The

macro overview of municipal finance in India, attempted in the preceding chapter,

brought out the significance of municipal finance for the overall financial well-being

of the economy and provided an insight into the sources, structure, composition

and trends of aggregate revenue and expenditure of the MCs in metropolitan cities

in India. It should be noted that many of the conclusions drawn at aggregate level

above may not hold good for individual ULBs and may not throw enough light on

the constraints faced by individual local bodies and the need for requisite policy

initiatives to address them. Therefore, the present chapter examines the financial

parameters of individual municipal bodies, to assess their ability to provide

the required civic amenities and to identify the constraints faced by them. 5.2

Analytical Framework

Fiscal assessment of any entity is generally

based on revenue and fiscal balance. Similarly, to assess qualitative aspects,

the ratio of revenue expenditure to total expenditure is considered. Any entity

generating surplus in revenue account (and if possible, in capital account) and

maintaining low proportion of revenue expenditure to total expenditure, is considered

to have sound financial health. However, this “standard approach”

for making assessment may not hold for the ULBs. Municipal authorities are constrained

by statutory mandates of balanced budgets4 and they are also notgranted liberal

permission by State Governments to incur debt [Mathur and Thakur (2004)] . However,

revenue expenditure is not undesirable, if a good proportion of this goes for

operation and maintenance of civic amenities provided by the ULBs. With

the above in the background, the assessment of ULBs needs to proceed on a different

track, making use of an alternate set of parameters. These parameters are normative

benchmarks which define the minimum level of expenditure that the ULBs are required

to incur, in order to ensure a minimum standard of living to the inhabitants.

A set of expenditure benchmarks, both for creating new assets, and for their maintenance

were derived by the Zakaria Committee in 1964 for core urban services. These expenditure

norms for service provision (capital) as well as operation & maintenance (O&M)

are for the cities that are divided into categories AA, A, B, C, D and E, based

on the population size. The expenditure norms for 5 core civic activities viz.,

water supply, roads, storm water drainage, sewerage and street lighting for 3

major city classes covered by this study (at the 1996-97 prices) are shown in

Table 25.

A comparison of municipal spending with these norms, after revising

them to the current period, would reveal the level of underspending by the ULBs.

There are a host of factors which could be responsible for the level of under-spending,

which can be divided into two broad categories. - exogenous and endogenous.

As the terms

Table

25: Zakaria Committee Norms of Expenditure on Services |

(Rupees

per capita at 1996-97 prices) | City

Class | Water

Supply | Sewerage | Storm

Drainage | Roads | Street

Lights | Capital | O

& M | Capital | O

& M | Capital | O

& M | Capital | O

& M | Capital | O

& M | AA | 968 | 161 | 1117 | 182 | 611 | - | 1207 | 37 | 447 | 45 |

A | 700 | 152 | 968 | 177 | 432 | - | 1043 | 33 | 372 | 42 |

B | 699 | 146 | 819 | 161 | 387 | - | 611 | 27 | 328 | 37 |

AA -More than

20 Lakhs population; A - 5-20 Lakhs population; B – 1-5 Lakhs population

Source: Mathur and Singh (1998) |

suggest, exogenous factors are those that are not

within the control of concerned ULB whereas endogenous factors refer

to those that have to do with the ULBs’ own operation Exogenous factors

include: delegation of revenue powers (decentralization) and dependency of ULB

for resources on upper tier of government (dependency ratio). Endogenous factors

include: revenue (tax) administration, cost recovery and quality of expenditure.

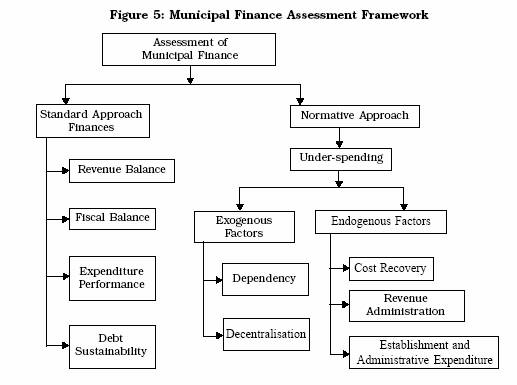

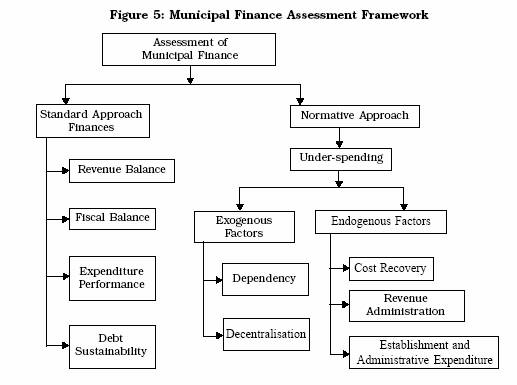

The framework of analysis proposed to be followed for assessment of ULB performance

is set out in Figure 5.

Thus the assessment of finances of ULBs is proposed

to proceed as follows:

• First, the ULBs have been assessed

in terms of “standard approach” using revenue balance,

fiscal balance and the ratio of revenue expenditure to total expenditure.

•

Secondly, ULBs were assessed in terms of “normative approach” by using

Zakaria Committee norms. The Zakaria Committee norms for civic amenities are adjusted

to the current prices of the period of 1999-2000 to 2003-2004, using an appropriate

inflation index, i.e. WPI. The performance of individual MCs is compared

against the respective norms, and, the level of under-spending is worked out.

This is followed by the identification of the factors responsible for the level

of under-spending. • Next section, deals with ‘use of debt’

and ‘debt sustainability’ of the MCs and ascertain the capacity of

the MCs to borrow for augmenting spending on provision of services. •

The subsequent section summarises the performance of individual MCs in terms of

different parameters and attempts to rank them. • In the last section,

estimates of resource requirements of the urban sector and the potential of revenues

of the ULBs in India have been attempted. 5.3 Major Inferences from

Analysis 5.3.1 Standard Approach i)

Revenue Balance Revenue balance, measured as revenue receipts net

of revenue or current expenditure, indicates whether a municipal corporation (MC)

is able to meet its revenue expenditure from its own resources including grants

from the upper tiers of Government. Table 26 reveals that all the MCs, barring

Pune and Patna, were able to generate revenue surplus5.

Table

26: Balance of Municipal Revenues and Expenditure |

(Average

of 1999-2000 to 2003-2004) | Sl.

No. | Municipal

Corporation | Revenue

Income

(Rs Crore) | Per

capita

Revenue

Income

(Rs) | Revenue

Expenditure

(Rs Crore)

(Rs) | Per

capita

Revenue

Expenditure

Deficit | Total

Revenue

Surplus/

deficit

(Rs Crore) | Per

capita

Revenue

surplus/ |

1 | Hyderabad

| 338.8 | 964.5 | 273.4 | 779.1 | 65.4 | 185.4 |

2 | Visakhapatnam

| 110.1 | 1093.3 | 74.6 | 742.5 | 35.5 | 350.8 |

3 | Vijayawada

| 61.7 | 705.6 | 44.5 | 509.8 | 17.2 | 195.7 |

4 | Patna

| 21.8 | 150.4 | 29.6 | 205.1 | -7.8 | -54.7 |

5 | Delhi

| 880.3 | 872.3 | 361.1 | 341.1 | 519.2 | 531.2 |

6 | Ahmedabad | 599.4 | 1668.5 | 556.7 | 1551.6 | 42.7 | 116.9 |

7 | Surat

| 662.3 | 2577.0 | 208.7 | 816.5 | 453.5 | 1760.4 |

8 | Vadodara | 159.3 | 1233.4 | 141.8 | 1099.1 | 17.4 | 134.3 |

9 | Rajkot

| NA | NA | NA | NA | NA | NA |

10 | Jamshedpur

| NA | NA | NA | NA | NA | NA |

11 | Dhanbad | NA | NA | NA | NA | NA | NA |

12 | Bangalore

| 369.5 | 810.4 | 296.4 | 643.5 | 73.2 | 166.8 |

13 | Kochi

| 51.7 | 858.8 | 25.8 | 430.4 | 25.8 | 428.4 |

14 | Indore

| 180.0 | 1029.6 | 81.4 | 464.9 | 98.6 | 564.7 |

15 | Bhopal

| 80.4 | 545.4 | 27.8 | 189.2 | 52.5 | 356.2 |

16 | Jabalpur

| 54.0 | 551.0 | 33.7 | 344.4 | 20.2 | 206.6 |

17 | Greater

Mumbai | 4162.0 | 3417.1 | 1560.2 | 1283.8 | 2601.8 | 2133.3 |

18 | Pune | 507.2 | 1890.3 | 697.9 | 2582.0 | -190.7 | -691.7 |

19 | Nagpur

| 249.6 | 1197.8 | 204.0 | 979.4 | 45.6 | 218.4 |

20 | Nashik | 268.3 | 2344.7 | 138.7 | 1221.2 | 129.6 | 1123.5 |

21 | Amritsar

| NA | NA | NA | NA | NA | NA |

22 | Ludhiana

| 194.7 | 1333.2 | 109.4 | 749.6 | 85.2 | 583.6 |

23 | Jaipur | 122.9 | 493.7 | 49.7 | 198.9 | 73.2 | 294.8 |

24 | Chennai | 591.0 | 1385.5 | 242.7 | 570.1 | 348.3 | 815.5 |

25 | Coimbatore

| 72.1 | 763.0 | 47.1 | 498.7 | 25.0 | 264.3 |

26 | Madurai

| 56.6 | 610.7 | 45.4 | 489.3 | 11.2 | 121.4 |

27 | Lucknow

| 84.6 | 369.0 | 62.8 | 274.8 | 21.8 | 94.2 |

28 | Kanpur

| 100.3 | 382.9 | 86.2 | 330.4 | 14.1 | 52.5 |

29 | Allahabad

| 36.4 | 365.0 | 25.8 | 259.0 | 10.5 | 106.0 |

30 | Agra

| 39.7 | 303.5 | 24.7 | 189.2 | 15.1 | 114.3 |

31 | Varanasi

| 36.5 | 325.4 | 21.8 | 195.8 | 14.7 | 129.6 |

32 | Meerut

| 40.9 | 365.3 | 31.6 | 283.0 | 9.4 | 82.3 |

33 | Faridabad

| 78.1 | 697.4 | 75.1 | 671.3 | 3.0 | 26.1 |

34 | Kolkata | 542.4 | 1178.5 | 387.1 | 841.4 | 155.3 | 337.1 |

35 | Asansol | 11.1 | 218.2 | 7.4 | 145.8 | 3.7 | 72.4 |

| Total

for35 MCs | 10228 | 1271 | 5456 | 678 | 4772 | 593 |

Source:

Budgets of Municipal Corporations. | ii) Fiscal

Balance

This measure reveals the overall resource gap, after

meeting both revenue and capital expenditure, that needs to be met through borrowings.

It can be observed from the above table that except 7 municipal corporations,

viz. Mumbai, Chennai, Visakhapatnam, Surat, Delhi, Coimbatore and Faridabad,

all other MCs had their revenue falling short of expenditure (having a negative

surplus). This is significant in that for maintaining the present level of expenditure,

revenues are inadequate and borrowed funds are used. Hence MCs are constrained

to raise the expenditure to the desired level for ensuring minimum level of civic

amenities. The level of shortfall ranges from Rs.3 per capita for Jabalpur MC

to Rs.1,411 per capita for Pune MC. However, the 7 MCs which are enjoying surplus

have the fiscal space and clear scope for improving the civic amenities in the

immediate future. There was a surplus of more than Rs.750 and Rs.500 per capita

in case of Surat and Mumbai, respectively6 (Table 27) .

iii)

Expenditure Performance

A proportion of revenue expenditure to

total expenditure reveals the quantum of funds spent for maintaining the current

assets and that available for creating new capital assets.

Table

28 shows categorisation of the MCs on this parameter. It indicates that many of

them have very high proportion of revenue expenditure as compared to the group

average of 56 per cent. Faridabad, Vishakhapatnam, Kolkata, Kanpur and Pune have

shown revenue expenditure constituting more than 70 per cent of their total expenditure,

while Kochi, Indore, Greater Mumbai, Jaipur and Chennai have shown it at less

than 40 per cent of total expenditure. The MCs with very a high proportion of

revenue expenditure need to prioritise their expenditure in favour of capital

expenditure.

Table

27: Resource Gap of the Municipal Corporations | Sl.

No. | Municipal

Corporation | Resource

Gap in Rupees per-Capita

(Average of 1999-2000 to 2003-2004) |

Revenue

Receipts | Total

Expenditure | Resource

Gap | 1 | Greater

Mumbai | 3417 | 2912 | -505 |

2 | Delhi

| 739 | 721 | -18 |

3 | Kolkata | 1178 | 1224 | 46 |

4 | Chennai | 1386 | 1216 | -170 |

5 | Hyderabad

| 964 | 984 | 19 |

6 | Ahmedabad | 1668 | 2040 | 372 |

7 | Kanpur

| 383 | 395 | 12 |

8 | Pune | 1890 | 3301 | 1411 |

9 | Surat

| 2577 | 1818 | -759 |

10 | Jaipur | 471 | 508 | 37 |

11 | Lucknow

| 369 | 449 | 80 |

12 | Vadodara | 1434 | 1678 | 244 |

13 | Agra

| 304 | 345 | 41 |

14 | Nashik | 2345 | 2711 | 366 |

15 | Meerut

| 365 | 398 | 32 |

16 | Faridabad

| 697 | 671 | -26 |

17 | Visakhapatnam

| 1093 | 941 | -152 |

18 | Allahabad

| 365 | 370 | 5 |

19 | Rajkot

| 1020 | 1325 | 305 |

20 | Jabalpur

| 551 | 554 | 3 |

21 | Coimbatore

| 763 | 700 | -63 |

22 | Madurai

| 624 | 874 | 249 |

23 | Vijayawada

| 706 | 772 | 66 |

24 | Kochi

| 813 | 1133 | 320 |

25 | Asansol | 218 | 367 | 149 |

| Total

for 25 MCs | 843 | 910 | 67 |

*: ‘-’

indicates fiscal surplus.

Source: Budgets of Municipal

Corporations. | 5.3.2 Normative Approach

i) Availability of Civic Amenities

The Municipal

Corporations are expected to provide certain minimum level of civic services to

the citizens, in accordance with their obligatory functions and mandates. The

availability of civic amenities in a MC could be approximated by the per capita

Table

28: Categorization of Municipal Corporations as per Revenue

Expenditure

to Total Expenditure Ratio (2003-04) | Parameter | Municipalities | Top

5 Municipalities | At

or Above Average | Hyderabad

| Faridabad (100%) |

Vishakhapatnam | | Vishakhapatnam

(83.69%) | Patna

| | Kolkata

(73.36%) | Ahmedabad | | Kanpur

(72.85%) | Jabalpur

| | Pune

(72.65%) | Pune | | |

Ludhiana | | |

Coimbatore | | |

Lucknow | | |

Kanpur | | |

Allahabad | | |

Meerut | | |

Faridabad | | |

Kolkata | | |

| | Bottom

5 Municipalities | Below

Average | Asansol | Kochi

(26.65%) | | Agra

| Indore (37.68%) |

| Chennai | Greater

Mumbai (38.03%) | | Greater

Mumbai | Jaipur (38.09%) |

| Indore

| Chennai (39.06%) |

| Jaipur | |

| Bhopal

| | | Madurai

| | | Nasik

| | | Kochi

| | | Bangalore

| | | Surat

| | | Vijayawada

| | Source:

Budgets of Municipal Corporations. | expenditure

made by the MC on various services. The adequacy of services

provided by the MCs is assessed by comparing the expenditure incurred by them

on core services, namely, water supply, sewerage, roads and street lighting with

Zakaria Committee expenditure norms7. Zakaria Committee norms were evolved in

1964. They were adjusted for inflation to arrive at norms for the period of 1999-2000

to 2003-2004. Since service-wise data for all the years have been available only

for 11 MCs, average proportion of service-wise expenditure to total expenditure

for these MCs was used to arrive at the expenditure incurred by remaining MCs

on these services. The results shown in Table 29 indicate that spending

on civic services of all the MCs has been lower than the Zakaria Committee norms.

The extent of under-spending varied between 30.78 per cent in the case of Pune

to 94.43 per cent in the case of Patna. The average level of under-spending for

the 30 MCs under the study works out to 76 per cent.

Table

29: Zakaria Committee Norms and Under-spending of the Municipal

Corporations (Averages of 1999-2000 to 2003-2004) |

Sl. No. | Municipal

Corporation | Average

Zakaria

Norm

(Rupees per capita) | Average

Expenditure

of the MC on Core

Services

capita) | Average

Under

Spending of the MC

(As Percentage

of Zakaria Norm) | 1 | Hyderabad

| 861.71 | 207.41 | -76.01 |

2 | Visakhapatnam

| 786.21 | 198.76 | -74.73 |

3 | Vijayawada

| 791.06 | 147.67 | -81.40 |

4 | Patna

| 856.56 | 47.56 | -94.43 |

5 | Delhi

| 920.78 | 137.35 | -85.38 |

6 | Surat

| 986.12 | 370.61 | -62.24 |

7 | Vadodara | 804.18 | 384.21 | -50.43 |

8 | Bangalore

| 983.77 | 249.24 | -74.92 |

9 | Kochi

| 747.95 | 277.34 | -63.65 |

10 | Indore

| 843.88 | 210.63 | -75.54 |

11 | Bhopal

| 823.74 | 127.53 | -84.50 |

12 | Jabalpur

| 808.08 | 115.18 | -85.79 |

13 | Greater

Mumbai | 873.37 | 597.17 | -31.64 |

14 | Pune | 985.55 | 684.89 | -30.78 |

15 | Nagpur

| 892.33 | 289.08 | -67.50 |

16 | Nashik | 883.52 | 571.11 | -35.52 |

17 | Ludhiana

| 744.84 | 281.92 | -62.77 |

18 | Jaipur | 979.17 | 114.32 | -88.48 |

19 | Chennai | 839.69 | 250.84 | -70.11 |

20 | Coimbatore

| 771.71 | 146.19 | -81.06 |

21 | Madurai

| 726.77 | 187.30 | -74.75 |

22 | Lucknow

| 921.07 | 93.38 | -89.88 |

23 | Kanpur

| 917.65 | 82.45 | -91.01 |

24 | Allahabad

| 795.23 | 78.08 | -90.17 |

25 | Agra

| 837.94 | 72.70 | -91.31 |

26 | Varanasi

| 783.51 | 76.58 | -90.17 |

27 | Meerut

| 840.60 | 82.84 | -90.15 |

28 | Faridabad

| 896.00 | 141.14 | -84.25 |

29 | Kolkata | 819.73 | 255.82 | -68.75 |

30 | Asansol | 788.63 | 77.26 | -90.21 |

ii) Factors influencing Under-spending

There

are a host of factors which influence the level of underspending by local bodies.

These could broadly be categorized as ‘exogenous’ or ‘endogenous’

in nature.

Exogenous Factors

The exogenous

factors are essentially those factors over which the MCs do not have any control.

Since the level of spending depends upon the level of resources available with

the MC, the delegation of revenue powers (fiscal decentralization) and grants

(intergovernmental transfers), which determine the resources of the local bodies,

would be the key exogenous factors influencing the ability of the MC to spend

and provide these services. These factors could be captured in the form of ‘dependency

ratio’ and ‘decentralization ratio’, defined as below: •

Dependency ratio refers to the share of grants a MC receives to its total

expenditure.

• Decentralisation ratio refers to the delegation

of autonomy in decision-making with respect to the finances of the MC. Revenue

decentralization ratio is measured by ratio of MC’s per capita revenue to

State per capita revenue receipt.

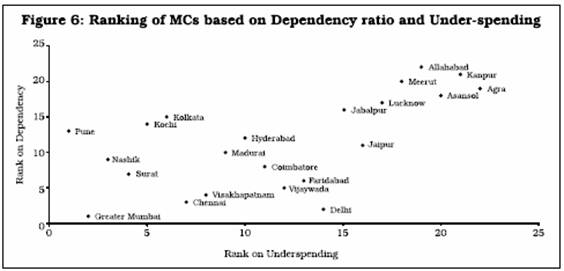

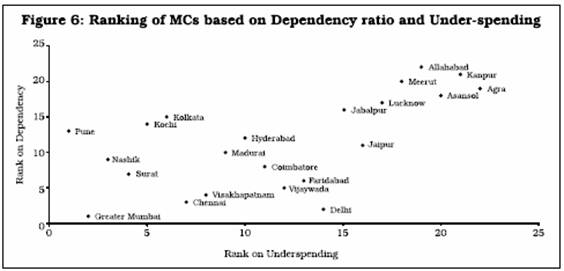

(a) Dependency and Under-spending

Table 30 juxtaposes the extent of under-spending with the dependency ratio of

the MCs. The rank correlation coefficient between these two series works out to

0.61. The coefficient is statistically significant at 1 per cent level of significance.

Figure 6 presents the scatter diagram between under-spending and dependency on

grants from higher level of governments. This indicates a significant positive

relationship, implying that higher dependency would lead to higher under-spending.

Table

30: Dependency ratio and Under-spending of the

Municipal

Corporations | Sl.

No. | Municipal

Corporation | Under

Spending (%) | Dependency

Ratio (%) | 1 | Greater

Mumbai | 31.64 | 0.69 |

2 | Delhi

| 85.38 | 2.35 |

3 | Kolkata | 68.75 | 46.50 |

4 | Chennai | 70.11 | 3.97 |

5 | Hyderabad

| 76.01 | 16.42 |

6 | Kanpur

| 91.01 | 72.28 |

7 | Pune | 30.78 | 22.45 |

8 | Surat

| 62.24 | 7.69 |

9 | Jaipur | 88.48 | 14.53 |

10 | Lucknow

| 89.88 | 61.50 |

11 | Agra

| 91.31 | 67.18 |

12 | Nashik | 35.52 | 8.98 |

13 | Meerut

| 90.15 | 67.46 |

14 | Faridabad

| 84.25 | 7.58 |

15 | Visakhapatnam

| 74.73 | 4.03 |

16 | Allahabad

| 90.17 | 72.67 |

17 | Jabalpur

| 85.79 | 60.43 |

18 | Coimbatore

| 81.06 | 8.01 |

19 | Madurai

| 74.75 | 9.31 |

20 | Vijayawada

| 81.40 | 4.80 |

21 | Kochi

| 63.65 | 43.03 |

22 | Asansol | 90.21 | 62.07 |

Table

31: Categorization of Municipal Corporations as per Dependency Ratio

(Average of 1999-00 to 2003-04) | Parameter | Municipal

Corporations | Top

5 Municipal Corporations | At

or Above Average | Kolkata | Kanpur

(0.72) | (High

dependency) | Kanpur | Allahabad

(0.72) | | Pune | Agra

(0.67) | | Lucknow

| Meerut (0.67) |

| Agra

| Asansol (0.62) |

| Meerut

| | | Jabalpur

| | | Kochi

| | | Ahmedabad | |

| Allahabad

| | | Asansol | |

| | Bottom

5 Municipal Corporations | Below

Average | Greater Mumbai | Greater

Mumbai (0.069) | (Low

dependency) | Delhi | Delhi

(0.023) | | Chennai | Chennai

(0.004) | | Hyderabad

| Vishakhapatnam (0.04) |

| Surat

| Vijayawada (0.05) |

| Jaipur | |

| Vadodara | |

| Nashik | |

| Faridabad

| | | Vishakhapatnam

| | | Rajkot

| | | Coimbatore

| | | Madurai

| | | Vijayawada

| | The

MCs falling above and below the group average of the average dependency ratio

(over the period 1999-2000 to 2003-2004) are shown in Table 31.

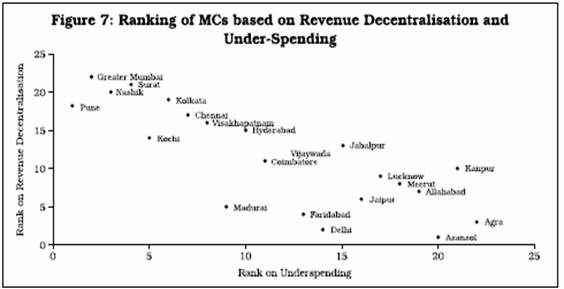

(b) Decentralisation and Under-spending

Table

32 compares the extent of under-spending and decentralization, a measure of delegation

of tax powers to the MCs. Here, decentralization ratio has been measured as proportion

of the MC’s per capita revenue to State per capita revenue, over the time

period of 1999-2000 to 2003-2004.

Table

32: Decentralisation and Under-Spending of the Municipal Corporations

(Average of 1999-2000 to 2003-2004) | Sl.

No. | Municipal

Corporation | Under

Spending (%) | Revenue

Decentralisation Ratio (%) | 1 | Greater

Mumbai | 31.64 | 110.61 |

2 | Delhi

| 85.38 | 18.03 |

3 | Kolkata | 68.75 | 67.65 |

4 | Chennai | 70.11 | 45.07 |

5 | Hyderabad

| 76.01 | 34.43 |

6 | Kanpur

| 91.01 | 24.67 |

7 | Pune | 30.78 | 61.19 |

8 | Surat

| 62.24 | 79.92 |

9 | Jaipur | 88.48 | 21.69 |

10 | Lucknow

| 89.88 | 23.77 |

11 | Agra

| 91.31 | 19.55 |

12 | Nashik | 35.52 | 75.90 |

13 | Meerut

| 90.15 | 23.53 |

14 | Faridabad

| 84.25 | 19.82 |

15 | Visakhapatnam

| 74.73 | 39.02 |

16 | Allahabad

| 90.17 | 23.52 |

17 | Jabalpur

| 85.79 | 25.67 |

18 | Coimbatore

| 81.06 | 24.82 |

19 | Madurai

| 74.75 | 20.31 |

20 | Vijayawada

| 81.40 | 25.18 |

21 | Kochi

| 63.65 | 26.76 |

22 | Asansol | 90.21 | 12.53 |

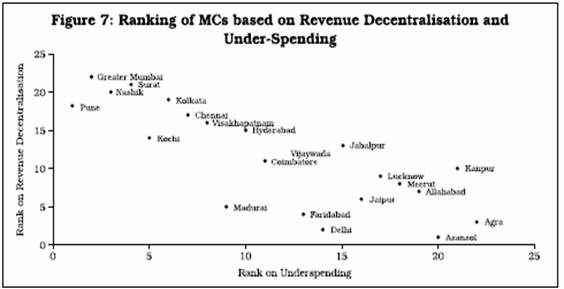

The results shown in Table 31 and the scatter diagram in

Figure 7 confirm our a priori view that higher the revenue

Table

33: Categorization of Municipal Corporations as per Revenue

Decentralisation

Ratio (Average of 1999-00 to 2003-04) | Parameter | Municipal

Corporations | Top

5 Municipal Corporations | At

or Above Average | Greater

Mumbai | Greater Mumbai (110.61%) |

(Highly decentralized) | Surat

| Surat (79.92%) |

| Nashik | Nashik

(75.9%) | | Pune | Kolkata

(67.65 %) | | Kolkata | Pune

(61.19%) | | Chennai | Surat

(38.99%) | | Visakhapatnam

| | | | Bottom

5 Municipal Corporations | Below

Average | Hyderabad | Asansol

(12.53%) | (Lowly

decentralized) | Kanpur | Delhi

(18.03%) | | Jaipur | Agra

(19.55%) | | Lucknow

| Faridabad (19.82%) |

| Agra

| Madurai (20.31%) |

| Delhi

| | | Kochi

| | | Madurai

| | | Vijayawada

| | | Jabalpur

| | | Meerut

| | | Coimbatore

| | | Faridabad

| | | Allahabad

| | | Asansol | |

decentralization, lower the level of under-spending. The

rank correlation computed as per Spearman’s rank correlation works out to

be - 0.81 and has a desired negative sign. It is highly significant at 1 per cent

level of significance.

Table 33 provides the list of MCs that fall above

or below the group average decentralization ratio.

Endogenous

Factors

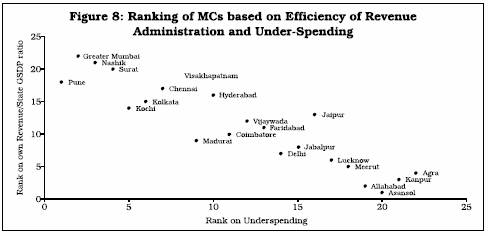

(a) Revenue Administration

This parameter refers to local body’s efficiency in levying and collecting

revenues which falls in its jurisdiction i.e, own sources of revenue of the MC.

Although not a very accurate measure, it aims at measuring MC’s performance

with regard to own revenue. The ratio of per capita own revenue of MC to

State GDP (GSDP) per capita could be taken as a close approximation of the efficiency

of revenue administration8. Table 34 provides a comparative scenario of under-spending

and efficiency of revenue administration.

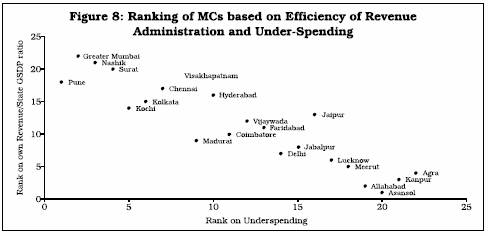

With efficient revenue administration

reflected by own revenue as a proportion to GSDP, the availability of resources

with the MC improves and level of under-spending is accordingly lower. Rank correlation

among the two parameters works out to -0.913, which is statisticallysignificant

at 1 per cent level.

The scatter diagram in Figure 8 clearly reveals a negative

relationship between efficiency of revenue administration and level of under-spending.

Table

34: Efficiency of Revenue Administration and Under-Spending of the

Municipal Corporations | Sl.

No. | Name

of the Municipal Corporation | Under

Spending (%) | Ratio

of Per capita Own Revenue to GSDP per capita (%) | 1 | Greater

Mumbai | 31.64 | 18.45 |

2 | Delhi

| 85.38 | 2.30 |

3 | Kolkata | 68.75 | 5.36 |

4 | Chennai | 70.11 | 6.61 |

5 | Hyderabad

| 76.01 | 5.75 |

6 | Kanpur

| 91.01 | 1.44 |

7 | Pune | 30.78 | 6.66 |

8 | Surat

| 62.24 | 9.69 |

9 | Jaipur | 88.48 | 4.43 |

10 | Lucknow

| 89.88 | 1.90 |

11 | Agra

| 91.31 | 1.50 |

12 | Nashik | 35.52 | 12.26 |

13 | Meerut

| 90.15 | 1.55 |

14 | Faridabad

| 84.25 | 3.82 |

15 | Visakhapatnam

| 74.73 | 7.25 |

16 | Allahabad

| 90.17 | 1.27 |

17 | Jabalpur

| 85.79 | 2.50 |

18 | Coimbatore

| 81.06 | 3.80 |

19 | Madurai

| 74.75 | 3.19 |

20 | Vijayawada

| 81.40 | 3.91 |

21 | Kochi

| 63.65 | 4.81 |

22 | Asansol | 90.21 | 0.73 |

A

comparison of the own revenue with performance on individual taxes that are levied

and collected by the Municipal Corporations would provide further insight into

tax efficiency of the urban local bodies. Table 35 provides a comparative position

of

Table

35: Own Revenue-GSDP Ratio and Performance on Individual Taxes |

Sl.

No. | Municipal

Corporation | Own

Revenue to GSDP | Property

tax | Profession

tax | Advertisement

tax | Octroi

Ratio | High

Own Tax | 1 | Greater

Mumbai | 8.63 | × | | × | v |

2 | Surat

| 9.93 | v | | | v |

3 | Chennai | 3.41 | v | v | × | |

4 | Visakhapatnam

| 8.24 | v | v | × | |

5 | Vijayawada

| 4.45 | v | v | | |

6 | Hyderabad

| 6.53 | v | v | v | |

Lower Own

Tax | 7 | Kochi

| 1.55 | v | v | | |

8 | Jabalpur

| 1.02 | × | × | | × |

9 | Nashik | 1.30 | × | | | v |

10 | Coimbatore

| 1.38 | × | × | | |

11 | Jaipur | .50 | × | | v | × |

12 | Madurai

| .93 | × | | | |

13 | Faridabad

| 1.11 | × | | × | |

Notes :

v : represents equal or above average performance,

× : represents

lower than average performance. In the case of blank cells, no information is

available. | different tax sources in order to

identify the corporations with potential for improving tax administration

It is pertinent to note that all MCs, barring Mumbai, with above average own tax

revenue have performed well in case of property tax and/or profession tax. In

case of Mumbai, it has done well in case of Octroi. On the other hand, except

Kochi, all MCs falling in the below average category have not done well in either

of the major taxes.

(b) Recovery of Cost

Cost

recovery of services is an important measure, which is used to assess the health

of municipal finances. It can be broadly measured as a ratio of municipal fees

and user charges to revenue expenditure incurred by an MC for the provision of

respective services viz., water supply, sanitation, health services,

education and street lighting. As detailed data on service-wise user charges and

fees are not available, the broad indicator of ratio of municipal fees and user

charges to aggregate revenue expenditure has been used as a proxy. Table 36 makes

a comparison of under-spending and cost recovery of the MCs. None of the MCs,

barring Delhi, Visakhapatnam and Bhopal show a high proportion of cost recovery.

It is less than 10 per cent in the MCs of Kerala and Tamil Nadu. Cost recovery

has to be an integral part of service provision, especially when services can

be measured and beneficiaries identified, as in case of water supply, education

and health.

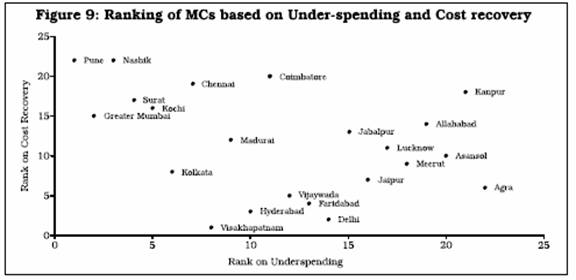

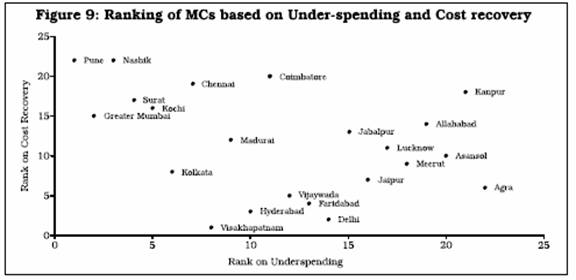

The scattered diagram in Figure 9 indicates a negative

but relatively weak relationship between under-spending and cost recovery. In

case of MCs such as Kanpur, Allahabad and Lucknow, despite higher cost recovery,

under-spending has not been lower. Rank correlation for these two series is -0.39,

which is significant at 10 per cent level. (c) Quality of Expenditure

The expenditure structure of Municipal Corporations throws some light on the relative

importance assigned to each component in the total expenditure and it also has

a bearing on the financial position and service delivery.

Table

36: Under-spending and Cost recovery of the Municipal Corporations |

Sl. No. | Municipal

Corporation | Under

Spending

of the MC (%) | Average

Cost

recovery (%) | 1 | Hyderabad

| 76.01 | 38.88 |

2 | Visakhapatnam

| 74.73 | 81.91 |

3 | Vijayawada

| 81.40 | 37.48 |

4 | Delhi

| 85.38 | 94.13 |

5 | Surat

| 62.24 | 11.11 |

6 | Bangalore

| 74.92 | 14.41 |

7 | Kochi

| 63.65 | 7.76 |

8 | Indore

| 75.54 | 31.83 |

9 | Bhopal

| 84.50 | 62.85 |

10 | Jabalpur

| 85.79 | 7.20 |

11 | Greater

Mumbai | 31.64 | 11.16 |

12 | Ludhiana

| 62.77 | 9.18 |

13 | Jaipur | 88.48 | 33.61 |

14 | Chennai | 70.11 | 7.74 |

15 | Coimbatore

| 81.06 | 4.47 |

16 | Madurai

| 74.75 | 4.79 |

17 | Lucknow

| 89.88 | 9.82 |

18 | Kanpur

| 91.01 | 3.90 |

19 | Allahabad

| 90.17 | 6.06 |

20 | Agra

| 91.31 | 23.25 |

21 | Varanasi

| 90.17 | 9.34 |

22 | Meerut

| 90.15 | 12.39 |

23 | Faridabad

| 84.25 | 28.15 |

24 | Kolkata | 68.75 | 15.17 |

25 | Asansol | 90.21 | 13.08 |

.

Relative

shares of Capital, Maintenance and Establishment Expenditures

While a low proportion of spending on establishment is desirable, too low a proportion

may hamper the capacity for service delivery. Likewise, expenditure on capital

works is important as it provides future sources of revenue; but very high proportion

on it would have a bearing on the finances available for provision of services

and even necessitate external support, in the form of either grants or borrowings.

Table 37 presents the relative shares of various expenditure components of the

MCs. It indicates that some of the MCs have an unsustainably high proportion of

(more than 50 per cent) total expenditure on establishment and administration,

which affects the future of their finance and their service delivery capacity.

Likewise, some MCs have an abysmally low capital expenditure (less than 10 per

cent to almost zero), which is equally detrimental to the health of civic finance

and its long-term sustainability. It is, therefore, desirable to develop certain

guidelines/norms for the municipal corporations towards spending on capital and

its maintenance works, as well for rationalizing the staffing pattern so as to

ensure that excessive amounts are not spent on staff.

Establishment

& Administration Expenditure and Under-spending

The revenue

expenditure, which comprises expenditures on (i) establishment and administration

and (ii) operations and maintenance, assumes critical importance, as it relates

to the provision of civic services to the people and their maintenance. However,

a very high proportion of expenditure on establishment and administration can

be detrimental to both the expansion of capital assets and maintenance of existing

facilities. Thus, with a relatively lower proportion of expenditure devoted to

establishment and administration, the MCs would be better equipped to provide

Table

37: Relative Share of Expenditure Components of the MCs

(Average

of the Shares during 1999-2003) | Sl.

No. | Municipal

Corporation | Share

of Establishment

& Administration

Expenditure

in Total

Expenditure (%) | Share

of Operations & Maintenance

Expenditure in Total

Expenditure (%) | Share

of Capital

Expenditure in Total

Expenditure

(%) | 1 | Hyderabad

| 56.95 | 22.19 | 19.82 |

2 | Visakhapatnam

| 46.55 | 32.38 | 18.74 |

3 | Vijaywada | 46.55 | 32.38 | 18.74 |

4 | Patna

| 53.09 | 26.46 | N.A. |

5 | Delhi

| 43.71 | 2.18 | 6.08 |

6 | Ahmedabad | 0.00 | 0.00 | 23.82 |

7 | Surat

| 37.61 | 8.01 | 39.47 |

8 | Vadodara | 41.53 | 20.03 | 13.48 |

9 | Bangalore

| 49.00 | 4.72 | N.A. |

10 | Kochi

| 16.01 | 32.94 | 1.25 |

11 | Indore

| 28.61 | 12.15 | 25.96 |

12 | Bhopal

| 20.64 | 11.06 | 2.85 |

13 | Jabalpur

| 55.34 | 7.52 | N.A. |

14 | Greater

Mumbai | 36.79 | 8.30 | 0.06 |

15 | Pune | 20.06 | 58.62 | 21.32 |

16 | Nagpur

| 37.98 | 36.72 | 25.30 |

17 | Nashik | 25.03 | 20.56 | 42.29 |

18 | Ludhiana

| 42.75 | 13.19 | 1.37 |

19 | Jaipur | 31.53 | 5.17 | 36.03 |

20 | Chennai | 42.77 | 4.76 | 21.61 |

21 | Coimbatore

| 55.91 | 15.53 | 28.56 |

22 | Madurai

| 53.21 | 2.34 | 29.98 |

23 | Lucknow

| 48.83 | 14.12 | 23.96 |

24 | Kanpur

| 66.89 | 17.15 | 1.50 |

25 | Allahabad

| 51.03 | 18.89 | 0.24 |

26 | Agra

| 50.72 | 4.16 | 12.41 |

27 | Varanasi

| 50.93 | 6.05 | 0.11 |

28 | Meerut

| 58.45 | 13.03 | 21.34 |

29 | Faridabad

| 46.84 | 53.16 | N.A. |

30 | Kolkata | 61.30 | 7.39 | 8.72 |

31 | Asansol | 32.07 | 7.92 | 40.12 |

| Total | 36.25 | 14.43 | 12.37 |

Source:

Budgets of Municipal Corporations. | civic amenities.

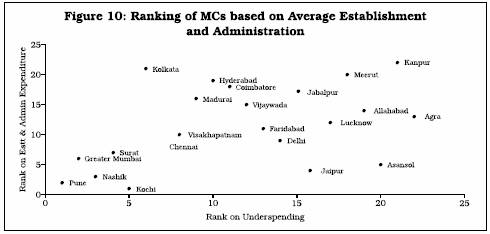

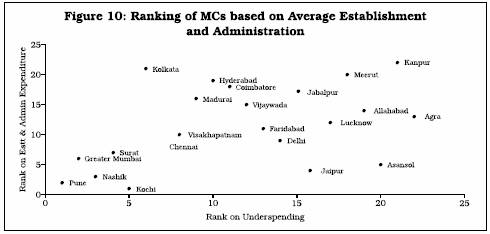

Table 38 compares the establishment and administration expenditure and under-spending

of the MCs. The relationship of under-spending with the proportion of expenditure

on establishment and administration is shown in the scatter diagram in Figure

10. It indicates a positive relationship conforming to a priori expectations.

Rank correlation for these two series is 0.44 which is significant at 5 per cent

level

Table

38: Average Establishment and Administration Expenditure of

the

Municipal Corporations (1999-2000 to 2003-2004) | Sl.

No. | Municipal

Corporation | Under

Spending (%) | Expenditure

on Establishment and Administration to Total

Expenditure

(%) | 1 | Greater

Mumbai | 31.64 | 36.79 |

2 | Delhi

| 85.38 | 43.71 |

3 | Kolkata | 68.75 | 61.30 |

4 | Chennai | 70.11 | 42.77 |

5 | Hyderabad

| 76.01 | 56.95 |

6 | Kanpur

| 91.01 | 66.89 |

7 | Pune | 30.78 | 20.06 |

8 | Surat

| 62.24 | 37.61 |

9 | Jaipur | 88.48 | 31.53 |

10 | Lucknow

| 89.88 | 48.83 |

11 | Agra

| 91.31 | 50.71 |

12 | Nashik | 35.52 | 25.03 |

13 | Meerut

| 90.15 | 58.45 |

14 | Faridabad

| 84.25 | 46.84 |

15 | Visakhapatnam

| 74.73 | 46.55 |

16 | Allahabad

| 90.17 | 51.03 |

17 | Jabalpur

| 85.79 | 55.34 |

18 | Coimbatore

| 81.06 | 55.91 |

19 | Madurai

| 74.75 | 53.21 |

20 | Vijayawada

| 81.40 | 51.03 |

21 | Kochi

| 63.65 | 16.01 |

22 | Asansol | 90.21 | 32.05 |

Table 39 provides a summary position on relationship of underspending

with other major variables as discussed above. Under-

Table

39: Summary of the Assessment of Finances of Municipal Corporations |

Sl.

No. | Municipal

Corporation | Under-

Spending % | Depend-

ency | Decentra-

lisation | Revenue

(Tax)

Adminis-

tration | Quality

of

Expendi-

ture | Cost

Recovery | 1 | Pune | 30.78 | v | v | v | v | |

2 | Greater

Mumbai | 31.64 | v | v | v | v | × |

3 | Nazi | 35.52 | v | v | v | v | |

4 | Vadodara | 50.43 | v | v | | | |

5 | Surat

| 62.24 | v | v | v | v | × |

6 | Ludhiana

| 62.77 | | | | | × |

7 | Kochi

| 63.65 | × | × | × | | × |

8 | Nagpur

| 67.50 | | | | | |

9 | Kolkata | 68.75 | × | v | v | × | × |

10 | Chennai | 70.11 | v | v | v | v | × |

11 | Visakhapatnam

| 74.73 | v | × | v | v | v |

12 | Madurai

| 74.75 | v | × | × | | × |

13 | Bangalore

| 74.92 | | | | | × |

14 | Indore

| 75.54 | | | | | v |

15 | Hyderabad

| 76.01 | v | × | v | × | v |

16 | Coimbatore

| 81.06 | v | × | × | × | × |

17 | Vijayawada

| 81.40 | v | × | × | × | v |

18 | Faridabad

| 84.25 | v | × | × | × | v |

19 | Bhopal

| 84.50 | | | | | v |

20 | Jabalpur

| 85.79 | × | × | × | × | × |

21 | Jaipur | 88.48 | v | × | × | | v |

22 | Lucknow

| 89.88 | × | × | × | × | × |

23 | Meerut

| 90.15 | × | × | × | × | × |

24 | Allahabad

| 90.17 | | × | × | × | × |

25 | Varanasi

| 90.17 | | | | | × |

26 | Asansol | 90.21 | × | × | × | v | × |

27 | Kanpur

| 91.01 | × | × | × | × | × |

28 | Agra

| 91.31 | × | × | × | × | v |

29 | Patna

| 94.43 | | | | | |

v : Above average

performance. × : Below average performance. | spending

has been shown in the ascending order with the MC on the top being the best performer

(with highest per capita spending on core services). Subsequent columns indicate

status of individual MCs against various parameters that are expected to influence

the level of under-spending. With a majority of the tick marks being concentrated

towards the top, the influence of various factors on the level of underspending

is quite apparent. (d) Debt Position

The debt position

of MCs can be assessed in terms of the followings: a) use of debt and b) debt

sustainability. The former has been examined by computing debt to capital expenditure

ratio and the latter has been ascertained by computing interest coverage and debt

coverage ratios. Use of Debt

Borrowed funds

are intended for creation/development of infrastructure by a MC, resulting in

asset creation so that the returns generated from the assets can be utilized for

servicing the debt (here, it is implicitly assumed that either returns are designed

to be adequate or facilities are subsidized by upper tiers). The ratio of borrowings

to capital expenditure of the municipalities provides an indication of the extent

to which borrowed funds are spent on capital formation. A value of the ratio above

one (a proportion greater than 100 per cent) will indicate that a portion of the

borrowed funds is utilized for current consumption.

Table 40 indicates that

except three MCs belonging to Kochi, Ludhiana & Allahabad no other MC have

a borrowing to capital expenditure ratio of more than one, suggesting that the

borrowed funds have been utilized for capital expenditure only.

Table

40: Borrowings to Capital Expenditure Ratio of the MCs

(Average

of 1999-2003) | Municipal

Corporation | Loans

(Rs. Lakhs) | Capital

Expenditure

(Rs. Lakhs) | Borrowings/Capital

Expenditure ratio’ (%) | Vijaywada | 520 | 1495 | 34.74 |

Delhi | 1253 | 4807 | 26.06 |

Ahmedabad | 12205 | 17564 | 69.49 |

Surat | 5653 | 18169 | 31.11 |

Kochi | 1562 | 148 | 1053.03 |

Indore | 1643 | 5323 | 30.86 |

Bhopal | 16 | 283 | 5.66 |

Nagpur | 2737 | 5620 | 48.69 |

Ludhiana | 715 | 268 | 266.92 |

Jaipur | 375 | 4875 | 7.69 |

Chennai | 4244 | 11314 | 37.51 |

Coimbatore | 763 | 1898 | 40.18 |

Madurai | 1118 | 2666 | 41.92 |

Lucknow | 2026 | 2595 | 78.09 |

Allahabad | 124 | 37 | 333.78 |

Meerut | 405 | 924 | 43.85 |

Asansol | 26 | 755 | 3.38 |

Source:

Budget documents of Municipal Corporations. | |

Debt Sustainability

Apart from the

use of borrowings, debt sustainability of the MCs needs to be assessed, and this

can be done in terms of two indicators: ratio of outstanding debt to total revenues

and ratio of debt servicing to revenue receipts. As the outstanding debt details

of the MCs are not available in the budget documents, the second measure is used

in the study. It may be noted that debt repayments include both principal and

interest components.

Table 41 sets out the information relating to debt

repayment to revenue receipt ratio of the MCs. It reflects that the debt repayment

of 18 MCs has not been very high. Excepting the cases of MCs of Chennai, Madurai

and Vijayawada, wherein the debt repayment is over and above 10 per cent of their

revenue receipts, there is a potential for using debt wisely, by the MCs for capital

formation.

Table

41: Debt Repayment to Revenue receipts ratio of the MCs

(Average

of 1999-2003) | Municipal

Corporation | Debt

Repayment

Rs. Lakhs) | Revenue

Receipts(Rs. Lakhs) | Debt

Repayment to Revenue receipts (%) | Hyderabad

| 307 | 33882 | 0.91 |

Visakhapatnam | 217 | 11007 | 1.97 |

Vijaywada | 935 | 6165 | 15.17 |

Delhi | 309 | 88030 | 0.35 |

Bangalore | 2805 | 36954 | 7.59 |

Kochi | 60 | 5168 | 1.16 |

Indore | 304 | 17997 | 1.69 |

Greater Mumbai | 29549 | 416203 | 7.10 |

Pune | 216 | 50716 | 0.43 |

Nagpur | 1574 | 24961 | 6.31 |

Nashik | 2231 | 26830 | 8.32 |

Ludhiana | 328 | 19467 | 1.68 |

Jaipur | 301 | 12286 | 2.45 |

Chennai | 6762 | 59103 | 11.44 |

Coimbatore | 124 | 7210 | 1.72 |

Madurai | 962 | 5660 | 17.00 |

Kanpur | 68 | 10033 | 0.68 |

Kolkata | 655 | 54239 | 1.21 |

Source:

Budget documents of Municipal Corporations. | However,

apart from the measure of debt service in relation to the revenue receipts, debt

sustainability should be examined from the point of view of an MC’s capacity

to service debt. The capacity to service the debt refers to how easily and readily

the MC will be able to meet its commitment in respect of the contractual interest

payment and the repayment of debt. The MC’s ability to service the liabilities

can be measured with the help of coverage ratios. The coverage ratios establish

relationship between committed liabilities, and the MC’s surplus out of

which these claims are to be paid. These measures try to relate the MC’s

surplus to the level of debt repayments with a view to assessing the degree of

comfort with which the MC can meet these repayments. The following coverage ratios

may used to analyze a MC’s ability to service committed liabilities.

Interest Coverage Ratio

This ratio is also

called the “times interest earned” ratio and it measures the ability

of an MC to pay the interest liability on debts. This is calculated as the ratio

of operating surplus to interest payment*. The Interest Coverage (IC) Ratio,

therefore, measures how many times the interest liability of the MC is covered

with the MC’s operating surplus. The ratio gives an idea of how much fall

in surplus the MC can sustain, before it defaults or borrows to meet the interest

liability. Table 42 shows the performance of the MCs on this measure.

For the MCs whose interest payment details exist, the measure shows that they

are on the higher side. The higher the IC ratio, the better it is both for the

MC and for the lenders. For the MC, the probability of committing default is reduced

and for the lenders, the

Table

42: Interest Coverage Ratio of the Municipal Corporations

(Average

of 1999 – 2003) | Sl.

No. | Municipal

Corporation | Interest

repayment

(Rs Lakhs) | Operating

Surplus

(Rs Lakhs) | Times

Interest

Earned Ratio (%) | 1. | Hyderabad

| 307 | 6852 | 22.32 |

2. | Kochi

| 20 | 2604 | 130.18 |

3. | Indore

| 202 | 10064 | 49.82 |

4. | Nagpur

| 593 | 5155 | 8.69 |

5. | Nashik | 1607 | 14565 | 9.06 |

6. | Jaipur | 172 | 7489 | 43.54 |

7. | Chennai | 1798 | 36629 | 20.37 |

Source

: Budgets of Municipal Corporations. | | |

MC is considered to be less risky. A lower IC ratio indicates a low

surplus or a deficit of the MC in relation to its interest payment commitments.

Mathur and Ray (2003) provide criteria based on IC ratio as follows: a

ratio less than 1.5 is poor, 1.5 to 3 is moderate, 3 to 6 is good and greater

than 6 is favourable. Therefore, all the above MCs are on a favourable side of

the measure.

Debt Coverage Ratio

The debt coverage ratio shows the relationship between the operating surplus of

the MCs and the committed liability in respect of interest and principal. It is

calculated as the ratio of operating surplus and debt repayment (interest and

principal repayments). Table 43 provides the performance of the MCs on this measure.

A high debt coverage ratio is indicative of the MC’s ability to meet

its committed payment obligations easily, while a low ratio indicates its difficulty

to meet the obligations.

According to Mathur and Ray (2003), the

criteria laid down for this measure are as follows: a ratio less than 1 is poor,

1 to 2 is moderate, 2 to 4 is good and greater than 4 is favourable. For the MCs

under study whose debt repayment details exist, the measure shows that all MCs

except 4 fall in category of ‘favourable’. Vijaywada and Madurai fall

in ‘moderate’ category whereas Bangalore and Nagpur could be termed

as ‘good’.

Table

43: Debt Coverage Ratio to Operating Surplus of the MCs

(Average

of 1999-2003) | Sl.

No. | Municipal

Corporation | Debt

Payment

(Rs Lakhs) | Operating

Surplus

(Rs Lakhs) | Times

Debt Covered

(Operating surplus/

Debt

payment) | 1. | Hyderabad

| 307 | 6852 | 22.3 |

2. | Visakhapatnam

| 217 | 3551 | 16.4 |

3. | Vijaywada | 935 | 1715 | 1.8 |

4. | Delhi

| 309 | 51917 | 168 |

5. | Bangalore

| 2805 | 7317 | 2.6 |

6. | Kochi

| 60 | 2604 | 43.4 |

7. | Indore

| 304 | 10064 | 33.1 |

8. | Greater

Mumbai | 29549 | 260181 | 8.8 |

9. | Pune | 216 | -19072 | Negative |

10. | Nagpur

| 1574 | 5155 | 3.3 |

11. | Nashik | 2231 | 14565 | 6.5 |

12. | Ludhiana

| 328 | 8524 | 26 |

13. | Jaipur | 301 | 7489 | 24.9 |

14. | Chennai | 6762 | 36629 | 5.4 |

15. | Coimbatore

| 124 | 2500 | 20.2 |

16. | Madurai

| 962 | 1125 | 1.2 |

17. | Kanpur

| 68 | 1408 | 20.7 |

18. | Kolkata | 655 | 15531 | 23.7 |

Source

: Budgets of Municipal Corporations. | 5.4

Projection of Investment Requirement in Urban Areas

This section

attempts to project resource requirement for basic civic amenities via, water

supply, sewerage, roads, solid waste management and street lighting and for the

provision of mass urban transport systems as well as road infrastructure. For

making these projections, various norms have been used: Zakaria Committee Norms

(Basic amenities), Service cost Norms (Rail/ Road based mass transport) and the

Expected Service cost (Inner and Outer ring roads). The details of methodology

used for projections are provided below.

5.4.1 Basic Amenities

There would be need for resources for creating new infrastructure for the growing

population (including backlog) and for maintenance of current and future assets.

Thus, funds would be needed for: i) New infrastructure for backlog, ii) New infrastructure

for incremental population and iii) Operation and Maintenance expenditure. (i)

The investment needs for creating new assets for civic amenities viz.,

water supply, sewerage, roads and street lighting were worked out using Zakaria

Committee norms. In the case of solid waste management, the norms were worked

out from the estimates made in Arabi (2006). These norms were adjusted for inflation

assuming head line inflation of 5 per cent per annum during the projection period.

(ii) It was assumed that there was a service backlog of 33 per cent i.e.

one third of the population did not have service coverage9 .

(iii)

Zakaria Committee norms were used for working out the operation and maintenance

expenditure requirement for all the services mentioned at (i) except solid waste

management10. Thus, the resource requirement for incremental investment and

O&M worked out for each year as:

Incremental Investment Need = Zakaria

Norm (adj)* Incremental Population

O&M expenditure Needs =

Zakaria Norm (adj) * Population

Resource requirement for backlog population

worked out as:

Backlog Investment Needs = Zakaria Norm (adj)* Backlog

Population

The total resource needs for the provision of major civic

services can be estimated by adding up:

Incremental Investment Needs

+ O&M Investment Needs + Backlog Investment Needs

Using the above

estimates of total investment needs for the 35 MCs, the corresponding figure for

the entire urban population is estimated. 5.4.2 Urban Mass Transport

Systems

Urban areas require not only the basic civic amenities

but also other services like urban transport and similar public goods and services.

An attempt is made to estimate the investment needs of providing (i) mass urban

transport systems and (ii) major road infrastructure in the form of inner and

outer ring roads for providing faster movement of vehicles. As these services

are meant to be provided in metropolitan cities/agglomerations, the 35 MCs with

urban agglomeration population more than one million population are considered

and categorized into Class AA, A and B based on the prevalent city (MC) population

as on 2001.

(i) The mass urban transport systems considered include:

elevated metro system for class AA and A cities (with service length of 100 and

50 km respectively) and bus rapid transit system for Class B cities (with a service

length of 100 km). Therefore, for all the cities, according to their city class,

the mass urban transport investment needs are estimated using the capital investment

norms provided in Bandai and Coppice (2004) together with the assumed service

length.

Mass Rapid Transport System Investment Needs = Norm * Service

length

(ii) The major road infrastructure needs include: Outer

and Inner ring roads for all class AA cities (with a service length of 100 km),

Inner ring roads for class A cities (with a service length of 100 km) and Inner

ring roads for class B cities (with service length of 50 km). The norms for Outer

and Inner investment needs of the roads / expressways per km length in urban areas

are formed using the actual cost estimates of their provision in Hyderabad11 .

Using these norms and coverage length, the investment needs of the cities for

the provision of road infrastructure/ expressways is estimated.

Table

44: Projection of Investment Requirement in Urban Areas |

Sl. No. | Infrastructure

Component | Investment

Need for Ten Years (2004-05 to 2013-14) (Rs Crore)* |

1 | Urban

basic services | Rs

3,25,010 | 2 | Mass

urban transport services | Rs

2,53,700 | 3 | Road

infrastructure services | Rs

49,500 | 4 | Total

urban services | Rs

6,28,210 | *:

At 2004-05 prices. | Road infrastructure Investment

Needs = Norm * Service length

Therefore, the total investment needs

of providing urban infrastructure services can be expressed as:

Total

Urban Investment Needs =Basic Amenities Investment Needs + Mass Rapid Transport

System Investment Needs + Major Road Infrastructure Investment Needs

The estimate given in Table 44 shows that on an average investment requirement

is around Rs 62,821 crore per annum at constant prices of 2004-05, which comes

to 2.2 per cent of GDP in year 2004-05. Here, it may be noted that total revenues

of ULBs remained stable at around 0.75 per cent of GDP, which is much less than

the requirement.

5.5 Estimate of Potential for Revenue Mobilisation

by ULBs

As mentioned earlier, shortfall in resources is on account

of the vertical imbalance as well as the nature of ULBs’ own operations.

The present section attempts to estimate the potential growth in ULB revenues

assuming a status quo in fiscal federal relationship. Thus, it would indicate

the size of revenue gap which would necessarily have to be met through major structural

reforms in the nature of altering fiscal federal relationship.

i)

For working out potential revenue, separate estimates were made for tax and non-tax

revenues and grants were assumed to grow at historical growth rate. For

working out tax revenue, estimates were made for major taxes viz., property,

advertisement and professional tax. For each tax, best performer among the 35

MCs was taken as the benchmark12 and potential revenue was worked out assuming

all ULBs are able to catch up with the benchmark13,14 .

ii) For working

non-tax revenue, the optimal performer in terms of proportion of cost recovery

was chosen as benchmark15 . In the previous chapter, cost recovery has been defined

as the ratio of user charges to revenue expenditure. Thus, to work out the potential

non-tax collections, the proportion of cost recovery of the optimal performer

was applied to aggregate revenue expenditures of ULBs in the country.

The sum of all above estimates provides the potential resource mobilization. However,

the entire resources cannot be assumed exclusively available for the provision

of core urban services or basic infrastructure services. Therefore, we use the

proportion of these resources that would reach to these services16 that give us

utilisable

Table

45: Projection of Potential Revenues of ULBs (2004-05) |

Sl. No. | Revenue

Source | Projected

Revenues (Rs Crores) | 1 | Property

Tax | 10,577 |

2 | Profession

Tax | 2,389 |

3 | Advertisement

Tax | 510 |

4 | All

Major Taxes (1+2+3) | 13,476 |

5 | Non

Tax (User charges & fees) | 9,746 |

6 | Grants

in Aid | 4,064 |

7 | Total

Potential Revenue (4+5+6) | 27,285 |

8 | Total

Utilisable revenue for Core Service provision(best case – 65%) | 17,736 |

9 | Total

Utilisable revenue for Core Service provision(conservative case – 35%) | 9,550 |

resources for service provision in the best case and in the average

case senerios. The estimates that have been made as per the procedures delineated

above for the year 2004-05 are set out in Table 45.

The above Table shows

that if current status in fiscal federal relationship continues, ULBs in India

together have the potential to raise revenues only up to Rs.27,285 crore in 2004-05.

This amounts to about 1.0 per cent of the GDP. Of these funds, in a best case

scenario, only 2/3rd would be available for asset creation after meeting the current

expenditure. Thus, the utilizable resources of the ULBs only for core service

provision even after attaining the benchmark figures of resource mobilization

fall short of investment needs (Rs.28,000 crore) to the tune of Rs.10,000 crore

in the best scenario and Rs.18,000 crore in the conservative (average) scenario

for the year 2004-05, which are substantial amounts that cannot be raised by ULBs

assuming status quo in all respects. There is, therefore, urgent need for reforms

to mobilize the funds needed for investment in urban infrastructure as estimated

in the previous section. Given the magnitude of the problem, it is necessary to

have a Centre-State-Local-Private Partnership (CSLPP) for development of urban

infrastructure.

5.6 Some Observations

The

key conclusions that emerge from the foregoing aggregative and Municipal Corporation-wise

analysis of municipal finances are: • Analysis of the revenue and expenditure

of the MCs reveals that most of them are generating revenue surplus and overall

resource gaps are not very large. At the same time, assessment of municipal finance

reveals that spending by all the municipal bodies is lower than that required

for providing a minimum level of civic amenities. The study observes that this

apparent contradiction of sound fiscal health and high level of underspending

is due to statutory obligations, whereby ULBs are generally bound to restrict

their expenditure to the resources available to them and also are not granted

liberal permission by State Governments to incur debt [Mathur and Thakur (2004)].

• In view of the above observation, the study has undertaken an assessment

of municipal finance in “normative terms”, besides the “standard

approach” of revenue or fiscal balance.

• A comparison

of per capita spending on core services by MCs in terms of the Zakaria Committee

norms indicates that the level of under-spending on an average works out to be

about 76 percent. Significantly, MCs belonging to Bihar and Uttar Pradesh are

the ones that have highest level of under-spending whereas those belonging to

Maharashtra, Gujarat are among the best performers.

• Reasons

for under-spending could be traced to MCs’ own operations (endogenous) as

well as to policy issues related to the upper tiers of Governments (exogenous).

Exogenous factors include dependency for resources on upper tiers of the Government

and inadequate delegation of revenue powers. Endogenous factors include inefficient

revenue (tax) administration, low cost recovery and poor quality of expenditure.

• MCs which have lower level of under-spending levels or better performance

have fared well on 4 out of 5 criteria viz.,dependency, decentralization,

tax administration and expenditure quality. On the other hand, MCs with ranking

“below average” on these 4 parameters are also the ones which have

been spending less on core civic amenities. Thus, the analysis suggests that restructuring

of revenue powers may be given top priority by State Governments if urban amenities

are to be improved.

• Though delegation of revenue powers is

a key factor, need for efficient revenue (tax) administration cannot be underplayed.

Examination of various taxes across the local bodies reveals that property and

profession taxes are important sources. (Octroi is the most important source of

revenue in municipal corporations belonging to Maharashtra and Gujarat). The local

bodies need to adequately tap the existing avenues. Unit area system of computation,

based on self-assessment principle, with respect to property tax needs to be extended

to all MCs and in the case of MCs where Octroi has been a major source they should

be adequately compensated when Octroi is abolished. Other sources like entertainment

tax, development charges, betterment levies etc. need to be tapped.

• Quality of expenditure, measured as establishment and administrative

expenditure as a proportion of total expenditure also turns out to be a major

factor in determining the ability of MCs to provide core services. Lower spending

on administrative purposes would leave more resources with the MCs to provide

for civic amenities. This calls for rationalization of the work force and reduction

in spending on establishment and administration.

• There is

a very weak link between under-spending and cost recovery. Interestingly, MCs

such as Mumbai, Surat and Pune which are among the best performers in terms of

other financial parameters, have below average user charges. This is because the

municipalities are resorting to lower use of user charges than would be desirable.

In fact, on an average the cost recovery is below 1/4th of the expenditure incurred

by the MCs. Considering the benefit principle17, there is a large scope for improvement

in levying User Charges. • It is apparent from the analysis that there

is a need to substantially increase the spending by local bodies. Given the constraints

faced by State Governments, it is essential that the MCs be granted access to

borrowed funds. At least there are two convincing arguments in favour of MCs going

for borrowed funds. First, there is a scope for MCs to go in for borrowed funds

as their current level of indebtedness is not very large. Secondly, there is a

scope to raise the user charges which are abysmally low across the States. Enhancement

of user charges would make the new projects undertaken with borrowed funds economically

viable and ensure that MCs are debt-sustainable.

• Investment

requirement for urban infrastructure has been estimated at about Rs.63,000 crore

per annum for the next ten year period (2004-05 to 2013-14), which forms about

2.2 per cent of GDP. Assuming the current status quo in fiscal federal relationship,

the study has projected that ULBs together have the potential to raise revenues

only up to about 1.0 per cent of the GDP.

• Given the magnitude

of the resource gap of the municipal sector as a whole, it is necessary to have

a Centre-State-Local-Private Partnership (CSLPP) for development of urban infrastructure.

Revisiting revenue assignment is the first task of a partnership.

*

Operating surplus is defined as current revenue - operating expenditure (operation

& maintenance including material as well as staff salaries). Given that the

accounts are not segregated in a manner required to measure operating surplus,

current expenditure net of interest payments has been used as operating expenditure

for computation.

4 Statutorily, municipal bodies cannot run

deficit and their revenue receipts must exceed revenue expenditure while presenting

budgets. It is quite possible that MCs might be compressing its expenditure in

order to meet the statutory requirement. Therefore, the surplus cannot be termed

as a genuine surplus.

5 It has been pointed out that since

a part of Municipal body expenditure is absorbed directly by the state government,

particularly relating to deputed employees, expenditure shown by them (municipal

bodies) is an underestimate. But this issue is not relevant for the bigger MCs

considered in the study. For instance, proportion of deputed employees is miniscule

in the case of Bangalore, Chennai and Hyderabad. 6 Budget

documents for the year 2002-03 and 2004-05 of Brihat Mumbai MC state that surplus

has resulted on account of efforts made by various economy measures to control

the expenditure and augment the revenue.7 Here,

the expenditure norm for storm water drainage has not been included, which is

not shown in the expenditure on services of the MCs. 8

The ability of the local body to collect taxes also depends upon delegation of

revenue powers.9 NIUA study (1998) states a 30 per cent backlog

in the year 1997-98. Given that the availability of civic amenities has not improved

since then and backlog would have increased, a conservative estimate of 33 per

cent backlog has been assumed.

10 Norms were worked out

from Arabi (2006).

11 The Hyderabad Urban Development

Authority (HUDA) has undertaken this major project in Hyderabad city and it shared

the unit costs information, which form the norms used here.

12

The average of top performer MCs of class AA and A cities has been taken as benchmark.

13 Computation of potential revenue would, however, be quite

an involved exercise which needs to take into account myriad number of factors

such as tax rate, tax base and tax exemption. Ignoring the tax rate factor, there

could be many ways to enhance the tax base and reduce the exemptions granted.

There are possibilities such as changing the base of the property tax, trade licensing

fee, advertisement fee etc., imposing vacant land tax, premium on Floor

Space Index (FSI), rationalization of user charges, formulae for inter-governmental

transfers etc. Exploring those is beyond the scope of the present study.

14 In an emerging global scenario, sunrise industries such as

IT are contributing towards employment and income generation in cities. While

income, turnover and services generated through these activities do not fall within

the revenue powers of the municipal bodies, there could be some indirect positive

contributions in terms of profession and property tax. But these aspects could

not be quantified in this study due to lack of detailed data. 15

It may be noted that cost recovery to the tune of 90 per cent of revenue expenditure,

as is found in the case of best performer MC (Vijayawada) is ridden with difficulties

as it leaves little room for revenue expenditure on establishment and administration

for service provision. An optimal performer MC (Bhopal) with a cost recovery

of 60 per cent of revenue expenditure is, therefore, taken as an appropriate benchmark.

16 Here, the average proportions of spending on core urban services

to total expenditure of average and best performer MC (Kolkata) of the 11 MCs,

for which continuous data were available, stood at 35% and 65% respectively. These

have been used as proxies.17 Benefit principle imply that services

that local governments provide should be paid for by those who benefit from them

(Bird, 1976). |

IST,

IST,