IST,

IST,

मुद्रास्फीति पर घरेलू अपेक्षाओं का सर्वेक्षण

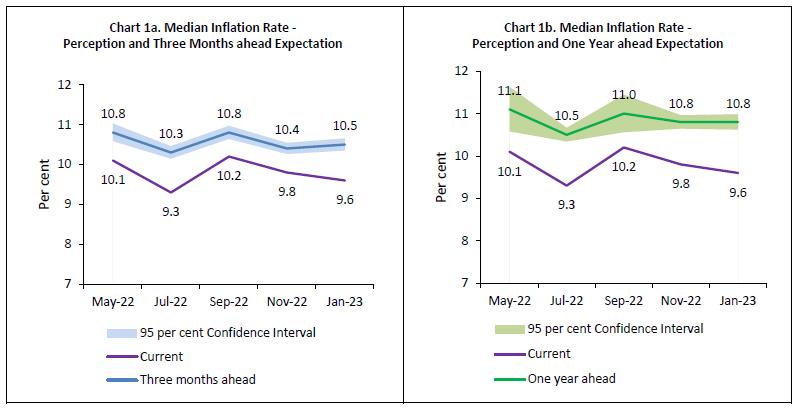

आज रिज़र्व बैंक ने अपने द्विमासिक मुद्रास्फीति पर घरेलू अपेक्षाओं का सर्वेक्षण (IESH)1 2 के जनवरी 2023 दौर के परिणाम जारी किए। सर्वेक्षण 2 से 11 जनवरी, 2023 के दौरान 19 प्रमुख शहरों में 6,024 शहरी परिवारों से प्रतिक्रिया के साथ किया गया था। इस नमूने में महिला उत्तरदाताओं की हिस्सेदारी 49.7 प्रतिशत थी। मीडियन के संदर्भ में परिणामों को संक्षेपित किया गया है। मुख्य विशेषताएं:

नोट: कृपया समय श्रृंखला डेटा के लिए एक्सेल फाइल देखें।3

1 सर्वेक्षण के परिणाम उत्तरदाताओं के विचारों को दर्शाते हैं, जो जरूरी नहीं कि रिज़र्व बैंक द्वारा मान्यताप्राप्त हों। पिछले सर्वेक्षण चक्र के परिणाम बैंक की वेबसाइट पर 07 दिसंबर 2022 को जारी किए गए थे। 2 यह सर्वेक्षण भारतीय रिज़र्व बैंक के द्वारा द्विमाही अंतरालों पर संचालित किया जाता है। यह सर्वेक्षण निकट भविष्य में मुद्रास्फीतिकारी दबावों पर उत्तरदाताओं से प्राप्त यथापेक्षित उपयोगी निदेशात्मक जानकारी प्रदान करता है और उनकी स्वयं की खपत प्रवृत्ति को प्रतिबिंबित करता है। अतः इन्हें मुद्रास्फीति पर पारिवारिक इकाइयो की भावनाओं के रूप में माना जाना चाहिए। मुद्रास्फीति प्रत्याशाओं के सभी अनुमान मीडियन के रूप में दिए गए हैं, अन्यथा जब तक न कहा गया हो। 3 सर्वेक्षण के पिछले चक्रों के लिए यूनिट-स्तर के डेटा, बैंक के भारतीय अर्थव्यवस्था पर डेटाबेस (DBIE) पोर्टल पर उपलब्ध हैं (वेबलिंक : https://dbie.rbi.org.in/DBIE/dbie.rbi?site=unitLevelData)। | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पृष्ठ अंतिम बार अपडेट किया गया: