मुद्रास्फीति पर घरेलू अपेक्षाओं का सर्वेक्षण

आज, रिजर्व बैंक ने अपने द्विमासिक मुद्रास्फीति पर घरेलू अपेक्षाओं के सर्वेक्षण (IESH)1 के मई 2021 चक्र के परिणाम जारी किए। कोविड-19 महामारी के चलते सर्वेक्षण टेलीफ़ोन पर, अप्रैल 29 से मई 11, 2021 के बीच 18 प्रमुख शहरों में आयोजित किया गया था। इसके परिणाम2 5,979 शहरी परिवारों3 के प्रत्युत्तरों पर आधारित हैं। विशेष: -

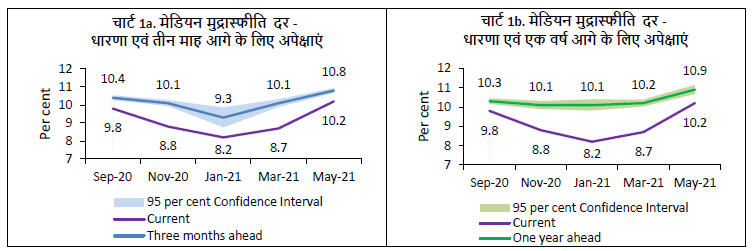

वर्तमान अवधि के लिए परिवारों की मेडियन मुद्रास्फीति अनुभूति में पिछले चक्र के मुकाबले क्रमशः 150 आधार अंक की वृद्धि हुई [चार्ट 1a और 1b; तालिका 3]। -

तीन माह और एक वर्ष आगे की दोनों अवधि के लिए नवीनतम चक्र में,परिवारों की मेडियन मुद्रास्फीति अपेक्षाओं में प्रत्येक के लिए 70 आधार अंक की वृद्धि हुई [चार्ट 1a और 1b; तालिका 3]।. -

लगभग 60 प्रतिशत उत्तरदाताओं को अगले तीन महीनों के साथ-साथ अगले एक वर्ष में सामान्य मुद्रास्फीति के बढ्ने की उम्मीद है [तालिका 1a और 1b]। -

सामान्य कीमतों और मुद्रास्फीति को लेकर उम्मीदें सामान्यतया खाद्य समूहों के साथ जुड़ी हुई थीं [तालिका 4]। -

गैर-खाद्य उत्पादों, घरेलू टिकाऊ वस्तुओं, आवास और सेवाओं के लिए तिमाही क्षितिज की तुलना में परिवारों को एक वर्ष के क्षितिज में कीमतों में ज्यादा वृद्धि होने की उम्मीद है [तालिका 1a और 1b]। नोट: कृपया समय शृंखला डेटा के लिए एक्सेल फ़ाइल देखें।

| Table 1(a): Product-wise Expectations of Prices for Three Months ahead | | (Percentage of Respondents) | | Survey period ended | May-20 | Nov-20 | Jan-21 | Mar-21 | May-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 85.3 | 0.73 | 83.3 | 0.85 | 83.7 | 0.89 | 86.6 | 0.74 | 83.7 | 0.68 | | Price increase more than current rate | 56.0 | 1.02 | 55.4 | 1.14 | 56.0 | 1.26 | 58.4 | 1.14 | 58.5 | 0.91 | | Price increase similar to current rate | 23.5 | 0.89 | 23.6 | 0.95 | 22.4 | 0.95 | 24.1 | 0.94 | 21.2 | 0.76 | | Price increase less than current rate | 5.8 | 0.49 | 4.4 | 0.46 | 5.3 | 0.53 | 4.1 | 0.50 | 4.0 | 0.37 | | No changes in prices | 12.4 | 0.69 | 14.2 | 0.81 | 14.3 | 0.86 | 11.1 | 0.71 | 14.0 | 0.63 | | Decline in prices | 2.3 | 0.32 | 2.4 | 0.32 | 1.9 | 0.30 | 2.3 | 0.29 | 2.3 | 0.30 | | Food Product | | | | | | | | | | | | Prices will increase | 84.6 | 0.75 | 81.5 | 0.83 | 80.9 | 0.95 | 85.2 | 0.70 | 84.4 | 0.72 | | Price increase more than current rate | 58.6 | 1.00 | 54.7 | 1.10 | 54.2 | 1.16 | 61.2 | 1.01 | 60.2 | 0.92 | | Price increase similar to current rate | 20.0 | 0.82 | 20.3 | 0.90 | 20.0 | 0.95 | 18.1 | 0.81 | 19.4 | 0.75 | | Price increase less than current rate | 6.0 | 0.49 | 6.5 | 0.59 | 6.7 | 0.57 | 6.0 | 0.55 | 4.8 | 0.38 | | No changes in prices | 10.7 | 0.64 | 11.6 | 0.67 | 13.0 | 0.82 | 9.3 | 0.60 | 11.8 | 0.63 | | Decline in prices | 4.7 | 0.45 | 6.9 | 0.54 | 6.1 | 0.54 | 5.5 | 0.45 | 3.9 | 0.39 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 76.7 | 0.88 | 74.8 | 0.99 | 79.3 | 0.98 | 81.0 | 0.78 | 78.6 | 0.79 | | Price increase more than current rate | 49.5 | 0.99 | 48.0 | 1.11 | 51.6 | 1.20 | 57.0 | 1.00 | 53.1 | 0.95 | | Price increase similar to current rate | 20.8 | 0.82 | 20.3 | 0.87 | 20.9 | 0.90 | 19.4 | 0.77 | 19.8 | 0.75 | | Price increase less than current rate | 6.4 | 0.50 | 6.4 | 0.57 | 6.7 | 0.56 | 4.7 | 0.43 | 5.6 | 0.44 | | No changes in prices | 17.8 | 0.79 | 20.1 | 0.92 | 16.9 | 0.91 | 12.9 | 0.69 | 17.1 | 0.72 | | Decline in prices | 5.5 | 0.49 | 5.2 | 0.48 | 3.8 | 0.40 | 6.2 | 0.48 | 4.3 | 0.42 | | Household Durables | | | | | | | | | | | | Prices will increase | 55.1 | 1.04 | 60.3 | 1.09 | 64.3 | 1.11 | 68.1 | 0.92 | 58.8 | 0.96 | | Price increase more than current rate | 33.6 | 0.96 | 38.2 | 1.11 | 42.5 | 1.15 | 46.0 | 0.98 | 37.7 | 0.94 | | Price increase similar to current rate | 16.4 | 0.76 | 16.2 | 0.82 | 16.8 | 0.77 | 17.7 | 0.74 | 16.4 | 0.70 | | Price increase less than current rate | 5.1 | 0.44 | 5.8 | 0.59 | 5.0 | 0.49 | 4.4 | 0.44 | 4.7 | 0.40 | | No changes in prices | 29.7 | 0.94 | 27.4 | 1.00 | 27.2 | 1.05 | 24.6 | 0.84 | 32.2 | 0.90 | | Decline in prices | 15.2 | 0.76 | 12.3 | 0.71 | 8.4 | 0.58 | 7.3 | 0.50 | 9.0 | 0.56 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 48.6 | 1.01 | 60.7 | 1.12 | 66.1 | 1.11 | 68.9 | 0.93 | 54.9 | 0.94 | | Price increase more than current rate | 30.2 | 0.93 | 40.4 | 1.14 | 45.1 | 1.20 | 48.4 | 1.03 | 36.5 | 0.92 | | Price increase similar to current rate | 13.6 | 0.69 | 15.9 | 0.80 | 16.2 | 0.79 | 16.7 | 0.75 | 14.4 | 0.67 | | Price increase less than current rate | 4.8 | 0.45 | 4.4 | 0.50 | 4.8 | 0.49 | 3.8 | 0.40 | 3.9 | 0.36 | | No changes in prices | 30.3 | 0.93 | 25.9 | 1.01 | 24.6 | 1.02 | 22.2 | 0.86 | 30.5 | 0.89 | | Decline in prices | 21.1 | 0.83 | 13.4 | 0.84 | 9.3 | 0.66 | 8.9 | 0.54 | 14.6 | 0.69 | | Cost of Services | | | | | | | | | | | | Prices will increase | 68.3 | 0.97 | 70.4 | 1.02 | 68.8 | 1.06 | 75.6 | 0.90 | 67.6 | 0.89 | | Price increase more than current rate | 43.2 | 0.99 | 44.8 | 1.10 | 45.7 | 1.15 | 51.6 | 1.02 | 44.6 | 0.94 | | Price increase similar to current rate | 19.3 | 0.79 | 20.3 | 0.88 | 18.5 | 0.81 | 19.4 | 0.79 | 18.0 | 0.71 | | Price increase less than current rate | 5.9 | 0.46 | 5.3 | 0.50 | 4.6 | 0.50 | 4.5 | 0.44 | 5.0 | 0.40 | | No changes in prices | 27.4 | 0.93 | 25.2 | 0.98 | 27.4 | 1.02 | 20.8 | 0.84 | 29.2 | 0.87 | | Decline in prices | 4.4 | 0.42 | 4.4 | 0.44 | 3.8 | 0.47 | 3.6 | 0.36 | 3.2 | 0.35 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(b): Product-wise Expectations of Prices for One Year ahead | | (Percentage of Respondents) | | Survey period ended | May-20 | Nov-20 | Jan-21 | Mar-21 | May-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 85.6 | 0.73 | 86.5 | 0.77 | 88.0 | 0.80 | 88.7 | 0.61 | 86.9 | 0.65 | | Price increase more than current rate | 57.1 | 1.00 | 59.5 | 1.09 | 62.9 | 1.23 | 63.4 | 1.07 | 62.4 | 0.91 | | Price increase similar to current rate | 23.8 | 0.88 | 22.9 | 0.92 | 21.2 | 0.95 | 21.4 | 0.87 | 20.3 | 0.75 | | Price increase less than current rate | 4.7 | 0.43 | 4.1 | 0.44 | 3.9 | 0.43 | 3.8 | 0.44 | 4.2 | 0.38 | | No changes in prices | 11.9 | 0.67 | 10.3 | 0.69 | 9.6 | 0.75 | 8.5 | 0.54 | 10.4 | 0.58 | | Decline in prices | 2.5 | 0.33 | 3.2 | 0.39 | 2.4 | 0.33 | 2.8 | 0.32 | 2.7 | 0.33 | | Food Product | | | | | | | | | | | | Prices will increase | 77.3 | 0.86 | 77.7 | 0.97 | 80.5 | 0.96 | 81.7 | 0.74 | 81.7 | 0.76 | | Price increase more than current rate | 46.9 | 1.01 | 48.4 | 1.10 | 53.0 | 1.21 | 54.6 | 1.01 | 53.5 | 0.95 | | Price increase similar to current rate | 24.2 | 0.88 | 24.0 | 0.93 | 22.6 | 0.96 | 22.2 | 0.83 | 22.6 | 0.77 | | Price increase less than current rate | 6.3 | 0.51 | 5.4 | 0.48 | 4.9 | 0.49 | 4.9 | 0.46 | 5.6 | 0.43 | | No changes in prices | 15.7 | 0.74 | 14.3 | 0.82 | 13.4 | 0.84 | 12.0 | 0.61 | 12.5 | 0.64 | | Decline in prices | 6.9 | 0.52 | 8.0 | 0.58 | 6.1 | 0.55 | 6.3 | 0.45 | 5.8 | 0.46 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 73.3 | 0.92 | 75.0 | 0.98 | 80.4 | 0.93 | 79.9 | 0.79 | 79.2 | 0.78 | | Price increase more than current rate | 42.6 | 0.99 | 45.6 | 1.13 | 52.8 | 1.22 | 54.0 | 1.02 | 51.8 | 0.96 | | Price increase similar to current rate | 23.9 | 0.87 | 23.5 | 0.93 | 22.7 | 0.93 | 21.4 | 0.83 | 21.8 | 0.76 | | Price increase less than current rate | 6.8 | 0.51 | 5.9 | 0.55 | 4.9 | 0.45 | 4.6 | 0.44 | 5.7 | 0.44 | | No changes in prices | 20.7 | 0.84 | 19.3 | 0.89 | 15.0 | 0.84 | 13.4 | 0.66 | 15.8 | 0.70 | | Decline in prices | 6.0 | 0.49 | 5.8 | 0.51 | 4.6 | 0.46 | 6.6 | 0.47 | 5.0 | 0.44 | | Household Durables | | | | | | | | | | | | Prices will increase | 59.6 | 1.03 | 65.0 | 1.08 | 69.8 | 1.07 | 70.3 | 0.90 | 64.7 | 0.94 | | Price increase more than current rate | 34.8 | 0.99 | 39.9 | 1.08 | 45.0 | 1.20 | 47.2 | 0.98 | 41.2 | 0.94 | | Price increase similar to current rate | 19.1 | 0.79 | 19.7 | 0.88 | 19.9 | 0.81 | 18.8 | 0.74 | 18.6 | 0.72 | | Price increase less than current rate | 5.7 | 0.47 | 5.4 | 0.54 | 4.9 | 0.48 | 4.4 | 0.42 | 4.9 | 0.39 | | No changes in prices | 28.4 | 0.93 | 24.6 | 1.01 | 22.1 | 0.97 | 22.7 | 0.81 | 26.7 | 0.86 | | Decline in prices | 12.1 | 0.67 | 10.3 | 0.68 | 8.1 | 0.63 | 6.9 | 0.48 | 8.6 | 0.55 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 59.7 | 1.00 | 72.1 | 1.01 | 74.8 | 1.05 | 75.7 | 0.86 | 65.4 | 0.93 | | Price increase more than current rate | 36.9 | 0.98 | 47.8 | 1.10 | 49.9 | 1.22 | 53.8 | 1.04 | 43.5 | 0.97 | | Price increase similar to current rate | 17.3 | 0.77 | 19.8 | 0.87 | 20.2 | 0.91 | 18.3 | 0.79 | 17.5 | 0.71 | | Price increase less than current rate | 5.5 | 0.46 | 4.5 | 0.44 | 4.7 | 0.48 | 3.6 | 0.38 | 4.5 | 0.40 | | No changes in prices | 25.1 | 0.89 | 19.2 | 0.86 | 17.7 | 0.95 | 17.8 | 0.76 | 23.3 | 0.83 | | Decline in prices | 15.2 | 0.73 | 8.7 | 0.65 | 7.5 | 0.61 | 6.5 | 0.48 | 11.2 | 0.62 | | Cost of Services | | | | | | | | | | | | Prices will increase | 74.4 | 0.91 | 77.2 | 0.98 | 78.5 | 0.98 | 81.4 | 0.75 | 76.5 | 0.82 | | Price increase more than current rate | 44.6 | 0.98 | 49.0 | 1.11 | 51.1 | 1.21 | 55.2 | 1.02 | 50.0 | 0.94 | | Price increase similar to current rate | 23.1 | 0.85 | 22.2 | 0.87 | 22.9 | 0.96 | 21.5 | 0.82 | 21.3 | 0.75 | | Price increase less than current rate | 6.7 | 0.50 | 6.1 | 0.55 | 4.6 | 0.45 | 4.7 | 0.44 | 5.2 | 0.43 | | No changes in prices | 22.1 | 0.87 | 18.6 | 0.91 | 18.2 | 0.94 | 15.2 | 0.67 | 20.1 | 0.77 | | Decline in prices | 3.5 | 0.38 | 4.2 | 0.45 | 3.3 | 0.41 | 3.4 | 0.35 | 3.4 | 0.36 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 2: Inflation Expectations of Various Groups: May 2021 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Overall | 10.4 | 0.09 | 10.2 | 0.04 | 11.4 | 0.09 | 10.8 | 0.07 | 10.7 | 0.11 | 10.9 | 0.12 | | Gender-wise | | | | | | | | | | | | | | Male | 10.6 | 0.10 | 10.3 | 0.05 | 11.5 | 0.10 | 11.0 | 0.19 | 10.8 | 0.12 | 11.0 | 0.28 | | Female | 9.8 | 0.13 | 9.5 | 0.38 | 11.0 | 0.13 | 10.5 | 0.09 | 10.6 | 0.15 | 10.7 | 0.12 | | Category-wise | | | | | | | | | | | | | | Financial Sector Employees | 9.5 | 0.44 | 8.7 | 0.92 | 10.8 | 0.44 | 10.7 | 0.97 | 10.1 | 0.53 | 10.4 | 1.34 | | Other Employees | 10.3 | 0.14 | 10.2 | 0.07 | 11.3 | 0.14 | 10.8 | 0.15 | 10.7 | 0.17 | 10.8 | 0.18 | | Self Employed | 10.7 | 0.15 | 10.3 | 0.07 | 11.7 | 0.14 | 11.3 | 0.50 | 10.8 | 0.18 | 11.3 | 0.50 | | Homemakers | 9.8 | 0.14 | 9.6 | 0.38 | 11.0 | 0.14 | 10.5 | 0.09 | 10.6 | 0.18 | 10.7 | 0.14 | | Retired Persons | 10.9 | 0.32 | 10.5 | 0.14 | 11.7 | 0.34 | 12.2 | 0.94 | 11.2 | 0.42 | 12.6 | 1.49 | | Daily Workers | 10.5 | 0.21 | 10.3 | 0.09 | 11.6 | 0.22 | 11.3 | 0.63 | 10.9 | 0.28 | 11.4 | 0.76 | | Other category | 10.1 | 0.22 | 10.0 | 0.33 | 10.8 | 0.22 | 10.4 | 0.15 | 10.2 | 0.29 | 10.5 | 0.21 | | Age Group-wise | | | | | | | | | | | | | | Up to 25 years | 9.4 | 0.17 | 8.6 | 0.24 | 10.5 | 0.18 | 10.1 | 0.19 | 10.3 | 0.21 | 10.5 | 0.12 | | 25 to 30 years | 10.2 | 0.16 | 10.2 | 0.12 | 11.2 | 0.16 | 10.7 | 0.13 | 10.6 | 0.21 | 10.8 | 0.24 | | 30 to 35 years | 10.5 | 0.17 | 10.3 | 0.08 | 11.5 | 0.16 | 11.0 | 0.31 | 10.7 | 0.20 | 10.9 | 0.29 | | 35 to 40 years | 10.4 | 0.17 | 10.2 | 0.09 | 11.4 | 0.17 | 10.9 | 0.28 | 10.9 | 0.21 | 11.3 | 0.57 | | 40 to 45 years | 10.6 | 0.17 | 10.3 | 0.08 | 11.7 | 0.16 | 11.1 | 0.41 | 10.9 | 0.21 | 11.2 | 0.51 | | 45 to 50 years | 10.6 | 0.22 | 10.4 | 0.10 | 11.6 | 0.21 | 11.8 | 0.60 | 10.7 | 0.25 | 11.2 | 0.58 | | 50 to 55 years | 10.8 | 0.27 | 10.4 | 0.13 | 11.6 | 0.27 | 11.2 | 0.68 | 10.5 | 0.34 | 10.7 | 0.40 | | 55 to 60 years | 10.7 | 0.28 | 10.4 | 0.11 | 11.4 | 0.27 | 10.7 | 0.22 | 10.3 | 0.34 | 10.7 | 0.37 | | 60 years and above | 10.9 | 0.27 | 10.4 | 0.14 | 11.7 | 0.27 | 11.6 | 0.77 | 11.2 | 0.32 | 12.4 | 1.05 | | City-wise | | | | | | | | | | | | | | Ahmedabad | 10.1 | 0.34 | 10.1 | 0.41 | 11.3 | 0.31 | 11.2 | 0.78 | 11.1 | 0.35 | 11.4 | 0.89 | | Bengaluru | 10.5 | 0.26 | 10.4 | 0.10 | 11.9 | 0.25 | 12.4 | 0.64 | 12.0 | 0.31 | 15.2 | 0.33 | | Bhopal | 9.5 | 0.70 | 8.9 | 1.12 | 10.9 | 0.74 | 10.5 | 1.01 | 9.5 | 0.90 | 10.2 | 1.14 | | Bhubaneswar | 10.0 | 0.74 | 10.1 | 1.00 | 11.2 | 0.75 | 12.5 | 2.26 | 10.3 | 0.82 | 11.1 | 2.04 | | Chennai | 9.3 | 0.33 | 9.6 | 0.72 | 10.3 | 0.34 | 10.2 | 0.44 | 10.4 | 0.42 | 10.8 | 0.72 | | Delhi | 10.5 | 0.23 | 10.3 | 0.11 | 11.5 | 0.23 | 11.1 | 0.52 | 10.6 | 0.27 | 10.7 | 0.30 | | Guwahati | 11.6 | 0.63 | 10.8 | 0.80 | 12.4 | 0.66 | 12.7 | 1.23 | 12.4 | 0.77 | 13.9 | 1.69 | | Hyderabad | 10.9 | 0.26 | 10.5 | 0.16 | 11.9 | 0.25 | 12.0 | 0.90 | 11.4 | 0.34 | 13.0 | 1.17 | | Jaipur | 11.3 | 0.50 | 10.8 | 0.90 | 11.6 | 0.50 | 11.2 | 1.30 | 11.2 | 0.62 | 11.5 | 1.52 | | Kolkata | 11.1 | 0.28 | 10.6 | 0.16 | 12.1 | 0.27 | 13.0 | 0.98 | 11.5 | 0.31 | 12.3 | 0.85 | | Lucknow | 10.1 | 0.44 | 9.1 | 0.41 | 10.7 | 0.41 | 9.9 | 0.40 | 10.7 | 0.50 | 10.7 | 0.44 | | Mumbai | 10.8 | 0.21 | 10.3 | 0.12 | 11.6 | 0.21 | 11.1 | 0.48 | 10.0 | 0.29 | 10.7 | 0.30 | | Nagpur | 7.5 | 0.44 | 6.7 | 0.42 | 8.7 | 0.42 | 8.2 | 0.49 | 8.2 | 0.58 | 8.4 | 0.47 | | Patna | 9.5 | 0.86 | 8.9 | 0.90 | 10.1 | 0.88 | 9.8 | 0.88 | 8.8 | 1.06 | 8.8 | 1.13 | | Thiruvananthapuram | 6.1 | 0.80 | 4.8 | 0.64 | 7.6 | 0.79 | 6.3 | 0.55 | 8.7 | 0.99 | 8.1 | 1.30 | | Chandigarh | 10.8 | 0.47 | 10.7 | 0.48 | 11.0 | 0.49 | 11.1 | 0.72 | 10.1 | 0.79 | 10.7 | 0.78 | | Ranchi | 8.1 | 0.51 | 7.5 | 0.52 | 8.4 | 0.47 | 7.9 | 0.56 | 6.9 | 0.67 | 7.1 | 0.71 | | Raipur | 9.4 | 0.69 | 8.9 | 0.68 | 10.3 | 0.71 | 9.7 | 0.71 | 9.8 | 0.81 | 9.6 | 0.74 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3: Household Inflation Expectations – Current Perception, Three Months and One Year Ahead Expectations | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | May-20 | 9.6 | 0.09 | 9.3 | 0.28 | 10.6 | 0.09 | 10.4 | 0.06 | 9.7 | 0.12 | 10.2 | 0.07 | | Nov-20 | 9.5 | 0.11 | 8.8 | 0.18 | 10.4 | 0.11 | 10.1 | 0.09 | 9.8 | 0.13 | 10.1 | 0.11 | | Jan-21 | 9.1 | 0.12 | 8.2 | 0.17 | 10.0 | 0.12 | 9.3 | 0.29 | 9.7 | 0.13 | 10.1 | 0.15 | | Mar-21 | 9.4 | 0.11 | 8.7 | 0.16 | 10.4 | 0.11 | 10.1 | 0.11 | 10.0 | 0.12 | 10.2 | 0.09 | | May-21 | 10.4 | 0.09 | 10.2 | 0.04 | 11.4 | 0.09 | 10.8 | 0.07 | 10.7 | 0.11 | 10.9 | 0.12 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 4: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three Months Ahead and One Year Ahead | | (Percentage of Respondents) | | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three Months Ahead | | May-20 | 63.3 | 59.8 | 46.5 | 42.6 | 57.3 | | Nov-20 | 62.7 | 63.5 | 52.4 | 54.0 | 60.7 | | Jan-21 | 63.3 | 64.3 | 54.5 | 55.7 | 62.8 | | Mar-21 | 67.0 | 65.7 | 57.4 | 58.6 | 65.1 | | May-21 | 68.0 | 65.1 | 51.8 | 50.3 | 60.5 | | One Year Ahead | | May-20 | 62.3 | 59.5 | 50.9 | 50.3 | 62.3 | | Nov-20 | 66.4 | 65.9 | 56.7 | 62.1 | 68.9 | | Jan-21 | 68.4 | 68.6 | 60.6 | 63.0 | 69.0 | | Mar-21 | 69.6 | 70.1 | 62.4 | 65.5 | 71.6 | | May-21 | 68.3 | 67.1 | 57.7 | 57.1 | 67.2 | | Note: Figures are based on sample observations |

| Table 5(a): Cross-tabulation of Number of Respondents by Current Inflation Perception and Three Months Ahead Inflation Expectations: May 2021 | | Three Months Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 6 | 4 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 13 | | 1-<2 | 3 | 14 | 6 | 5 | 1 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 31 | | 2-<3 | 2 | 5 | 80 | 40 | 24 | 12 | 4 | 0 | 3 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 173 | | 3-<4 | 0 | 2 | 7 | 75 | 39 | 39 | 23 | 2 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 190 | | 4-<5 | 0 | 0 | 2 | 1 | 82 | 50 | 42 | 10 | 7 | 1 | 5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 200 | | 5-<6 | 0 | 3 | 7 | 9 | 17 | 359 | 118 | 135 | 74 | 8 | 94 | 0 | 2 | 0 | 0 | 10 | 7 | 1 | 844 | | 6-<7 | 0 | 1 | 1 | 2 | 6 | 8 | 118 | 70 | 64 | 11 | 22 | 2 | 7 | 0 | 0 | 1 | 0 | 1 | 314 | | 7-<8 | 1 | 0 | 1 | 1 | 5 | 11 | 5 | 147 | 101 | 51 | 45 | 4 | 12 | 2 | 1 | 7 | 1 | 1 | 396 | | 8-<9 | 0 | 0 | 0 | 2 | 0 | 1 | 3 | 6 | 197 | 70 | 118 | 16 | 23 | 8 | 5 | 4 | 11 | 0 | 464 | | 9-<10 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 2 | 85 | 36 | 20 | 22 | 2 | 1 | 5 | 3 | 0 | 178 | | 10-<11 | 0 | 0 | 0 | 1 | 1 | 22 | 6 | 2 | 21 | 8 | 497 | 52 | 174 | 45 | 18 | 256 | 144 | 2 | 1249 | | 11-<12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 13 | 10 | 2 | 1 | 8 | 1 | 1 | 37 | | 12-<13 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 2 | 0 | 39 | 7 | 14 | 21 | 8 | 0 | 93 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 17 | 3 | 1 | 6 | 0 | 29 | | 14-<15 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 9 | 6 | 7 | 0 | 25 | | 15-<16 | 0 | 0 | 0 | 0 | 0 | 3 | 0 | 1 | 0 | 0 | 8 | 1 | 3 | 4 | 0 | 120 | 191 | 0 | 331 | | >=16 | 1 | 0 | 0 | 0 | 3 | 12 | 0 | 1 | 1 | 0 | 16 | 0 | 0 | 0 | 1 | 35 | 1333 | 9 | 1412 | | Total | 13 | 29 | 106 | 136 | 180 | 518 | 320 | 375 | 475 | 234 | 847 | 109 | 293 | 87 | 53 | 475 | 1713 | 16 | 5979 | | Note: Figures are based on sample observations |

| Table 5(b): Cross-tabulation of Number of Respondents by Current Inflation Perception and One Year Ahead Inflation Expectations: May 2021 | | One Year Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 3 | 2 | 4 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 13 | | 1-<2 | 5 | 7 | 7 | 4 | 3 | 3 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 31 | | 2-<3 | 37 | 2 | 39 | 27 | 34 | 8 | 6 | 4 | 5 | 2 | 4 | 0 | 1 | 1 | 0 | 0 | 2 | 1 | 173 | | 3-<4 | 29 | 0 | 5 | 38 | 26 | 35 | 18 | 10 | 13 | 3 | 7 | 0 | 4 | 0 | 0 | 2 | 0 | 0 | 190 | | 4-<5 | 47 | 0 | 1 | 3 | 31 | 25 | 39 | 18 | 19 | 0 | 11 | 1 | 3 | 0 | 1 | 1 | 0 | 0 | 200 | | 5-<6 | 124 | 0 | 0 | 8 | 7 | 204 | 65 | 119 | 91 | 22 | 118 | 7 | 16 | 5 | 3 | 38 | 16 | 1 | 844 | | 6-<7 | 34 | 0 | 0 | 1 | 3 | 4 | 83 | 35 | 60 | 31 | 32 | 6 | 11 | 1 | 0 | 6 | 7 | 0 | 314 | | 7-<8 | 56 | 0 | 1 | 1 | 3 | 7 | 5 | 94 | 49 | 76 | 52 | 6 | 13 | 1 | 9 | 14 | 9 | 0 | 396 | | 8-<9 | 64 | 0 | 0 | 0 | 2 | 2 | 4 | 5 | 116 | 42 | 110 | 22 | 42 | 9 | 4 | 23 | 19 | 0 | 464 | | 9-<10 | 24 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 45 | 33 | 24 | 21 | 4 | 2 | 16 | 7 | 0 | 178 | | 10-<11 | 147 | 0 | 1 | 0 | 1 | 12 | 2 | 6 | 14 | 3 | 306 | 32 | 119 | 32 | 25 | 265 | 283 | 1 | 1249 | | 11-<12 | 4 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 8 | 4 | 6 | 2 | 4 | 7 | 0 | 37 | | 12-<13 | 8 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 19 | 9 | 7 | 22 | 25 | 0 | 93 | | 13-<14 | 7 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 11 | 1 | 3 | 6 | 0 | 29 | | 14-<15 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 2 | 1 | 5 | 4 | 8 | 0 | 25 | | 15-<16 | 27 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 2 | 0 | 5 | 0 | 2 | 0 | 2 | 83 | 208 | 0 | 331 | | >=16 | 171 | 0 | 0 | 0 | 0 | 2 | 0 | 2 | 0 | 0 | 23 | 0 | 1 | 0 | 1 | 21 | 1188 | 3 | 1412 | | Total | 790 | 11 | 58 | 84 | 110 | 304 | 224 | 293 | 372 | 226 | 705 | 107 | 258 | 80 | 62 | 503 | 1786 | 6 | 5979 | | Note: Figures are based on sample observations |

|

IST,

IST,