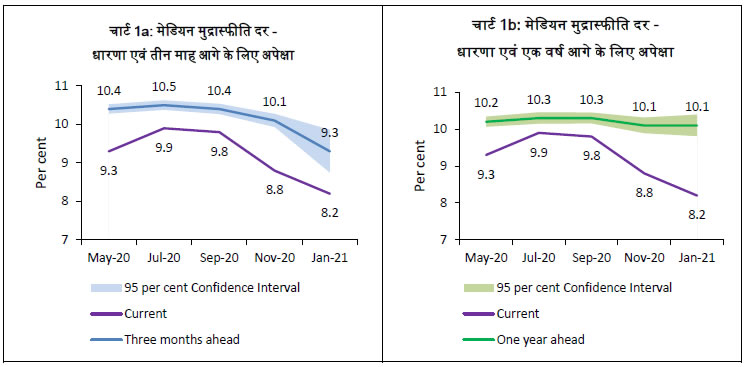

आज, रिजर्व बैंक ने अपने द्विमासिक मुद्रास्फीति पर घरेलू अपेक्षाओं के सर्वेक्षण (IESH)1 के जनवरी 2021 चक्र के परिणाम जारी किए। कोविद-19 महामारी के चलते, यह सर्वेक्षण 18 प्रमुख शहरों में जनवरी 2 से 11, 2021 के दौरान, जहाँ कहीं भी संभव हो सका फ़ील्ड पर साक्षात्कार के माध्यम से, अन्यत्र, टेलीफ़ोनिक साक्षात्कार के माध्यम से आयोजित किया गया था। इसके परिणाम 5,940 शहरी परिवारों2 के प्रत्युत्तरों पर आधारित हैं। विशेष: i. नवंबर 2020 के चक्र की तुलना में मौजूदा अवधि के लिए परिवारों की मुद्रास्फीति की धारणा और तीन महीने आगे मुद्रास्फीति की अपेक्षाओं में क्रमशः 60 आधार अंकों और 80 आधार अंकों की गिरावट आई है, जबकि एक वर्ष आगे मुद्रास्फीति की अपेक्षाएँ अपरिवर्तित रहीं [चार्ट 1a एवं 1b; तालिका 3]। ii. पिछले कुछ सर्वेक्षण चक्रों की तुलना में उत्तरदाता भविष्य की मुद्रास्फीति के बारे में अधिक अनिश्चित थे, जैसा कि विस्तृत आत्मविश्वास अंतराल में परिलक्षित होता है [चार्ट 1a एवं 1b; तालिका 3]। iii. अधिकाधिक परिवारों को अगले एक वर्ष में सामान्य कीमतों के साथ-साथ मुद्रास्फीति बढ़ने की उम्मीद है। खाद्य और गैर-खाद्य वस्तुओं के मामले में यह प्रमुखता से परिलक्षित है [तालिका 1b]। iv. परिवारों को एक वर्ष आगे सेवाओं की कीमतों पर, एक तिमाही आगे की तुलना में, अधिक दबाव की उम्मीद है। नोट: कृपया समय श्रृंखला डेटा के लिए एक्सेल फ़ाइल देखें। | Table 1(a): Product-wise Expectations of Prices for Three Months ahead | | (Percentage of Respondents) | | Survey period ended | Jan-20 | Jul-20 | Sep-20 | Nov-20 | Jan-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 83.2 | 0.87 | 83.5 | 0.92 | 81.6 | 0.78 | 83.3 | 0.85 | 83.7 | 0.89 | | Price increase more than current rate | 56.1 | 1.16 | 52.2 | 1.14 | 53.9 | 1.02 | 55.4 | 1.14 | 56.0 | 1.26 | | Price increase similar to current rate | 23.4 | 0.91 | 26.0 | 1.03 | 22.5 | 0.84 | 23.6 | 0.95 | 22.4 | 0.95 | | Price increase less than current rate | 3.6 | 0.37 | 5.3 | 0.54 | 5.2 | 0.46 | 4.4 | 0.46 | 5.3 | 0.53 | | No changes in prices | 14.4 | 0.81 | 14.0 | 0.84 | 15.9 | 0.74 | 14.2 | 0.81 | 14.3 | 0.86 | | Decline in prices | 2.4 | 0.31 | 2.5 | 0.43 | 2.5 | 0.31 | 2.4 | 0.32 | 1.9 | 0.30 | | Food Product | | | | | | | | | | | | Prices will increase | 81.7 | 0.80 | 82.3 | 0.86 | 80.4 | 0.80 | 81.5 | 0.83 | 80.9 | 0.95 | | Price increase more than current rate | 56.0 | 1.11 | 54.7 | 1.08 | 52.6 | 1.00 | 54.7 | 1.10 | 54.2 | 1.16 | | Price increase similar to current rate | 20.1 | 0.85 | 21.9 | 0.89 | 21.2 | 0.81 | 20.3 | 0.90 | 20.0 | 0.95 | | Price increase less than current rate | 5.5 | 0.45 | 5.7 | 0.47 | 6.6 | 0.51 | 6.5 | 0.59 | 6.7 | 0.57 | | No changes in prices | 11.2 | 0.67 | 13.2 | 0.75 | 14.3 | 0.70 | 11.6 | 0.67 | 13.0 | 0.82 | | Decline in prices | 7.2 | 0.50 | 4.5 | 0.56 | 5.3 | 0.46 | 6.9 | 0.54 | 6.1 | 0.54 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 77.8 | 0.91 | 79.1 | 0.99 | 75.8 | 0.87 | 74.8 | 0.99 | 79.3 | 0.98 | | Price increase more than current rate | 51.4 | 1.15 | 48.3 | 1.11 | 47.3 | 0.99 | 48.0 | 1.11 | 51.6 | 1.20 | | Price increase similar to current rate | 21.2 | 0.88 | 24.6 | 0.98 | 21.9 | 0.82 | 20.3 | 0.87 | 20.9 | 0.90 | | Price increase less than current rate | 5.3 | 0.43 | 6.2 | 0.51 | 6.6 | 0.50 | 6.4 | 0.57 | 6.7 | 0.56 | | No changes in prices | 17.7 | 0.82 | 15.2 | 0.87 | 19.2 | 0.80 | 20.1 | 0.92 | 16.9 | 0.91 | | Decline in prices | 4.4 | 0.39 | 5.6 | 0.59 | 5.0 | 0.45 | 5.2 | 0.48 | 3.8 | 0.40 | | Household Durables | | | | | | | | | | | | Prices will increase | 60.3 | 1.02 | 57.8 | 1.14 | 56.3 | 1.02 | 60.3 | 1.09 | 64.3 | 1.11 | | Price increase more than current rate | 37.9 | 1.03 | 34.7 | 1.07 | 35.0 | 0.96 | 38.2 | 1.11 | 42.5 | 1.15 | | Price increase similar to current rate | 17.5 | 0.76 | 17.6 | 0.87 | 15.8 | 0.74 | 16.2 | 0.82 | 16.8 | 0.77 | | Price increase less than current rate | 4.8 | 0.43 | 5.4 | 0.48 | 5.5 | 0.47 | 5.8 | 0.59 | 5.0 | 0.49 | | No changes in prices | 26.8 | 0.91 | 28.4 | 1.00 | 30.7 | 0.94 | 27.4 | 1.00 | 27.2 | 1.05 | | Decline in prices | 12.9 | 0.65 | 13.8 | 0.86 | 13.1 | 0.69 | 12.3 | 0.71 | 8.4 | 0.58 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 69.7 | 1.04 | 46.9 | 1.08 | 51.8 | 0.98 | 60.7 | 1.12 | 66.1 | 1.11 | | Price increase more than current rate | 48.4 | 1.10 | 28.1 | 0.98 | 32.8 | 0.93 | 40.4 | 1.14 | 45.1 | 1.20 | | Price increase similar to current rate | 17.3 | 0.74 | 14.9 | 0.78 | 14.4 | 0.69 | 15.9 | 0.80 | 16.2 | 0.79 | | Price increase less than current rate | 4.0 | 0.40 | 3.9 | 0.39 | 4.6 | 0.43 | 4.4 | 0.50 | 4.8 | 0.49 | | No changes in prices | 22.0 | 0.95 | 29.9 | 1.03 | 29.1 | 0.91 | 25.9 | 1.01 | 24.6 | 1.02 | | Decline in prices | 8.3 | 0.54 | 23.2 | 0.95 | 19.1 | 0.78 | 13.4 | 0.84 | 9.3 | 0.66 | | Cost of Services | | | | | | | | | | | | Prices will increase | 72.5 | 0.98 | 70.1 | 1.06 | 70.3 | 0.91 | 70.4 | 1.02 | 68.8 | 1.06 | | Price increase more than current rate | 46.4 | 1.13 | 43.3 | 1.11 | 45.5 | 1.01 | 44.8 | 1.10 | 45.7 | 1.15 | | Price increase similar to current rate | 21.1 | 0.81 | 21.2 | 0.92 | 19.1 | 0.79 | 20.3 | 0.88 | 18.5 | 0.81 | | Price increase less than current rate | 4.9 | 0.43 | 5.6 | 0.49 | 5.7 | 0.47 | 5.3 | 0.50 | 4.6 | 0.50 | | No changes in prices | 23.4 | 0.90 | 25.7 | 0.99 | 25.8 | 0.88 | 25.2 | 0.98 | 27.4 | 1.02 | | Decline in prices | 4.1 | 0.38 | 4.2 | 0.52 | 3.9 | 0.38 | 4.4 | 0.44 | 3.8 | 0.47 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(b): Product-wise Expectations of Prices for One Year ahead | | (Percentage of Respondents) | | Survey period ended | Jan-20 | Jul-20 | Sep-20 | Nov-20 | Jan-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 88.1 | 0.74 | 84.6 | 0.87 | 84.8 | 0.73 | 86.5 | 0.77 | 88.0 | 0.80 | | Price increase more than current rate | 63.6 | 1.13 | 55.9 | 1.12 | 59.6 | 1.00 | 59.5 | 1.09 | 62.9 | 1.23 | | Price increase similar to current rate | 21.4 | 0.88 | 24.3 | 0.93 | 20.4 | 0.82 | 22.9 | 0.92 | 21.2 | 0.95 | | Price increase less than current rate | 3.2 | 0.37 | 4.4 | 0.46 | 4.7 | 0.43 | 4.1 | 0.44 | 3.9 | 0.43 | | No changes in prices | 9.5 | 0.67 | 12.9 | 0.82 | 12.1 | 0.67 | 10.3 | 0.69 | 9.6 | 0.75 | | Decline in prices | 2.4 | 0.30 | 2.5 | 0.35 | 3.1 | 0.35 | 3.2 | 0.39 | 2.4 | 0.33 | | Food Product | | | | | | | | | | | | Prices will increase | 84.8 | 0.73 | 75.3 | 1.00 | 77.3 | 0.85 | 77.7 | 0.97 | 80.5 | 0.96 | | Price increase more than current rate | 56.0 | 1.14 | 45.2 | 1.10 | 48.3 | 0.99 | 48.4 | 1.10 | 53.0 | 1.21 | | Price increase similar to current rate | 24.3 | 0.93 | 24.1 | 0.96 | 22.5 | 0.82 | 24.0 | 0.93 | 22.6 | 0.96 | | Price increase less than current rate | 4.5 | 0.40 | 6.0 | 0.50 | 6.4 | 0.51 | 5.4 | 0.48 | 4.9 | 0.49 | | No changes in prices | 9.8 | 0.59 | 17.4 | 0.88 | 14.8 | 0.72 | 14.3 | 0.82 | 13.4 | 0.84 | | Decline in prices | 5.4 | 0.42 | 7.3 | 0.63 | 7.9 | 0.55 | 8.0 | 0.58 | 6.1 | 0.55 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 81.6 | 0.80 | 74.3 | 1.04 | 75.7 | 0.87 | 75.0 | 0.98 | 80.4 | 0.93 | | Price increase more than current rate | 53.1 | 1.14 | 44.0 | 1.13 | 47.3 | 1.00 | 45.6 | 1.13 | 52.8 | 1.22 | | Price increase similar to current rate | 23.5 | 0.88 | 24.3 | 0.92 | 22.2 | 0.83 | 23.5 | 0.93 | 22.7 | 0.93 | | Price increase less than current rate | 5.1 | 0.44 | 6.0 | 0.50 | 6.1 | 0.49 | 5.9 | 0.55 | 4.9 | 0.45 | | No changes in prices | 14.1 | 0.72 | 18.7 | 0.97 | 18.2 | 0.78 | 19.3 | 0.89 | 15.0 | 0.84 | | Decline in prices | 4.3 | 0.39 | 7.0 | 0.71 | 6.1 | 0.49 | 5.8 | 0.51 | 4.6 | 0.46 | | Household Durables | | | | | | | | | | | | Prices will increase | 68.0 | 0.96 | 62.4 | 1.14 | 62.3 | 0.98 | 65.0 | 1.08 | 69.8 | 1.07 | | Price increase more than current rate | 44.0 | 1.10 | 35.6 | 1.08 | 38.8 | 0.98 | 39.9 | 1.08 | 45.0 | 1.20 | | Price increase similar to current rate | 20.0 | 0.80 | 21.1 | 0.91 | 18.4 | 0.77 | 19.7 | 0.88 | 19.9 | 0.81 | | Price increase less than current rate | 4.0 | 0.40 | 5.8 | 0.51 | 5.1 | 0.45 | 5.4 | 0.54 | 4.9 | 0.48 | | No changes in prices | 21.2 | 0.84 | 26.0 | 1.01 | 26.5 | 0.88 | 24.6 | 1.01 | 22.1 | 0.97 | | Decline in prices | 10.7 | 0.60 | 11.6 | 0.81 | 11.2 | 0.64 | 10.3 | 0.68 | 8.1 | 0.63 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 77.8 | 0.89 | 57.4 | 1.10 | 63.9 | 0.95 | 72.1 | 1.01 | 74.8 | 1.05 | | Price increase more than current rate | 54.7 | 1.09 | 34.7 | 1.10 | 42.0 | 0.99 | 47.8 | 1.10 | 49.9 | 1.22 | | Price increase similar to current rate | 19.0 | 0.83 | 18.4 | 0.88 | 17.4 | 0.75 | 19.8 | 0.87 | 20.2 | 0.91 | | Price increase less than current rate | 4.1 | 0.39 | 4.3 | 0.43 | 4.6 | 0.43 | 4.5 | 0.44 | 4.7 | 0.48 | | No changes in prices | 15.0 | 0.77 | 26.1 | 1.01 | 23.8 | 0.85 | 19.2 | 0.86 | 17.7 | 0.95 | | Decline in prices | 7.2 | 0.50 | 16.5 | 0.83 | 12.2 | 0.67 | 8.7 | 0.65 | 7.5 | 0.61 | | Cost of Services | | | | | | | | | | | | Prices will increase | 82.5 | 0.79 | 75.6 | 1.06 | 76.8 | 0.86 | 77.2 | 0.98 | 78.5 | 0.98 | | Price increase more than current rate | 54.6 | 1.15 | 46.1 | 1.11 | 48.5 | 1.01 | 49.0 | 1.11 | 51.1 | 1.21 | | Price increase similar to current rate | 23.0 | 0.87 | 23.7 | 0.90 | 22.0 | 0.83 | 22.2 | 0.87 | 22.9 | 0.96 | | Price increase less than current rate | 4.9 | 0.44 | 5.8 | 0.50 | 6.3 | 0.50 | 6.1 | 0.55 | 4.6 | 0.45 | | No changes in prices | 14.6 | 0.72 | 20.5 | 0.97 | 19.6 | 0.81 | 18.6 | 0.91 | 18.2 | 0.94 | | Decline in prices | 2.9 | 0.33 | 3.9 | 0.57 | 3.6 | 0.37 | 4.2 | 0.45 | 3.3 | 0.41 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 2: Inflation Expectations of Various Groups: January 2021 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Overall | 9.1 | 0.12 | 8.2 | 0.17 | 10.0 | 0.12 | 9.3 | 0.29 | 9.7 | 0.13 | 10.1 | 0.15 | | Gender-wise | | | | | | | | | | | | | | Male | 9.3 | 0.14 | 8.4 | 0.18 | 10.1 | 0.14 | 9.5 | 0.34 | 9.8 | 0.16 | 10.1 | 0.15 | | Female | 8.7 | 0.14 | 7.7 | 0.21 | 9.7 | 0.15 | 8.9 | 0.24 | 9.5 | 0.17 | 9.7 | 0.39 | | Category-wise | | | | | | | | | | | | | | Financial Sector Employees | 9.0 | 0.63 | 7.9 | 0.78 | 9.5 | 0.59 | 8.8 | 0.78 | 8.8 | 0.53 | 8.5 | 0.82 | | Other Employees | 8.8 | 0.19 | 7.7 | 0.25 | 9.7 | 0.19 | 8.8 | 0.24 | 9.4 | 0.22 | 9.4 | 0.40 | | Self Employed | 9.5 | 0.19 | 8.8 | 0.38 | 10.0 | 0.19 | 9.4 | 0.46 | 9.7 | 0.23 | 10.1 | 0.33 | | Homemaker | 8.6 | 0.17 | 7.7 | 0.23 | 9.6 | 0.17 | 8.8 | 0.23 | 9.2 | 0.20 | 9.2 | 0.36 | | Retired Persons | 10.3 | 0.36 | 10.3 | 0.22 | 11.0 | 0.36 | 10.8 | 0.53 | 10.3 | 0.38 | 10.5 | 0.51 | | Daily Workers | 9.2 | 0.26 | 8.4 | 0.33 | 10.1 | 0.25 | 9.6 | 0.45 | 9.9 | 0.31 | 10.1 | 0.35 | | Other category | 8.8 | 0.23 | 7.9 | 0.40 | 9.6 | 0.23 | 9.0 | 0.36 | 9.7 | 0.26 | 9.8 | 0.42 | | Age Group-wise | | | | | | | | | | | | | | Up to 25 years | 8.3 | 0.20 | 7.4 | 0.28 | 9.3 | 0.20 | 8.6 | 0.25 | 9.4 | 0.22 | 9.5 | 0.48 | | 25 to 30 years | 8.9 | 0.20 | 8.0 | 0.24 | 9.8 | 0.20 | 9.0 | 0.29 | 9.4 | 0.23 | 9.6 | 0.44 | | 30 to 35 years | 8.8 | 0.20 | 7.9 | 0.29 | 9.6 | 0.20 | 8.9 | 0.31 | 9.5 | 0.23 | 9.7 | 0.42 | | 35 to 40 years | 9.1 | 0.20 | 8.3 | 0.25 | 9.9 | 0.20 | 9.2 | 0.38 | 9.7 | 0.23 | 9.8 | 0.34 | | 40 to 45 years | 9.4 | 0.23 | 8.3 | 0.33 | 10.3 | 0.22 | 9.9 | 0.38 | 9.7 | 0.26 | 9.7 | 0.43 | | 45 to 50 years | 9.5 | 0.25 | 9.2 | 0.55 | 10.3 | 0.25 | 10.1 | 0.29 | 9.8 | 0.32 | 10.2 | 0.21 | | 50 to 55 years | 9.6 | 0.30 | 9.5 | 0.61 | 10.2 | 0.29 | 10.0 | 0.43 | 9.4 | 0.36 | 10.1 | 0.41 | | 55 to 60 years | 9.8 | 0.32 | 9.7 | 0.50 | 10.6 | 0.32 | 10.4 | 0.28 | 10.0 | 0.40 | 10.6 | 0.28 | | 60 years and above | 10.3 | 0.29 | 10.1 | 0.37 | 10.9 | 0.28 | 10.5 | 0.24 | 10.1 | 0.34 | 10.2 | 0.30 | | City-wise | | | | | | | | | | | | | | Ahmedabad | 10.3 | 0.44 | 10.0 | 0.44 | 11.6 | 0.42 | 11.6 | 1.19 | 11.7 | 0.37 | 12.5 | 1.59 | | Bengaluru | 7.9 | 0.35 | 5.9 | 0.26 | 9.2 | 0.31 | 8.2 | 0.37 | 10.1 | 0.28 | 10.4 | 0.17 | | Bhopal | 8.2 | 1.04 | 6.6 | 1.43 | 8.9 | 0.94 | 7.7 | 1.19 | 8.0 | 0.85 | 7.1 | 1.09 | | Bhubaneswar | 10.3 | 1.05 | 10.2 | 1.77 | 11.8 | 1.07 | 13.6 | 2.21 | 10.4 | 1.29 | 12.1 | 2.00 | | Chennai | 10.0 | 0.46 | 10.2 | 0.35 | 11.2 | 0.46 | 11.2 | 0.97 | 11.5 | 0.53 | 12.8 | 1.43 | | Delhi | 8.8 | 0.32 | 8.0 | 0.44 | 9.6 | 0.33 | 8.7 | 0.45 | 9.1 | 0.37 | 8.8 | 0.40 | | Guwahati | 11.9 | 0.73 | 12.5 | 2.25 | 12.3 | 0.75 | 13.4 | 2.19 | 11.4 | 0.74 | 12.7 | 1.96 | | Hyderabad | 9.7 | 0.50 | 9.1 | 0.94 | 10.9 | 0.48 | 10.6 | 0.57 | 10.5 | 0.58 | 11.1 | 0.59 | | Jaipur | 9.7 | 0.90 | 8.8 | 1.38 | 9.2 | 0.66 | 9.0 | 0.98 | 8.8 | 0.66 | 9.0 | 1.02 | | Kolkata | 10.1 | 0.37 | 9.5 | 0.60 | 10.9 | 0.34 | 10.4 | 0.33 | 10.8 | 0.35 | 10.7 | 0.58 | | Lucknow | 8.8 | 0.57 | 8.1 | 0.68 | 9.4 | 0.58 | 8.8 | 0.70 | 9.2 | 0.69 | 9.3 | 0.84 | | Mumbai | 8.9 | 0.30 | 8.1 | 0.31 | 9.4 | 0.30 | 8.6 | 0.33 | 8.0 | 0.37 | 7.9 | 0.45 | | Nagpur | 8.5 | 0.42 | 7.5 | 0.49 | 10.0 | 0.49 | 8.8 | 0.51 | 10.0 | 0.49 | 10.1 | 0.38 | | Patna | 7.0 | 0.32 | 6.5 | 0.50 | 7.7 | 0.37 | 7.2 | 0.50 | 7.2 | 0.42 | 7.2 | 0.46 | | Thiruvananthapuram | 5.6 | 0.60 | 5.1 | 0.43 | 6.9 | 0.65 | 6.1 | 0.48 | 8.2 | 0.85 | 8.5 | 1.45 | | Chandigarh | 9.5 | 0.60 | 9.9 | 0.55 | 9.4 | 0.68 | 9.6 | 0.75 | 9.2 | 0.72 | 9.5 | 0.95 | | Ranchi | 7.6 | 0.40 | 7.3 | 0.60 | 8.0 | 0.43 | 7.7 | 0.62 | 7.7 | 0.91 | 8.3 | 0.66 | | Raipur | 6.5 | 0.41 | 5.7 | 0.21 | 8.0 | 0.44 | 7.5 | 0.46 | 10.2 | 0.98 | 10.2 | 0.91 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3: Household Inflation Expectations – Current Perception, Three Months and One Year Ahead Expectations | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Jan-20 | 8.7 | 0.11 | 7.6 | 0.19 | 9.5 | 0.11 | 8.6 | 0.16 | 9.3 | 0.13 | 9.2 | 0.25 | | Jul-20 | 10.0 | 0.11 | 9.9 | 0.21 | 10.8 | 0.11 | 10.5 | 0.06 | 9.8 | 0.14 | 10.3 | 0.08 | | Sep-20 | 9.9 | 0.10 | 9.8 | 0.25 | 10.8 | 0.10 | 10.4 | 0.07 | 9.9 | 0.12 | 10.3 | 0.08 | | Nov-20 | 9.5 | 0.11 | 8.8 | 0.18 | 10.4 | 0.11 | 10.1 | 0.09 | 9.8 | 0.13 | 10.1 | 0.11 | | Jan-21 | 9.1 | 0.12 | 8.2 | 0.17 | 10.0 | 0.12 | 9.3 | 0.29 | 9.7 | 0.13 | 10.1 | 0.15 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 4: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three Months Ahead and One Year Ahead | | (Percentage of Respondents) | | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three Months Ahead | | Jan-20 | 66.1 | 66.2 | 53.4 | 59.3 | 64.5 | | Jul-20 | 62.8 | 61.0 | 49.9 | 43.6 | 58.4 | | Sep-20 | 62.1 | 61.0 | 50.4 | 45.9 | 60.5 | | Nov-20 | 62.7 | 63.5 | 52.4 | 54.0 | 60.7 | | Jan-21 | 63.3 | 64.3 | 54.5 | 55.7 | 62.8 | | One Year Ahead | | Jan-20 | 72.2 | 70.9 | 60.3 | 67.8 | 72.8 | | Jul-20 | 63.9 | 64.5 | 55.2 | 51.2 | 65.7 | | Sep-20 | 63.0 | 64.8 | 55.5 | 53.6 | 66.6 | | Nov-20 | 66.4 | 65.9 | 56.7 | 62.1 | 68.9 | | Jan-21 | 68.4 | 68.6 | 60.6 | 63.0 | 69.0 | | Note: Figures are based on sample observations |

| Table 5(a): Cross-tabulation of Number of Respondents by Current Inflation Perception and Three Months Ahead Inflation Expectations: January 2021 | | Three Months Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 19 | 4 | 1 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 27 | | 1-<2 | 0 | 23 | 12 | 7 | 1 | 0 | 1 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 46 | | 2-<3 | 3 | 9 | 92 | 62 | 35 | 12 | 2 | 2 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 221 | | 3-<4 | 0 | 2 | 7 | 89 | 69 | 45 | 16 | 5 | 2 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 238 | | 4-<5 | 1 | 0 | 5 | 13 | 142 | 74 | 76 | 19 | 8 | 1 | 4 | 0 | 3 | 0 | 0 | 0 | 0 | 1 | 347 | | 5-<6 | 0 | 1 | 13 | 31 | 21 | 450 | 174 | 241 | 102 | 12 | 112 | 5 | 3 | 1 | 0 | 11 | 2 | 1 | 1180 | | 6-<7 | 0 | 0 | 1 | 7 | 4 | 7 | 183 | 63 | 64 | 17 | 20 | 0 | 3 | 1 | 0 | 0 | 2 | 0 | 372 | | 7-<8 | 1 | 1 | 0 | 3 | 2 | 7 | 14 | 176 | 98 | 49 | 66 | 2 | 3 | 2 | 0 | 1 | 1 | 2 | 428 | | 8-<9 | 0 | 0 | 1 | 2 | 3 | 6 | 8 | 6 | 247 | 67 | 120 | 11 | 11 | 3 | 4 | 2 | 4 | 2 | 497 | | 9-<10 | 0 | 0 | 0 | 0 | 1 | 0 | 2 | 1 | 2 | 91 | 41 | 18 | 13 | 5 | 8 | 7 | 1 | 1 | 191 | | 10-<11 | 0 | 0 | 1 | 1 | 3 | 41 | 3 | 10 | 27 | 9 | 403 | 45 | 162 | 53 | 12 | 180 | 87 | 1 | 1038 | | 11-<12 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 11 | 9 | 3 | 0 | 2 | 1 | 0 | 28 | | 12-<13 | 0 | 1 | 0 | 0 | 0 | 0 | 2 | 1 | 2 | 0 | 2 | 0 | 23 | 3 | 13 | 15 | 8 | 0 | 70 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 2 | 7 | 4 | 0 | 20 | | 14-<15 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 9 | 4 | 5 | 0 | 19 | | 15-<16 | 0 | 0 | 0 | 0 | 0 | 7 | 0 | 3 | 3 | 0 | 14 | 0 | 4 | 2 | 1 | 75 | 111 | 1 | 221 | | >=16 | 1 | 0 | 1 | 1 | 3 | 10 | 2 | 0 | 1 | 0 | 25 | 0 | 4 | 2 | 1 | 18 | 924 | 4 | 997 | | Total | 25 | 41 | 134 | 217 | 286 | 659 | 484 | 528 | 558 | 247 | 810 | 92 | 239 | 82 | 50 | 322 | 1150 | 16 | 5940 | | Note: Figures are based on sample observations |

| Table 5(b): Cross-tabulation of Number of Respondents by Current Inflation Perception and One Year Ahead Inflation Expectations: January 2021 | | One Year Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 17 | 1 | 2 | 3 | 2 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 27 | | 1-<2 | 7 | 10 | 12 | 5 | 5 | 3 | 2 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 46 | | 2-<3 | 30 | 1 | 67 | 30 | 45 | 28 | 3 | 5 | 3 | 0 | 3 | 0 | 0 | 0 | 0 | 3 | 0 | 3 | 221 | | 3-<4 | 32 | 1 | 4 | 60 | 30 | 45 | 27 | 13 | 5 | 6 | 8 | 2 | 2 | 0 | 1 | 0 | 2 | 0 | 238 | | 4-<5 | 37 | 1 | 4 | 5 | 71 | 67 | 75 | 32 | 24 | 10 | 12 | 2 | 1 | 0 | 3 | 1 | 2 | 0 | 347 | | 5-<6 | 151 | 0 | 3 | 7 | 19 | 271 | 85 | 215 | 132 | 27 | 175 | 13 | 17 | 5 | 2 | 45 | 12 | 1 | 1180 | | 6-<7 | 40 | 0 | 0 | 0 | 4 | 4 | 111 | 33 | 77 | 24 | 54 | 2 | 14 | 2 | 1 | 4 | 2 | 0 | 372 | | 7-<8 | 54 | 0 | 0 | 1 | 1 | 4 | 4 | 103 | 59 | 72 | 81 | 10 | 20 | 5 | 3 | 8 | 2 | 1 | 428 | | 8-<9 | 73 | 1 | 1 | 0 | 4 | 3 | 6 | 6 | 139 | 38 | 135 | 18 | 38 | 9 | 6 | 12 | 7 | 1 | 497 | | 9-<10 | 29 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 43 | 40 | 24 | 21 | 7 | 8 | 14 | 4 | 0 | 191 | | 10-<11 | 109 | 0 | 0 | 1 | 0 | 18 | 2 | 9 | 14 | 8 | 276 | 24 | 117 | 46 | 21 | 205 | 186 | 2 | 1038 | | 11-<12 | 3 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 10 | 2 | 6 | 3 | 2 | 1 | 0 | 28 | | 12-<13 | 4 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 1 | 0 | 15 | 5 | 13 | 14 | 16 | 0 | 70 | | 13-<14 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 3 | 7 | 5 | 1 | 20 | | 14-<15 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 2 | 10 | 0 | 19 | | 15-<16 | 22 | 0 | 0 | 0 | 0 | 2 | 0 | 1 | 1 | 0 | 6 | 0 | 3 | 3 | 2 | 51 | 130 | 0 | 221 | | >=16 | 106 | 0 | 0 | 1 | 1 | 2 | 0 | 0 | 0 | 0 | 18 | 0 | 5 | 3 | 1 | 19 | 839 | 2 | 997 | | Total | 717 | 15 | 93 | 113 | 182 | 448 | 317 | 419 | 455 | 228 | 811 | 105 | 255 | 94 | 71 | 388 | 1218 | 11 | 5940 | | Note: Figures are based on sample observations |

|  IST,

IST,