IST,

IST,

V. Monetary Policy and Inflation (Part 1 of 2)

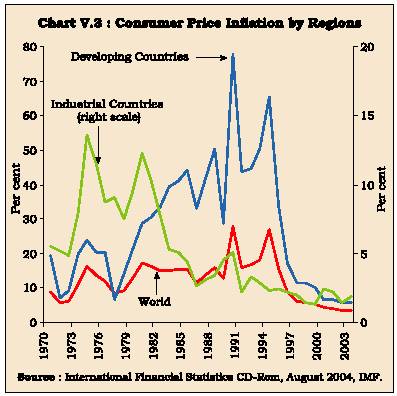

5.1 It is now widely agreed that monetary policy can contribute to sustainable growth by maintaining price stability. Price stability, in turn, may be defined as a rate of inflation that is sufficiently low that households and businesses do not have to take it into account in making everyday decisions. High inflation has an adverse effect on growth due to a number of factors: distortion of relative prices which lowers economic efficiency; redistribution of wealth between debtors and creditors; aversion to long-term contracts and excessive resources are devoted to hedging inflation risks. In developing economies, in particular, an additional cost of high inflation emanates from its adverse effects on the poor population. Maintenance of low and stable inflation has thus emerged as a key objective of monetary policy and a noteworthy development during the 1980s and the 1990s was the reduction in inflation across a number of countries, irrespective of their stages of development. This reduction in inflation is believed to be on account of improvements in the conduct of monetary policy, although there is an ongoing debate on this in view of other factors such as globalisation, deregulation, competition and prudent fiscal policies that might have also played a role. In advanced economies, inflation rates in the recent decade have averaged around 2-3 per cent per annum - consistent with the establishment of reasonable price stability. In developing and emerging economies too, inflation rates have declined significantly.

5.2 The current phase of low global inflation is comparable with the pre-World War II phenomenon when inflation rates across regions were quite low. In the post-World War-II period, however, price levels showed a clear upward trend, with inflation rates rather than price levels clustering around a stationary level following price shocks. In particular, the collapse of the Bretton Woods arrangement was associated with a surge in inflation during the 1970s. Commodity price shocks, especially oil prices, coupled with expansionar y demand management policies including Vietnam-war related fiscal expansion in the US provided a significant impetus to inflation. The belief that there existed a stable long-run trade-off between inflation and output as well as overestimation of potential output also contributed to the accommodative stance of monetary policies during this period. With inflation in double digits, deliberate disinflation strategies were put in place in a number of advanced economies during the 1980s and these were successful in reducing inflation. In particular, co-ordinated fiscal and monetary policies were deployed to curtail demand pressures in the economy.

5.3 Ongoing improvements in the conduct of monetary policy and other economic reforms helped to reduce inflation further during the 1990s. Structural reforms in labour markets, increased competition brought in by the forces of globalisation and fiscal consolidation contributed to low inflation. In order to keep inflation as well as inflation expectations low and stable, efforts to improve monetary-fiscal coordination have been strengthened through emphasis on fiscal rules.

5.4 Low and stable inflation - called the 'Death of Inflation' - has been accompanied with a relatively higher stability in economic activity and the period has been termed as a NICE - Non-Inflationary Consistently Expansionary - decade (King, 2004). However, low levels of inflation can also be a source of concern. Inflation during 2001-03 had fallen to such low levels in various countries following the global slowdown that it raised concerns of a generalised deflation. Aggressive monetary policy easing, however, prevented a generalised deflation. More recently, with signs of economic recovery, central banks have started withdrawing monetary stimuli in a measured manner.

5.5 The world has thus experienced a significant rise and fall in inflation. Concomitantly, the past half-century has also seen major changes in monetary policy frameworks. The debate on 'rules' versus 'discretion' led to a renewed focus on price stability by central banks, and issues such as central bank independence have come to the forefront. A number of central banks have adopted explicit inflation targets under an inflation targeting (IT) regime.

5.6 Like other economies, India too witnessed a rise in inflation during the 1970s and 1980s reflecting a mix of expansionary fiscal policy, accommodative monetary policy and supply shocks. In the aftermath of the balance of paymentsdifficulties, inflation rose further during the first half of the 1990s reflecting a variety of factors. Improved monetar y-fiscal interface and other refor ms imparted greater flexibility to the Reserve Bank in its monetary management since the mid-1990s, even though it had to contend with large capital flows. Equipped with abundant food stocks and foreign exchange reserves, the Reserve Bank has been able to contain inflation. Significant success in reining in inflation has helped to lower inflation expectations while the tolerable level of inflation has also come down.

5.7 Against this background, this Chapter covers issues related to the final objective of monetary process, viz., price stability. Section I examines the international inflation record of the last half-century -the rise during the 1970s and the subsequent moderation. It undertakes a critical assessment of the various factors leading to this inflation behaviour. The brief experience till date of inflation targeting framework is critically analysed. Issues such as the conduct of monetary policy in a low inflation environment in the context of the recent threat of deflation, growth-inflation trade-off and exchange-rate pass-through to domestic prices are also addressed. Finally, this Section undertakes an assessment of the impact of oil shocks on economic activity and inflation. Section II focuses on the behaviour of inflation in India. It explores various factors that led to inflationary pressures during the 1970s and 1980s and the subsequent containment since mid-1990s. Relevance of core measures of inflation and inflation targeting for an emerging economy like India is critically assessed. In view of recent divergence between alternative indicators of inflation, an empirical exercise is undertaken to examine their long-run behaviour. Finally, the Section attempts to model inflation process in India. In view of the growing openness of the Indian economy coupled with a mar ket-deter mined exchange rate system, an attempt is also made to estimate pass-through of exchange rate to domestic inflation. Concluding observations are presented in the final section.

I. GLOBAL INFLATION EXPERIENCE

5.8 Sustained inflation is a relatively modern phenomenon (IMF, 1996). The international experience until World War II was one of long run stability in prices, with periods of inflation - generally war induced - getting offset by periods of deflation. Average inflation was lower in the first half of the 20th century than that in the second half of the century (Christiano and Fitzgerald, 2003) (Table 5.1). At the same time, this pattern of increasing prices followed by declining prices rendered inflation more volatile in the period before the World War II vis-à-vis the post-War period. Following disturbances in the inter-war period and due to factors like changes in macroeconomic policies and varying degrees of supply shocks, the world experienced rising price levels from the late 1960s. Before the 1970s, the gold-dollar nominal anchor of the Bretton Woods system acted as a constraint on accommodative policies as long as the US maintained low inflation, because of other countries commitment to maintain the exchange value of their currency. In the post-Bretton Woods era, however, the freedom to pursue independent monetary policy emerged as a key factor contributing to high inflation during the 1970s.

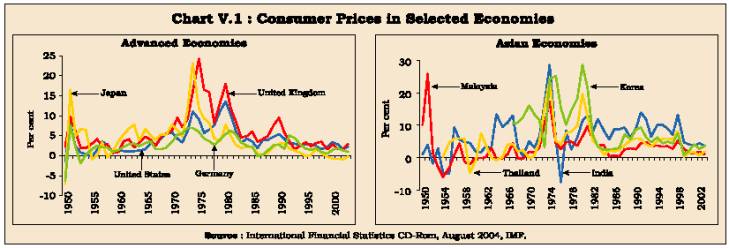

5.9 Since the late 1960s, expansionary fiscal policies and accommodative monetary policies contributed to a strong cyclical upswing in the global economy creating supply-demand imbalances in many non-fuel primary commodities. In the US, for instance, the Vietnam war and tax cuts expanded the fiscal deficit. Fiscal deficits in advanced economies expanded from 1.2 per cent of GDP during the 1960s to 3.4 per cent during the 1970s. Capacity constraints were already putting upward pressure on wages and prices and as the oil price shock hit in 1973, many countries pursued accommodative monetary policies to offset the adverse output and employment effects of the shock. Consequently, inflation surged to double digits in many countries including the US, the UK and Japan. In response, monetary policies were tightened but inflation persisted - the period of the 1970s has come to be called the 'Great Inflation' (Meltzer, 2004) (Table 5.2 and Chart V.1).

|

Table 5.1: Inflation: A Historical Perspective |

||||||||||

|

(Consumer price inflation in per cent) |

||||||||||

|

Country Group |

1900-13 |

1930-39 |

1950-60 |

1961-70 |

1971-80 |

1981-90 |

1991-95 |

1996-2000 |

2000 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|

Advanced Economies |

1.5 |

0.2 |

4.3 |

4.0 |

10.8 |

8.1 |

3.9 |

2.0 |

2.5 |

|

|

Selected Emerging Market Economies 1.2 |

1.6 |

15.2 |

18.3 |

29.8 |

139.7 |

94.4 |

23.4 |

7.8 |

||

|

Source :World Economic Outlook, May 2002, IMF. |

||||||||||

|

Table 5.2: Consumer Price Inflation - A Cross-Country Survey |

|||||||||||

|

(Per cent) |

|||||||||||

|

Country |

1950s |

1960s |

1970s |

1980s |

1990s |

1990-94 |

1995-99 |

2000-03 |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|||

|

Developed Economies |

|||||||||||

|

Australia |

6.5 |

2.5 |

9.8 |

8.4 |

2.5 |

3.0 |

2.0 |

3.7 |

|||

|

Canada |

2.4 |

2.5 |

7.4 |

6.5 |

2.2 |

2.8 |

1.6 |

2.6 |

|||

|

France |

6.2 |

3.9 |

8.9 |

7.4 |

1.9 |

2.5 |

1.2 |

1.8 |

|||

|

Germany |

1.1 |

2.4 |

4.9 |

2.9 |

2.3 |

3.3 |

1.3 |

1.5 |

|||

|

Japan |

3.0 |

5.4 |

9.1 |

2.5 |

1.2 |

2.0 |

0.4 |

-0.6 |

|||

|

New Zealand |

5.0 |

3.2 |

11.5 |

12.0 |

2.0 |

2.4 |

1.7 |

2.4 |

|||

|

Switzerland |

1.1 |

3.1 |

5.0 |

3.3 |

2.3 |

3.9 |

0.8 |

1.0 |

|||

|

US |

1.8 |

2.3 |

7.1 |

5.6 |

3.0 |

3.6 |

2.4 |

2.5 |

|||

|

UK |

3.5 |

3.5 |

12.6 |

7.4 |

3.7 |

4.6 |

2.8 |

2.3 |

|||

|

Developing Economies |

|||||||||||

|

Argentina |

30.4 |

22.9 |

132.9 |

565.7 |

252.9 |

505.1 |

0.8 |

9.3 |

|||

|

Brazil |

– |

– |

– |

354.5 @ |

843.3 |

1667.2 |

19.4 |

9.3 |

|||

|

Chile |

37.9 |

25.1 |

174.6 |

21.4 |

11.8 |

17.5 |

6.0 |

3.2 |

|||

|

Egypt |

0.9 |

2.9 |

7.8 |

17.4 |

10.5 |

14.1 |

6.9 |

3.0 |

|||

|

India |

2.1 |

6.0 |

7.5 |

9.1 |

9.5 |

10.2 |

8.9 |

4.0 |

|||

|

Indonesia |

40.8 |

# |

213.3 |

16.9 |

9.6 |

14.5 |

8.6 |

20.4 |

8.6 |

||

|

Israel |

2.4 |

5.2 |

32.7 |

129.7 |

11.2 |

14.3 |

8.2 |

2.2 |

|||

|

Korea |

– |

11.3 |

* |

15.2 |

8.4 |

5.7 |

7.0 |

4.4 |

3.1 |

||

|

Malaysia |

2.7 |

0.8 |

5.5 |

3.7 |

3.7 |

3.8 |

3.5 |

1.5 |

|||

|

Mexico |

7.7 |

2.7 |

14.7 |

69.0 |

20.4 |

16.3 |

24.5 |

6.4 |

|||

|

Philippines |

0.5 |

4.7 |

14.6 |

14.2 |

9.5 |

11.1 |

7.9 |

4.1 |

|||

|

Singapore |

– |

1.2 |

## |

5.9 |

2.8 |

1.9 |

2.9 |

1.0 |

0.6 |

||

|

South Africa |

2.5 |

^ |

2.5 |

9.7 |

14.6 |

9.9 |

12.4 |

7.3 |

6.5 |

||

|

Thailand |

3.0 |

2.2 |

8.0 |

5.8 |

5.0 |

4.8 |

5.1 |

1.4 |

|||

|

#Average for the period 1958 and 1959. |

|||||||||||

5.10 A number of factors contributed to the surge in inflation. In addition to supply shocks, the high inflation in the 1970s is believed to have been due to lax monetary policies. Although nominal interest rates were raised, it appears that they did not keep pace with the rise in inflation rates. As a result, despite increases in short-term nominal interest rates, real interest rates declined (Table 5.3).

Estimates of monetary policy reaction functions like the Taylor rule that relate short-term policy rate to inflation and output show that the coefficient on the inflation rates was less than unity for the period prior to the 1980s (Table 5.4) (Clarida, Gertler and Gali, 1998). Falling real interest rates during the 1970s provided a further boost to aggregate demand and, in turn, this kept inflation high. One reason as to why

|

Table 5.3: Short-term Real Interest Rates |

||||||

|

(Per cent) |

||||||

|

Country |

1960s |

1970s |

1980s |

1990s |

2000-03 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

United States |

1.8 |

-0.3 |

2.7 |

1.5 |

0.0 |

|

|

United Kingdom |

1.5 |

-4.9 |

2.9 |

1.6 |

1.0 |

|

|

Japan |

0.9 |

-3.1 |

2.0 |

0.8 |

0.8 |

|

|

Germany |

1.3 |

1.1 |

3.5 |

3.3 |

2.1 |

|

|

Note: Short-term

real interest rate is short-term nominal interest rate less consumer price

inflation. |

||||||

monetary authorities were accommodative during the 1970s could perhaps be attributed to the belief that there existed a long-run trade-off between inflation and output, i.e., monetary policy makers could achieve permanently lower unemployment by accepting a little more inflation (Box V.1). Initially,the trade-off argument appeared to be holding true as unemployment fell and inflation rose only moderately during the later part of the 1960s. However, the developments during the 1970s showed no such trade-off and the actual outcome was stagflation - high inflation and high unemployment - validating the Friedman-Phelps critique which stressed no exploitable long-run trade-off. Although a consensus has emerged on the basis of empirical evidence that in the long run there is no trade-off between employment and inflation, it is the inconclusive evidence in the short-run that poses a challenge for monetary management(Reddy, 2001).

|

Table 5.4: Taylor Rule Coefficients for the US |

|||

|

Study |

Pre-1979 Period |

Post-1979 Period |

|

|

1 |

2 |

3 |

|

|

Judd and Rudebusch |

0.85 (1970-78) |

1.69 (1979-87) |

|

|

(1998) |

1.57 (1987-97) |

||

|

Clarida, Gali and |

0.83 (1960-79) |

2.15 (1979-96) |

|

|

Gertler (2000) |

|||

|

Note:Figures

in parentheses indicate the estimation period. |

|||

Box V.1

Growth-Inflation Trade-off

The possibility of a trade-off between inflation and output was first highlighted by Phillips (1958) who found a negative relationship between wage inflation and unemployment behaviour for the UK economy. While this gave an impression that the inflation-output trade-off, later known as the Phillips Curve, could be stable, Friedman (1968) and Phelps (1967) were strongly critical of the possibility of a stable long-run trade-off. In particular, both of them stressed that the tradeoff would vanish once the role of expectations is incorporated in the simple Phillips Curve. The expectations augmented Phillips Curve would not be upward sloping; rather, it would be vertical at the economy's natural rate of unemployment, indicative of no long-run trade-off. The attempts of monetary authorities to reduce unemployment below its natural rate (alternatively, to increase output above its potential) would be reflected in higher inflation. The predictions of Friedman-Phelps were fully supported by the developments in the early 1970s as higher inflation was not accompanied by output gains; rather, the phenomenon of stagflation - higher inflation and lower output - was witnessed. While the Friedman-Phelps view discounted the proposition of a long-run trade-off, the possibility of even a short-run predictable trade-off also came under attack with the onslaught of rational expectations school of thought. The short-run trade-off continues to remain an issue of contention.

A short-run trade-off can arise on account of nominal and real rigidities in the economy (the New Keynesian perspective) or imperfect information (Lucas, 1973). In the latter view, as in 'misperceptions' model or 'signal extraction problem' of Lucas (1973), quantity supplied is a function of relative price movements (prices of firms' own goods vis-a-vis that of overall prices in the economy) but economic agents have imperfect information on aggregate price level movements in the economy. If the agents perceive the movements in the prices of their own goods as reflecting relative price movements, nominal demand shocks originating from monetary policy would have real impact leading to an observed trade-off. On the other hand, if the agents believe that the movements in the prices of their goods are only mirroring the aggregate price level movements, i.e., they perceive no change in relative prices, nominal demand shocks will have no effect at all on real output and will lead only to changes in the prices. The trade-off, therefore, depends upon the perception of economic agents. If the past demand shocks have been large, economic agents may attribute all the price level movements to aggregate prices and perceive no relative price shocks. In this case, there are no real effects and no trade-off would arise. On the other hand, if the past nominal disturbances have been small, the price movements may be viewed as mainly reflecting relative movements which would lead to changes in real output and, hence, an observed trade-off. Even though models with rational expectations rule out a systematic short-run inflation-output trade-off, imperfect information produces the observed short-run trade-off.

In contrast to the new classical emphasis on flexible wages and prices, the New Keynesian view attributes the short-run trade-off to nominal and real wage rigidities in the economy that may arise on account of menu costs, overlapping contracts, asynchronised timing of price changes and aggregate demand externalities. Nominal rigidities can result from optimising choices of agents and the real effects of nominal demand shocks can be large even if the frictions preventing full nominal flexibility are small. Macroeconomic effects of such small rigidities can be substantial in the presence of externalities (Ball et al., 1988). In this framework, nominal shocks have real effects because nominal prices change infrequently. An increase in the average rate of inflation causes firms to adjust prices more frequently to keep up with the rising price level. In turn, more frequent price changes imply that prices adjust more quickly to nominal shocks, and thus the shocks have smaller real effects. Countries with lower inflation levels are, therefore, expected to have relatively flat short-run Phillips Curves and hence, higher trade-offs (higher sacrifice ratios) and vice versa. Thus, as in the Lucas model, real effects of nominal shocks arise, albeit for different reasons: while the imperfect information model focuses on the variability of nominal shocks, the new Keynesians focus on the level of average inflation in generating real effects. In brief, it is now recognised that there is no long-run trade-off. The short-run trade-off is, at best, temporary when the economy is adjusting to shocks to aggregate demand and that too as long as expected inflation is lower than actual inflation (Jadhav, 2003).

5.11 More recently, the view that central banks made a deliberate attempt to exploit the inflation-output trade-off during the 1970s has been subjected to a critical analysis. It has been argued that inflation increased during the 1970s because policymakers overestimated the degree of productive potential in the economy (Orphanides, 2003). Overestimation of potential gross domestic product (GDP) prompted policymakers to provide excessive monetary stimulus resulting in the 'Great Inflation'. The misplaced belief in the potential efficacy of wage-price controls also played a key role (Romer and Romer, 2002; Orphanides, 2001). The monetary policy neglect hypothesis - monetary policy was not seen as essential for inflation control and the job was delegated to income policies (wage and price controls) - led to a combination of easy monetary policy and use of other means to control inflation resulting in the breakout of inflation in the 1960s and 1970s (Nelson and Nikolov, 2002). A centralised wage bargaining and indexation system left most of the countries with higher inflationary expectations (IMF, op cit.). These alternative hypotheses notwithstanding, the primary cause of the 'Great Inflation' was over-expansionary monetary and fiscal policies beginning in the mid-1960s and continuing, in fits and starts, well into the 1970s (Bernanke, 2003).

5.12 In contrast to the mainstream view which stresses oil shocks as one of the factors contributing to high inflation during the 1970s, Barsky and Kilian (2004) argue that oil price increases and, for that matter, increases in other commodity prices as well during the 1970s were the effect of expansionary monetary policies being followed at that time. Monetary fluctuations help to explain the historical movements of the pr ices of oil and other commodities including the surge in the prices of industrial commodities that preceded the 1973-74 oil price hike. In this view, major oil price increases were not as essential a par t of the causal mechanism that generated the stagflation of the 1970s as is often thought. The causality is thus not from oil shocks to inflation but from macroeconomic variables to oil prices. Strong economic expansions strengthen cartels such as oil cartels while recessions weaken them.

5.13 The high and erratic inflation of the 1970s was also associated with periods of exceptionally poor economic performance in terms of marked instability in output and employment in the industrial countries (Table 5.5).

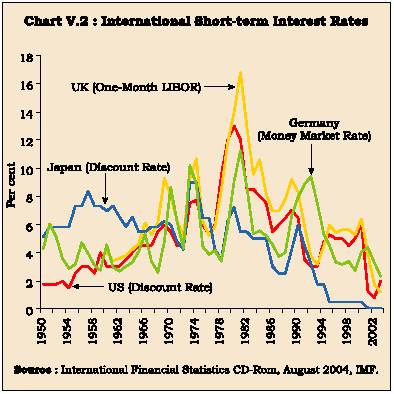

5.14 Recurrence of high inflation and the cumulative worsening of government finances brought into sharp focus both, the limitations of fiscal activism and the heavy costs of monetary instability (Jadhav, 2003). Therefore, central banks in advanced economies - notably, the US - resorted to deliberate disinflation measures. Monetary policies were tightened from the late 1970s onwards to rein in inflation and inflationary expectations (Chart V.2).

|

Table 5.5: Growth in Real GDP |

|||||||||||

|

(Per cent) |

|||||||||||

|

Country Group |

1970-74 |

1975-79 |

1980-84 |

1985-89 |

1990-94 |

1995-99 |

2000-01 |

||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

||||

|

World |

4.2 |

3.9 |

2.6 |

4.0 |

3.4 |

3.8 |

3.1 |

||||

|

Industrial Countries |

3.9 |

3.3 |

2.1 |

3.6 |

2.1 |

2.9 |

2.0 * |

||||

|

Developing Countries |

4.8 |

5.0 |

3.6 |

4.7 |

5.2 |

4.8 |

4.3 |

||||

|

Africa |

6.4 |

2.9 |

1.3 |

3.7 |

1.7 |

3.3 |

3.7 |

||||

|

Asia |

4.4 |

6.0 |

6.7 |

7.5 |

7.8 |

6.2 |

6.7 ** |

||||

|

Europe |

.. |

.. |

2.3 |

3.0 |

-1.7 |

3.5 |

3.0 * |

||||

|

Middle East |

10.7 |

4.7 |

1.2 |

0.4 |

4.8 |

3.7 |

4.0 |

||||

|

Western Hemisphere |

6.6 |

5.2 |

1.6 |

2.5 |

3.5 |

2.5 |

2.9 |

||||

|

..Not available. |

|||||||||||

|

Table 5.6: Global Consumer Price Inflation |

|||||||

|

(Per cent per annum) |

|||||||

|

Country Group |

1970-74 |

1975-79 |

1980-84 |

1985-89 |

1990-94 |

1995-99 |

2000-03 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

Average Inflation Rates |

|||||||

|

World |

9.6 |

11.3 |

15.7 |

13.9 |

21.2 |

8.3 |

3.9 |

|

Industrial Countries |

7.4 |

9.3 |

8.2 |

3.6 |

3.2 |

1.9 |

2.0 |

|

Developing Countries |

16.0 |

16.6 |

34.7 |

39.5 |

56.3 |

16.9 |

6.2 |

|

Africa |

7.9 |

17.3 |

16.9 |

17.6 |

34.2 |

17.5 |

9.8 |

|

Asia |

12.2 |

7.6 |

10.8 |

7.2 |

9.2 |

6.9 |

2.1 |

|

Europe |

7.7 |

15.7 |

29.2 |

46.3 |

128.6 |

56.0 |

18.2 |

|

Middle East |

7.7 |

14.7 |

19.0 |

20.6 |

12.9 |

11.8 |

5.9 |

|

Western Hemisphere |

33.6 |

31.3 |

77.5 |

104.7 |

242.4 |

18.7 |

8.6 |

|

Standard Deviation of Inflation |

|||||||

|

World |

4.4 |

2.4 |

0.9 |

1.9 |

5.7 |

4.2 |

0.4 |

|

Industrial Countries |

3.6 |

1.4 |

3.1 |

0.8 |

1.2 |

0.5 |

0.4 |

|

Developing Countries |

7.3 |

6.2 |

5.5 |

8.7 |

14.8 |

9.8 |

0.5 |

|

Africa |

3.5 |

1.9 |

1.7 |

1.4 |

12.2 |

10.5 |

2.7 |

|

Asia |

11.3 |

3.3 |

3.5 |

2.2 |

3.2 |

3.7 |

0.4 |

|

Europe |

1.9 |

6.4 |

17.6 |

30.5 |

49.4 |

37.7 |

6.1 |

|

Middle East |

5.5 |

3.0 |

1.9 |

6.0 |

2.0 |

6.5 |

1.1 |

|

Western Hemisphere |

21.7 |

24.4 |

28.4 |

23.2 |

143.8 |

13.0 |

1.9 |

|

Source : International Financial Statistics CD-Rom, August 2004, IMF. |

|||||||

5.16 Inflation moderated further in advanced economies during the 1990s. In contrast to the behaviour during the 1970s, estimates of Taylor rules show that the coefficient on inflation has exceeded unity in the period since early 1980s, i.e., in response to inflation threats, short-term nominal interest rates increased more than the increase in the inflation rate (see Table 5.4). Thus, real interest rates rose as inflation tended to go up which enabled a contractionary pull on aggregate demand and helped to contain inflation (Clarida et al., op cit.). A key factor that has contributed to low and stable inflation during the 1990s has been the institutional changes in the conduct of monetary policy - independent central banks, increased transparency and greater accountability - which has enhanced the reputation of monetary authorities and increased public credibility in their ability to deliver low inflation. Supporting economic policies - fiscal consolidation and structural reforms in the labour and product markets - also helped attain price stability. Efforts towards fiscal consolidation have been strengthened with clear-cut fiscal rules such as the Maastricht Treaty and the Stability and Growth Pact in the Euro area (see Chapter III).

5.17 Globalisation is also believed to have contributed to low and stable inflation. Lower trade barriers, deregulation, increased innovation and greater competition induced by the forces of globalisation have contributed to growth in cross-border trade exceeding that in output. Production of tradable goods has expanded rapidly and domestic economies are, therefore, increasingly exposed to the rigours of international competition and comparative advantage (Greenspan, 2004). This reduces unwarranted price mark-ups. Competition among countries to attract and retain mobile production factors also forces governments to reduce inefficiencies, ensure fiscal discipline as well as macroeconomic stability. The focus on macroeconomic stability is one of the factors that has led to greater central bank independence and, in turn, lower inflation (Wagner, 2001). Greater competition in the economy makes prices more flexible which reduces the impact of unanticipated inflation on output. This lowers the incentive for the monetary authority to systematically raise output above the potential (Rogoff, 2003). At the same time, there may be limits to globalisation and the speed of innovation since it is not apparent that globalisation will continue to progress at the same pace as seen in recent decades. Accordingly, as Fed Chairman Greenspan (2004) has recently observed, the structure of the transitional paradigm is necessarily sketchy as 'we have not experienced a sufficient number of economic turning points to judge the causal linkages among increased globalisation, improved monetary policy, significant disinflation and greater economic stability'.

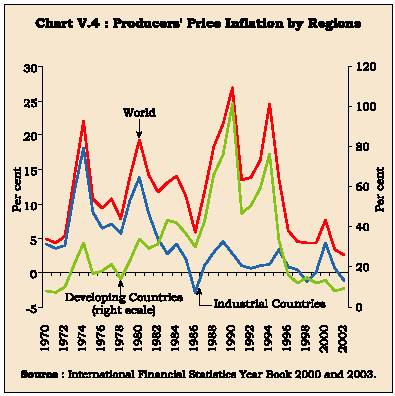

5.18 Low and stable inflation has also been attributed to technological advances in architecture and engineering as well as development of lighter but stronger materials. These technological advances have resulted in 'downsized' output, evident in the huge expansion of the money value of output and trade but not in tonnage. As a consequence, material intensity of production has declined reflecting, 'the substitution, in effect, of ideas for physical matter in the creation of economic value' (Greenspan, 1998). This has contributed to the secular decline in commodity prices, notwithstanding short spells of spikes in these prices. Concerns over increasing commodity price volatility around this declining trend have, however, increasingly engaged monetary policy attention in the short-run (Mohan, 2004). Declining share of commodity prices in final goods prices has been one important reason as to why consumer prices in most countries did not witness any sharp rise in 2003-04 even as commodity prices increased sharply during the period. The increase in commodity prices was reflected mainly in producer prices.

5.19 It is important to note that this moderation in inflation has not come at the cost of output volatility. Rather, the evidence suggests that output volatility has declined in the major advanced economies. For example, the standard deviation of growth rate of GDP in the US during 1984-2002 was two-thirds of that during 1960-83 (Stock and Watson, 2003). Relatively stable GDP growth in recent decades is attributed to a number of factors such as more effective monetary policy, the increasing share of services in GDP, better inventory management and improved consumption-smoothing on account of financial innovations and deregulation. Good luck -absence of major supply disruptions and other such macroeconomic shocks in the recent decades - is also considered as one of the contributory factors. According to estimates by Stock and Watson (2002) for the US economy, almost 20-30 per cent of reduction in output volatility can be attributed to improved policy, another 20-30 per cent is on account of 'identified' good luck in the form of productivity and commodity price shocks while the remaining part - a substantial 40-60 per cent - is due to 'unknown' forms of good luck (the regression residuals).

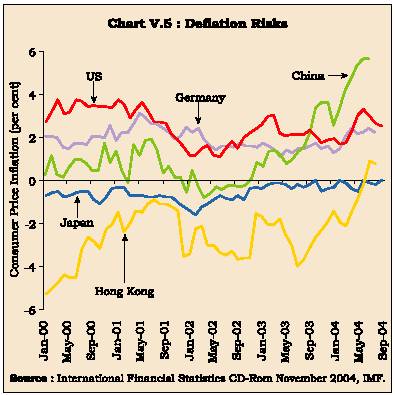

5.20 Following the recent global slowdown of 2000-03, the fall in aggregate demand in the advanced economies put further downward pressures on the already low inflation. Illustratively, core inflation fell to less than one per cent in the US during 2003. Coupled with the ongoing protracted deflation in Japan at that time and deflation in a few other economies such as China, this raised serious concerns about a generalised deflation (Chart V.5). Deflation in China - 'good' deflation - was largely the result of a fast growth on the supply side. Policy concerns mainly arise from deflation that emanates

from inadequate aggregate demand. In this case, expectations of falling prices encourage agents to defer purchases, thereby discouraging growth. Deflation does more macroeconomic damage than an equal and opposite amount of inflation and monetary policy may turn ineffective at very low inflation rates (DeLong 1999). These concerns with deflation arise, primarily on account of the zero bound on nominal interest rates which constrains the ability of monetary policy to pursue an accommodative stance (Box V.2).

5.21 An issue of debate in the context of global disinflation during the 1990s has been the role of China. In view of a sharp rise in its exports coupled with, at least till last year, a deflationary movement in its domestic prices, a view has gained that China has been a source of downward pressure on global prices. Estimates by Kamin, Marazzi and Schindler (2004) suggest that the impact of Chinese exports on global inflation has been fairly modest. China's exports could have reduced (i) global inflation by 30 basis points (bp) per annum; (ii) US import price inflation by 80 bp but, in view of the US being a relatively closed economy, the impact on producer and consumer prices has likely been quite small; and, (iii) import unit values inflation by 10-25 basis points in the OECD countries. However, these estimates should be treated as upper bounds since they ignore the fact that China's rapid export growth has also been associated with equally rapid import growth and China is, therefore, contributing to not only global supply but also to global demand. This has been vividly reflected in the sharp rise in global commodity prices beginning early 2003.

Inflation in Developing Countries

5.22 Inflation cycles in developing economies broadly resemble those in advanced economies. Inflation in the developing economies accelerated during the 1970s and the 1980s before moderating from the second half of the 1990s. The decline in the subsequent period has been dramatic (see Tables 5.2 and 5.6). Inflation fell from 56 per cent in the first half of the 1990s to six per cent in 2000-03. The decline is widespread. In Latin America and the countries in transition, inflation has fallen from 230 per cent and 360 per cent, respectively, during 1990-94 to less than 10 per cent in 2003. Out of 184 members of the IMF, 44 countries had inflation greater than 40 per cent in 1992. In 2003, this number fell to three (Rogoff, 2003). At the same time, in terms of magnitude, the developing world is not a homogeneous group.

Box V.2

Monetary Policy in a Low Inflationary Environment

Inflation in a number of economies fell below one per cent in early 2003 and, in some cases, inflation even turned negative. This raised serious concerns about a generalised global deflation and its adverse consequences. In particular, the episode highlighted the limitations of monetary policy in countering deflation. The constraints on monetary policy arise due to a lower bound of zero on nominal interest rates and the concomitant 'liquidity trap'. Coupled with downward nominal wage rigidities, a lower bound of zero on nominal rate restricts the ability of the monetary policy to drive down real interest rates. Rather, with falling prices, real interest rates would increase and further reduce domestic demand leading to a vicious circle. Due to the zero interest rate floor, the probability of a deflationary spiral increases sharply - from nil for an inflation target of two per cent and above to 11 per cent when inflation target is zero (IMF, 2003). If the shocks are large, the deflationary spiral cannot be reversed by adjustment of the short-term nominal interest rate alone. Deflation's adverse effects also take place through financial fragility due to debt-deflation cycle - harm to bank's balance sheets from reduced collateral and from debtors' diminished ability to service loans and widening of risk premium on corporate bonds in view of worsening balance sheets.

In view of these adverse consequences, the first principle is to avoid the deflationary spiral itself and this can be done by having an inflation target 'consistently on the high side of zero' (Akerlof et al. 2000). Central banks have, therefore, generally adopted inflation targets - whether implicit or explicit - of around two per cent. Furthermore, central banks and fiscal authorities should be prepared for the worst and accordingly make advance contingency plans for a series of emergency measures (Svensson, 1999). These measures could include:

- In an environment of low inflation, central banks should take sufficient insurance against downside risks through a precautionary easing of monetary policy (Ahearne, Gagnon, Haltmaier and Kamin, 2002; Bernanke, 2004).

- Easing of fiscal policy to boost domestic demand.

- Open market purchases of long-term bonds (which would reinflate asset prices through portfolio rebalancing and the expectations channel and enable reduction in external finance premium), and, if need be, more unorthodox open market interventions in corporate bonds, property and stocks.

- Increase inflation expectations, i.e., 'credibly promise to be irresponsible' (Krugman, 1998).

- Depreciation of the exchange rate coupled with a price level target path (Svensson, 1999).

- Carry-tax on money (both reserve balances and currency) in order to lower short-term rates significantly below zero; an occasional carry-tax could be superior to perennially incurring a positive inflation rate (Goodfriend, 2000). However, the possibility of currency substitution could weaken the efficacy of a tax on currency.

As the Japanese experience shows, deflation can be quite protracted and the efficacy of the above proposals is debatable. Since the ability of monetary policy to avoid or counteract the deflationary spiral is uncertain, a policy of prevention rather than cure has been stressed. Monetary policy should be non-linear, i.e., respond more aggressively to shortfalls of output from its potential than to a positive output gap so as to avoid deflationary spiral in the first place. This principle appears to have been the dominating feature of monetary policy reaction in response to the threat of deflation during 2003.

Central banks pursued aggressive easing of monetary policy. Short-term policy rates in a number of advanced economies were cut quite sharply to their record lows in the past four decades. For instance, the US Federal Reserve reduced the Federal Funds rate by 550 basis points from 6.5 per cent in November 2000 to one per cent by June 2003. Not only the actual rates were cut, the Federal Reserve committed itself to maintaining low rates 'for a considerable period' to reassure financial markets and to keep inflation expectations stable (Bernanke, 2003). These measures appear to have succeeded in preventing the deflationary spiral. With a pick-up in economic activity and signs of incipient inflation, a number of central banks around the world started raising policy rates from late 2003 onwards.

Countries in Asia appear to be an exception and the inflation rates in these countries have been closer to that of the developed economies, reflecting fiscal prudence and sound macroeconomic management.

Box V.3

Fiscal Theory of the Price Level

Traditionally, it is believed that inflation is ultimately a monetary phenomenon, i.e., sustained and high inflation is the outcome of excessive money supply. More recently, a significant body of literature has argued that general price level determination is essentially a fiscal, rather than a monetary, phenomenon (Woodford, 1997 and Cochrane, 1999). In the new 'fiscal theory of the price level' (FTPL) view, an independent central bank is not sufficient to ensure price stability. Price stability requires not only an appropriate monetary policy, but also an appropriate fiscal policy.

FTPL essentially extends the unpleasant monetarist arithmetic (UMA) proposition of Sargent and Wallace (1981). The UMA proposition analysed the build-up of public debt and its inflationary implications in the context of a conflict between the monetary and fiscal authorities. It argued that, if real interest rates exceed the real growth rate, then bond financing may turn out to be more inflationary than money financing in the long-run. The reliance on bond-financing continues to raise the public debt over time in an explosive manner. At some point, the monetary authority would then be forced to provide seigniorage revenues to finance not only the future government primary deficits but also to service the existing public debt, forcing the creation of additional high-powered money, culminating in additional inflation. Therefore, fighting current inflation through tight monetary policy works only temporarily; eventually, it leads to higher inflation. In other words, an increase in primary fiscal deficits, at some time, requires a permanent increase in the inflation rate to ensure that the government's inter-temporal budget constraint is satisfied. If economic agents have rational expectations, a tight monetary policy today leads to higher inflation not only eventually but starting today; tighter money today lacks even a temporary ability to fight inflation (Sargent and Wallace, op cit.).

The UMA hypothesis - a weak form of FTPL - is consistent with Friedman's dictum, since here fiscal policy affects prices and inflation only through its effect on money. The more recent stronger versions of the FTPL de-emphasise the role of money in the causal process. In this non-Ricardian view, the inter-temporal budget constraint is perceived not as a constraint on fiscal policy but as an equilibrium condition. When something threatens to disturb the inter-temporal equilibrium, the market-clearing mechanism moves the price level to restore equality, i.e., price level adjusts to equilibrate the real value of nominal government debt with the present value of surpluses.

Nominal Debt / Price Level = Present Value of Surpluses

Thus, prices increase without any increase in money supply per se and the causation is from prices to money rather than the conventional money to prices. In FTPL, the above equation determines the price level in much the same way that MV= PY determines the price level in the quantity theory (Cochrane, 1999). The underlying premise of the FTPL is that the government can behave in a fundamentally different way from households: while households face inter-temporal budget constraints, the government does not face this same requirement. The government can follow non-Ricardian fiscal policies under which inter-temporal budget constraint is satisfied for some, but not all, price paths.

However, the key building block of the FTPL - government is not subject to inter-temporal budget constraint - is debatable (Buiter, 2002; McCallum, 2003). The fiscal theory of the price level rests on a fundamental confusion between equilibrium conditions and budget constraints. Policy conclusions drawn from FTPL would be harmful if they influenced the actual policy behaviour of the fiscal and monetary authorities and 'when reality dawns, the result could be painful fiscal tightening, government default or unplanned recourse to inflation tax' (Buiter, 1999).

5.23 A key distinguishing feature of the developing world is their chronic fiscal deficits on account of low tax bases. Coupled with underdeveloped financial sector, high fiscal deficits increase the reliance of the governments in these economies on seigniorage revenues. The monetisation of government budget deficits fuels inflationary pressures, leading to a vicious nexus between fiscal deficits, money supply and inflation. More recent versions of the fiscal dominance theory suggest that high fiscal deficits can increase prices even without any increase in money supply - money supply adjusts to prices and not the other way around (Box V.3). The breakdown of the Bretton Woods system made it easier for the developing economies to explore seigniorage revenues in the 1970s and the 1980s until public apathy to inflation became an increasingly binding domestic constraint (IMF, 2002). Non-monetary factors - supply shocks due to the continued predominance of the agricultural sector - further complicate monetary management by blurring the role of demand side factors in the inflation process. Sharp devaluations in developing economies have often been fully transmitted to domestic prices which puts additional pressures on inflation. However, it may be noted that inflation hardly rose in Thailand, Indonesia and South Korea in the aftermath of the Asian crisis despite substantial devaluation of their currencies. In the case of transition economies, administered pricing as well as backward-looking wage indexation necessitated large adjustments in relative prices to catch up with free market prices at the demise of central planning.

5.24 An empirical analysis of 24 inflation episodes in 15 EMEs between 1980 and 2001 suggests that increases in output gap, agricultural shocks and expansionary fiscal policies raise the probability of inflation. A more democratic environment and an increase in capital flows (relative to GDP) reduce the probability of inflation starts (Domac and Yucel, 2004). A reduction of one percentage point in fiscal deficit/ GDP ratio reduces inflation by 2-6 percentage points (Catao and Terrones, 2003). In order to reduce

|

Table 5.7: Fiscal Deficits in Emerging Market Economies |

|||||

|

(Per cent to GDP) |

|||||

|

Region |

1971-80 |

1981-85 |

1986-90 |

1991-95 |

1996- |

|

2000 |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

All Emerging Markets |

5.1 |

5.7 |

3.9 |

2.6 |

2.7 |

|

Latin America |

2.1 |

4.1 |

4.9 |

1.0 |

2.0 |

|

Asia |

3.5 |

5.0 |

3.2 |

1.2 |

2.8 |

|

Europe |

2.5 |

2.4 |

2.5 |

4.4 |

3.4 |

|

Africa and |

|||||

|

the Middle East |

12.4 |

11.2 |

5.3 |

3.7 |

2.4 |

|

Source : World Economic Outlook, May 2002, IMF. |

|||||

inflation, macroeconomic policies in developing economies during the 1980s and 1990s, therefore, focused on fiscal consolidation and structural reforms to provide monetary policy necessary flexibility in its operations. Indeed, fiscal deficits in EMEs are now less than half of their levels in 1970s and 1980s (Table 5.7). Taken together with the earlier noted estimated impact of fiscal deficits on inflation, this suggests that inflation could have declined by 5-15 percentage points on account of the lower fiscal deficits (IMF, 2002).

5.25 Developing countries also benefited from lower import prices due to low inflation that had already been achieved in advanced economies. Openness to trade and liberalisation fostered competitive pressures which also contributed to lowering of inflation. Reduction or elimination of indexation of wage and financial contracts helped to reduce inflation inertia. Finally, as in advanced economies, improvements in the institutional design of monetary policy - increased central bank independence - with increased policy emphasis on price stability as an objective of monetary policy helped in lowering inflation in developing economies (IMF, op cit.).

Exchange Rate Pass-through

5.26 Sharp swings in exchange rates have become quite common as has been the recent experience of movements in the US dollar vis-à-vis the euro since 2000. Such sharp movements in exchange rates have significant implications for inflation process. One reason as to why emerging economies do not adopt flexible exchange rates is the alleged 'fear of floating' (Calvo and Reinhart, 2002). This fear of floating is, inter alia, on account of a high and immediate pass through from exchange rate to prices, i.e., sharp movements in the exchange rate can induce equivalent movements in domestic inflation. The degree of pass-through is important for the conduct of forward looking monetary policy (Ball, 1999).

5.27 The role of pass-through in explaining inflation received little attention in the traditional open-economy macroeconomic models because the assumptions of Purchasing Power Parity (PPP) implied complete and immediate pass-through. More recent research has approached this issue from the industrial organisation perspective and has stressed upon industry- or market-specific factors to explain the pricing behaviour of producers. Under imperfect competition, 'pricing to market' may take place when markets are segmented and firms with some monopoly power price discriminate across countries. Incomplete pass-through results from third-degree price discrimination which allows destination prices to be stable in the face of exchange rate fluctuations due to nominal rigidity and local currency pricing (Devereux and Engel, 2002), market segmentation and presence of local distribution costs (Choudhri, Faruqee and Hakura, 2002) and adjustment in mark-ups for maintaining market share (McCarthy, 2000). The incomplete pass-through - 'exchange rate disconnect' - has important implications for monetary policy as it affects both the forecasts of inflation and also the effects of monetary policy on inflation.

5.28 Analysis across the distribution chain shows that pass-through is highest for imported goods at the dock and the lowest for consumer prices (Frankel, Parsley and Wei, 2004; Faruqee, 2004) (Table 5.8). Pass-through is largest and fastest for non-oil import price shocks followed by exchange rate shocks and oil price shocks (Hahn, 2003). Pass-through to import prices is relatively quick and, in the long-run, more or less complete. Illustratively, for a sample of 25 OECD countries over the period 1975-99, Campa and Goldberg (2002) find that short-run pass-through coefficient to import prices is 0.61 while the long-run coefficient is 0.77; similarly, for a sample of 11 industrialised countries over the sample period 1977-2001, Bailliu and Fujii (2004) estimates these coefficients at 0.75 and 0.91, respectively. In contrast, pass-through to producer prices and consumer prices is much lower at 0.20 and 0.08, respectively, in the short-run; the corresponding long-run coefficients are 0.16 and 0.30 (Bailiu and Fujii op cit.). Lower pass-through to consumer prices reflects the fact that local distribution costs are a large part of retail prices. Distribution costs are estimated to be 45-65 per cent of the final goods price in the case of the USA, 55-65 per cent in the euro area and even higher at 65-70 per cent in Japan (Faruqee, 2004).

|

Table 5.8: Exchange Rate Pass-through Coefficients |

|||||||

|

Response at Quarter: |

Canada |

France |

Germany |

Italy |

Japan |

U.K. |

Average |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

Consumer Prices |

|||||||

|

1 |

-0.02 |

0.00 |

0.15 |

0.02 |

-0.01 |

0.02 |

0.02 |

|

4 |

0.08 |

0.10 |

0.20 |

0.14 |

0.04 |

0.10 |

0.11 |

|

10 |

0.20 |

0.09 |

0.36 |

0.26 |

0.09 |

0.11 |

0.19 |

|

Producer Prices |

|||||||

|

1 |

0.03 |

-0.09 |

0.02 |

0.10 |

0.02 |

0.01 |

0.01 |

|

4 |

0.22 |

-0.14 |

0.17 |

0.34 |

0.13 |

0.06 |

0.13 |

|

10 |

0.28 |

-0.07 |

0.16 |

0.33 |

0.12 |

0.05 |

0.15 |

|

Import Prices |

|||||||

|

1 |

0.34 |

0.32 |

0.39 |

0.50 |

0.80 |

0.37 |

0.45 |

|

4 |

0.51 |

0.68 |

0.77 |

0.70 |

1.34 |

0.40 |

0.73 |

|

10 |

-0.18 |

0.18 |

0.27 |

0.13 |

0.79 |

0.16 |

0.22 |

|

Export Prices |

|||||||

|

1 |

0.23 |

0.30 |

0.03 |

0.29 |

0.50 |

0.17 |

0.25 |

|

4 |

0.30 |

0.39 |

0.16 |

0.59 |

0.50 |

0.23 |

0.36 |

|

10 |

0.19 |

0.24 |

0.06 |

0.25 |

0.44 |

0.07 |

0.21 |

|

Terms of Trade |

|||||||

|

1 |

-0.11 |

-0.03 |

-0.36 |

-0.21 |

-0.30 |

-0.20 |

-0.20 |

|

4 |

-0.21 |

-.0.28 |

-.0.61 |

-0.11 |

-0.84 |

-.017 |

-0.37 |

|

10 |

0.37 |

0.06 |

-0.21 |

0.12 |

-0.35 |

-0.09 |

-0.02 |

|

Source : Choudhri, Faruqee and Hakura, 2002. |

|||||||

5.29 Moreover, there is evidence that exchange rate pass-through to domestic inflation has tended to decline during the 1990s across a number of countries. Illustratively, the 1992 depreciation and the 1996 appreciation in the UK, the 1992 depreciation in Sweden, and the 1999 depreciation in Brazil showed a significantly small pass-through of exchange rate fluctuations to retail prices (Cunningham and Haldane, 1999). For a sample of 11 industrial countries, Gagnon and Ihrig (2001) find that the pass-through to consumer price inflation almost halved in the 1990s compared to the pre-1990s period (from 0.12 to 0.06). Similar results are reported by McCarthy (2000) for nine OECD countries; his results show that pass-through more than halved in the US, UK, Japan and France and to a lesser extent in other countries during the period 1983-96 compared to the earlier period 1976-82. There is evidence that pass-through has declined in developing countries also during the 1990s and the extent of decline in these countries is estimated to be larger than that in advanced economies (Frankel, Parsley and Wei, op cit.)

5.30 Interestingly, the decline in the pass-through during the 1990s has taken place in an environment characterised by a greater openness to external trade. A key explanation for the decline in the pass-through is the increased commitment of monetary policy towards maintaining price stability. When a central bank is committed to price stability, the pass-through is lower because inflation expectations do not rise proportionally with the movement in the exchange rate. This occurs as the central bank applies countervailing measures to contain aggregate demand contemporaneously and firms believe that the central bank will be successful in its objective. As the decade of the 1990s was one of low and stable inflation, the decline in pass-through may be correlated with this low inflation environment (Gagnon and Ihrig, 2001; Taylor, 2000; Choudhri and Hakura, 2001) (Table 5.9).

|

Table 5.9: Exchange Rate Pass-through and |

||||

|

Country Group Pass-through Coefficient after Quarters |

||||

|

1 2 |

4 |

20 |

||

|

1 2 3 |

4 |

5 |

||

|

Low Inflation Countries 0.04 0.08 |

0.14 |

0.16 |

||

|

Moderate Inflation Countries 0.09 0.19 |

0.33 |

0.35 |

||

|

High Inflation Countries 0.22 0.32 |

0.50 |

0.56 |

||

|

Note:Low

-, moderate- and high-inflation groups are defined |

||||

5.31 Financial innovations such as availability of hedging products can also lower pass-through by permitting importers to ignore temporary shocks. Another view suggests that the decline in the pass-through could be due to a change in the composition of imports towards sectors with low pass-through rather than a decline across all sectors (Campa and Goldberg, 2002). Available evidence for industrialised economies, at least, confirms that their import composition has shifted in favour of sectors with low pass-through such as the manufacturing sector. According to Burstein, Eichenbaum and Rebelo (2003), the low observed pass-through might be due to disappearance of newly expensive goods from consumption and their replacement by inferior local substitutes.

Inflation Targeting

5.32 The choice of the nominal anchor is crucial for anchoring agents' expectations for maintaining price stability. Monetary regimes have evolved over time in order to reduce the inflationary bias in the economy through various refinements under the broader debate on 'rules' versus 'discretion' in policy making and more recently, 'constrained discretion' which believes that the doctrines of 'rules' and 'discretion' are not mutually exclusive (Bernanke, 2003). In practice, there has been widespread use of either monetary or exchange rate targets as nominal anchors for policy. Since the mid-1980s, developments in financial markets and ongoing financial innovations brought about by financial liberalisation have rendered monetary targeting less effective. Exchange rate pegging aimed at controlling inflation by importing credibility from abroad (from a large successful low inflation anchor country) also turned out to be increasingly fragile, as countries opened their economies to external flows. The weaknesses with these intermediate targeting frameworks led to a search for alternative frameworks for ensuring price stability. One such framework that has become popular during the 1990s is 'Inflation Targeting'. Under this approach, central banks target the final objective i.e., inflation itself rather than targeting any intermediate variable. Inflation targeting is considered as a mechanism to overcome inflationary bias in monetary policy through transparency, accountability and credibility (Box V.4).

5.33 The experience of inflation targeting countries to date appears to have been satisfactory. This is evident in the case of emerging countries starting from high levels of inflation as well as for industrial countries with lower inflation. Inflation in IT countries is less persistent than those in non-IT countries (Kuttner, 2004). At the same time, the decade of the 1990s has also been one of a generalised fall in inflation worldwide. Even countries that have not adopted IT have seen a significant decline in inflation or have been able to maintain low inflation. There is no unique or even best way of monetary policy making and different approaches or frameworks can lead to successful policies by adapting better to diverse institutional, economic and social environments (Issing, 2004). Moreover, some evidence suggests that average inflation as well as its volatility in prominent non-IT industrial countries has, in fact, been somewhat lower than that in prominent IT industrial countries. IT is not found to have any beneficial effect on the level of long-term interest rates (Gramlich, 2003; Ball and Sheridan, 2003). Although transparency is a key feature of IT, most IT central banks are extremely reluctant to discuss concerns about output fluctuations even though their actions show that they do care about them (Mishkin, 2004).

5.34 The ongoing slowdown in global economic activity and the threat of deflation has weakened the analytical edifice of the IT framework (Mohan, 2004a). The relevance of a single inflation target for a large economy, in particular, can be debated. Regional disparities warrant different short-run monetary policy approaches to its objectives. Indeed, there is a growing sense that by the time the current phase of the global business cycle has run itself out, inflation targeting may not be seen to have stood the test of time. The effectiveness of inflation targeting regime is also debatable, given the stylised evidence that monetary policy decisions affect prices with a lag of around two years, and more exogenous shocks can occur in this period.

5.35 It is also argued that an IT framework reduces the flexibility available to a central bank in reacting to shocks (Kohn, 2003). Although a number of EMEs have adopted IT, they face additional problems. These economies are typically more open and it exposes them to large exchange rate shocks which can have a significant influence on short-run inflation. Boom-bust pattern of capital flows can lead to substantial movements in exchange rate. Illustratively, Brazil was faced with a negative swing of US $ 30 billion - six per cent of its GDP - in net capital flows during 2002 that led to a sharp nominal depreciation of 50 per cent. Inflation rate reached 12.5 per cent, breaching the target of four per cent (Fraga, Minella and Goldfaj, 2003). EMEs may have to manage exchange ratesmore heavily since they are more commodity-price sensitive than advanced economies and commodity price fluctuations can wreak havoc with the forecastability of consumer price inflation (Eichengreen, 2002). An empirical evaluation of the experience of EMEs that have adopted IT confirms that IT is a more challenging task in such economies compared to developed economies that have adopted IT. While inflation in EMEs was indeed lower after they adopted IT, their performance was relatively worse vis-à-vis developed IT countries. Deviation of inflation from its targets is found to be larger and more common (Fraga, Minella and Goldfaj, 2003). The main strength of IT in EMEs is in its capacity to keep inflation under control once it is low (IMF, 2002). Inflation targeting by itself is not a sufficient condition for success. As with any other monetary regime, its success depends on the consistency and credibility with which it is applied. Erroneous or irresponsible fiscal, exchange rate and monetary policies will condemn to failure any monetary regime and inflation targeting is no exception (Loayza and Soto, 2002).

Box V.4

Inflation Targeting

Inflation targeting is a framework for monetary policy characterised by the public announcement of official quantitative targets (or target ranges) for the inflation rate and by explicit acknowledgment that low, stable inflation is monetary policy's primary long-run goal (Bernanke et al., 1999). Following the pioneering approach of the Reserve Bank of New Zealand in 1989, more than 20 central banks have formally adopted an 'inflation targeting' (IT) framework. Adoption of IT has occurred in two distinct waves: between 1989 and 1995, seven countries adopted IT. This was followed by a three-year hiatus and then, beginning with the Czech Republic in January 1998, another 14 countries adopted IT (Kuttner, 2004).

Inflation targeting central banks have also typically placed a heavy emphasis on communication, transparency, and accountability; indeed, the announcement of the inflation target itself was motivated in large part as a means of clarifying the central bank's objectives and plans for the public. Inflation targeting encompasses five elements: 1) the public announcement of medium-term numerical targets for inflation; 2) an institutional commitment to price stability as the primary goal of monetary policy, to which other goals are subordinated; 3) an information inclusive strategy in which many variables, and not just monetary aggregates or the exchange rate are used for setting policy instruments; 4) increased transparency of the monetary policy strategy through communication with the public and the markets about the plans, objectives, and decisions of the monetary authorities; and 5) increased accountability of the central bank for attaining its objectives. Inflation targeting is 'a way of thinking about policy', rather than 'an automatic answer to all the difficult policy questions' (King, 1999).

A survey of the practices in the IT countries shows that the inflation target is close to two per cent in the advanced economies and somewhat higher in emerging economies (Annex V.1). A measure of consumer price inflation is the underlying target - in most cases, headline measures are preferred over 'core' measures of inflation for their clarity and easy understanding. In view of various supply shocks, all IT central banks, in practice, retain flexibility by attempting to meet the target on average rather than at all points of time. Various 'escape clauses' also provide maneuverability to these central banks. Thus, all central banks that have adopted IT follow a flexible version of the framework and not strict IT (Svensson, 1999).

Inflation forecast serves as the intermediate target. Monetary policy is conducted to bridge the gap between the inflation forecast and the mandated inflation target in a forward-looking manner. The success of this strategy thus is contingent upon the quality of inflation forecast and the central bank's commitment to policy decisions as well as effective communication of the decision process to the public for credibility gain.

Inflation targeting has several advantages as a medium-term strategy for monetary policy. In contrast to an exchange rate peg, inflation targeting enables monetary policy to focus on domestic considerations and to respond to shocks to the domestic economy. In contrast to monetary targeting, inflation targeting has the advantage that a stable relationship between money and inflation is not critical to its success: the strategy does not depend on such a relationship, but instead uses all available information to determine the best settings for the instruments of monetary policy. Inflation targeting also has the key advantage that it is easily understood by the public and is thus highly transparent. Inflation targeting central banks have taken public outreach a step further: they publish Inflation Report-type documents to clearly present their views about the past and future performance of inflation and monetary policy. The Inflation Reports provide good practical examples of communication with the public about the central bank's policy commitments. Better information on the part of market participants about central bank actions and intentions increases the degree to which central bank policy decisions can actually affect the expectations, and this increases the effectiveness of monetary policy.

5.36 In contrast to most recent papers which assess the performance of IT countries versus non-IT countries, Fatás, Mihov and Rose (2004) focus on the macroeconomic performance of the three key monetary regimes: exchange rate targeting countries, money growth targeting countries and IT countries. They find that what matters most for macroeconomic performance - low and stable inflation and output stability - is clear-cut quantitative goals by the monetary authority. Both having and hitting quantitative targets for monetary policy is found to be systematically and robustly associated with lower inflation. The exact form of the monetary target matters somewhat, but is less important than having some quantitative target. Successfully achieving a quantitative monetary goal is also associated with less volatile output.

5.37 In a similar vein, Sterne (2004) makes a distinction between inflation targeting and inflation targets. While only around 20 central banks follow the inflation targeting approach, a large number of central banks - such as, India - make public some sort of loose inflation targets (which could take the form of inflation forecasts/projections rather than targets per se). According to one survey, out of 95 countries, as many as 57 countries had some sort of inflation target/ projection/forecast (Table 5.10). Such inflation targets/ forecasts increase transparency and help to reinforce societies support for low inflation policies. They also provide a platform to the central bank to voice its independent opinion. In cases where inflation targets/ forecasts are missed, a central bank can provide analytical insights by identifying factors (say, fiscal dominance) contributing to missing the target. This can increase the costs to the government of ignoring the central bank advice. Explicit inflation targets and a credible commitment to them helps to stabilise financial markets. Gurkanyak, Sack and Swanson (2003) find that long-term forward interest rates in the US often react considerably to surprises in macroeconomic data releases and monetary policy announcements. In contrast, in the UK - which has an explicit inflation target - long-term forward interest rates demonstrate less excess sensitivity.

|

Table 5.10: Number of Countries |

||

|

Using Inflation Targets |

||

|

Year |

Countries with |

Of which: Inflation |

|

Inflation Target |

Targeting Countries |

|

|

1 |

2 |

3 |

|

1990 |

7 |

1 |

|

1993 |

23 |

9 |

|

1995 |

37 |

11 |

|

2000 |

56 |

17 |

|

2001 |

57 |

18 |

|

Source : |

Mahadeva and Sterne (2002). |

|

5.38 A stylised fact in regard to inflation is that it is highly persistent, i.e., if there is a shock that raises inflation today, inflation continues to remain high in the future and vice versa. High persistence (a unit root) indicates that inflation expectations are not well-anchored and policy efforts to reduce inflation will have to bear significant output losses. In this context, increased transparency in monetary policy formulation with priority to price stability as a key objective is expected to provide an anchor to inflation expectations and hence lower the persistence of inflation (Clark, 2003). This has an important implication: any future shock that raises inflation temporarily will not lead to a permanent rise in inflation expectations and actual inflation. Empirical evidence on persistence of inflation remains mixed. IMF (2002) suggests that inflation has become more predictable and less persistent. Levin, Natalucci and Piger (2004) find that IT anchors inflation expectations and, therefore, inflation is less persistent in IT countries than in non-IT countries. On the other hand, Cecchetti and Debelle (2004) and Marques (2004) argue that there has not been much change in persistence. Once a structural break in the mean of inflation is taken into account, there is no evidence that inflation persistence has been high in the previous decades.

पृष्ठ अंतिम बार अपडेट किया गया: