IST,

IST,

Page

Official Website of Reserve Bank of India

Overview

Overview

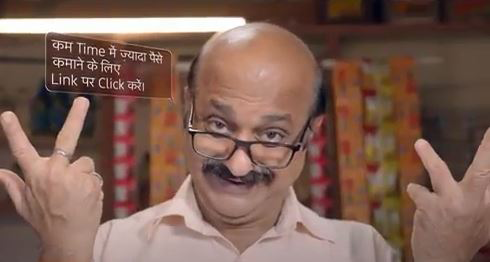

Do not get tricked by imposters. Imposters scare people into depositing money or sharing confidential information:

- Verify the identity of unknown callers thoroughly

- Officials from banks, financial institutions, etc. will never ask you to share confidential information

- Do not share your username/password/card details/CVV/OTP

Don’t get trapped by fraudsters. Beware of fake requests for money:

- Always verify genuineness of fund requests

- Do not share personal and confidential information with anyone

- Do not make payments to unknown persons

Beware of fraudsters:

- Do not answer calls/emails from unknown persons demanding money

- Check details of websites/Apps offering high returns

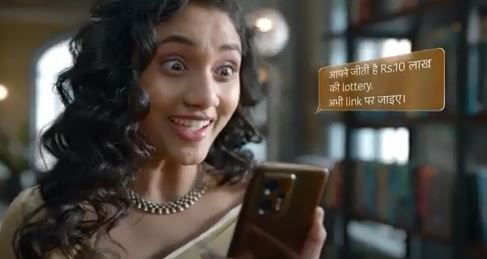

Beware of unknown links:

- Never click on unknown links as you may risk exposing your bank account to frauds

- Delete SMS/emails with unknown links immediately

- Verify details of website if it requests financial details

- Quick-win Lottery Schemes. Do not share personal or bank information on social media or with unknown entities

- Unauthorised Digital Lending Apps. Never download Lending Apps from unknown sources

Be cautious while scanning QR codes to make payments:

- While making payments using QR codes, confirm the name on the screen

Digital payments are simple and can be used by anyone and everyone:

- Register your mobile number and email with your bank to get instant alerts

- Do not store important banking data in mobile, email or wallet

- Change banking Passwords & PIN regularly

- Block your Debit/Credit Card, immediately if it is lost or stolen

Quick Links

Click on the topic you want to know more about and you will have detailed information on it. In case you need further clarifications, please write to us at rbikehtahai[at]rbi[dot]org[dot]in.

Bank smarter

Protect Your Finances

Page Last Updated on: May 23, 2022

Was this page helpful?