IST,

IST,

Partial Credit Enhancements to Corporate Bonds – Draft Circular

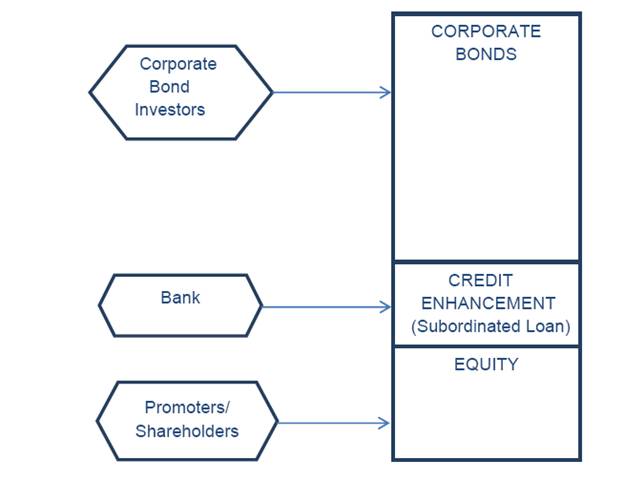

DBOD.BP.BC.No. /08.12.014/2013-14 May 20, 2014 All Scheduled Commercial Banks Dear Sir, Partial Credit Enhancements to Corporate Bonds – Draft Circular Please refer to paragraph 30 of the Second Quarter Review of Monetary Policy 2013-14 (extract enclosed) announced on October 29, 2013 proposing to allow banks to offer partial credit enhancements to corporate bonds. 2. The corporate bond market in India currently lacks sufficient depth and liquidity. As a result, corporates have significant dependence on bank financing. A deep and liquid corporate bond market could provide alternate source of financing for corporates. As an initial measure, with a view to encouraging corporates to avail bond financing, it has been decided to allow banks to provide partial credit enhancements to bonds issued for funding infrastructure projects by Companies/Special Purpose Vehicles (SPVs) subject to the guidelines in the Annex. 3. Banks should have a Board approved policy on partial credit enhancements covering issues such as permissible types of credit enhancements, assessment of risk, setting limits, etc. Banks should also have an overall exposure limit to the infrastructure sector i.e. on account of their direct exposures by way of fund-based and non-fund based exposures to companies including NBFC - IFCs, indirect exposures by way of sponsoring IDFs, partial credit enhancements, etc. 4. The arrangement of banks providing partial credit enhancement to corporate bonds will be reviewed after a period of two years. 5. Comments/feedback on the various proposals enumerated in these guidelines may be sent latest by June 30, 2014 to the Principal Chief General Manager, Reserve Bank of India, Department of Banking Operations and Development, Central Office, 12th Floor, Central Office Building, Shahid Bhagat Singh Marg, Fort, Mumbai- 400 001 or by e-mail. Yours faithfully, (Rajesh Verma) Extract from Second Quarter Review of Monetary Policy 2013-14 announced on October 29, 2013 Credit Enhancements in Corporate Bonds 30. The corporate bond market in India currently lacks sufficient depth and liquidity. As a result, corporates have significant dependence on bank financing. Therefore, it is proposed to: Allow banks to offer partial credit enhancements to corporate bonds by way of providing credit facilities and liquidity facilities to the corporates, and not by way of guarantee. Detailed guidelines in this regard will be issued separately. Draft Guidelines on partial credit enhancements to corporate bonds by banks I. Introduction 1. The credit needs of infrastructure sector in India are huge. Bond market should be the natural choice for corporates to raise resources to meet the credit needs of infrastructure sector. However, Indian corporate bond market is in a nascent stage of development. Therefore, there is a pressure on the banking system to fund the credit needs of infrastructure sector. Due to asset-liability mismatch in infrastructure financing, banks are exposed to liquidity risk. The insurance and provident/pension funds whose liabilities are long term, are better suited to finance infrastructure projects. 2. The regulatory requirement for insurance and provident/pension funds is to invest in bonds of high or relatively high credit rating. However, bonds issued for funding infrastructure projects by Companies/SPVs do not get high ratings by the credit rating agencies (CRAs), because of the inherent risk in the initial stages of project implementation. 3. With a view to overcoming the limitation of long term providers of funds like insurance and provident/pension funds as also other investors in investing in the bonds issued for funding infrastructure projects by Companies/SPVs, the RBI in its Second Quarter Review of Monetary Policy 2013-14 announced on October 29, 2013 proposed to allow banks to offer partial credit enhancements to corporate bonds. 4. The mechanism of improving the credit rating of a bond issued for funding infrastructure projects by Companies/SPVs is to separate the debt of the project company into senior and subordinate tranches. The credit enhancement provided by banks will be able to provide such bonds with partial credit enhancement in the form of a subordinated instrument – either a loan or contingent facility – to support senior project bonds issued by the Companies/SPVs, and thereby improve their credit rating. 5. The objective of allowing banks to extend partial credit enhancement is to enhance the credit ratings of the bonds raised to set up the infrastructure project so as to enable corporates to better access the funds from corporate bond market. 6. Partial credit enhancement provided by banks shall be limited to the extent of improving the credit rating of bonds (assigned by a recognised external credit rating agency) by a maximum of two notches [including modifiers {"+" (plus) / "-"(minus)} e.g., migration from AA- to AA+ will be considered as an improvement by two notches] or 20 per cent of the entire bond issue, whichever is lower. The above restrictions would apply at the time of issuance of the bond as also when the senior bond amortises. 7. Credit enhancements are typically subordinated to the senior bond in terms of repayment priority, but should rank ahead of remaining liabilities of the project such as equity. These act as ‘first loss piece’ and improve the credit quality of the senior bond. 8. As a subordinated instrument, partial credit enhancement should serve to increase the credit rating of the senior bonds but not to extend the bank’s credit rating to the infrastructure project. Banks cannot also provide partial credit enhancement by way of guarantee. II. Salient features of partial credit enhancement facility A. Credit enhancement as a loan 9. Banks may provide credit enhancement as a subordinated loan facility, subject to the maximum extent permitted as per para 6 above, of the total credit enhanced senior bond. This will benefit bond holders by considerable reduction in loss given default during both construction and operation phases as the amount of the senior bond drawn down/outstanding will be lower and the bank will be subordinated to the senior bondholders in terms of repayment priority. There will also be improvement in debt service coverage ratio of the senior bond. 10. A pictorial and tabular representation of credit enhancement as a loan facility is given below: Pictorial representation of a subordinated credit facility – loan

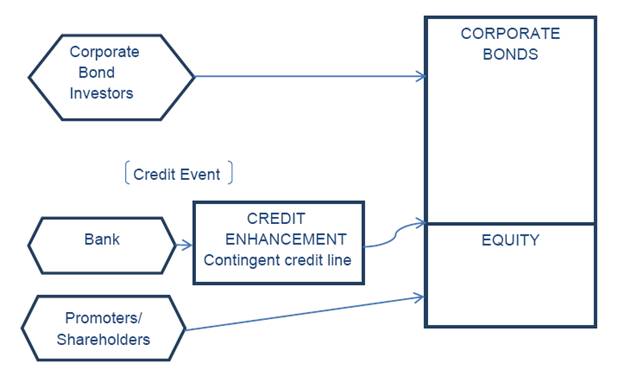

11. Subordinated credit/loan facility is similar to typical infrastructure mezzanine finance. This is used with other financing to fund construction and other project costs, and then repaid during the operations phase. In terms of repayment priority, such finance rank below the senior bond but ahead of the remaining risk capital of the project (e.g., equity). From the perspective of the investors of senior bond, the subordinated loan will therefore act as a “first loss piece” during both construction and operation period and hence improve credit quality of senior bond. Subordinated loan will therefore generally reduce the probability of default during the operation phase. B. Credit enhancement as a contingent facility 12. Alternatively, banks can provide credit enhancement as a non-funded facility in the form of an irrevocable and revolving contingent credit line subject to the maximum extent permitted as per para 6 above, of the total credit enhanced senior bond, which may be drawn onoccurrence of a credit event such as cash shortfall during construction, debt service shortfall post-completion etc. 13. In the event that the project runs into difficulties and the credit line is drawn, the bank will inject funds under the facility which will create a mezzanine instrument broadly similar to funded credit facility. However, the mezzanine loan only arises when the project risk occurs, not before. The documentation for the facility must clearly define the circumstances under which the facility may or may not be drawn on. 14. The contingent line of credit facility should not be available for meeting recurring expenses of the corporate, other than servicing the senior bonds and funding acquisition of additional assets by the corporate. 15. A pictorial and tabular representation of credit enhancement as a contingent facility is given below: Pictorial representation of a subordinated credit facility – non-funded

16. The senior bondholder will be benefitted by way of reduction in the probability of senior bond default as non-funded facility will mitigate risk in the event of cash flow shortfall; as the facility could be revolving, amounts drawn and subsequently repaid may be made available for redrawing. There is likely to be considerable reduction in loss given default during both construction and operation period as the bank will be subordinated to the senior bondholders in terms of repayment priority. III. Other aspects 17. As a credit enhancement, a bank can either provide a funded subordinated loan or a non-funded contingent line of credit, but not both. 18. Contingent line of credit facility should be provided to the Companies/SPVs and not directly to the investors. 19. The effect of the credit enhancement on the bond rating must be disclosed in the bond offer document i.e., the rating of the bond without and with the credit enhancement should be disclosed. 20. Partial credit enhancement facility may be extended to enable the corporates to access funds from the corporate bond market and not for availing finance from other banks/financial institutions. 21. Banks should neither invest in the bonds for which they have provided partial credit enhancement nor should they provide any other credit facility to the specific project /SPV. As per extant instructions, banks should not extend any non-fund based facilities or additional/ad-hoc credit facilities to parties who are not their regular constituents, nor should they discount bills drawn under LCs, or otherwise, for beneficiaries who are not their regular clients. These restrictions would not be applicable in cases where partial credit enhancement has been provided in the form of funded or non-funded facilities to bonds issued for funding specific infrastructure projects by Companies/SPVs. 22. Banks should ensure that the project assets, created out of the bond issue for which partial credit enhancement has been provided by them, and the cash flows from the project are ring fenced through an escrow account mechanism. The proportion in which security interest in the project assets and cash flows would be shared by the lenders to the project, bond holders and banks providing the credit enhancements should be decided and agreed upon before the issue of bonds and should be properly documented. 23. The project should have a robust financial structure even before the credit enhancements are taken into account. While providing partial credit enhancement, banks should exercise necessary due diligence and risk appraisal, including making their own internal credit analysis/rating and should not entirely rely on the ratings of external agencies. Banks should strengthen their internal rating systems which should also include building up of a system of regular (quarterly or half-yearly) tracking of the financial position of the issuer with a view to ensuring continuous monitoring of the rating migration of the issuers/issues. 24. The terms and conditions involved in providing partial credit enhancement should not expose the bank to any additional liabilities on account of legal risk, reputational risk, etc. The bank should obtain written opinions from its legal advisors that the terms of agreement protect it from any liability to the corporate bond investors and/ or to the corporate, except in relation to its contractual obligations pursuant to the agreement governing provision of the facility. 25. Separate record of partial credit enhancements provided by the bank should be maintained. Such record should inter alia include corporate wise and project-wise outstanding fund-based and non-fund based exposures on account of credit enhancements, details of various credit enhancement facilities provided, etc. IV. Balance sheet treatment, capital requirements and asset classification norms for exposures arising on account of providing partial credit enhancements 26. Credit facilities to the extent funded or drawn in case of non-funded contingent line of credit facilities should be treated as advances in the balance sheet. Credit facilities, typically being ‘first loss positions’ will attract a risk weight of 1111%. 27. Non-funded contingent line of credit facilities would be off-balance sheet item and reported under ‘Contingent Liability – Others’. They will attract 100% Credit Conversion Factor (CCF) and 1111% risk weight. 28. If interest/instalment (including maturity proceeds) are due and remain unpaid for more than 90 days, the exposure/credit facility becomes non-performing and needs to be fully provided for. |

|||||||||||||||||||||||||||||||||||||||

पृष्ठ अंतिम बार अपडेट किया गया: