IST,

IST,

विदेशी मुद्रा भंडार प्रबंधन पर रिपोर्ट

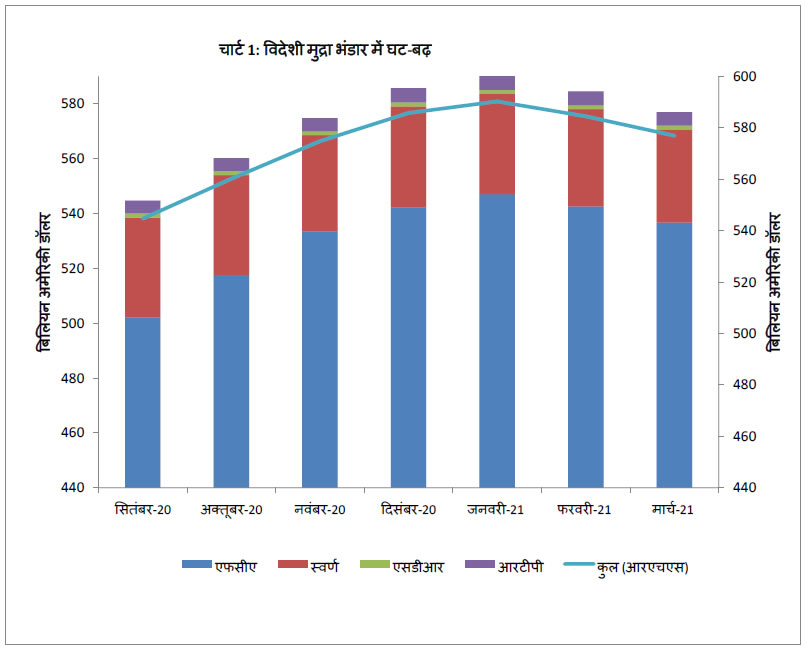

विषय-वस्तु मार्च 2021 को समाप्त छमाही के दौरान की गतिविधियां भारतीय रिज़र्व बैंक विदेशी मुद्रा भंडार के प्रबंधन में अधिक पारदर्शिता लाने एवं प्रकटन स्तर को उन्नत करने के प्रयास के रूप में विदेशी मुद्रा भंडार के प्रबंधन पर अर्धवार्षिक रिपोर्ट प्रकाशित करता है। यह रिपोर्ट प्रत्येक वर्ष छमाही आधार पर मार्च-अंत और सितंबर-अंत के अनुसार स्थिति के संदर्भ में तैयार की जाती है। मौजूदा रिपोर्ट (इस श्रृंखला में 36वीं) मार्च 2021 को समाप्त स्थिति के संदर्भ में है। रिपोर्ट दो भागों में विभाजित हैः भाग I में समीक्षाधीन छमाही के दौरान विदेशी मुद्रा भंडार में घट-बढ़ संबंधी गतिविधियों, विदेशी मुद्रा भंडार के मुकाबले बाहरी देयताओं और विदेशी मुद्रा भंडार की पर्याप्तता आदि के संबंध में जानकारी दी गई है। रिपोर्ट के भाग II में विदेशी मुद्रा भंडार प्रबंधन के उद्देश्य, सांविधिक प्रावधान, जोखिम प्रबंधन प्रथाओं, विदेशी मुद्रा भंडार प्रबंधन के संबंध में भारतीय रिज़र्व बैंक द्वारा अपनाई गई पारदर्शिता और प्रकटीकरण प्रथाओं के संबंध में जानकारी प्रस्तुत की गई है। I.2 विदेशी मुद्रा भंडार में घट-बढ़ I.2.1 विदेशी मुद्रा भंडार में वृद्धि की समीक्षा समीक्षाधीन छमाही अवधि के दौरान, विदेशी मुद्रा भंडार में बढ़त हुई जो सितंबर 2020 के अंत में 544.69 बिलियन अमेरिकी डॉलर से बढ़कर मार्च 2021 के अंत में 576.98 बिलियन अमेरिकी डॉलर हो गया (सारणी 1 तथा चार्ट 1)। यद्यपि अमेरिकी डॉलर और यूरो दोनों मध्यवर्ती मुद्राएं हैं और विदेशी मुद्रा आस्तियां (एफसीए) प्रमुख मुद्राओं में धारित की जाती हैं, तथापि विदेशी मुद्रा भंडार अमेरिकी डॉलर मूल्यवर्ग में ही अभिव्यक्त किया जाता है। विदेशी मुद्रा आस्तियों में घट-बढ़ का मुख्य कारण भारतीय रिजर्व बैंक द्वारा विदेशी मुद्राओं का क्रय-विक्रय, विदेशी मुद्रा भंडार के नियोजन से अर्जित होनेवाली आय, केंद्र सरकार की बाह्य सहायता प्राप्तियां और आस्तियों के पुनर्मूल्यन के चलते होनेवाला परिवर्तन है।  I.2.2 विदेशी मुद्रा भंडार में वृद्धि के स्रोत भुगतान संतुलन के आधार पर (अर्थात् मूल्यन प्रभावों को छोड़कर), अप्रैल-दिसंबर 2020 के दौरान विदेशी मुद्रा भंडार में 83.9 बिलियन अमेरिकी डॉलर की वृद्धि हुई, जबकि अप्रैल-दिसंबर 2019 के दौरान इसमें 40.7 बिलियन अमेरिकी डॉलर की वृद्धि हुई थी। विदेशी मुद्रा भंडार में सांकेतिक आधार पर (मूल्यन प्रभावों सहित) अप्रैल-दिसंबर 2020 के दौरान 108.0 बिलियन अमेरिकी डॉलर की वृद्धि हुई, जबकि 2019-20 की इसी अवधि के दौरान इसमें 47.0 बिलियन अमेरिकी डॉलर की वृद्धि हुई थी। सारणी 2 में अप्रैल-दिसंबर 2020 के दौरान, पिछले वर्ष की इसी अवधि की तुलना में, विदेशी मुद्रा भंडार में हुए परिवर्तन के स्रोतों का विवरण दर्शाया गया है। मूल्यन अभिलाभ, जो मुख्य रूप से, प्रमुख मुद्राओं की तुलना में अमेरिकी डॉलर का कमजोर होना और स्वर्ण कीमतों में वृद्धि को प्रदर्शित करता है, अप्रैल-दिसंबर 2020 के दौरान 24.1 बिलियन अमेरिकी डॉलर रहा, जबकि अप्रैल-दिसंबर 2019 के दौरान यह 6.3 बिलियन अमेरिकी डॉलर था। घरेलू विदेशी मुद्रा बाज़ार में रिज़र्व बैंक की निवल वायदा आस्ति (प्राप्य राशि) मार्च 2021 के अंत में 68.20 बिलियन अमेरिकी डॉलर रही। I.4 बाह्य देयताएं बनाम विदेशी मुद्रा भंडार भारत की अंतरराष्ट्रीय निवेश स्थिति (आईआईपी), जो कि दिसंबर 2020 के अंत में देश की बाह्य वित्तीय आस्तियों और देयताओं के स्टॉक का संक्षिप्त विवरण है, सारणी 3 में प्रस्तुत है। दिसंबर 2019 के अंत और दिसंबर 2020 के अंत के बीच की अवधि के दौरान, बाह्य आस्तियों में 154.2 बिलियन अमेरिकी डॉलर की वृद्धि हुई तथा बाह्य देयताओं में 69.7 बिलियन अमेरिकी डॉलर की वृद्धि हुई। दिसंबर 2020 के अंत में निवल आईआईपी ऋणात्मक 340.6 बिलियन अमेरिकी डॉलर रही, जबकि दिसंबर 2019 के अंत में निवल आईआईपी ऋणात्मक 425.1 बिलियन अमेरिकी डॉलर थी, जिसका अर्थ हुआ कि दोनों अवधियों1 में सभी बाह्य देयताओं का जोड़ बाह्य आस्तियों से अधिक था। वर्ष-दर-वर्ष आधार पर ऋणात्मक अंतर में कमी हुई है। I.5 विदेशी मुद्रा भंडार की पर्याप्तता दिसंबर 2020 के अंत में, आयात के लिए विदेशी मुद्रा भंडार कवर बढ़कर 18.6 महीने का हो गया, जबकि सितंबर 2020 के अंत में यह 17.1 महीने का था। अल्पावधि ऋण (मूल परिपक्वता) एवं विदेशी मुद्रा भंडार का अनुपात, जो सितंबर 2020 के अंत में 18.9 प्रतिशत था, दिसंबर 2020 के अंत में घटकर 17.7 प्रतिशत हो गया। विदेशी मुद्रा भंडार की तुलना में अस्थिर पूंजी प्रवाह (संचयी संविभाग अंतर्वाहों तथा बकाया अल्पावधि ऋण सहित) अनुपात जो सितंबर 2020 के अंत में 68.0 प्रतिशत था, दिसंबर 2020 के अंत में घटकर 67.0 प्रतिशत हो गया। I.6. आरक्षित स्वर्ण का प्रबंधन मार्च-अंत 2021 की स्थिति के अनुसार, भारतीय रिजर्व बैंक के पास 695.31 मेट्रिक टन सोना है। जबकि 403.01 मेट्रिक टन सोना विदेश में बैंक ऑफ इंगलैण्ड तथा अंतरराष्ट्रीय निपटान बैंक (बीआईएस) की सुरक्षित अभिरक्षा में रखा गया है, 292.30 टन स्वर्ण घरेलू रूप में रखा गया है। मूल्य निर्धारण (अमेरिकी डॉलर) के अनुसार, कुल विदेशी मुद्रा भंडार में स्वर्ण का हिस्सा सितंबर 2020 के अंत में लगभग 6.69 प्रतिशत से घटकर मार्च 2021 के अंत में लगभग 5.87 प्रतिशत हो गया। I.7 विदेशी मुद्रा आस्तियों (एफसीए) के निवेश का स्वरूप विदेशी मुद्रा आस्तियों में बहु-मुद्रा आस्तियां शामिल हैं, जो मौजूदा मानदंडों के अनुसार बहु-आस्ति संविभागों में रखी जाती हैं और जो इस संबंध में अपनाई जाने वाली सर्वश्रेष्ठ अंतरराष्ट्रीय प्रथाओं के अनुरूप है। मार्च 2021 अंत तक की स्थिति के अनुसार, 536.69 बिलियन अमेरिकी डॉलर की कुल विदेशी मुद्रा आस्तियों में से, 359.88 बिलियन अमेरिकी डॉलर का निवेश प्रतिभूतियों में किया गया, 153.39 बिलियन अमेरिकी डॉलर अन्य केंद्रीय बैंकों तथा बीआईएस में जमा किए गए हैं और शेष 23.43 बिलियन अमेरिकी डॉलर विदेश स्थित वाणिज्यिक बैंकों में रखे गए हैं (सारणी 4)। I.8.1 आईएमएफ की वित्तीय लेनदेन योजना (एफटीपी) समीक्षाधीन छमाही के दौरान, आईएमएफ की एफटीपी के तहत कुल 417.65 मिलियन अमेरिकी डॉलर के तीन क्रय लेनदेन तथा कुल 249.26 मिलियन अमेरिकी डॉलर के दो पुनः क्रय लेनदेन हुए। I.8.2 आईएमएफ के साथ नई उधार व्यवस्था (एनएबी) और नोट खरीद करार (एनपीए) के अंतर्गत निवेश भारत ने आईएमएफ की नई उधार व्यवस्था (एनएबी) के तहत 4,440.91 मिलियन एसडीआर तक संसाधन उपलब्ध कराने की प्रतिबद्धता जताई थी। 01 जनवरी 2021 से प्रभावी आईएमएफ की एनएबी का आकार, दोगुना कर दिया गया है। 31 मार्च 2021 की स्थिति के अनुसार एनएबी के तहत भारत की प्रतिबद्धता अब 8,881.82 मिलियन एसडीआर है। भारत सरकार के अंशदान के भाग के रूप में, भारतीय रिजर्व बैंक ने मार्च 2021 के अंत तक एनएबी के अंतर्गत 127.06 मिलियन एसडीआर के सममूल्य नोट खरीदे हैं। भारतीय रिजर्व बैंक तथा अंतरराष्ट्रीय मुद्रा कोष के बीच नोट खरीद करार (एनपीए) 2016 के अंतर्गत, भारतीय रिजर्व बैंक ने आईएमएफ द्वारा जारी एसडीआर मूल्यवर्गित नोट में 10 बिलियन अमेरिकी डॉलर की सममूल्य राशि तक निवेश करने की सहमति दी है। I.8.3 भारत और भूटान के बीच सार्क स्वैप व्यवस्था भूटान ने 14 फरवरी 2020 को 200 मिलियन अमेरिकी डॉलर के सममूल्य ₹14,277.30 मिलियन की स्वैप सुविधा ली थी, जिसकी देय परिपक्वता 14 मई 2020 को थी। इस स्वैप को दो बार तीन-तीन महीने के लिए रोलओवर किया गया। दूसरे रोलओवर के बाद स्वैप 17 नवंबर 2020 को परिपक्व हुआ। इसके बाद भूटान ने 15 मार्च 2021 को तीन महीने के लिए 200 मिलियन अमेरिकी डॉलर के सममूल्य ₹14,541.94 मिलियन की स्वैप सुविधा ली, जिसकी परिपक्वता 15 जून 2021 को होगी। I.8.4 भारत और मालदीव के बीच सार्क स्वैप व्यवस्था मालदीव ने 27 अप्रैल 2020 को छः महीने के लिए 150 मिलियन अमेरिकी डॉलर की स्वैप सुविधा ली जिसकी परिपक्वता तारीख 27 अक्तूबर 2020 को थी। इस स्वैप को छह महीने, अर्थात 27 अप्रैल 2021 तक के लिए रोलओवर किया गया। तथापि 28 जनवरी 2021 को इसका पूर्व भुगतान कर दिया गया। इसके बाद मालदीव ने 29 दिसंबर 2020 को 250 मिलियन अमेरिकी डॉलर की स्वैप सुविधा ली, जिसकी परिपक्वता 29 जून 2021 को होगी। I.8.5 भारत और श्रीलंका के बीच सार्क स्वैप व्यवस्था श्रीलंका ने 31 जुलाई 2020 को तीन महीने के लिए 400 मिलियन अमेरिकी डॉलर की स्वैप सुविधा ली जिसकी परिपक्वता तारीख 02 नवंबर 2020 को थी। इस स्वैप को तीन महीने के लिए रोलओवर किया गया और यह 02 फरवरी 2021 को परिपक्व हुआ। I.8.6 आईआईएफसी (यूके) द्वारा जारी बॉण्डों में निवेश भारतीय रिज़र्व बैंक को इंडिया इंफ्रास्ट्रक्चर फाइनैंस कंपनी (यूके) लिमिटेड द्वारा जारी बॉण्डों में 5 बिलियन अमेरिकी डॉलर तक निवेश करने का अधिदेश है। मार्च 2021 अंत की स्थिति के अनुसार, ऐसे बॉण्डों में निवेश की गई राशि 1.86 बिलियन अमेरिकी डॉलर रही। विदेशी मुद्रा भंडार प्रबंधन के उद्देश्य, विधिक ढांचा, II.1. विदेशी मुद्रा भंडार प्रबंधन के उद्देश्य भारत में विदेशी मुद्रा भंडार प्रबंधन के मार्गदर्शी उद्देश्य विश्व के अन्य कई केंद्रीय बैंकों के समान हैं। विदेशी मुद्रा भंडार की मांग में कई घटकों के कारण व्यापक रूप से परिवर्तन आता है जिनमें देश द्वारा अपनाई गई विनिमय दर प्रणाली, अर्थव्यवस्था के खुलेपन की सीमाएं, देश के सकल घरेलू उत्पाद में बाह्य क्षेत्र का आकार और देश में कार्यरत बाजारों का स्वरूप शामिल है। भारत में जहां विदेशी मुद्रा भंडार प्रबंधन का दोहरा उद्देश्य सुरक्षा और तरलता को बनाए रखना है, वहीं इसी ढांचे में अधिकतम प्रतिलाभ का दृष्टिकोण भी समाहित है। भारतीय रिजर्व बैंक अधिनियम, 1934 में मुद्राओं, लिखतों, जारीकर्ताओं और प्रतिपक्षकारों के व्यापक मानदंड के तहत विभिन्न विदेशी मुद्रा आस्तियों और स्वर्ण में विदेशी मुद्रा भंडार के अभिनियोजन के लिए आवश्यक व्यापक विधिक ढांचे का प्रावधान किया गया है। उक्त अधिनियम की उपधारा 17(6ए) 17(12), 17(12ए), 17(13) और 33(6) में विदेशी मुद्रा प्रबंधन के संबंध में आवश्यक विधिक ढांचे का प्रावधान किया गया है। संक्षेप में, कानून निम्नलिखित व्यापक निवेश श्रेणियों की अनुमति देता हैः

विदेशी मुद्रा भंडार प्रबंधन संबंधी व्यापक रणनीति, जिसमें मुद्रा संरचना और निवेश संबंधी नीति शामिल है, भारत सरकार के साथ विचार-विमर्श करके निर्धारित की जाती है। जोखिम प्रबंधन संबंधी कार्यों का मुख्य उद्देश्य सर्वोत्तम अंतरराष्ट्रीय प्रथाओं के अनुरूप एक सशक्त अभिशासन संरचना का विकास, उन्नत जवाबदेही, सभी परिचालनों में जोखिम संबंधी सतर्कता की संस्कृति, संसाधनों का प्रभावी आबंटन और आंतरिक कौशल एवं दक्षता का विकास करना है। आगे के पैराग्राफ में विदेशी मुद्रा भंडार के अभिनियोजन से संबंधित जोखिमों अर्थात् क्रेडिट जोखिम, बाजार जोखिम, तरलता जोखिम एवं परिचालनगत जोखिम और इन जोखिमों के प्रबंधन के लिए कार्यरत प्रणालियों के संबंध में विस्तृत जानकारी प्रस्तुत की गई है। भारतीय रिज़र्व बैंक अंतरराष्ट्रीय बाजारों में विदेशी मुद्रा भंडार के निवेश से उत्पन्न क्रेडिट जोखिम के मामले में संवेदनशील रहा है। भारतीय रिज़र्व बैंक द्वारा उच्च रेटिंग वाले सरकारी, केंद्रीय बैंक और सुप्रानेशनल संस्थाओं के ऋण दायित्व वाले बॉण्डों/खजाना बिलों में निवेश किया जाता है। इसके अलावा, केंद्रीय बैंकों, अंतरराष्ट्रीय निपटान बैंक (बीआईएस) और विदेश स्थित वाणिज्यिक बैंकों में जमाराशियां रखी जाती हैं। भारतीय रिजर्व बैंक ने विदेशी मुद्रा भंडार की सुरक्षा तथा तरलता पहलुओं को उन्नत करने के प्रयोजन से जारीकर्ता/प्रतिपक्षकारों के चयन के संबंध में मानदंड निर्धारित करते हुए अपेक्षित मार्गदर्शी सिद्धांत तैयार किए हैं। भारतीय रिजर्व बैंक ने प्रतिपक्षकारों के चयन के लिए कड़े मापदंड अपनाना जारी रखा है। अनुमोदित प्रतिपक्षकारों की स्वीकृत सीमा के सापेक्ष में उनके क्रेडिट एक्सपोजर पर निरंतर निगरानी रखी जाती है। प्रतिपक्षकारों से संबंधित गतिविधियों पर निरंतर नजर रखी जाती है। इस प्रकार के निरंतर प्रयास का मूल उद्देश्य यह निर्धारित करना होता है कि किसी प्रतिपक्षकार की क्रेडिट ग़ुणवत्ता संभावित खतरे के दायरे में तो नहीं आ रही है। बहुमुद्रा वाले किसी संविभाग के मामले में बाजार जोखिम, मूल्यांकन में होनेवाले उस संभाव्य परिवर्तन को दर्शाता है, जो वित्तीय बाजार में कीमतों में होने वाले उतार-चढ़ाव जैसेकि ब्याज-दर, विदेशी मुद्रा विनिमय दर, इक्विटी मूल्य और पण्य मूल्य में परिवर्तन के कारण होती है। केंद्रीय बैंकों के लिए बाजार जोखिम के प्रमुख स्रोत मुद्रा जोखिम, ब्याज-दर जोखिम तथा सोने की कीमतों में होने वाले उतार-चढ़ाव हैं। विनिमय दरों और/या सोने की कीमत में उतार-चढ़ाव के कारण विदेशी मुद्रा आस्तियों (एफसीए) और सोने के मूल्यांकन पर होनेवाले लाभ-हानि को तुलन पत्र में मुद्रा एवं स्वर्ण पुनर्मूल्यन खाता (सीजीआरए) नामक शीर्ष के अंतर्गत दर्शाया जाता है। सीजीआरए में शेषराशियां विनिमय दर/स्वर्ण मूल्य में उतार-चढ़ाव के प्रति सुरक्षा प्रदान करती है। विदेशी दिनांकित प्रतिभूतियों का मूल्यांकन प्रत्येक सप्ताह और माह के अंतिम कारोबार दिवस की बाज़ार की कीमतों के अनुसार किया जाता है और उसमें हुई मूल्यवृद्धि/मूल्यहृास को निवेश पुनर्मूल्यन खाता (आईआरए) में स्थानांतरित किया जाता है। आईआरए की शेषराशियां, प्रतिभूतियों को धारित किए जाने की अवधि के दौरान, उनके मूल्य में होने वाले परिवर्तनों के सापेक्ष कुशन प्रदान करती है। मुद्रा जोखिम विनिमय दरों में उतार-चढ़ाव के कारण उत्पन्न होती है। अलग-अलग मुद्राओं के मामले में दीर्घकालीन निवेश संबंधी निर्णय विनिमय दर में होनेवाली संभाव्य उतार-चढ़ाव और अन्य मध्यम एवं दीर्घकालीन अपेक्षाओं के आधार पर लिए जाते हैं। नियमित आधार पर नीति की समीक्षा द्वारा निर्णयों की पुष्टि की जाती है। ब्याज-दर के परिवर्तनों के प्रतिकूल प्रभावों से निवेश के मूल्य को यथासंभव संरक्षित रखना ब्याज-दर जोखिम के प्रबंधन का महत्वपूर्ण पहलू है। संविभाग के ब्याज-दर की संवेदनशीलता, मापदंड (बेंचमार्क) अवधि और मापदंड से अनुमोदित विचलन द्वारा निर्धारित की जाती है। तरलता जोखिम में, आवश्यकता के अनुसार बिना किसी लागत के किसी लिखत को बेच न पाने अथवा किसी पोजीशन को समाप्त न कर पाने का जोखिम अंतर्निहित होता है। विदेशी मुद्रा भंडार में सदैव उच्च स्तर की तरलता रखी जानी अपेक्षित है ताकि किसी अप्रत्याशित अथवा अत्यावश्यक जरूरतों को पूरा किया जा सके। बाह्य मोर्चे पर कोई प्रतिकूल गतिविधि हमारे विदेशी मुद्रा भंडार की मांग को बढ़ाएगी, और इसलिए, निवेश रणनीति में उच्च स्तर की तरलता वाले संविभाग की आवश्यकता होती है। संविभाग की तरलता लिखतों के चयन से निर्धारित होती है। उदाहरण के लिए, कुछ बाज़ारों में, खजाना प्रतिभूतियां को बाज़ार में मूल्य को ज्यादा प्रभावित किए बगैर बड़ी संख्या में अर्थसुलभ बनाया जा सकता है और इसलिए उन्हें तरल माना जाता है। बीआईएस/विदेश स्थित वाणिज्यिक बैंकों/केंद्रीय बैंकों में धारित मीयादी जमाराशियों और सुप्रानेशनल द्वारा जारी प्रतिभूतियों को छोड़कर लगभग सभी अन्य प्रकार के निवेशों में तरलता अधिक होती है, जो अल्प सूचना पर नकदी में परिवर्तित किए जा सकते हैं। भारतीय रिज़र्व बैंक विदेशी मुद्रा भंडार के ऐसे हिस्से पर कड़ी नज़र रखता है जिन्हें किसी अप्रत्याशित/आकस्मिक आवश्यकताओं की पूर्ति के लिए काफी अल्प सूचना पर नकदी में परिवर्तित किया जा सकता है। II.3.3 परिचालनगत जोखिम और नियंत्रण प्रणाली वैश्विक रुझान के अनुरूप, परिचालनगत जोखिम नियंत्रण संबंधी व्यवस्थाओं को मजबूत करने की ओर गहराई से ध्यान दिया जाता है। महत्वपूर्ण परिचालनगत प्रक्रियाओं का प्रलेखन किया गया है। आंतरिक रूप से, फ्रंट तथा बैक कार्यालय के कार्यों को पूरी तरह से पृथक रखा गया है और आंतरिक नियंत्रण प्रणाली द्वारा यह सुनिश्चित किया जाता है कि किए गए डील, डील प्रोसेसिंग और निपटान के स्तरों पर कई जांच बिंदु हों। भुगतान अनुदेशों को जेनरेट करने सहित डील प्रोसेसिंग तथा निपटान प्रणाली भी आंतरिक नियंत्रण संबंधी मार्गदर्शी सिद्धांतों के अधीन है। आंतरिक नियंत्रण संबंधी मार्गदर्शी सिद्धांतों के अनुपालन की निगरानी के लिए समवर्ती लेखापरीक्षा प्रणाली कार्यरत है। इसके अलावा, नियमित रूप से लेखों का मिलान किया जाता है। आंतरिक लेखापरीक्षा के अलावा, बाहरी सांविधिक लेखापरीक्षकों द्वारा वित्तीय लेखों की लेखापरीक्षा की जाती है। विदेशी मुद्रा भंडार प्रबंधन संबंधी क्षेत्र की महत्वपूर्ण गतिविधियों/परिचालनों को सम्मिलित करते हुए एक व्यापक रिपोर्टिंग प्रक्रियातंत्र मौजूद है। वरिष्ठ प्रबंध तंत्र को आवधिक रूप से, निरंतर आधार पर, सूचना के प्रकार एवं उसकी संवेदनशीलता को देखते हुए, इस प्रक्रियातंत्र द्वारा तदनुसार जानकारी उपलब्ध कराई जाती है। रिज़र्व बैंक अपने सौदों के निपटान तथा अपने प्रतिपक्षकारों, प्रतिभूतियों के अभिरक्षकों और अन्य कारोबारी भागीदारों को वित्तीय संदेश भेजने के लिए ‘स्विफ्ट’ का प्रयोग मैसेजिंग प्लेटफार्म के रूप में करता है। स्विफ्ट प्रणाली के प्रयोग तथा उसकी सुरक्षा के संबंध में सर्वोत्तम अंतरराष्ट्रीय प्रथाओं का पालन किया जाता है। स्विफ्ट अलायंस ऐक्सेस सिस्टम में समयबद्ध रूप से सभी आवश्यक अपग्रेड कार्यान्वित किए गए है, साथ ही स्विफ्ट की अनुशंसा के अनुसार सभी अनिवार्य सुरक्षा नियंत्रण उपायों का कठोर अनुपालन किया जाता है। भारतीय रिज़र्व बैंक विदेशी मुद्रा भंडार एवं विदेशी मुद्रा बाजार में अपने परिचालनों से संबंधित आंकड़े, देश की बाह्य आस्तियों एवं देयताओं संबंधी स्थिति और विदेशी मुद्रा आस्तियों तथा स्वर्ण के अभिनियोजन के माध्यम से प्राप्त आय से संबंधित आंकड़े साप्ताहिक सांख्यिकीय संपूरक (डब्ल्यूएसएस), मासिक बुलेटिन, वार्षिक रिपोर्ट आदि के माध्यम से आवधिक प्रेस प्रकाशनों द्वारा सार्वजनिक करता रहता है। पारदर्शिता और प्रकटीकरण के बारे में भारतीय रिज़र्व बैंक का दृष्टिकोण इससे संबंधित सर्वोत्तम अंतरराष्ट्रीय प्रथाओं के अनुरूप रहता है। भारतीय रिज़र्व बैंक ने विदेशी मुद्रा भंडार संबंधी विस्तृत आंकड़ों के प्रकटीकरण के लिए अंतरराष्ट्रीय मुद्रा कोष (आईएमएफ) के विशेष आंकड़ा प्रसार मानक (एसडीडीएस) टेम्प्लेट को अपनाया है। ये आंकड़े भारतीय रिज़र्व बैंक की वेबसाइट पर मासिक आधार पर उपलब्ध कराए जाते हैं। 1 आंशिक रूप से संशोधित आंकड़े हैं तथा ये पिछली रिपोर्ट में प्रकाशित आंकड़ों से मेल नहीं खा सकते हैं। |

पृष्ठ अंतिम बार अपडेट किया गया: