|

आज भारतीय रिज़र्व बैंक ने 2025-26 की पहली तिमाही के दौरान संचालित सेवा और आधारभूत संरचना (इन्फ्रास्ट्रक्चर) परिदृश्य (एसआइओएस) के सर्वेक्षण के 45 वें दौर का परिणाम जारी किया। भविष्योन्मुखी सर्वेक्षण1 यह अग्रलक्षी सर्वेक्षण सेवा और बुनियादी ढांचा क्षेत्रों में संलग्न भारतीय कंपनियों की मांग की स्थिति, मूल्य स्थिति और अन्य व्यापार स्थितियों से संबंधित व्यापार मापदंडों पर गुणात्मक मूल्यांकन और अपेक्षाओं को दर्शाता है।सर्वेक्षण2 ,के इस दौर में, 693 कंपनियों ने 2025-26 की पहली तिमाही के लिए अपना मूल्यांकन और 2025-26 दूसरी तिमाही के लिए अपेक्षाओं के साथ-साथ बाद की दो तिमाहियों के लिए प्रमुख मापदंडों पर अपना दृष्टिकोण प्रदान किया।

विशेष:

A. सेवा क्षेत्र

2025-26 की पहली तिमाही के लिए मूल्यांकन

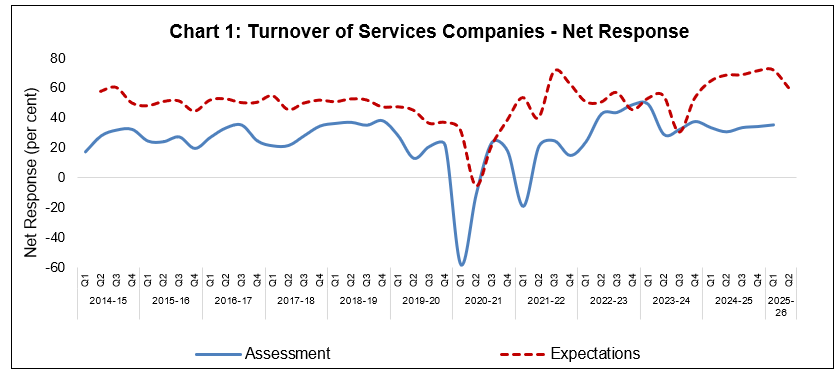

- सेवा क्षेत्र के उद्यमों ने 2025-26 की पहली तिमाही के दौरान समग्र व्यावसायिक स्थिति, रोज़गार की स्थिति और अपने कारोबार में सुधार का आकलन किया (चार्ट 1 और तालिका ए)।

- प्रतिक्रिया देने वाली कंपनियों ने इनपुट और वित्तीय लागतों से दबाव कम होने की सूचना दी, जबकि वेतन व्यय से उत्पन्न दबाव में वृद्धि हुई।

- सेवा कंपनियों के लाभ मार्जिन संबंधी आकलन में सुधार हुआ, जो टर्नओवर और बिक्री मूल्यों में सुधार के समर्थन से हुआ ।

2025-26 की दूसरी तिमाही के लिए अपेक्षाएं

- सेवा कंपनियों ने 2025-26 की दूसरी तिमाही में माँग की स्थिति पर अपना सकारात्मक दृष्टिकोण बनाए रखा, हालाँकि पिछली तिमाही की तुलना में उनके आशावाद के स्तर में कुछ कमी दर्ज की गई (चार्ट 1 और तालिका ए)।

- वेतन बिल, इनपुट लागत और वित्तीय लागत का दबाव मामूली रूप से कम होने की संभावना है।

- कंपनियों ने बिक्री मूल्य और लाभ मार्जिन के बारे में कम आशावाद व्यक्त किया।

2025-26 की तीसरी और चौथी तिमाही के लिए अपेक्षाएं

- सेवा क्षेत्र की कंपनियाँ 2025-26 की चौथी तिमाही तक समग्र व्यावसायिक स्थिति, कारोबार और रोज़गार के प्रति आशावादी बनी हुई हैं (तालिका सी)।

- इनपुट लागत का दबाव 2025-26 की दूसरी छमाही में बने रहने की संभावना है।

- प्रतिक्रिया देने वाली सेवा कंपनियो ने बताया कि अपने मौजूदा संसाधनों के साथ वे 2024-25 की चौथी तिमाही के दौरान 11.2 प्रतिशत अतिरिक्त सेवाएं प्रदान कर सकते हैं (तालिका S14)।

B. आधारभूत संरचना क्षेत्र

2025-26 की पहली तिमाही के लिए मूल्यांकन

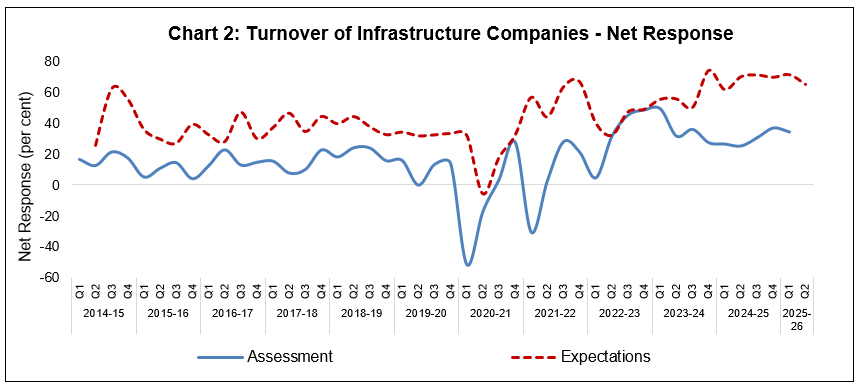

- आधारभूत संरचना क्षेत्र कंपनियाँ 2025-26 की पहली तिमाही के दौरान समग्र व्यावसायिक स्थिति, रोज़गार और अपने कारोबार के मामले में सकारात्मक रहीं (चार्ट 2 और तालिका बी)।

- उत्तरदाताओं ने लागत दबाव में कमी का आकलन किया; जबकि विक्रय मूल्य वृद्धि और लाभ मार्जिन पर धारणाएँ नरम रहीं।

2025-26 की दूसरी तिमाही के लिए अपेक्षाएं

- आधारभूत संरचना क्षेत्र कंपनियाँ समग्र व्यावसायिक स्थिति और कारोबार के बारे में अत्यधिक आशावादी बनी हुई हैं (चार्ट 2 और तालिका बी)।

- लागत दबाव उच्च बने रहने की संभावना है, जिससे बिक्री मूल्यों और लाभ मार्जिन में वृद्धि की उम्मीदें कम हो सकती हैं।

2025-26 की तीसरी और चौथी तिमाही के लिए अपेक्षाएं

- आधारभूत संरचना कंपनियों को 2025-26 की दूसरी छमाही के दौरान कारोबार और समग्र व्यावसायिक स्थिति में क्रमिक सुधार की उम्मीद है (तालिका डी)।

- निकट भविष्य में इनपुट लागत का दबाव जारी रहने की संभावना है; साथ ही बिक्री मूल्यों में भी वृद्धि होगी।

Summary of Net Responses3 on Survey Parameters

|

Table A: Services Sector

|

|

(per cent)

|

|

Parameters

|

Assessment period

|

Expectations period

|

|

Q4:2024-25*

|

Q1:2025-26

|

Q1:2025-26*

|

Q2:2025-26

|

|

Overall Business Situation

|

34.9

|

35.5

|

69.6

|

58.7

|

|

Turnover

|

34.3

|

35.4

|

72.3

|

60.3

|

|

Full-time Employees

|

20.4

|

21.5

|

53.9

|

40.4

|

|

Part-time Employees

|

15.8

|

16.1

|

56.5

|

39.8

|

|

Availability of Finance

|

19.7

|

23.1

|

57.0

|

44.4

|

|

Cost of Finance

|

-26.8

|

-23.9

|

-59.5

|

-39.7

|

|

Salary & Wages

|

-25.5

|

-38.8

|

-61.5

|

-42.7

|

|

Cost of Inputs

|

-36.7

|

-35.9

|

-69.2

|

-53.2

|

|

Selling Price

|

14.8

|

15.4

|

55.8

|

37.2

|

|

Profit Margin

|

7.6

|

8.1

|

49.3

|

34.6

|

|

Inventories

|

18.6

|

14.3

|

54.1

|

39.0

|

|

Technical/Service Capacity

|

17.1

|

19.7

|

62.7

|

45.7

|

|

Physical Investment

|

14.8

|

17.5

|

57.6

|

42.3

|

*: Based on the previous round’s response.

|

Table B: Infrastructure Sector

|

|

(per cent)

|

|

Parameters

|

Assessment period

|

Expectations period

|

|

Q4:2024-25*

|

Q1:2025-26

|

Q1:2025-26*

|

Q2:2025-26

|

|

Overall Business Situation

|

37.9

|

32.2

|

68.9

|

66.7

|

|

Turnover

|

37.0

|

34.5

|

71.2

|

65.0

|

|

Full-time Employees

|

23.4

|

16.0

|

59.9

|

54.8

|

|

Part-time Employees

|

28.5

|

13.8

|

59.7

|

64.1

|

|

Availability of Finance

|

27.5

|

13.4

|

69.8

|

61.7

|

|

Cost of Finance

|

-29.6

|

-15.8

|

-62.8

|

-56.1

|

|

Salary & Wages

|

-33.3

|

-25.0

|

-66.0

|

-61.7

|

|

Cost of Inputs

|

-47.7

|

-32.7

|

-71.1

|

-71.6

|

|

Selling Price

|

25.6

|

13.3

|

62.1

|

60.4

|

|

Profit Margin

|

16.3

|

6.9

|

57.9

|

51.3

|

|

Inventories

|

26.9

|

16.8

|

70.6

|

58.2

|

|

Technical/Service Capacity

|

32.2

|

14.6

|

72.6

|

70.9

|

|

Physical Investment

|

31.7

|

20.2

|

73.8

|

77.8

|

*: Based on the previous round’s response.

Expectations of Select Parameters for extended period – Net response (in per cent)

| Table C: Services Sector |

|

Parameter

|

Round 44

|

Round 45

|

|

Q1:2025-26

|

Q2:2025-26

|

Q3:2025-26

|

Q4:2025-26

|

|

Overall Business Situation

|

69.6

|

58.7

|

61.7

|

61.0

|

|

Turnover

|

72.3

|

60.3

|

63.0

|

63.0

|

|

Full-time Employees

|

53.9

|

40.4

|

41.3

|

40.3

|

|

Part-time Employees

|

56.5

|

39.8

|

40.7

|

39.8

|

|

Cost of Inputs

|

-69.2

|

-53.2

|

-51.4

|

-49.5

|

|

Selling Price

|

55.8

|

37.2

|

35.1

|

36.3

|

|

Table D: Infrastructure Sector

|

|

Parameter

|

Round 44

|

Round 45

|

|

Q1:2025-26

|

Q2:2025-26

|

Q3:2025-26

|

Q4:2025-26

|

|

Overall Business Situation

|

68.9

|

66.7

|

70.9

|

71.6

|

|

Turnover

|

71.2

|

65.0

|

69.5

|

74.4

|

|

Full-time Employees

|

59.9

|

54.8

|

56.9

|

56.0

|

|

Part-time Employees

|

59.7

|

64.1

|

64.5

|

64.5

|

|

Cost of Inputs

|

-71.1

|

-71.6

|

-67.6

|

-67.6

|

|

Selling Price

|

62.1

|

60.4

|

60.0

|

61.0

|

Note: Please see the excel file for time series data

Service Sector

|

Table S1: Assessment and Expectation for Overall Business Situation

|

| (Percentage responses)@ |

|

Quarter

|

Assessment

|

Expectation

|

|

Better

|

No Change

|

Worse

|

Net response#

|

Better

|

No Change

|

Worse

|

Net response

|

|

Q1:24-25

|

43.0

|

48.1

|

8.9

|

34.1

|

68.5

|

28.4

|

3.1

|

65.3

|

|

Q2:24-25

|

41.9

|

46.4

|

11.7

|

30.2

|

71.5

|

26.5

|

2.0

|

69.4

|

|

Q3:24-25

|

42.8

|

48.3

|

8.9

|

33.9

|

70.1

|

27.8

|

2.1

|

68.0

|

|

Q4:24-25

|

42.5

|

49.9

|

7.6

|

34.9

|

71.4

|

26.4

|

2.2

|

69.2

|

|

Q1:25-26

|

45.8

|

44.0

|

10.2

|

35.5

|

71.7

|

26.2

|

2.1

|

69.6

|

|

Q2:25-26

|

|

|

|

|

60.9

|

36.9

|

2.2

|

58.7

|

|

‘Increase’ in Overall business situation is optimistic.

|

|

@: Due to rounding off percentage may not add up to 100.

|

|

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism.

|

|

Table S2: Assessment and Expectation for Turnover

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

45.2

|

43.1

|

11.7

|

33.5

|

70.5

|

23.6

|

5.9

|

64.6

|

|

Q2:24-25

|

43.6

|

43.5

|

12.9

|

30.7

|

71.9

|

24.8

|

3.3

|

68.7

|

|

Q3:24-25

|

44.8

|

44.0

|

11.2

|

33.5

|

71.9

|

25.2

|

3.0

|

68.9

|

|

Q4:24-25

|

44.9

|

44.4

|

10.7

|

34.3

|

74.1

|

23.3

|

2.6

|

71.6

|

|

Q1:25-26

|

46.8

|

41.8

|

11.4

|

35.4

|

74.8

|

22.7

|

2.5

|

72.3

|

|

Q2:25-26

|

|

|

|

|

64.0

|

32.4

|

3.7

|

60.3

|

|

‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S3: Assessment and Expectation for Full-time Employees

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

34.8

|

58.2

|

7.0

|

27.8

|

48.4

|

49.5

|

2.1

|

46.3

|

|

Q2:24-25

|

29.0

|

62.0

|

9.0

|

20.1

|

52.2

|

46.0

|

1.7

|

50.5

|

|

Q3:24-25

|

34.5

|

58.7

|

6.8

|

27.8

|

45.8

|

52.4

|

1.8

|

44.0

|

|

Q4:24-25

|

28.4

|

63.7

|

7.9

|

20.4

|

54.3

|

44.0

|

1.7

|

52.6

|

|

Q1:25-26

|

30.5

|

60.6

|

9.0

|

21.5

|

55.1

|

43.8

|

1.1

|

53.9

|

|

Q2:25-26

|

|

|

|

|

41.9

|

56.7

|

1.5

|

40.4

|

|

‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S4: Assessment and Expectation for Part-time Employees

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

28.9

|

65.0

|

6.1

|

22.7

|

50.8

|

46.7

|

2.5

|

48.3

|

|

Q2:24-25

|

22.2

|

69.6

|

8.3

|

13.9

|

55.4

|

42.1

|

2.5

|

52.9

|

|

Q3:24-25

|

29.7

|

64.4

|

5.9

|

23.8

|

54.1

|

43.8

|

2.1

|

52.1

|

|

Q4:24-25

|

22.5

|

70.7

|

6.8

|

15.8

|

59.0

|

38.9

|

2.2

|

56.8

|

|

Q1:25-26

|

23.4

|

69.3

|

7.3

|

16.1

|

58.0

|

40.6

|

1.5

|

56.5

|

|

Q2:25-26

|

|

|

|

|

41.9

|

56.1

|

2.1

|

39.8

|

|

‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S5: Assessment and Expectation for Availability of Finance

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Improve

|

No Change

|

Worsen

|

Net response

|

Improve

|

No Change

|

Worsen

|

Net response

|

|

Q1:24-25

|

37.9

|

56.2

|

5.9

|

32.0

|

56.4

|

42.5

|

1.1

|

55.3

|

|

Q2:24-25

|

28.5

|

62.8

|

8.7

|

19.8

|

58.8

|

40.0

|

1.2

|

57.6

|

|

Q3:24-25

|

34.7

|

58.9

|

6.4

|

28.3

|

51.4

|

47.2

|

1.4

|

50.1

|

|

Q4:24-25

|

27.9

|

63.9

|

8.2

|

19.7

|

58.0

|

40.6

|

1.4

|

56.6

|

|

Q1:25-26

|

30.1

|

62.8

|

7.0

|

23.1

|

58.4

|

40.2

|

1.4

|

57.0

|

|

Q2:25-26

|

|

|

|

|

46.1

|

52.2

|

1.7

|

44.4

|

|

‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S6: Assessment and Expectation for Cost of Finance

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

40.0

|

55.1

|

4.9

|

-35.1

|

51.0

|

43.5

|

5.5

|

-45.5

|

|

Q2:24-25

|

36.6

|

59.0

|

4.3

|

-32.3

|

59.4

|

38.0

|

2.6

|

-56.9

|

|

Q3:24-25

|

38.9

|

57.7

|

3.4

|

-35.4

|

55.9

|

42.5

|

1.6

|

-54.3

|

|

Q4:24-25

|

33.7

|

59.3

|

6.9

|

-26.8

|

61.1

|

37.0

|

1.9

|

-59.2

|

|

Q1:25-26

|

32.3

|

59.4

|

8.3

|

-23.9

|

61.5

|

36.4

|

2.0

|

-59.5

|

|

Q2:25-26

|

|

|

|

|

44.1

|

51.4

|

4.4

|

-39.7

|

|

‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S7: Assessment and Expectation for Salary/Wages

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

45.3

|

52.0

|

2.7

|

-42.6

|

46.7

|

53.3

|

0.0

|

-46.7

|

|

Q2:24-25

|

29.9

|

66.0

|

4.1

|

-25.8

|

54.5

|

44.9

|

0.7

|

-53.8

|

|

Q3:24-25

|

33.5

|

63.5

|

3.0

|

-30.4

|

45.0

|

54.5

|

0.5

|

-44.5

|

|

Q4:24-25

|

29.5

|

66.4

|

4.0

|

-25.5

|

55.7

|

43.7

|

0.6

|

-55.1

|

|

Q1:25-26

|

42.2

|

54.4

|

3.4

|

-38.8

|

61.9

|

37.7

|

0.4

|

-61.5

|

|

Q2:25-26

|

|

|

|

|

43.6

|

55.5

|

0.9

|

-42.7

|

|

‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S8: Assessment and Expectation for Cost of Inputs

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

47.5

|

49.6

|

2.9

|

-44.7

|

57.1

|

42.5

|

0.4

|

-56.7

|

|

Q2:24-25

|

44.4

|

51.8

|

3.8

|

-40.6

|

66.5

|

32.9

|

0.6

|

-65.9

|

|

Q3:24-25

|

46.2

|

50.4

|

3.4

|

-42.7

|

65.6

|

33.1

|

1.3

|

-64.2

|

|

Q4:24-25

|

41.2

|

54.2

|

4.5

|

-36.7

|

69.4

|

30.1

|

0.5

|

-68.9

|

|

Q1:25-26

|

41.4

|

53.1

|

5.5

|

-35.9

|

70.1

|

29.0

|

0.9

|

-69.2

|

|

Q2:25-26

|

|

|

|

|

54.3

|

44.7

|

1.0

|

-53.2

|

|

‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S9: Assessment and Expectation for Selling Price)

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

26.9

|

67.9

|

5.2

|

21.7

|

52.4

|

46.0

|

1.6

|

50.8

|

|

Q2:24-25

|

20.5

|

71.1

|

8.4

|

12.1

|

55.5

|

43.2

|

1.4

|

54.1

|

|

Q3:24-25

|

29.0

|

64.1

|

6.9

|

22.2

|

50.4

|

47.3

|

2.3

|

48.0

|

|

Q4:24-25

|

21.2

|

72.4

|

6.4

|

14.8

|

57.9

|

39.8

|

2.3

|

55.6

|

|

Q1:25-26

|

22.9

|

69.6

|

7.5

|

15.4

|

57.4

|

41.1

|

1.6

|

55.8

|

|

Q2:25-26

|

|

|

|

|

39.4

|

58.4

|

2.2

|

37.2

|

|

‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S10: Assessment and Expectation for Profit Margin

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

26.5

|

57.5

|

16.0

|

10.5

|

50.6

|

45.1

|

4.2

|

46.4

|

|

Q2:24-25

|

21.0

|

62.1

|

16.8

|

4.2

|

49.6

|

46.3

|

4.2

|

45.4

|

|

Q3:24-25

|

28.4

|

58.2

|

13.4

|

15.0

|

42.3

|

53.7

|

3.9

|

38.4

|

|

Q4:24-25

|

21.2

|

65.1

|

13.6

|

7.6

|

52.6

|

43.7

|

3.7

|

48.9

|

|

Q1:25-26

|

24.4

|

59.3

|

16.3

|

8.1

|

53.0

|

43.3

|

3.7

|

49.3

|

|

Q2:25-26

|

|

|

|

|

39.2

|

56.1

|

4.6

|

34.6

|

|

‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S11: Assessment and Expectation for Inventories

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

31.2

|

62.0

|

6.9

|

24.3

|

50.9

|

45.9

|

3.2

|

47.8

|

|

Q2:24-25

|

24.5

|

69.4

|

6.1

|

18.4

|

54.3

|

43.4

|

2.3

|

52.0

|

|

Q3:24-25

|

29.8

|

64.6

|

5.5

|

24.3

|

47.7

|

51.3

|

1.1

|

46.6

|

|

Q4:24-25

|

26.5

|

65.6

|

7.9

|

18.6

|

55.0

|

43.6

|

1.4

|

53.6

|

|

Q1:25-26

|

22.8

|

68.6

|

8.6

|

14.3

|

56.1

|

41.9

|

2.0

|

54.1

|

|

Q2:25-26

|

|

|

|

|

41.9

|

55.3

|

2.9

|

39.0

|

|

‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S12: Assessment and Expectation for Technical/Service Capacity

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

29.4

|

67.4

|

3.2

|

26.2

|

54.7

|

45.3

|

0.0

|

54.7

|

|

Q2:24-25

|

23.0

|

72.5

|

4.5

|

18.5

|

57.2

|

42.5

|

0.2

|

57.0

|

|

Q3:24-25

|

32.4

|

64.2

|

3.4

|

29.0

|

58.6

|

41.1

|

0.3

|

58.3

|

|

Q4:24-25

|

22.0

|

73.2

|

4.8

|

17.1

|

64.3

|

35.0

|

0.7

|

63.6

|

|

Q1:25-26

|

23.3

|

73.0

|

3.7

|

19.7

|

62.7

|

37.3

|

0.0

|

62.7

|

|

Q2:25-26

|

|

|

|

|

46.0

|

53.7

|

0.3

|

45.7

|

|

‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

|

Table S13: Assessment and Expectation for Physical Investment

|

| (Percentage responses) |

|

Quarter

|

Assessment

|

Expectation

|

|

Increase

|

No Change

|

Decrease

|

Net response

|

Increase

|

No Change

|

Decrease

|

Net response

|

|

Q1:24-25

|

27.4

|

69.3

|

3.2

|

24.2

|

53.8

|

45.7

|

0.5

|

53.2

|

|

Q2:24-25

|

21.6

|

72.9

|

5.5

|

16.1

|

55.7

|

44.1

|

0.3

|

55.4

|

|

Q3:24-25

|

30.2

|

66.4

|

3.4

|

26.8

|

57.0

|

42.7

|

0.3

|

56.7

|

|

Q4:24-25

|

20.2

|

74.4

|

5.4

|

14.8

|

61.5

|

37.7

|

0.9

|

60.6

|

|

Q1:25-26

|

20.8

|

75.8

|

3.4

|

17.5

|

58.0

|

41.6

|

0.4

|

57.6

|

|

Q2:25-26

|

|

|

|

|

43.1

|

56.0

|

0.9

|

42.3

|

|

‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table S1 are applicable here.

|

| Table S14: Estimated Spare Capacity for the Services Sector |

|

Survey conducted during

|

Reference quarter

|

Response rate for the

question on Spare Capacity

(per cent)

|

Spare Capacity

(per cent)

|

|

Q4:2022-23

|

Q3:2022-23

|

63.0

|

13.8

|

|

Q1:2023-24

|

Q4:2022-23

|

79.8

|

13.6

|

|

Q2:2023-24

|

Q1:2023-24

|

84.3

|

12.3

|

|

Q3:2023-24

|

Q2:2023-24

|

74.0

|

11.8

|

|

Q4:2023-24

|

Q3:2023-24

|

74.8

|

11.7

|

|

Q1:2024-25

|

Q4:2023-24

|

78.8

|

11.3

|

|

Q2:2024-25

|

Q1:2024-25

|

71.5

|

11.2

|

|

Q3:2024-25

|

Q2:2024-25

|

79.9

|

10.6

|

|

Q4:2024-25

|

Q3:2024-25

|

83.7

|

10.9

|

|

Q1:2025-26

|

Q4:2024-25

|

65.7

|

11.2

|

Infrastructure Sector

| Table I1: Assessment and Expectation for Overall Business Situation |

| (Percentage responses)@ |

| Quarter |

Assessment |

Expectation |

| Better |

No Change |

Worse |

Net response# |

Better |

No Change |

Worse |

Net response |

| Q1:24-25 |

37.7 |

51.3 |

11 |

26.6 |

70.3 |

25.4 |

4.2 |

66.1 |

| Q2:24-25 |

38.4 |

44.9 |

16.7 |

21.7 |

76.5 |

21.6 |

2 |

74.5 |

| Q3:24-25 |

40.2 |

47.2 |

12.6 |

27.6 |

70.3 |

26.8 |

2.9 |

67.4 |

| Q4:24-25 |

44.4 |

49 |

6.5 |

37.9 |

70.9 |

25.2 |

3.9 |

66.9 |

| Q1:25-26 |

41.3 |

49.6 |

9.1 |

32.2 |

72.2 |

24.5 |

3.3 |

68.9 |

| Q2:25-26 |

|

|

|

|

69.2 |

28.2 |

2.6 |

66.7 |

‘Increase’ in Overall business situation is optimistic.

@: Due to rounding off percentage may not add up to 100.

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism. |

| Table I2: Assessment and Expectation for Turnover |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

37.7 |

51.3 |

11 |

26.6 |

68.4 |

24.8 |

6.8 |

61.5 |

| Q2:24-25 |

41.3 |

42.8 |

15.9 |

25.4 |

73.2 |

23.5 |

3.3 |

69.9 |

| Q3:24-25 |

44.1 |

42.5 |

13.4 |

30.7 |

73.2 |

24.6 |

2.2 |

71 |

| Q4:24-25 |

45.5 |

46.1 |

8.4 |

37 |

72.7 |

24.2 |

3.1 |

69.5 |

| Q1:25-26 |

46.2 |

42 |

11.8 |

34.5 |

75.2 |

20.9 |

3.9 |

71.2 |

| Q2:25-26 |

|

|

|

|

69.2 |

26.5 |

4.3 |

65 |

| ‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I3: Assessment and Expectation for Full-time Employees |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

31.2 |

59.1 |

9.7 |

21.4 |

47.5 |

51.7 |

0.8 |

46.6 |

| Q2:24-25 |

28.3 |

61.6 |

10.1 |

18.1 |

64.7 |

33.3 |

2 |

62.7 |

| Q3:24-25 |

30.7 |

60.6 |

8.7 |

22 |

41.5 |

56.3 |

2.2 |

39.3 |

| Q4:24-25 |

29.9 |

63.6 |

6.5 |

23.4 |

48.4 |

48.4 |

3.1 |

45.3 |

| Q1:25-26 |

22.7 |

70.6 |

6.7 |

16 |

61.2 |

37.5 |

1.3 |

59.9 |

| Q2:25-26 |

|

|

|

|

56.5 |

41.7 |

1.7 |

54.8 |

| ‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I4: Assessment and Expectation for Part-time Employees |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

32.8 |

59.9 |

7.3 |

25.5 |

55.8 |

41.9 |

2.3 |

53.5 |

| Q2:24-25 |

21.5 |

66.7 |

11.8 |

9.7 |

63.7 |

33.3 |

3 |

60.7 |

| Q3:24-25 |

30.3 |

61.6 |

8.1 |

22.2 |

54.3 |

40.2 |

5.4 |

48.9 |

| Q4:24-25 |

31.5 |

65.4 |

3.1 |

28.5 |

62 |

34 |

4 |

58 |

| Q1:25-26 |

19.1 |

75.5 |

5.3 |

13.8 |

62.8 |

34.1 |

3.1 |

59.7 |

| Q2:25-26 |

|

|

|

|

66.3 |

31.5 |

2.2 |

64.1 |

| ‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I5: Assessment and Expectation for Availability of Finance |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Improve |

No Change |

Worsen |

Net response |

Improve |

No Change |

Worsen |

Net response |

| Q1:24-25 |

35.1 |

59.1 |

5.8 |

29.2 |

58.6 |

40.5 |

0.9 |

57.8 |

| Q2:24-25 |

31.4 |

55.5 |

13.1 |

18.2 |

68 |

32 |

0 |

68 |

| Q3:24-25 |

34.1 |

57.9 |

7.9 |

26.2 |

55.1 |

44.1 |

0.7 |

54.4 |

| Q4:24-25 |

34 |

59.5 |

6.5 |

27.5 |

60.8 |

37.6 |

1.6 |

59.2 |

| Q1:25-26 |

22.7 |

68.1 |

9.2 |

13.4 |

71.8 |

26.2 |

2 |

69.8 |

| Q2:25-26 |

|

|

|

|

63.5 |

34.8 |

1.7 |

61.7 |

| ‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I6: Assessment and Expectation for Cost of Finance |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

36.4 |

56.3 |

7.3 |

-29.1 |

60.4 |

38.7 |

0.9 |

-59.4 |

| Q2:24-25 |

38.3 |

50 |

11.7 |

-26.6 |

65.1 |

32.2 |

2.7 |

-62.4 |

| Q3:24-25 |

37.3 |

52.4 |

10.3 |

-27 |

63.5 |

33.3 |

3.2 |

-60.3 |

| Q4:24-25 |

40.1 |

49.3 |

10.5 |

-29.6 |

60.7 |

36.9 |

2.5 |

-58.2 |

| Q1:25-26 |

25 |

65.8 |

9.2 |

-15.8 |

68.2 |

26.4 |

5.4 |

-62.8 |

| Q2:25-26 |

|

|

|

|

60.5 |

35.1 |

4.4 |

-56.1 |

| ‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I7: Assessment and Expectation for Salary/Wages |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No

Change |

Decrease |

Net response |

| Q1:24-25 |

38.3 |

57.8 |

3.9 |

-34.4 |

55.2 |

44.8 |

0 |

-55.2 |

| Q2:24-25 |

31.9 |

63 |

5.1 |

-26.8 |

70.6 |

29.4 |

0 |

-70.6 |

| Q3:24-25 |

34.9 |

61.1 |

4 |

-31 |

43.1 |

56.9 |

0 |

-43.1 |

| Q4:24-25 |

35.9 |

61.4 |

2.6 |

-33.3 |

47.6 |

52.4 |

0 |

-47.6 |

| Q1:25-26 |

30 |

65 |

5 |

-25 |

66.7 |

32.7 |

0.7 |

-66 |

| Q2:25-26 |

|

|

|

|

63.5 |

34.8 |

1.7 |

-61.7 |

| ‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I8: Assessment and Expectation for Cost of Inputs |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

42.2 |

51.7 |

6.1 |

-36.1 |

63.4 |

36.6 |

0 |

-63.4 |

| Q2:24-25 |

49.2 |

42.3 |

8.5 |

-40.8 |

75.9 |

23.4 |

0.7 |

-75.2 |

| Q3:24-25 |

48 |

45.6 |

6.4 |

-41.6 |

70.8 |

29.2 |

0 |

-70.8 |

| Q4:24-25 |

52.3 |

43 |

4.6 |

-47.7 |

70.4 |

29.6 |

0 |

-70.4 |

| Q1:25-26 |

39.8 |

53.1 |

7.1 |

-32.7 |

74.3 |

22.4 |

3.3 |

-71.1 |

| Q2:25-26 |

|

|

|

|

74.3 |

22.9 |

2.8 |

-71.6 |

| ‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I9: Assessment and Expectation for Selling Price |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

30.8 |

60 |

9.2 |

21.5 |

60.7 |

33.7 |

5.6 |

55.1 |

| Q2:24-25 |

24.5 |

61.8 |

13.6 |

10.9 |

69.8 |

27.1 |

3.1 |

66.7 |

| Q3:24-25 |

27 |

63.1 |

9.9 |

17.1 |

52.7 |

44.5 |

2.7 |

50 |

| Q4:24-25 |

30.1 |

65.4 |

4.5 |

25.6 |

56.4 |

43.6 |

0 |

56.4 |

| Q1:25-26 |

22.9 |

67.6 |

9.5 |

13.3 |

62.9 |

36.4 |

0.8 |

62.1 |

| Q2:25-26 |

|

|

|

|

63.4 |

33.7 |

3 |

60.4 |

| ‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I10: Assessment and Expectation for Profit Margin |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

28.6 |

59.7 |

11.7 |

16.9 |

54.7 |

38.5 |

6.8 |

47.9 |

| Q2:24-25 |

26.8 |

52.2 |

21 |

5.8 |

65.1 |

31.6 |

3.3 |

61.8 |

| Q3:24-25 |

28 |

55.2 |

16.8 |

11.2 |

45.7 |

49.3 |

5.1 |

40.6 |

| Q4:24-25 |

27.5 |

61.4 |

11.1 |

16.3 |

55.2 |

40 |

4.8 |

50.4 |

| Q1:25-26 |

23.3 |

60.3 |

16.4 |

6.9 |

61.8 |

34.2 |

3.9 |

57.9 |

| Q2:25-26 |

|

|

|

|

55.7 |

40 |

4.3 |

51.3 |

| ‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I11: Assessment and Expectation for Inventories |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

34.8 |

59.4 |

5.8 |

29 |

58 |

39 |

3 |

55 |

| Q2:24-25 |

30.4 |

59.8 |

9.8 |

20.5 |

71.5 |

27 |

1.5 |

70.1 |

| Q3:24-25 |

35.6 |

56.8 |

7.6 |

28 |

59.1 |

38.2 |

2.7 |

56.4 |

| Q4:24-25 |

37.2 |

52.4 |

10.3 |

26.9 |

62.4 |

35.9 |

1.7 |

60.7 |

| Q1:25-26 |

24.8 |

67.3 |

8 |

16.8 |

74.1 |

22.4 |

3.5 |

70.6 |

| Q2:25-26 |

|

|

|

|

62.7 |

32.7 |

4.5 |

58.2 |

| ‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I12: Assessment and Expectation for Technical/Service Capacity |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

36.2 |

59.5 |

4.3 |

31.9 |

66.2 |

32.4 |

1.4 |

64.9 |

| Q2:24-25 |

30.9 |

57.4 |

11.8 |

19.1 |

79.1 |

20.9 |

0 |

79.1 |

| Q3:24-25 |

32.9 |

62 |

5.1 |

27.8 |

72.5 |

27.5 |

0 |

72.5 |

| Q4:24-25 |

34.8 |

62.6 |

2.6 |

32.2 |

68.8 |

30 |

1.3 |

67.5 |

| Q1:25-26 |

20.7 |

73.2 |

6.1 |

14.6 |

72.6 |

27.4 |

0 |

72.6 |

| Q2:25-26 |

|

|

|

|

72.2 |

26.6 |

1.3 |

70.9 |

| ‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

| Table I13: Assessment and Expectation for Physical Investment |

| (Percentage responses) |

| Quarter |

Assessment |

Expectation |

| Increase |

No Change |

Decrease |

Net response |

Increase |

No Change |

Decrease |

Net response |

| Q1:24-25 |

33.1 |

61.2 |

5.8 |

27.3 |

64 |

36 |

0 |

64 |

| Q2:24-25 |

36.5 |

52.7 |

10.8 |

25.7 |

75.8 |

24.2 |

0 |

75.8 |

| Q3:24-25 |

32.6 |

61.6 |

5.8 |

26.7 |

75.3 |

24.7 |

0 |

75.3 |

| Q4:24-25 |

34.1 |

63.4 |

2.4 |

31.7 |

71.1 |

28.9 |

0 |

71.1 |

| Q1:25-26 |

25 |

70.2 |

4.8 |

20.2 |

73.8 |

26.2 |

0 |

73.8 |

| Q2:25-26 |

|

|

|

|

77.8 |

22.2 |

0 |

77.8 |

| ‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table I1 are applicable here. |

[1] The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank.

[2] Results of the previous survey round were released on the Bank’s website on April 09, 2025.

[3]Net Response (NR) is the difference between the percentage of respondents reporting optimism and those reporting pessimism. It ranges between -100 to 100. Positive value indicates expansion/optimism and negative value indicates contraction/pessimism. In other words, NR = (I – D); where, I is the percentage response of ‘Increase/optimism’, D is the percentage response of ‘Decrease/pessimism’ and E is the percentage response as ‘no change/ equal’ (i.e., I+D+E=100). For example, increase in turnover is optimism whereas decrease in cost of inputs is optimism.

|

IST,

IST,