IST,

IST,

RBI@90 - Commemorating 90 years of Reserve Bank of India

ഏപ്രി 01, 2024

The Reserve Bank of India (RBI), set up under the RBI Act, 1934, commenced its operations on April 1, 1935. Today marks the 90th year from its establishment. To mark this momentous occasion, a commemorative event was organised by the Reserve Bank of India in Mumbai with the Hon’ble Prime Minister of India Shri Narendra Modi as the Chief Guest and with the participation of Hon’ble Governor of Maharashtra, Shri C. Ramesh Bais, Hon’ble Finance Minister, Smt. Nirmala Sitharaman, Hon’ble Chief Minister of Maharashtra, Shri Eknath Shinde, Hon’ble Ministers of State for Finance, Shri Pankaj Chaudhary and Dr. Bhagwat Kishanrao Karad, Hon’ble Deputy Chief Ministers of Maharashtra, Shri Devendra Fadnavis and Shri Ajit Pawar

RBI OECD High Level Global Symposium on Financial Education

നവം 08, 2017

The Reserve Bank of India (RBI) in collaboration with Organization for Economic Co-operation and Development (OECD) is organizing RBI-OECD High Level Global Symposium on Financial Education on 8-9 November 2017 New Delhi, India.

The conference aims to stimulate ideas, discussions and solutions around implementing effective financial literacy policies in a changing financial landscape and will focus on the following topics:

- Financial literacy in the digital age: challenges and opportunities

- Effective delivery of financial literacy in the digital age:

- National strategies for financial education

- The role of public, private and civil stakeholders

12th Central Bank Risk Managers' Conference

നവം 17, 2016

The Central Bank Risk managers’ Conference (CBRMC) is an annual event and provides a unique opportunity for central bank risk managers to build and maintain an informal network to discuss issues related to central banks’ financial risk management. After the first conference held in 2004 by the Bank for International Settlements (BIS), Basel in Switzerland, these annual conferences have been organised by various central banks around the world.

The 12th edition of the Central Bank Risk Managers’ Conference was hosted by the Reserve Bank of India in Mumbai on November 17-18, 2016. It focused on economic capital and risk appetite frameworks at central banks, risks arising from unconventional monetary policy operations, integrated risk management, as well as model validation. The conference was attended by senior officials from leading central banks and the BIS who are responsible for developing and implementing risk management policies or processes relating to foreign exchange reserves and balance sheet exposures of central banks.

International Seminar on Adoption of ISO 20022 for RTGS

സെപ്റ്റം 30, 2013

On behalf of Reserve Bank of India, I am thankful to you for having participated in the Seminar on 'Adoption of ISO 20022 Messaging Standards for RTGS'.

Your presence has added a lot of value to the seminar. I am sure that the deliberations during seminar have been useful to you and was a learning experience for you as much as it was for the rest of us.

I hope you had an opportunity to interact with the speakers and participants from other departments, banks, countries.

Here's hoping for more such interactions in future.

INDIA-OECD-WORLD BANK REGIONAL CONFERENCE ON FINANCIAL EDUCATION

മാർ 04, 2013

The Reserve Bank of India in collaboration with OECD and the World Bank will host the Regional Dissemination Conference on Financial Education to present the work of the Russia/OECD/World Bank Trust Fund on Financial Literacy and Education and address specificities from India and the Asia region, notably national strategies for financial education, the measurement of financial literacy and methods for programme evaluation together with financial education for young people and women, as well as innovative delivery methods. Each session will include a discussion of case studies chosen among relevant and successful examples from Asia in particular. This conference will be attended by high-level Indian, OECD and World Bank representatives, high-level officials and experts from ministries of finance and education, central banks, regulatory and supervisory authorities, officials of State governments and international organisations, the private sector, the academic and civil community as well as NGOs.

Joint India-IMF Training Programme

ജനു 28, 2013

Launched on May 1, 2006, the Joint India-IMF Training Programme (ITP) is a cooperative venture of the International Monetary Fund (IMF) and the Reserve Bank of India (RBI).The Joint India-IMF Training Programme was formally inaugurated on January 24, 2007 by Mr. John Lipsky, First Deputy Managing Director of IMF and Dr. Rakesh Mohan, Deputy Governor of RBI The ITP is located in Pune, India

The purpose of the ITP is to provide policy-oriented training in economics and related operational fields to selected Indian officials, as well as to officials of certain other countries in South Asia and East Africa to be designated jointly by the RBI and the IMF.

RBI~ADB CONFERENCE ON MANAGING CAPITAL FLOWS

നവം 19, 2012

During the past decade, the global gross capital flows increased substantially, indicating growing interconnectedness, particularly between advanced economies and emerging market economies. These flows were driven by a "search for yield" and aided by some reduction in regulatory barriers, and were increasing till 2007, before contracting sharply in the aftermath of the global financial crisis. Moreover, the capital flows tended to be volatile, and posed significant challenges to central bankers. With the onset of the global crisis, and increase in the volatility of capital flows, the pace of both tightening and easing measures related to capital flows has picked up. With the increasing challenges posed by capital flows particularly for the monetary policymakers, there has also been considerable research on the subject.

The present Conference on Management of Capital Flows, jointly organised by Reserve Bank of India and the Asian Development Bank in Mumbai, India, during November 19-20, 2012 is an attempt to understand the issues in capital flows management and provide policy-relevant inputs for practitioners.

SECOND INTERNATIONAL RESEARCH CONFERENCE

ഫെബ്രു 01, 2012

The Reserve Bank of India organised the First International Research Conference (FIRC) in February 2010 on the occasion of its Platinum Jubilee Year along with a series of other knowledge-sharing events. These initiatives were aimed at making the Reserve Bank a more responsive, relevant, professional and effective public institution. To continue the knowledge-sharing events, it was decided that the International Research Conference would be held once in two years. Therefore, this Conference is the second in the series of the International Research Conferences.

The theme of the Second International Research Conference is ‘Monetary Policy, Sovereign Debt and Financial Stability: The New Trilemma’. Post-crisis, the unprecedented monetary policy easing and fiscal stimulus has resulted in sovereign debts getting bloated but supported by low interest rate regimes that artificially boost risk appetite and blur the financial stability issues. As monetary and fiscal authorities have started exiting the stimulus, interest rates could rise, resurrecting the history of sovereign debt and financial stability troubles.

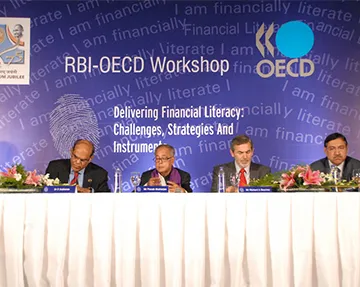

RBI-OECD Workshop

മാർ 22, 2010

Delivering Financial Literacy: Challenges, Approaches and Instruments March 22 - 23, 2010 Bangalore

This Workshop, co-hosted by the Reserve Bank of India (RBI) and the Organisation for Economic Co-operation and Development (OECD) will seek to advance and elevate the policy dialogue on financial education and literacy in the international arena and particularly in India and countries from the ASEAN (Association of Southeast Asian Nations), SAARC (South Asian Association for Regional Co-Operation). Building on the OECD internationally recognized standards in the area of financial education, participants in this event will benefit from its high-level cross-country context to share international efficient practices and experiences in order to better address their national and regional challenges.