IST,

IST,

Consultation Paper on Peer to Peer Lending

The financial sector is not immune from the advent of online industry and its potential impact. For this reason, it is attracting attention of analysts, investors, customers, businesses and regulators in a major way. Peer-to-Peer (P2P) lending is one such business model that has gathered momentum globally and is taking roots in India. Although nascent in India and not significant in value yet, the potential benefits that P2P lending promises to various stakeholders (to the borrowers, lenders, agencies etc.) and its associated risks to the financial system are too important to be ignored. The Reserve Bank (the Bank) has therefore found it necessary to put out this discussion paper to elicit public opinion and views of the various stakeholders on the future course of action having regard to the current legal and regulatory framework in place to regulate the business of financial intermediation. 1.2 This paper basically attempts to assess the various business models that are operational both domestically and internationally and the legal framework within which these institutions operate. Further, international regulatory practices on crowd funding and P2P lending available in public domain were also examined to get an understanding of the regulatory approaches adopted by different jurisdictions. 1.3 The “Consultation Paper on Crowdfunding in India” issued by SEBI on June 17, 2014, was taken into consideration so as to avoid overlap of jurisdiction. The paper had examined Security Based Crowdfunding framework in India within the existing legal framework. In summary, it suggested that under Security Based Crowd funding, the possible routes that could be explored are the following:

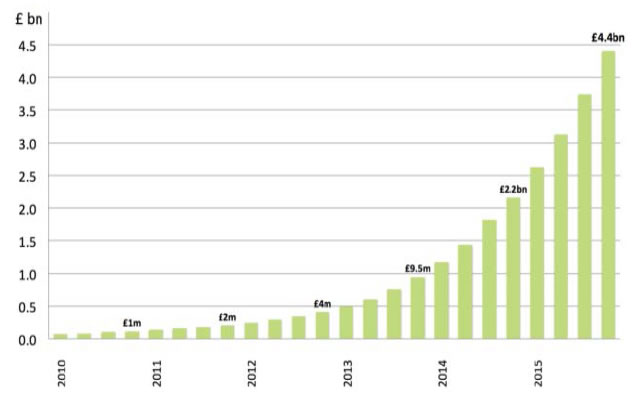

1.4 Suggestions/Recommendations made in the present consultation paper pertain exclusively to lending through P2P platforms. What is Crowd Funding and Peer to Peer Lending Crowd Funding 1.5 'Crowd Funding' generally refers to a method of funding a project or venture through small amounts of money raised from a large number of people, typically through a portal acting as an intermediary. There are numerous forms of crowd funding: some are charitable donations that provide intangible benefits but no financial returns; others, such as equity crowd funding would fall within the domain of financial markets. Peer-To-Peer Lending (P2P Lending) 1.6 P2P lending is a form of crowd-funding used to raise loans which are paid back with interest. It can be defined as the use of an online platform that matches lenders with borrowers in order to provide unsecured loans. The borrower can either be an individual or a legal person requiring a loan. The interest rate may be set by the platform or by mutual agreement between the borrower and the lender. Fees are paid to the platform by both the lender as well as the borrower. The borrowers pay an origination fee (either a flat rate fee or as a percentage of the loan amount raised) according to their risk category. The lenders, depending on the terms of the platform, have to pay an administration fee and an additional fee if they choose to use any additional service (e.g. legal advice etc.), which the platform may provide. The platform provides the service of collecting loan repayments and doing preliminary assessment on the borrower’s creditworthiness. The fees go towards the cost of these services as well as the general business costs. The platforms do the credit scoring and make a profit from arrangement fees and not from the spread between lending and deposit rates as is the case with normal financial intermediation. While crowd funding - equity, debt based and fund based- would fall under the purview of capital markets regulator (SEBI), P2P lending would fall within the domain of the Bank. 2. P2P Lending- Global Experience Market Size 2.1 According to data released by P2PFA, the cumulative lending through P2P platforms globally, at the end of Q4 of 2015, has reached 4.4 billion GBP1. Lending through P2P has grown dramatically from 2.2 million GBP in 2012 to 4.4 billion GBP in 2015.  Regulatory Practices 2.2 P2P lending is approached differently by regulators in different jurisdictions, treated as banking by some jurisdictions and as an intermediary in some others, while some jurisdictions like Israel and Japan have prohibited it altogether(Annex). Across the globe, P2P lending is regulated in five different ways2 as outlined below:

3.1 In India, there are many online P2P lending platforms. Some of these are involved in the business targeted at micro finance activities with the stated primary goal being social impact and providing easier access of credit to small entrepreneurs. They provide web-based platform to bring the lenders and the borrowers together. One of the main advantages of P2P lending for borrowers has been lower rates than those offered by money lenders/unorganized sector and the advantages for lenders are higher returns than what conventional investment opportunities offer. Interest rates and the methodology for calculating those rates vary among P2P lending platforms. They range from a flat interest rate fixed by the platform to dynamic interest rates as agreed upon by the borrowers and the lenders to cost plus model (operational costs plus margin for platform and returns for lender). 3.2 There is no credible data available regarding total lending through P2P platforms in India. However, the number of such Companies has been increasing significantly. According to newspaper reports, close to 20 new online P2P lending companies have been launched in the last one year. Presently, there are around 30 start-up P2P lending companies in India3. Operational Business Models in India 3.3 P2P lending platforms are largely tech companies registered under the Companies Act and acting as an aggregator for lenders and borrowers thereby, helping create a match between them. Once the borrowers and lenders register themselves on the website, due diligence is carried out by the platform and those found acceptable are allowed to participate in lending/borrowing activity. The companies often follow a reverse auction model in which the lenders bid for a borrower’s loan proposal and the borrower has the freedom to either accept or reject the offer. Some platforms provide several additional services like credit assessment, recovery etc. In most cases, the platform moderates the interaction between the borrower and the lender. The documentation for the lending and borrowing arrangement is facilitated by the P2P platform. The lender transfers money from his/her bank account to borrower’s bank account. The platform facilitates collection of post-dated cheques from the borrower in the name of the lender as a proxy for repayment of the loan. The P2P forum, in general, also helps in the recovery process and as part of this, follows up for repayments and if need be, employs recovery agents too. 3.4 In this elementary model, the lending is primarily from one individual to another. The regulatory concerns in such cases would relate to KYC and recovery practices. Since all payments are through bank accounts, the KYC exercise can be deemed to have been carried out by the banks concerned. Though these platforms claim to follow soft recovery practices, the possibility of use of coercive methods cannot be ruled out. 4. Should the Activity be regulated? 4.1 As mentioned earlier, the international practice on regulation of the P2P lending business is varied. The arguments for and against not regulating this activity in India are delineated below: Arguments for Not Regulating 4.2 The arguments for not regulating the activity are following:

Arguments for Regulating the Activity 4.3 Following are the arguments in support of regulating the activity:

4.4. The balance of advantage would lie in developing an appropriate regulatory and supervisory toolkit that facilitates the orderly growth of this sector so that its ability to provide an alternative avenue for credit for the right kind of borrowers is harnessed. 5.1 For the reasons outlined in Section 4, it is proposed to bring the P2P lending platforms under the purview of Reserve Bank’s regulation by defining P2P platforms as NBFCs under section 45I(f)(iii) of the RBI Act by issuing a notification in consultation with the Government of India. Once notified as NBFCs, RBI can issue regulations under sections 45JA and 45L. 5.2 After the notification, RBI can issue directions under sections 45JA and 45L of RBI Act to such platforms regarding registration requirements and prudential norms. The broad contours of the proposed regulation are given below: The Regulatory Framework 5.3 The proposed regulatory framework would encompass the permitted activity, prudential regulations on capital, governance, business continuity plan (BCP) and customer interface, apart from regulatory reporting. (i) Permitted Activity Considering the present stage of development, the platform could be registered only as an intermediary i.e. the role of the platform would be limited to bringing the borrower and lender together without the lending and borrowing getting reflected on its balance sheet. The platform will be required to ensure that section 45S of the RBI Act is not attracted by its activities. The platforms will be prohibited from giving any assured return either directly or indirectly. The platforms will be allowed to opine on the suitability of a lender and creditworthiness of a borrower. Adequate regulations on advertisements will also be put in place. It will also be mandated that funds will have to necessarily move directly from the lender’s bank account to the borrower’s bank account to obviate the threat of money laundering. The guidelines would also prohibit the platforms being used for any cross-border transaction in view of FEMA provisions relating to transactions between residents and non-residents. (ii) Prudential Requirements The prudential requirements will include a minimum capital of Rs 2 crore. With a view to ensure that there is enough skin in the game at a later date, leverage ratio may be prescribed so that the platforms do not expand with indiscriminate leverage. Given that the lenders may include uninformed individuals, prudential limits on maximum contribution by a lender to a borrower/segment of activity could also be specified. (iii) Governance Requirements The guidelines in this regard will include fit and proper criteria for promoters, directors and CEO. A reasonable proportion of board members having financial sector background could be suggested. The guidelines may also require the P2P lender to have a brick and mortar place of business in India. The management and operational personnel of the platform would need to be stationed within the country. (iv) Business Continuity Plan (BCP) The platforms need to put in place adequate risk management systems for its smooth operations. BCP and back up for the data needs to be put in place since the platform also acts as a custodian of the agreements/cheques etc. In case of failure of the platform to continue its operations, it should have a ‘living will’ or alternative arrangement in the form of an agreement for continuation of its operations. (v) Customer Interface Most of the platforms operating in India provide a credit score for the borrowers using their customized algorithms. Confidentiality of the customer data and data security would be the responsibility of the Platform. Transparency in operations, adequate measures for data confidentiality and minimum disclosures to borrowers and lenders would also be mandated through a fair practices code. P2P lending platforms may be prohibited from promising or suggesting a promise of extraordinary returns, which implies some form of guarantee of returns to lenders. Some platforms do perform the role of a recovery agent for recovery of loans on behalf of lenders. The current regulations applicable to other NBFCs will be made applicable to the P2P platforms in regard to recovery practice. The operators would also be mandated to have a proper grievance redress mechanism to deal with complaints from both lenders and borrowers and require reporting to the Board. (vi) Reporting Requirements In order to assist monitoring, the platforms will need to submit regular reports on their financial position, loans arranged each quarter, complaints etc. to the Reserve Bank. The Bank may come out with a detailed reporting requirement. Scope of Reserve Bank’s Regulation 5.4 It may be noted here that RBI has powers to regulate entities which are in the form of companies or cooperative societies. However, if the P2P platforms are run by individuals, proprietorship, partnership or Limited Liability Partnerships, it would not fall under the purview of RBI. Hence, it is essential that P2P platforms adopt company structure. The notification can therefore specify that no entity other than a company can undertake this activity. This will render such services provided under any other organisational structure illegal. Alternatively, the other forms of structure may be regulated by the State Governments. Comments are sought on following aspects of this discussion paper:

Regulatory Practices by Major Countries Australia 5The P2P lending model broadly fits within Australia's existing managed investment scheme regulatory structure. 6Currently, P2P offerings are limited to just a few providers namely Society One, Rattesetter, ThinCats Australia and Moneyplace. Last two of these are relatively new. SocietyOne and RateSetter both operate as managed investment schemes under the Corporations Act 2001 (Cth). SocietyOne operates through a wholesale unregistered scheme. RateSetter operates through a registered scheme. It has also issued a product disclosure statement that will allow retail investors to put money into the RateSetter lending platform. As an interest in a managed investment scheme constitutes a financial product, P2P lenders generally deal in a financial product in a manner that requires an Australian Financial Services Licence (AFSL). P2P platforms can either hold the AFSL directly, or operate under the auspices of an AFSL held by another entity. This is how SocietyOne has established itself. Holding an AFSL licence does require certain capital and cash requirements to be met but, depending on how a new entrant structures itself, these are not overly onerous. If a new entrant outsources the custody role, they can be kept to a reasonably minimal level. As P2P lenders offer credit, they require an Australian Credit Licence (ACL). P2P lenders also need to comply with know-your-customer (KYC) requirements under anti-money laundering and counter terrorism financing (AML/CTF) legislation and the credit provider and credit information requirements under Part IIIA of the Privacy Act 1988 (Cth). China The P2P lending industry in China is the largest in the world with hundreds of platforms offering diverse services but it is not regulated currently. The China Banking Regulatory Commission (CBRC) has issued draft rules for online lending on December 28, 2015. France 7The French regulators, the AMF and the ACPR, issued rules and regulations for equity crowd funding and peer-to-peer lending in France in October 2014. 8The French regulations address equity, debt and donations based crowd funding. Investment portals or intermediaries have been divided into three categories. For loans, either interest free or generating interest, this asset class falls under the category of “intermediaire en financement participatif (IFP)”. For securities including equity, these intermediaries would come under the “conseiller en investissement participatif (CIP)”. There is also the “prestataire en services d’investissement (PSI)” that may offer securities as well. A PSI may give advice and must be approved by the ACPR. All three types of securities platforms must be registered with ORIAS. A PSI is a more involved crowd funding platform that also has certain minimum capital requirements. All investment platforms must register with the authorities and are compelled to comply with certain requirements and skills. Portal managers are expected to have a background in banking or finance. French crowd funding platforms are required to prominently display the risks involved with investing in unlisted securities. Any investor must affirm their understanding that they may lose their entire investments prior to participating in crowd funded offers. Germany 9Under German law (‘Kreditwesengesetz’), only banks may originate loans. To comply with regulation, each P2P lending service has to partner with a bank which formally originates the loan and later sells the rights to proceeds to the investors via the platform. This requires a complex legal (and technical) structure in which no direct contractual relationship between investor and borrower exists. Laws also prohibit usury; therefore prohibiting APRs that are more than double the market average which caps maximum possible interest rates somewhere around 16 to 18%.Presently,there is little to no market for P2P lending in Germany. New Zealand 10The Financial Markets Authority (FMA) has standards for licensing P2P lending providers. There are also ongoing requirements. Directors and senior managers must be fit and proper for their position and the business must be capable of performing effectively and in keeping with its obligations. It must meet all the requirements and obligations of the Financial Markets Conduct Act, including providing disclosure statements and easily understood client agreements. Another requirement is membership of a financial dispute resolution scheme and professional indemnity insurance. The provider must also ensure borrowers don’t exceed borrowing limits. The regulations for providers limit the amount an individual or business can borrow from New Zealand P2P lending providers to $2 million in a 12-month period. But P2P providers may limit borrowers to smaller loans than this. P2P providers are also required to have a contingency plan to protect an investor’s money if it goes under. If the provider fails or its licence is revoked, existing loans will continue to be managed, investors’ payments collected, and defaults followed up by a “back-up servicer”. When they’re not out on loan, investors’ funds are held in an investor trust account at ASB, not by the provider. United Kingdom 11The UK has a legal definition of what constitutes a P2P loan (Regulatory Activities Order 36H- Operating an electronic system in relation to lending). Further, from 1 April 2014, the UK regulator, the Financial Conduct Authority (FCA), introduced a disclosure-based regulatory regime for P2P platforms to provide protection for consumer investors. Along with the requirement ensuring that all financial promotions are fair, clear and not misleading, client money provisions and minimum capital standards are applied. Firms running platforms must also have resolution plans in place that mean, in the event of the platform collapsing, loan repayments will continue to be collected so lenders do not lose out. United States of America 12There are two levels of securities regulation in the US: The federal regulator in the SEC and State level regulators. SEC Level Regulation The notes being sold under this model constitute a “security” under the Securities Act 1933. As such they must comply with SEC regulation. P2P lenders are required to register each loan, in its entirety, which the platform arranges. These platforms are considered public entities and therefore must make public details on loan origination, investors and borrowers by month. As a bank originates the loan, the bank and the platform are regulated in accordance to a number of federal statutes on credit provision, including but not limited to: the Bank Secrecy Act, the Electronic Fund Transfer Act, the Electronic Signatures in Global and National Commerce Act, the Equal Credit Opportunity Act and the Fair Credit Reporting Act. 13The crowdfunding rules have been adopted by SEC on October 30, 2015. State Level Regulation State level regulation varies from state to state with three main responses:

1http://p2pfa.info/data (Peer to peer finance association maintaining data of the peer-to-peer lending market in the UK undertaken by the major players) 2http://www.iosco.org/research/pdf/swp/Crowd-funding-An-Infant-Industry-Growing-Fast.pdf 3http://www.livemint.com/Money/6KEmfQvVnCkUAeNCfGB9AM/Are-the-P2P-lending-platforms-for-you.html 4Proviso to Section 45S(1) of RBI Act reads as under: 5http://www.allens.com.au/pubs/baf/cubaf5dec14.htm 6http://www.canstar.com.au/p2p-lending/who-offers-peer-to-peer-lending-in-australia/ 7http://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2015-uk-alternative-finance-benchmarking-report.pdf 8http://www.crowdfundinsider.com/2014/10/51484-french-crowdfunding-laws-now-force/ 9http://www.altfi.com/news/572 10https://www.consumer.org.nz/articles/peer-to-peer-lending#article-oversight 11http://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2015-uk-alternative-finance-benchmarking-report.pdf 12http://www.iosco.org/research/pdf/swp/Crowd-funding-An-Infant-Industry-Growing-Fast.pdf | ||||||||||||||||||||||||||||||||

पृष्ठ अंतिम बार अपडेट किया गया: