companies (HFCs)1 across 13 cities, viz., Mumbai, Chennai, Delhi, Bengaluru, Hyderabad, Kolkata, Pune, Jaipur, Chandigarh, Ahmedabad, Lucknow, Bhopal and Bhubaneswar. Time series on selected ratios2 (i) loan to value (LTV) ratio, a measure of credit risk on housing loans; (ii) EMI-to-income (ETI) ratio - representing loan eligibility; (iii) house price to income (HPTI) ratio – reflecting affordability; and (iv) loan to income (LTI) ratio - another affordability measure, are prepared. Today, the Reserve Bank released the results of the March 2019 round along with the summary time series data since March 2015. Highlights: i. The median LTV ratio moved from 67.7 per cent to 69.6 per cent between March 2015 and March 2019 showing that banks have become increasingly risk tolerant (Chart 1, Table 1). ii. The median EMI-to-Income (ETI) ratio has remained relatively steady during the past 2 years (Chart 1); however, Mumbai, Pune and Ahmedabad recorded higher median ETI compared to other cities (Table 2). iii. Housing affordability worsened over the past 4 years as the house price to income (HPTI) ratio increased from 56.1 in March 2015 to 61.5 in March 2019 (Chart 1). Mumbai remains the least affordable city in India, while Bhubaneswar remains the most affordable city (Table 3). iv. The movement of median loan to income (LTI) ratio also confirms worsening housing affordability as it moved from 3.0 in March 2015 to 3.4 in March 2019 (Table 4). Ajit Prasad

Director (Communications) Press Release : 2019-2020/125

Data on Select Indicators based on Residential Asset Price Monitoring Survey (RAPMS) | Table 1: Median Value of Select Ratios by Bank Group | | Quarter | Median Loan to Value (LTV) Ratio

(per cent) | Median EMI to Income Ratio

(per cent) | | Public Sector Banks | Private Banks | Foreign Banks | Housing Finance Companies | All | Public Sector Banks | Private Banks | Foreign Banks | Housing Finance Companies | All | | Mar-15 | 67.7 | 63.5 | 48.0 | 73.3 | 67.7 | 34.3 | 44.0 | 24.2 | 42.6 | 37.8 | | Jun-15 | 68.1 | 63.8 | 45.5 | 74.4 | 68.1 | 37.4 | 42.3 | 20.5 | 43.1 | 39.6 | | Sep-15 | 65.5 | 63.2 | 44.5 | 71.6 | 66.4 | 32.0 | 39.3 | 21.9 | 43.6 | 36.0 | | Dec-15 | 69.9 | 64.6 | 44.6 | 72.4 | 69.2 | 32.5 | 40.7 | 19.3 | 44.2 | 36.6 | | Mar-16 | 66.6 | 64.1 | 41.1 | 71.9 | 67.9 | 39.1 | 40.2 | 20.5 | 39.1 | 39.1 | | Jun-16 | 66.7 | 65.9 | 41.5 | 72.0 | 68.2 | 38.5 | 41.4 | 17.7 | 39.0 | 39.0 | | Sep-16 | 67.3 | 66.0 | 41.2 | 72.1 | 68.5 | 38.3 | 40.4 | 22.4 | 38.7 | 38.7 | | Dec-16 | 67.5 | 67.3 | 40.6 | 71.9 | 68.8 | 38.1 | 38.8 | 18.8 | 38.1 | 38.0 | | Mar-17 | 66.9 | 67.0 | 49.0 | 72.8 | 68.7 | 36.8 | 36.8 | 17.6 | 37.8 | 37.0 | | Jun-17 | 67.8 | 66.1 | 41.2 | 74.8 | 69.7 | 37.5 | 37.9 | 19.6 | 38.5 | 37.8 | | Sep-17 | 67.5 | 65.6 | 47.1 | 74.9 | 69.5 | 37.1 | 38.0 | 18.3 | 38.4 | 37.5 | | Dec-17 | 68.8 | 67.6 | 43.2 | 75.0 | 70.6 | 37.5 | 38.3 | 15.7 | 37.9 | 37.7 | | Mar-18 | 69.5 | 66.7 | 64.6 | 75.0 | 70.8 | 38.9 | 38.2 | 28.3 | 37.8 | 38.4 | | Jun-18 | 70.6 | 64.8 | 60.5 | 75.0 | 71.1 | 38.1 | 38.6 | 25.0 | 38.3 | 38.2 | | Sep-18 | 69.8 | 64.3 | 59.5 | 75.0 | 70.5 | 38.3 | 38.3 | 26.9 | 37.8 | 38.0 | | Dec-18 | 70.3 | 64.8 | 58.9 | 74.7 | 70.5 | 38.7 | 39.6 | 25.5 | 37.1 | 38.3 | | Mar-19 | 69.9 | 64.6 | 62.9 | 72.0 | 69.6 | 38.3 | 41.1 | 28.5 | 36.4 | 38.2 |

| Table 2: Median EMI to Income Ratio by City (per cent) | | Quarter | Mumbai | Chennai | Delhi | Bengaluru | Hyderabad | Kolkata | Pune | Jaipur | Chandigarh | Ahmedabad | Lucknow | Bhopal | Bhubaneswar | All | | Mar-15 | 42.6 | 36.7 | 35.1 | 35.4 | 35.1 | 34.0 | 40.8 | 35.3 | 29.8 | 41.8 | 31.5 | 34.6 | 33.0 | 37.8 | | Jun-15 | 44.1 | 39.3 | 36.0 | 38.5 | 36.9 | 37.6 | 43.6 | 37.7 | 31.0 | 42.2 | 34.9 | 35.9 | 35.1 | 39.6 | | Sep-15 | 41.7 | 35.1 | 35.0 | 33.1 | 32.5 | 32.4 | 38.9 | 32.6 | 27.1 | 38.1 | 33.8 | 34.3 | 29.8 | 36.0 | | Dec-15 | 43.7 | 34.6 | 36.0 | 33.2 | 31.7 | 30.8 | 39.9 | 34.9 | 34.1 | 39.2 | 31.0 | 36.2 | 31.5 | 36.6 | | Mar-16 | 42.8 | 39.6 | 37.2 | 37.0 | 35.5 | 37.4 | 42.9 | 40.7 | 39.6 | 42.7 | 33.6 | 36.9 | 35.0 | 39.1 | | Jun-16 | 42.8 | 39.5 | 37.0 | 36.9 | 35.9 | 37.6 | 43.2 | 39.4 | 33.9 | 43.5 | 33.3 | 35.0 | 35.4 | 39.0 | | Sep-16 | 42.0 | 39.3 | 36.7 | 36.9 | 35.3 | 36.6 | 43.3 | 39.2 | 34.6 | 43.4 | 34.9 | 34.8 | 35.4 | 38.7 | | Dec-16 | 41.6 | 38.8 | 36.6 | 36.1 | 35.2 | 35.2 | 42.2 | 38.0 | 36.0 | 41.4 | 34.2 | 35.6 | 32.4 | 38.0 | | Mar-17 | 40.3 | 38.4 | 35.8 | 35.6 | 34.9 | 34.5 | 40.6 | 36.5 | 33.9 | 38.9 | 32.0 | 33.3 | 30.5 | 37.0 | | Jun-17 | 41.7 | 40.1 | 35.9 | 35.8 | 35.3 | 35.2 | 41.6 | 37.0 | 35.0 | 40.3 | 33.3 | 34.6 | 34.0 | 37.8 | | Sep-17 | 41.9 | 39.2 | 36.2 | 35.8 | 34.6 | 35.2 | 41.5 | 36.6 | 35.0 | 39.6 | 34.1 | 34.3 | 34.6 | 37.5 | | Dec-17 | 42.5 | 38.5 | 36.3 | 36.0 | 35.8 | 35.4 | 42.1 | 37.4 | 33.8 | 40.2 | 32.8 | 34.4 | 32.8 | 37.7 | | Mar-18 | 43.5 | 38.3 | 37.0 | 36.6 | 36.4 | 37.0 | 41.9 | 37.7 | 34.1 | 40.8 | 33.7 | 37.0 | 32.8 | 38.4 | | Jun-18 | 43.7 | 38.3 | 36.6 | 34.9 | 35.8 | 36.9 | 41.6 | 37.2 | 36.3 | 43.7 | 33.8 | 35.2 | 31.5 | 38.2 | | Sep-18 | 43.0 | 38.5 | 36.6 | 35.5 | 35.7 | 36.6 | 40.6 | 37.4 | 35.6 | 43.6 | 35.1 | 35.5 | 33.8 | 38.0 | | Dec-18 | 43.5 | 38.2 | 37.1 | 36.3 | 37.1 | 36.8 | 41.6 | 36.1 | 35.8 | 42.6 | 32.3 | 36.7 | 34.3 | 38.3 | | Mar-19 | 43.3 | 38.4 | 36.9 | 35.6 | 36.8 | 35.8 | 40.7 | 36.6 | 36.7 | 43.5 | 32.4 | 36.2 | 32.6 | 38.2 |

| Table 3: Median House Price to Monthly Income (HPTI) Ratio by City | | Quarter | Mumbai | Chennai | Delhi | Bengaluru | Hyderabad | Kolkata | Pune | Jaipur | Chandigarh | Ahmedabad | Lucknow | Bhopal | Bhubaneswar | All | | Mar-15 | 64.1 | 51.9 | 54.0 | 52.2 | 47.9 | 48.8 | 60.9 | 53.4 | 52.2 | 59.5 | 52.5 | 49.1 | 47.2 | 56.1 | | Jun-15 | 66.5 | 51.9 | 54.4 | 58.2 | 52.7 | 54.2 | 66.4 | 60.3 | 53.2 | 62.9 | 54.5 | 55.6 | 51.3 | 59.3 | | Sep-15 | 64.0 | 52.8 | 57.5 | 51.8 | 47.2 | 49.2 | 62.4 | 56.3 | 48.9 | 56.5 | 55.0 | 51.4 | 43.0 | 56.4 | | Dec-15 | 66.2 | 52.4 | 58.5 | 51.8 | 46.3 | 46.8 | 61.9 | 57.2 | 57.4 | 57.4 | 53.5 | 53.2 | 47.9 | 57.1 | | Mar-16 | 70.1 | 59.2 | 59.6 | 59.0 | 51.7 | 57.2 | 67.7 | 63.5 | 64.7 | 64.4 | 61.2 | 58.2 | 53.1 | 61.3 | | Jun-16 | 71.0 | 59.6 | 59.5 | 58.4 | 53.1 | 57.5 | 67.6 | 65.3 | 58.9 | 66.6 | 58.5 | 55.9 | 55.5 | 61.5 | | Sep-16 | 69.9 | 58.5 | 58.5 | 57.3 | 51.6 | 56.6 | 67.0 | 62.2 | 62.4 | 66.7 | 56.2 | 53.4 | 53.3 | 60.5 | | Dec-16 | 69.3 | 59.1 | 59.0 | 57.4 | 51.9 | 55.2 | 67.1 | 60.0 | 60.5 | 64.9 | 58.4 | 55.6 | 51.3 | 60.2 | | Mar-17 | 70.1 | 59.6 | 58.6 | 57.9 | 53.6 | 56.6 | 67.2 | 62.9 | 61.7 | 64.7 | 57.9 | 57.6 | 48.2 | 60.6 | | Jun-17 | 73.4 | 62.2 | 58.7 | 58.0 | 53.6 | 57.8 | 69.2 | 62.5 | 64.0 | 66.9 | 59.4 | 56.7 | 54.0 | 61.9 | | Sep-17 | 75.4 | 61.9 | 60.3 | 58.7 | 54.9 | 57.4 | 69.3 | 62.6 | 63.3 | 67.1 | 57.9 | 62.2 | 53.9 | 62.4 | | Dec-17 | 76.4 | 60.7 | 60.1 | 59.3 | 56.1 | 59.5 | 69.9 | 60.5 | 61.4 | 65.4 | 57.2 | 58.3 | 55.1 | 62.6 | | Mar-18 | 76.8 | 59.7 | 59.6 | 59.2 | 57.8 | 59.0 | 69.3 | 59.7 | 63.0 | 67.6 | 58.2 | 60.0 | 52.6 | 62.7 | | Jun-18 | 75.1 | 58.0 | 57.7 | 56.1 | 56.3 | 58.4 | 67.5 | 55.6 | 64.8 | 68.4 | 56.5 | 56.6 | 52.9 | 61.1 | | Sep-18 | 75.5 | 58.7 | 58.6 | 57.0 | 57.7 | 58.9 | 67.8 | 56.0 | 64.7 | 69.2 | 60.0 | 56.1 | 56.0 | 61.8 | | Dec-18 | 76.9 | 58.2 | 59.5 | 56.9 | 59.2 | 57.5 | 68.0 | 56.0 | 63.5 | 69.7 | 56.6 | 56.3 | 54.4 | 62.0 | | Mar-19 | 74.4 | 58.6 | 58.5 | 56.1 | 60.3 | 56.5 | 66.6 | 55.9 | 63.4 | 70.4 | 58.6 | 56.2 | 54.3 | 61.5 |

| Table 4: Median Loan to annual income (LTI) Ratio by City | | Quarter | Mumbai | Chennai | Delhi | Bengaluru | Hyderabad | Kolkata | Pune | Jaipur | Chandigarh | Ahmedabad | Lucknow | Bhopal | Bhubaneswar | All | | Mar-15 | 3.4 | 2.9 | 2.8 | 2.8 | 2.7 | 2.7 | 3.3 | 2.8 | 2.3 | 3.2 | 2.5 | 2.7 | 2.5 | 3.0 | | Jun-15 | 3.5 | 3.2 | 3.0 | 3.1 | 2.8 | 2.9 | 3.6 | 3.0 | 2.5 | 3.3 | 2.8 | 3.0 | 2.8 | 3.2 | | Sep-15 | 3.3 | 2.8 | 2.9 | 2.7 | 2.6 | 2.6 | 3.2 | 2.6 | 2.2 | 2.9 | 2.6 | 2.7 | 2.4 | 2.9 | | Dec-15 | 3.5 | 2.8 | 3.1 | 2.8 | 2.5 | 2.5 | 3.3 | 2.8 | 2.9 | 3.1 | 2.5 | 3.0 | 2.5 | 3.0 | | Mar-16 | 3.7 | 3.3 | 3.2 | 3.1 | 2.9 | 3.1 | 3.6 | 3.4 | 3.5 | 3.5 | 2.9 | 3.1 | 2.8 | 3.3 | | Jun-16 | 3.7 | 3.3 | 3.1 | 3.2 | 3.0 | 3.2 | 3.7 | 3.3 | 2.9 | 3.6 | 2.8 | 2.9 | 2.9 | 3.3 | | Sep-16 | 3.6 | 3.3 | 3.1 | 3.1 | 2.9 | 3.1 | 3.7 | 3.2 | 2.9 | 3.7 | 2.9 | 3.0 | 2.9 | 3.3 | | Dec-16 | 3.6 | 3.3 | 3.1 | 3.1 | 2.9 | 3.0 | 3.7 | 3.1 | 3.0 | 3.6 | 2.9 | 3.0 | 2.7 | 3.2 | | Mar-17 | 3.6 | 3.4 | 3.1 | 3.1 | 3.0 | 3.1 | 3.7 | 3.1 | 3.0 | 3.5 | 2.8 | 3.0 | 2.6 | 3.3 | | Jun-17 | 3.9 | 3.6 | 3.2 | 3.1 | 3.1 | 3.2 | 3.8 | 3.2 | 3.1 | 3.7 | 2.9 | 3.2 | 2.9 | 3.4 | | Sep-17 | 3.9 | 3.5 | 3.3 | 3.2 | 3.1 | 3.2 | 3.9 | 3.2 | 3.2 | 3.6 | 3.0 | 3.2 | 2.9 | 3.4 | | Dec-17 | 4.0 | 3.5 | 3.3 | 3.3 | 3.1 | 3.2 | 3.9 | 3.2 | 3.0 | 3.7 | 2.9 | 3.2 | 2.9 | 3.4 | | Mar-18 | 4.0 | 3.5 | 3.3 | 3.3 | 3.3 | 3.4 | 3.9 | 3.3 | 3.2 | 3.8 | 3.0 | 3.4 | 2.8 | 3.5 | | Jun-18 | 4.0 | 3.4 | 3.3 | 3.1 | 3.2 | 3.3 | 3.9 | 3.2 | 3.2 | 3.9 | 3.0 | 3.1 | 2.7 | 3.4 | | Sep-18 | 3.9 | 3.4 | 3.2 | 3.2 | 3.2 | 3.3 | 3.8 | 3.2 | 3.1 | 3.9 | 3.1 | 3.2 | 2.9 | 3.4 | | Dec-18 | 4.0 | 3.3 | 3.3 | 3.2 | 3.2 | 3.2 | 3.8 | 3.2 | 3.2 | 3.9 | 2.8 | 3.3 | 2.9 | 3.4 | | Mar-19 | 4.0 | 3.3 | 3.2 | 3.1 | 3.3 | 3.2 | 3.7 | 3.1 | 3.2 | 3.9 | 2.7 | 3.2 | 2.8 | 3.4 | Note: 1) Generally, 32 select banks/ Housing Finance Companies (HFCs) participate in the survey, although this number may vary due to non-reporting/participating by Bank/HFC or non-inclusion of data due to quality control issues.

2) Outliers are discarded while calculation of median ratios. |

|  IST,

IST,